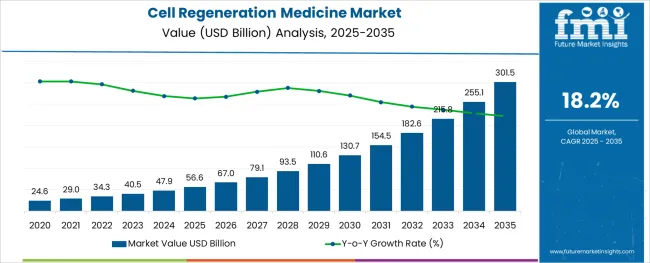

The Cell Regeneration Medicine Market is estimated to be valued at USD 56.6 billion in 2025 and is projected to reach USD 301.5 billion by 2035, registering a compound annual growth rate (CAGR) of 18.2% over the forecast period.

The cell regeneration medicine market is undergoing rapid evolution, fueled by significant advancements in cell-based therapies, biomanufacturing capabilities, and regenerative biology. Increased investment from pharmaceutical companies, public research institutions, and venture-backed biotech firms has accelerated the commercialization of regenerative therapeutics.

Growing demand for personalized treatment and long-term disease reversal is reshaping healthcare strategies across oncology, cardiology, and orthopedics. Improvements in stem cell harvesting, tissue engineering, and delivery mechanisms have enhanced clinical outcomes, making regenerative therapies increasingly viable for chronic and degenerative diseases.

Regulatory support through expedited pathways and designations such as RMAT (Regenerative Medicine Advanced Therapy) status is also facilitating market entry and boosting investor confidence. As aging populations and unmet medical needs continue to grow, the sector is poised for further expansion, supported by innovation in gene editing, 3D bioprinting, and biomaterial integration.

The market is segmented by Product Type and Therapeutic Category and region. By Product Type, the market is divided into Therapeutics, Tools, Banks, and Services. In terms of Therapeutic Category, the market is classified into Oncology, Dermatology, Musculoskeletal, Immunology & Inflammation, Cardiovascular, Ophthalmology, and Other Therapeutic Categories. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type and Therapeutic Category and region. By Product Type, the market is divided into Therapeutics, Tools, Banks, and Services. In terms of Therapeutic Category, the market is classified into Oncology, Dermatology, Musculoskeletal, Immunology & Inflammation, Cardiovascular, Ophthalmology, and Other Therapeutic Categories. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

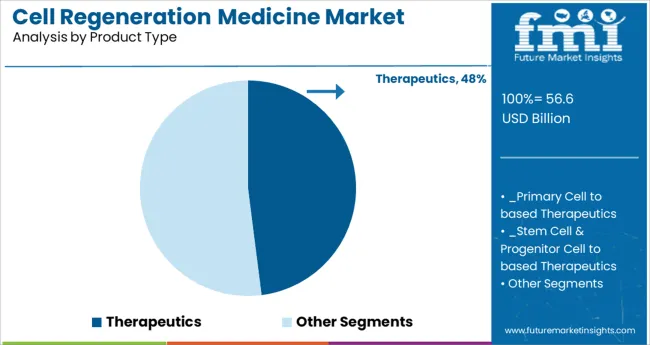

Therapeutics are expected to account for 48.0% of the total revenue in the cell regeneration medicine market by 2025, positioning this segment as the primary growth driver. This dominance is being supported by the increasing success of cell-based treatments in delivering functional recovery and disease modification.

Therapeutic solutions—ranging from stem cell therapies to engineered tissues—are being adopted in clinical pipelines for both acute injuries and chronic conditions, especially where conventional drugs offer limited relief. Advancements in cell sourcing, ex vivo expansion, and immune-matching techniques have improved scalability and reduced rejection risks.

Moreover, increasing collaboration between academic research centers and biotech firms is accelerating the transition of regenerative therapeutics from experimental stages to market-ready interventions. As healthcare systems seek long-term, curative treatment models over symptom management, therapeutic products continue to gain priority in regulatory and investment landscapes.

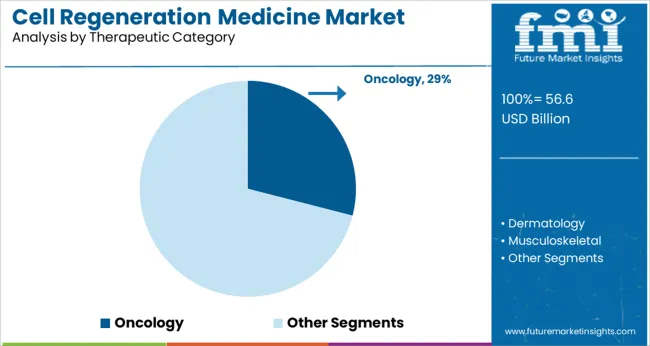

Oncology is projected to contribute 29.0% of the overall market revenue in 2025, making it the leading therapeutic category in cell regeneration medicine. This position is being reinforced by the urgent demand for innovative treatments that address tumor recurrence, tissue damage, and post-surgical recovery.

Regenerative strategies, including cancer-targeted cell therapy and tumor-specific immune modulation, are gaining traction due to their potential for durable remission. Recent clinical developments in CAR-T and stem cell-derived immunotherapies are offering promising results, driving further interest and funding in oncology-focused regenerative research.

Additionally, supportive regulatory initiatives and growing patient enrollment in cancer-related trials are accelerating therapeutic validation. The ability of regenerative approaches to complement existing oncologic interventions such as chemotherapy and radiotherapy has expanded their utility, making oncology a cornerstone of innovation within the market.

As per the publications released by Future Market Insights - market research and competitive intelligence provider, on Cell Regeneration Medicine Market, the market is currently valued at USD 47.9 Billion in 2024 and is expected to rise at a CAGR of 14.4% during the period between 2025 and 2035.

This growth has been significantly higher than the historical growth of 12.4%. The market is expected to offer an absolute dollar opportunity of USD 56.6 Billion between 2025 and 2035. By the end of 2035, the global market for Cell Regeneration Medicine is likely to hit the valuation of USD 130.8 Billion.

The market valuation is projected to grow at a significant CAGR of 14.4% as compared to historical CAGR of 12.4% owing to factors such as introduction of gene therapy, advancements in stem cell and tissue engineering, ongoing funding in R&D by government and commercial entities and continuous regulatory approvals for advanced therapeutic medical products.

Global Cell Regeneration Medicine Market is likely to be driven by the introduction of gene therapy, advancements in stems cells and growth in tissue engineering. Furthermore, various projects like T-Cell therapy, which comes under the manufacturing industry of cell therapy regenerative medicine are being undertaken by any businesses in cooperation with other businesses or research institutions. Furthermore, the government regulatory approvals has led to increase in the market growth.

The global pandemic has provided the global players with various chances to bring medicinal solution to fight against SARS-COV-2. Along with various initiatives, the ongoing investments by government and private sector agencies in R&D has accelerated the industry's advancement. Companies are collaborating to expand their R&D skills to develop and sell innovative therapies to secure a position in a competitive global market.

Researchers' perspectives on Cell Regeneration Medicine have been transformed by technological developments like Nanotechnology, 3D bioprinting techniques and AI in stem cell-based therapeutics. These developments are making dermatological grafting operations like persistent burns, bone abnormalities and skin wounds more efficient.

The market is being driven by the rising frequency of chronic medical conditions and genetic abnormalities such as congestive heart failure, myocardial infarction, Parkinson's disease and various kinds of bone losses. In addition, the growing elderly population suffering from musculoskeletal, oncological and cardiological problems is driving market expansion.

The sales of Cell Regeneration Medicine is likely to be affected by the high cost of therapies. This high cost of treatment acts as a barrier in entering the new market. People in emerging economies are unable to finance organ transplantation due to socioeconomic constraints. Organ trafficking is a serious crime that is in prevalence due to a scarcity of organs.

The developing countries pose to be a potential market with rising rates of chronic diseases, hereditary diseases, rising geriatric population and higher demanding regions for organs and biomaterials. But with little awareness of Cell Regeneration Medicine, these potential markets are difficult to capture.

The gene correction treatment involves nucleases that have been modified to successfully change the human genome. However, the use of gene correction treatment is limited due to some unintended consequences, such as cell manipulation, which has impacted the efficacy of cell formation and proliferation. However, with sufficient capital and financing, R&D is proceeding toward the cost-effective commercialization of such complex medical operations.

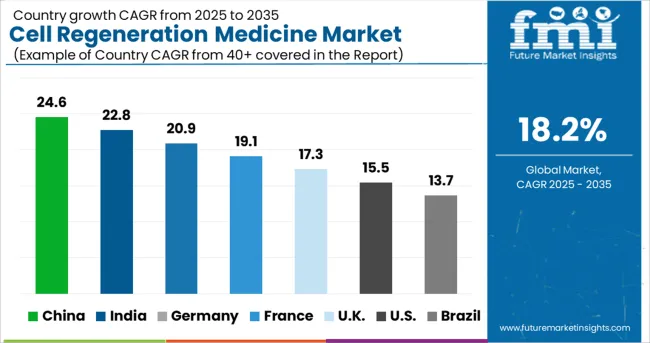

In 2024, the United States Accounted for nearly 2/5th share of the global market for Cell Regeneration Medicines. The USA market growth is significantly higher from its historical average growth of 11.9%. Between 2025 and 2035, the market is estimated to witness an absolute dollar opportunity of USD 36.6 Billion.

The presence of significant players in the United States, the availability of modern technologies and increasing financing of research institutes involved in the creation of innovative treatments can all be attributed to this expansion. In addition, the United States has the biggest revenue flow due to a large number of clinical trials, the availability of financing, and various government and private-sector efforts. For example, the US Department of Health and Human Services launched a campaign to place Cell Regeneration Medicine at the forefront of healthcare.

According to Future Market Insights data, the market in China is anticipated to grow at the fastest rate of 18.2% between 2025 and 2035. The projected CAGR of the USA is significantly higher than the historical CAGR of 13.7%. In the next ten years, the Chinese market is estimated to offer an absolute dollar opportunity of USD 14.8 Billion to reach a valuation of USD 17.8 Billion.

The rising CAGR of the Chinese market for Cell Regeneration Medicines is attributed to the rapid expansion of healthcare infrastructure and research institutes to accelerate stem cell research in a rapidly developing market.

With rising government approvals for research projects involving human embryonic stem cells, scientists are encouraged to investigate the cells' clinical potential. Additionally, the rising prevalence of cardiovascular and musculoskeletal illnesses is driving this trend. Furthermore, the market is likely to be explored by global players targeting the untapped segments of the market.

The Therapeutics segment is the largest revenue generating segment in the Global Cell Regeneration Medicine Market, growing at a CAGR of 17.8% during the period between 2025 and 2035.

Despite source diversification, this category is anticipated to maintain its leadership position in the marketplace throughout the projected period. Primary cell-based therapies are the most developed medications available from the medical sector, as they are suitable for use in both clinical applications and approved in different areas.

In addition, the stem cell & progenitor cell-based therapies market is predicted to grow significantly over the forecast years, owing to increased investments in stem cell research and regulatory policy revisions.

Oncology therapeutic category is expected to lead the market with the highest share in global market for Cell Regeneration Medicines. It is forecasted to grow at a CAGR of 13.1% during the period.

This can be attributable to high cancer prevalence globally and the development of efficient cancer treatment options. Furthermore, huge investments by government organizations and private companies to finance cancer research is aiding the growth.

A number of companies invested in the development of cell regenerative medicine to meet demand for clinical needs without resorting to more-invasive procedures. The market is extremely competitive, and players are making joint efforts for product development.

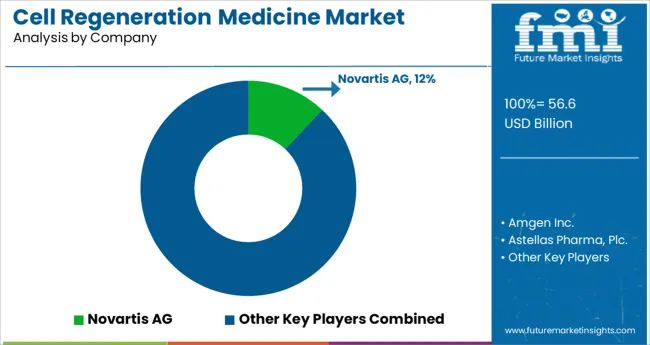

Some of the prominent Cell Regeneration Medicine manufacturers are AstraZeneca plc, Astellas Pharma, Inc., F. Hoffmann-La Roche Ltd., Integra Lifesciences Corp., Cook Biotech, Inc., Bayer AG, Pfizer, Inc., Merck KGaA, Abbott, Vericel Corp., Novartis AG, GlaxoSmithKline (GSK), Baxter International, Inc., Takara Bio, Inc.

The recent developments in the Global Cell Regeneration Medicine Market are:

Similarly, recent developments related to companies offering Cell Regeneration Medicine Market have been tracked by the team at Future Market Insights, which are available in the full report.

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Quantitative Units | In million |

| Key Regions Covered | North America; Latin America; Europe; APAC and MEA |

| Key Countries Covered | United States, China, Japan, South Korea, UK, Canada, Brazil, Mexico, Germany, France, Spain, Italy, Russia, India, Australia, South Africa, Saudi Arabia, UAE, Israel |

| Key Market Segments Covered | Product Type, Therapeutic Category and Region |

| Pricing | Available upon Request |

The global cell regeneration medicine market is estimated to be valued at USD 56.6 billion in 2025.

It is projected to reach USD 301.5 billion by 2035.

The market is expected to grow at a 18.2% CAGR between 2025 and 2035.

The key product types are therapeutics, _primary cell to based therapeutics, _stem cell & progenitor cell to based therapeutics, _cell to based immunotherapies, _gene therapies, tools, banks and services.

oncology segment is expected to dominate with a 29.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulite Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cell Isolation Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Waste Aspirator Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Media Market Size and Share Forecast Outlook 2025 to 2035

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Supplements Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Media & Cell Lines Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA