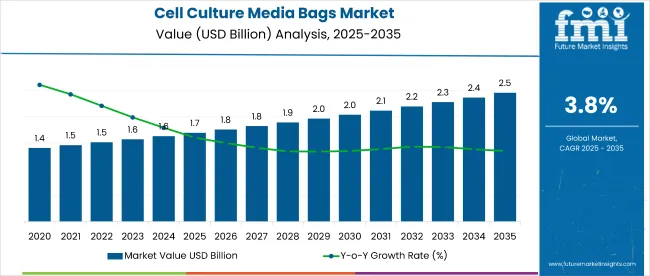

The global cell culture media bags market is projected to grow from approximately USD 1.69 billion in 2025 to USD 2.45 billion by 2035, registering a CAGR of around 3.8%. In 2024, the market generated approximately USD 1.64 billion in sales. This steady growth is driven by increasing demand for biopharmaceuticals, advancements in cell culture technologies, and growing adoption of single-use bioprocessing systems.

Cell culture media bags are essential components in bioprocessing, used for storing and transporting culture media in research and production of biologics, vaccines, and cell therapies. The shift towards single-use technologies in biopharmaceutical manufacturing has significantly increased the adoption of flexible media bags, which reduce contamination risks and improve process efficiency.

Recent innovations in the market focus on improving bag materials and designs to enhance durability, sterility, and ease of use. In 2024, several manufacturers introduced media bags with multi-layer film constructions that provide superior oxygen and moisture barrier properties, ensuring optimal culture conditions. Companies such as Sartorius and Thermo Fisher Scientific have launched new product lines featuring integrated sampling ports and customizable sizes to meet diverse bioprocessing requirements.

The biopharmaceutical sector remains the dominant end-user, driven by rising demand for monoclonal antibodies, cell and gene therapies, and vaccines. Increasing investments in biomanufacturing infrastructure, especially in North America and Europe, support market growth. Meanwhile, the Asia Pacific region is expected to witness significant expansion due to rising pharmaceutical production capabilities and expanding healthcare sectors.

Sustainability considerations are also influencing product development, with manufacturers exploring recyclable materials and designs that reduce waste generation during production and disposal.

With ongoing technological advancements and expanding biopharmaceutical production, the cell culture media bags market is poised for steady growth through 2035, catering to the evolving needs of global life sciences and healthcare industries.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 1.64 billion |

| Estimated Size, 2025 | USD 1.69 billion |

| Projected Size, 2035 | USD 2.45 billion |

| CAGR (2025 to 2035) | 3.8% |

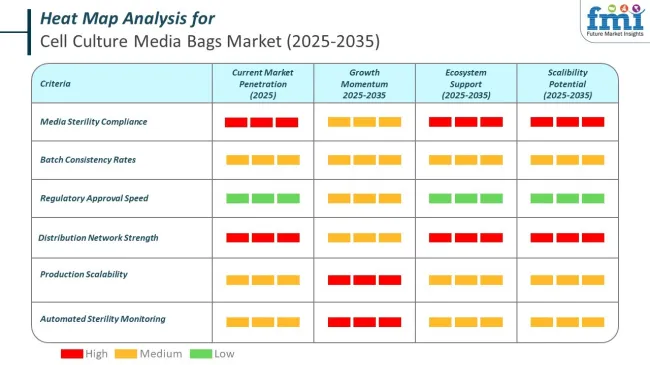

The cell culture media bags market is governed by a network of global and national regulatory frameworks that ensure the sterility, safety, and quality of these single-use systems. Countries like the United States, China, and members of the European Union have specific current Good Manufacturing Practice (cGMP) requirements, while international standards provide harmonized guidelines to support consistent compliance across regions.

Top companies in the cell culture media bags market are actively aligning their manufacturing processes, materials, and product designs with international regulatory standards to ensure quality, safety, and compliance in biopharmaceutical production. Leaders like Sartorius, Thermo Fisher Scientific, and Merck KGaA are prioritizing regulatory readiness across global markets by adhering to Good Manufacturing Practices and quality system certifications.

These companies are also working to meet expectations around extractables and leachables, a key concern in regulatory inspections. Bags are tested for biocompatibility and manufactured in ISO 7 cleanrooms to maintain sterility standards.

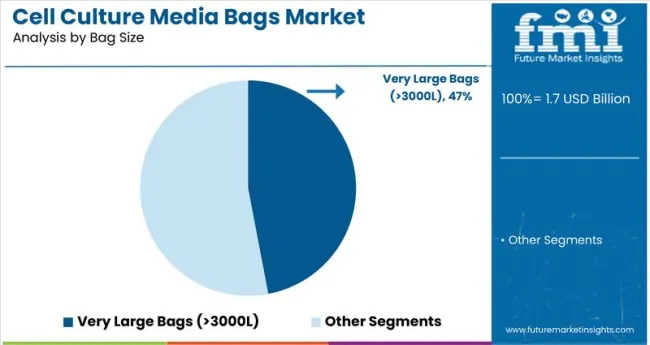

The very large bags segment, with capacities exceeding 3000 liters, is projected to lead the cell culture media bags market, holding around 47.0% market share by 2025. This segment’s growth is driven by increasing requirements in large-scale biopharmaceutical manufacturing, particularly for cell-based therapies, vaccines, and biologics production. The ability to handle large volumes of sterile media while preventing contamination is essential for efficient bioprocessing.

Very large bags simplify production workflows by reducing the need for multiple smaller bags, thereby lowering costs related to cleaning, sterilization, and validation. They also support continuous manufacturing and bioreactor integration, allowing seamless scaling of production processes. Additionally, contract manufacturing organizations (CMOs) frequently require high-capacity systems to meet growing outsourcing demands. These factors collectively fuel the adoption of very large bags, positioning them as the dominant segment in cell culture media bags by 2025.

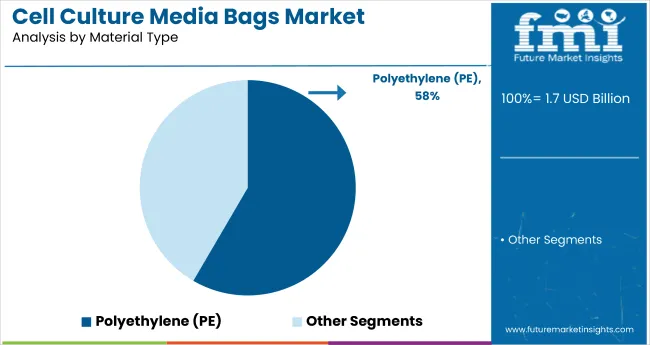

Polyethylene (PE)-based cell culture media bags are expected to capture approximately 58.4% market share by 2025, establishing PE as the leading material type in the market. PE offers cost-efficiency, durability, and excellent barrier properties, effectively protecting media from moisture, oxygen, and contaminants while maintaining sterility.

PE’s versatility enables its use across biopharmaceutical applications, from small-scale research to large industrial production. Its lightweight and flexible nature improve handling efficiency during production and transportation. PE’s compatibility with single-use bioprocessing systems reduces the need for cleaning and sterilization, cutting operational costs significantly. Furthermore, innovations in sustainable PE variants, including recyclable and bio-based options, appeal to environmentally conscious customers. The combination of affordability, performance, and eco-friendliness secures PE’s leadership position in the cell culture media bags market through 2025.

Below is the table of how the global compound annual growth rate (CAGR) of the cell culture media bags market differed between the first half of 2024 and 2025. It was important for gaining an insight from the revenue in terms of its changes and trends about the performance within the industry. Here, H1 has been considered January to June while H2 denotes July to December. The company will grow from 2024 to 2034, in H1 of this decade, by a CAGR of 3.7%. The business growth rate in the second half of the same decade will be 4.2%.

| Particular | Value CAGR |

|---|---|

| H1 | 3.7% (2024 to 2034) |

| H2 | 4.2% (2024 to 2034) |

| H1 | 3.8% (2025 to 2035) |

| H2 | 4.5% (2025 to 2035) |

Moving into the later period, in H1 2025 till H2 2035 CAGR will become slightly decreased down to 3.8% in H1 and somewhat remaining moderate in 4.5% in the H2 Industry witnessed growth as 10 BPS in the H1 followed by a rapid increase of the industry 33 BPS.

Rising demand for biologics is driving the market growth

The demand for biologics is primarily driven by the rising demand for biologics, vaccines, and cell-based therapies, which are gaining new momentum worldwide. Biologics encompass drugs like monoclonal antibodies, recombinant proteins, and gene therapies involving complex manufacturing procedures concerning sterility, scalability, and efficiency of operations.

Cell culture media bags fit well into the ambit of single-use systems, thereby serving to meet the mentioned requirements by creating a contamination-free environment for the storage, mixing, and transport of media during the bioprocessing process.

In addition, there is a strong boost from the increasing need for vaccines-a response to emerging infectious diseases and pandemic preparedness- through an increase in flexible and scalable bioprocessing solutions. Cell-based therapies such as CAR-T treatments for cancer increase the demand even further because these therapies heavily rely on precise and sterile cell culture environments to ensure product quality and efficacy.

A concrete example of usage is in biopharmaceutical manufacturing with Sartorius' Flexsafe® bags, ensuring the integrity of sensitive biologics while handling high-throughput production. Since bags are available across wide ranges of bioreactors and other kinds of processing devices used, streamlined flows are enabled to occur.

As the global biologics market continues to expand, cell culture media bags can ensure efficient, reliable, and scalable production processes in accordance with the stringent regulatory standards of the industry.

Expanding research in regenerative medicine, stem cell therapies, etc., is driving the industry's growth

As advancements in regenerative medicine, stem cell therapies, and tissue engineering progress, cell-based research is growing faster than any other kind of therapy. In fact, this area requires more accurate, sterile, and scalable systems to handle cells while cultivating them to achieve better results for therapy and medical solutions.

Cell culture media bags are best suited for such applications, as they provide contamination-free environments, compatibility with various cell types, and the ability to support both small-scale experiments and large-scale production.

In regenerative medicine, the development of therapies for conditions such as organ damage or degenerative diseases mainly depends on efficient cultivation of stem cells, focusing on preserving cell viability and sterility. Tissue engineering applications require highly high-quality cell culture systems to propagate functional tissues for transplantation or research.

For instance, Corning's single-use media bags create controlled conditions for stem cell culture. They are designed to integrate easily with bioprocessing workflows. More so, these bags help researchers scale their processes efficiently while ensuring the integrity of the cells.

As the need for new treatments and therapies pushes the boundaries of cell-based research to go beyond geographical barriers, the demand for advanced cell culture media bags continues to grow, supporting this transformative field.

Rising investments in biosimilars present a significant opportunity in the market

One significant opportunity in cell culture media bags is the surge of investments in biosimilars, as this production requires cheaper, more efficient, and scalable bioprocessing. Biosimilars are biological medicines that have a high similarity to already approved reference products; they are rapidly gaining popularity, mainly because they are affordable, and there has been a high demand for available biologic treatments.

The global pressure on reducing healthcare costs and the patent expirations of several blockbuster biologics has driven biosimilars in their development and manufacturing.

Cell culture media bags are an important part of the bioprocessing of biosimilars, as they offer a single-use, scalable, and contamination-free platform for media storage, mixing, and transport. These bags reduce operational costs, eliminate cleaning validation, and support rapid scale-up, making them an ideal choice for biosimilar manufacturers aiming to optimize production while maintaining quality and compliance.

For example, single-use systems under the brand Allegro™ from Pall Corporation are used broadly in biosimilar manufacturing. Single-use systems make bioprocessing workflows flexible and efficient, thus quickly bringing biosimilars into the market.

As biosimilars continue to see growth, their demand for the advanced yet affordable solutions such as cell culture media bags will see an increase; this will thus create a money-making opportunity for any manufacturer in that space.

High initial costs may restrict market growth

The high initial cost is a strong barrier in the market, mainly for small and medium-sized biopharmaceutical companies. Installation of single-use systems, in general, and of cell culture media bags, specifically, involves heavy investment in pre-compatible equipment such as bioreactors, mixers, and storage systems, tailored to be directly integrated with these bags.

Additionally, there are the costs of training personnel to use and manage these systems correctly and to ensure regulatory compliance and best practice standards.

These are challenges for those with more limited budgets, especially in developing countries where investment in state-of-the-art bioprocessing infrastructure is unavailable or at least very limited. Also, moving from traditional stainless steel to single-use technology is a learning curve and requires adjustments in operational management, thus adding to the total cost of implementation.

While single-use systems may save companies the long-term costs of cleaning, sterilization, and validation, the high upfront costs may be a barrier to entry for companies adopting such solutions. Thus, high cost can limit the market growth.

The global cell culture media bags industry recorded a CAGR of 2.8% during the historical period between 2020 and 2024. The growth of cell culture media bags industry was positive as it reached a value of USD 1.64 billion in 2024 from USD 1.46 billion in 2020.

Traditional cell culture methods used reusable glass or stainless-steel vessels like flasks, roller bottles, or bioreactors. The systems were intensive in cleaning, sterilization, and validation procedures to ensure sterility and cross-contamination avoidance. They are effective for small-scale applications but labor-intensive, time-consuming, and prone to risks of contamination.

In contrast, the current methods have adopted single-use systems, such as pre-sterilized and disposable cell culture media bags. These bags replace cleaning and sterilization procedures, thereby saving labor and operating costs. These are also scalable, compatible with automated bioprocessing, and pose less contamination risk, making them appropriate for the manufacture of biologics and cell therapy.

Outsourcing biopharmaceutical production to CMOs has been the other major growth driver for the cell culture media bags market. Biopharma companies are increasingly using the services of CMOs to meet increasing demands for the production of biologics, biosimilars, and cell-based therapies. For these, single-use systems such as cell culture media bags have an advantage with respect to costs, scalability, and turnaround times.

Media bags allow CMOs the flexibility of manufacturing production without the washing and sterilizing steps, and thus, batches can be faster to switch into production. That is particularly important because CMOs often manage so many different kinds of products, and single-use technology allows them to handle high volumes while maintaining those quality standards-a, key drivers in the cell culture media bag market.

Tier 1 companies are the industry leaders with 54.4% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include Sartorious AG, Thermo Fisher Scientific, Inc., Merck KGaA, Pall Corporation and General Electric Co.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 22.2% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology.

The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Saint-Gobain Performance Plastics, Charter Medical, Avantor Fluid Handling LLC, and Lonza.

Compared to Tiers 1 and 2, Tier 3 companies offer cell culture media bags, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. The companies such as Entegris Inc., and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

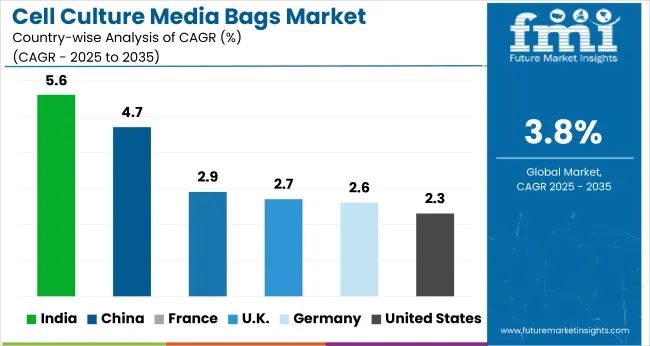

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.3% |

| Germany | 2.6% |

| France | 2.9% |

| China | 4.7% |

| India | 5.6% |

| UK | 2.7% |

An overview of the analysis of the cell culture media bag market in several countries is done in the below section. It also included analysis on key countries around the globe that include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

In the North American market, the United States is set to be a strong leader that maintains its ranking for the time horizon of 2035 at an estimated value share of 86.7%. China will similarly register a CAGR of 4.7% in the Asia-Pacific market through 2035.

Germany’s cell culture media bags market is poised to exhibit a CAGR of 2.6% between 2025 and 2035. The Germany holds highest market share in European market.

Germany’s government plays a pivotal role toward strengthening the life science & biotechnological industry sector to a considerable proportion supported by large inflows and promotions for researches and development and innovation in regions such as medicine, pharmaceutical companies, regeneratory medicine, as well as those gene therapies.

These programs not only enhance the development of new therapies but also encourage the adoption of top-of-the-line manufacturing technology, including cell culture bags like single-use systems.

It is due to government-backed grants and subsidies that the costs are reduced for biotech companies in integrating these technologies to produce their goods instead of using traditional systems, which are always more costly and less efficient.

Support from Germany accelerates the introduction of high-level solutions since the entry barriers have been lowered, and collaboration is enhanced between public research institutions and private companies. Such developments enhance demand for products like cell culture media bags, used to ensure sterility in any production and provide quality biopharmaceutical products.

United States cell culture media bags market will to show a CAGR of 2.3% between 2025 and 2035.

The trend of outsourcing biopharmaceutical manufacturing is a key driver for the market in the USA Biopharma companies have increasingly pushed their production upscaling into contract manufacturing organizations, especially for biologics, vaccines, and cell-based therapies. Currently, CMOs prefer single-use systems like cell culture media bags to raise production to scale, mainly due to factors such as efficiency, flexibility, and cost-effectiveness.

Single-use systems eliminate the need to clean and sterilize, leading to reduced operational downtimes and thus increased throughput. These also allow very rapid change-over between different batches of products enabling CMOs to manage a whole portfolio of drugs. The high complexity of biologics and the urgency for personalized therapeutics further accelerates the demand for scalable, contamination-free production environments in which media bags play a prime role.

As the USA demand for outsourced biopharmaceutical production continues to rise, utilization of single-use technologies, such as media bags, is expected to grow, contributing to further market growth.

China cell culture media bags market will to show a CAGR of 4.7% between 2025 and 2035.

Emerging cell-based research investment, especially in stem cell therapies and regenerative medicine, is the driving force behind the need for scalable and sterile bioprocessing solutions such as cell culture media bags. The more China progresses with its capabilities in these innovative fields, the greater the need to have systems to be used for culturing and growing cells in a controlled environment.

In stem cell therapies and regenerative medicine, it usually presents itself with quite complex high-precision procedures with very tight conditions that ensure zero contamination.

Cell culture media bags are a type of single-use bioprocessing technologies, which presents the best approach with flexibility and scalability as well as with an overall reduced risk of contamination. It is a disposable, presterilized product suitable for use within automated systems; thus, working in large scale production will become easy.

China's elevated interest in the use of treatments based on stem cells and regenerative medicine requires further advanced solutions to cell cultures. Growing research projects and clinical trials in these fields accelerate the demand for cell culture media bags to ensure the production of high-quality, efficient cell-based therapies.

Key players in the cell culture media bags market undertake various strategies to ensure competitive advantage. These include product innovation in developing high-performance materials and designs, enhancing bag performance, sterility, and scalability. The companies also attach importance to strategic partnering and collaboration with biopharmaceutical companies to increase market penetration.

Another strategic approach is to expand geographically-into emerging markets with biopharma industries that are making significant gains, including Asia-Pacific and Latin America. Alongside geographic expansion, companies continue to invest in sustainability initiatives, developing eco-friendly and recyclable media bags for environmental-focused clienteles.

Recent Industry Developments in Cell Culture Media Bags Market

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 1.64 billion |

| Current Total Market Size (2025) | USD 1.69 billion |

| Projected Market Size (2035) | USD 2.45 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Bag Sizes Analyzed (Segment 1) | <150 ml, 151-500 ml, 501 ml-1000L, 1001L-3000L, >3000L |

| Bag Designs Analyzed (Segment 2) | 2D, 3D |

| Host Cells Analyzed (Segment 3) | Mesenchymal Cells, Plant Cells, Insect Cells, Bacteria Cells, Yeast Cells, CHO, BHK |

| Applications Analyzed (Segment 4) | Storage, Mixing, Processing |

| Material Types Analyzed (Segment 5) | Polyethylene (PE), Ethylene Vinyl Alcohol (EVOH), Fluorinated Ethylene Propylene (FEP), Polyolefin, Others |

| End Users Analyzed (Segment 6) | Life Science R&D, Biopharmaceutical Manufacturers |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Cell Culture Media Bags Market | Sartorius AG, Pall Corporation, General Electric Co., Saint-Gobain Performance Plastics, Charter Medical, Thermo Fisher Scientific, Inc., Merck KGaA, Avantor Fluid Handling LLC, Lonza, Entegris Inc., Others |

| Additional Attributes | Growth in demand from large-scale biologics production, Adoption trends of 2D vs 3D bag configurations, Cell line-specific packaging preferences, Durability, sterility, and barrier property optimization, Biopharma-driven shift to single-use flexible systems |

| Customization and Pricing | Customization and Pricing Available on Request |

The industry classifies bag sizes into very small bags (< 150 ml), small bags (151 - 500 ml), medium bags (501 ml - 1000L), large bags (1001L - 3000L), and very large bags (>3000L).

In terms of bag design, the industry is segregated into 2D and 3D

In terms of host cell, the industry is segmented into mesenchymal cells, plant cells, insect cells, bacteria cells, yeast cells, Chinese hamster ovary, and baby hamster kidney.

In application, the industry is segregated into storage, mixing, and processing

Regarding material types, the sector is categorized into polyethylene (PE), ethylene vinyl alcohol (EVOH), fluorinated ethylene propylene (FEP), polyolefin, and additional options.

Life science R&D and biopharmaceutical manufacturer are further sub-division for end users.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global cell culture media bags industry is projected to witness CAGR of 3.8% between 2025 and 2035.

The global cell culture media bags industry stood at USD 1.64 billion in 2024.

The global cell culture media bags industry is anticipated to reach USD 2.45 billion by 2035 end.

China is expected to show a CAGR of 4.7% in the assessment period.

The key players operating in the global cell culture media bags industry Sartorious AG, Thermo Fisher Scientific, Inc., Merck KGaA, Pall Corporation, General Electric Co., Saint-Gobain Performance Plastics, Charter Medical, Avantor Fluid Handling LLC, Lonza and Entegris Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Bag Size, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Host Cell , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Bag Design, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Bag Size, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Host Cell , 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Bag Design, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Bag Size, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Host Cell , 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Bag Design, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Bag Size, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Host Cell , 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Bag Design, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Bag Size, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Host Cell , 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Bag Design, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Bag Size, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Host Cell , 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Bag Design, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Bag Size, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Host Cell , 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Bag Design, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Value (US$ Million) Forecast by Bag Size, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Middle East and Africa Market Value (US$ Million) Forecast by Host Cell , 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Bag Design, 2018 to 2033

Table 48: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Bag Size, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Host Cell , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Bag Design, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Bag Size, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Bag Size, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Bag Size, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Host Cell , 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Host Cell , 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Host Cell , 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Bag Design, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Bag Design, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Bag Design, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Bag Size, 2023 to 2033

Figure 26: Global Market Attractiveness by Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Host Cell , 2023 to 2033

Figure 28: Global Market Attractiveness by Bag Design, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Bag Size, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Host Cell , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Bag Design, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Bag Size, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Bag Size, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Bag Size, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Host Cell , 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Host Cell , 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Host Cell , 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Bag Design, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Bag Design, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Bag Design, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 55: North America Market Attractiveness by Bag Size, 2023 to 2033

Figure 56: North America Market Attractiveness by Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Host Cell , 2023 to 2033

Figure 58: North America Market Attractiveness by Bag Design, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Bag Size, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Host Cell , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Bag Design, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Bag Size, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Bag Size, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Bag Size, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Host Cell , 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Host Cell , 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Host Cell , 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Bag Design, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Bag Design, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Bag Design, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Bag Size, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Host Cell , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Bag Design, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Bag Size, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Host Cell , 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Bag Design, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Bag Size, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Bag Size, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Bag Size, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Host Cell , 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Host Cell , 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Host Cell , 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Bag Design, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Bag Design, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Bag Design, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 115: Europe Market Attractiveness by Bag Size, 2023 to 2033

Figure 116: Europe Market Attractiveness by Application, 2023 to 2033

Figure 117: Europe Market Attractiveness by Host Cell , 2023 to 2033

Figure 118: Europe Market Attractiveness by Bag Design, 2023 to 2033

Figure 119: Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Bag Size, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Host Cell , 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Bag Design, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Bag Size, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Bag Size, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Bag Size, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Host Cell , 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Host Cell , 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Host Cell , 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by Bag Design, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Bag Design, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Bag Design, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Bag Size, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Host Cell , 2023 to 2033

Figure 148: South Asia Market Attractiveness by Bag Design, 2023 to 2033

Figure 149: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Bag Size, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Host Cell , 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Bag Design, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Bag Size, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Bag Size, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Bag Size, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Host Cell , 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Host Cell , 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Host Cell , 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by Bag Design, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Bag Design, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Bag Design, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Bag Size, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Host Cell , 2023 to 2033

Figure 178: East Asia Market Attractiveness by Bag Design, 2023 to 2033

Figure 179: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Bag Size, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Host Cell , 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Bag Design, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Bag Size, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Bag Size, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Bag Size, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Host Cell , 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Host Cell , 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Host Cell , 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Bag Design, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Bag Design, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Bag Design, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Bag Size, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Host Cell , 2023 to 2033

Figure 208: Oceania Market Attractiveness by Bag Design, 2023 to 2033

Figure 209: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Bag Size, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Host Cell , 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Bag Design, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Bag Size, 2018 to 2033

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Bag Size, 2023 to 2033

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Bag Size, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Host Cell , 2018 to 2033

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Host Cell , 2023 to 2033

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Host Cell , 2023 to 2033

Figure 229: Middle East and Africa Market Value (US$ Million) Analysis by Bag Design, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Bag Design, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Bag Design, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 235: Middle East and Africa Market Attractiveness by Bag Size, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Host Cell , 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Bag Design, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

China Cell Culture Media Bags Market Insights – Size, Trends & Growth 2025-2035

India Cell Culture Media Bags Market Growth – Demand, Trends & Forecast 2025-2035

France Cell Culture Media Bags Market Trends – Size, Share & Growth 2025-2035

Germany Cell Culture Media Bags Market Growth – Demand, Trends & Forecast 2025-2035

United States Cell Culture Media Bags Market Outlook – Trends, Demand & Forecast 2025-2035

Cell Culture Media Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Media & Cell Lines Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Waste Aspirator Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Supplements Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Sampling Devices Market Growth – Trends & Forecast 2025 to 2035

Cell Culture Incubator Market Growth – Trends & Forecast 2025 to 2035

Cell Culture Market Analysis – Trends, Growth & Forecast 2024-2034

Culture Media Preparators Market Size and Share Forecast Outlook 2025 to 2035

3D Cell Culture Market - Demand, Size & Industry Trends 2025 to 2035

Cell Freezing Media Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Bags Market

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Dehydrated Culture Media Market Analysis - Size, Share, and Forecast 2025 to 2035

Pure Suspension Cell Culture Medium Market Size and Share Forecast Outlook 2025 to 2035

Balanced Salt Solution For Cell Culture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA