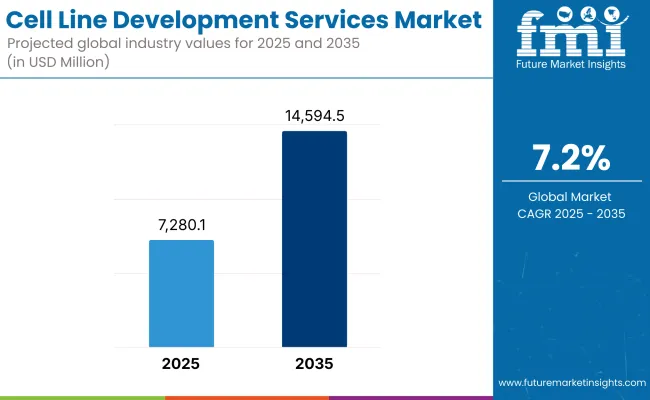

The global market for cell line development services is forecasted to attain USD 7,280.1 million by 2025, expanding at 7.2% CAGR to reach USD 14,594.5 million by 2035. In 2024, the revenue of Cell Line Development Serviceswas around USD 2,089.2 million

Growing awareness of biotechnology advancements, increasing demand for biologics, and the rising prevalence of chronic and rare diseases are key factors driving the cell line development services market globally. Cell line development plays a crucial role in biologic drug production, gene therapy, and vaccine manufacturing, supporting the development of monoclonal antibodies, recombinant proteins, and biosimilars.

The adoption of mammalian cell lines, particularly CHO and HEK-293 cells, is expanding due to their efficiency in producing high-yield and high-quality therapeutic proteins. Additionally, the increasing investment in biopharmaceutical R&D, personalized medicine, and regenerative therapies has led to greater demand for optimized cell lines that ensure stable and scalable production.

With growing regulatory support and advancements in automation, gene editing, and single-use bioprocessing technologies, the cell line development market is poised for significant growth, offering innovative solutions for drug discovery, vaccine production, and advanced therapeutics.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7,280.1 Million |

| Industry Value (2035F) | USD 14,594.5 Million |

| CAGR (2025 to 2035) | 7.2% |

North America dominates the cell line development services market, driven by the strong presence of leading biopharma companies, advanced research infrastructure, and increasing biologics approvals. The USA leads in outsourcing partnerships with CDMOs offering cell line development for monoclonal antibodies, fusion proteins, and gene therapy vectors.

FDA emphasis on cGMP-compliant production and quality by design (QbD) is prompting biotechs to seek expert-driven service providers. Canada is also seeing growth with rising government funding in biologics and precision medicine. The region benefits from a mature contract development ecosystem and robust regulatory guidance supporting clinical-grade cell line usage.

Europe is a key contributor to the cell line development services market, supported by strong academic-industry collaborations, EMA-compliant production standards, and growth in biosimilar development. Countries such as Germany, Switzerland, the UK, and France are major hubs for biologic drug development and bioprocess optimization.

European biotechs are increasingly relying on external service providers for rapid cell line screening, stability testing, and clone selection. EU-funded initiatives supporting advanced therapy medicinal products (ATMPs) and pandemic preparedness are expanding service demand. Regional emphasis on data traceability and single-use bioprocessing systems further supports market maturity.

Asia-Pacific is the fastest-growing region in the cell line development services market due to rising biologics manufacturing, growing R&D investment, and cost-effective service offerings. China and India are rapidly becoming outsourcing hubs with expanding GMP-compliant facilities and skilled scientific talent.

Japan and South Korea lead in biopharma innovation and regulatory reforms encouraging faster drug development cycles. Local CDMOs are increasingly partnering with Western firms to offer integrated development platforms from cell line generation to commercial-scale production. Government support for biotech clusters and international collaborations is expected to further accelerate regional market growth.

Comprehensive Analysis of Challenges Impacting the Cell Line Development ServicesMarket

Key challenges include variability in cell line performance, lengthy development timelines, and complex regulatory documentation for clinical-grade lines. IP protection issues and transfer of proprietary vectors or plasmids can complicate outsourcing agreements.

Ensuring cell line stability, productivity, and scalability under GMP conditions requires significant expertise and validation resources. Additionally, managing biosafety risks and meeting data traceability standards are critical for regulatory compliance. Smaller biotech firms may face cost barriers and dependency risks when outsourcing core development functions.

Emerging Opportunities and Innovations Driving Growth in the Cell Line Development ServicesMarket

Opportunities lie in expanding service portfolios to include CHO (Chinese Hamster Ovary) cell line engineering, stable pool generation, transfection optimization, and cell bank characterization. Integration of advanced software in clone selection and productivity forecasting can shorten timelines and enhance quality.

Growth in mRNA vaccines, viral vector production, and oncolytic virus therapies is creating demand for customized mammalian and insect cell lines. As cell therapy and regenerative medicine markets expand, stem cell-derived lines and immortalized cell platforms are gaining traction. CDMOs that offer end-to-end services from vector design to GMP cell banking will gain competitive advantage.

One emerging trend is the adoption of single-use bioreactors and perfusion systems in early-stage cell line development, enabling continuous processing and scalability from lab to clinic. Moreover, other trend that is observed, the convergence of multi-omics and high-throughput screening for advanced cell line characterization, facilitating precision cell engineering and regulatory readiness.

From 2020 through 2024, the global cell line development services market experienced steady growth, driven by the increasing demand for biologics and biosimilars, advancements in cell line development technologies, and the expanding biopharmaceutical industry.

The growth was also supported by the rising need for high-quality, stable, and high-yield cell lines essential for producing monoclonal antibodies, vaccines, recombinant proteins, and other therapeutic agents. However, challenges such as the complexity and high cost of cell line development, stringent regulatory requirements, and the need for specialized equipment and skilled personnel posed constraints on broader market expansion during this period.

Looking ahead to 2025 to 2035, the cell line development services market is poised for continued growth, propelled by ongoing technological innovations, increased investment in biopharmaceutical research and development, and a growing emphasis on personalized medicine.

The development of automated platforms and advanced expression systems is expected to enhance efficiency, reduce development timelines, and improve the quality of cell lines. Additionally, expanding applications of cell lines in regenerative medicine, gene therapy, and tissue engineering, along with increasing collaborations between academic institutions and biopharmaceutical companies, are anticipated to drive market growth.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Implementation of stringent guidelines ensuring the safety, efficacy, and quality of cell line development processes, leading to standardized protocols and increased oversight. |

| Technological Advancements | Introduction of advanced cell culture media, reagents, and equipment, enhancing the efficiency and reliability of cell line development. |

| Consumer Demand | Increased reliance on cell line development services for bioproduction , drug discovery, and toxicity testing, driven by the need for effective and reliable cell-based assays and production systems. |

| Market Growth Drivers | Rising demand for biologics and biosimilars, advancements in cell line development technologies, and increased outsourcing of cell line development activities to specialized service providers. |

| Sustainability | Initial efforts towards integrating sustainable practices in cell line development, including the use of animal-free media and reduction of waste in laboratory processes. |

| Supply Chain Dynamics | Dependence on specialized suppliers for high-quality reagents, media, and equipment, with efforts to ensure consistent availability amid regulatory changes and increasing demand. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Continuous monitoring and potential harmonization of regulations across countries to balance patient safety with technological innovation, alongside expedited approval processes for novel cell line development technologies addressing unmet medical needs. |

| Technological Advancements | Development of automated platforms and high-throughput screening technologies, improving the speed, accuracy, and reproducibility of cell line development processes, and enabling the creation of cell lines with enhanced productivity and stability. |

| Consumer Demand | Growing preference for customized and scalable cell line development solutions, driven by advancements in personalized medicine and a focus on patient-specific therapies, leading to widespread adoption across diverse therapeutic areas. |

| Market Growth Drivers | Expansion of biopharmaceutical pipelines, increasing investments in regenerative medicine and gene therapy, continuous technological innovations enhancing cell line development efficiency, and a global emphasis on personalized and precision medicine approaches. |

| Sustainability | Adoption of green technologies and sustainable manufacturing processes, aligning with global sustainability initiatives and reducing the environmental footprint of cell line development activities. |

| Supply Chain Dynamics | Strengthening of local manufacturing capabilities and diversification of supply sources, enhancing supply chain resilience and reducing reliance on imports, while ensuring compliance with evolving regulatory standards and meeting the growing demand for cell line development services in various regions. |

Market Outlook

The United States leads the global cell line development services market, driven by a robust biopharmaceutical pipeline, high demand for monoclonal antibodies, recombinant proteins, and gene therapies, and a well-established contract research and manufacturing ecosystem. Increasing investment in personalized medicine, biosimilars, and cell-based vaccine production is fueling service demand for stable, high-yielding cell lines.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

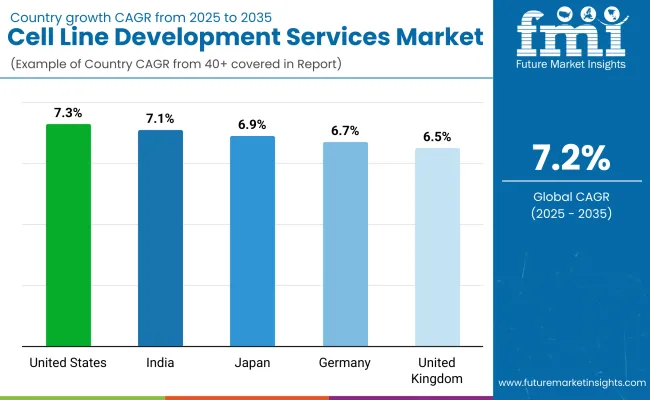

| United States | 7.3% |

Market Outlook

Germany’s cell line development services market is a cornerstone of the European biomanufacturing ecosystem, backed by its leadership in biosimilars, academic research excellence, and a growing number of biotech startups and biologic drug developers. Services are increasingly geared toward custom cell line engineering, host cell optimization, and regulatory-compliant cell banking.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.7% |

Market Outlook

The UK cell line development services market is expanding, fueled by the country’s strong position in cell and gene therapy, oncology biologics, and academic drug discovery partnerships. Advanced research hubs such as Cambridge and Oxford are creating high-value demand for customized, high-expression cell lines tailored for early- and mid-phase biologics development.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

Market Outlook

Japan’s cell line development services market is driven by its focus on biologic drug innovation, regenerative medicine, and cancer immunotherapy. With a rising pipeline of biosimilars and cell-based therapies, Japanese pharmaceutical companies and research institutions are increasingly outsourcing cell line development for clinical-grade and commercial-ready production systems.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

Market Outlook

India’s cell line development services market is rapidly growing, supported by expanding biopharmaceutical manufacturing, cost-effective R&D services, and a surge in domestic and international outsourcing contracts. The country's CDMO sector, bolstered by government initiatives like “Make in India” and Biotechnology Industry Research Assistance Council (BIRAC) support, is contributing to the rise of integrated cell line development services.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.1% |

Mammalian cell lines

Mammalian cell lines, particularly Chinese Hamster Ovary (CHO), Human Embryonic Kidney (HEK 293), and NS0/Sp2/0 myeloma cells, dominate the market due to their ability to express complex, human-like post-translational modifications-a requirement for most monoclonal antibodies (mAbs), recombinant proteins, and vaccines.

The rise in biologics and biosimilars production, coupled with the demand for high-yield, stable, and regulatory-compliant cell lines, is driving demand for outsourced development services. Major biopharma companies and emerging biotech firms are leveraging contract development and manufacturing organizations (CDMOs) for custom cell line engineering, clone screening, and stability testing.

North America and Europe are leading markets, while Asia-Pacific (especially China and South Korea) is expanding rapidly due to growing biomanufacturing capacity. Future trends include AI-assisted clone selection, single-cell transcriptomics for stability analysis, and CRISPR-based cell line optimization.

Microbial Cell Lines

Microbial systems particularly Escherichia coli and Saccharomyces cerevisiae are widely used for recombinant protein expression, enzymes, and industrial bioproducts. While lacking post-translational complexity, microbial systems are cost-effective, scalable, and fast-growing, making them suitable for early-stage development and non-glycosylated products. Demand is rising in agro-biotech, diagnostics, and synthetic biology applications.

Europe and the USA lead in microbial CDMO activity, while India and China are expanding microbial fermentation hubs. Future developments include synthetic promoter libraries, automated high-throughput strain engineering, and modular plasmid systems for rapid expression tuning.

Biologics Manufacturing (Monoclonal Antibodies and Recombinant Proteins)Leading the Cell Line Development ServicesLandscape

This is the largest application segment, driven by the surge in demand for therapeutic biologics, biosimilars, and next-gen biologic modalities. Cell line development is critical for producing stable, high-yield expression systems under Good Manufacturing Practice (GMP) conditions. Companies increasingly outsource to specialized CDMOs that offer end-to-end services from transfection to master cell bank (MCB) generation.

North America and Western Europe dominate, with strong demand from oncology, immunology, and metabolic disorder pipelines. Future trends include machine learning-guided cell line prediction, synthetic biology-enabled cell line tuning, and mini-bioreactor systems for early-stage screening.

Cell-based vaccine production is growing due to limitations in traditional egg-based methods and the need for rapid scalability, especially for pandemic preparedness and emerging infectious diseases. Mammalian cell lines such as Vero, PER.C6, and MDCK, along with insect cell platforms (e.g., Sf9 for baculovirus expression systems), are increasingly used in the development of influenza, COVID-19, and recombinant protein vaccines.

The market is supported by government funding, WHO-prequalified manufacturers, and public-private partnerships.

Asia-Pacific and Latin America are key regions for expanding vaccine manufacturing capacity. Future innovations include self-amplifying RNA delivery via cell lines, rapid clone selection via high-content imaging, and integrated AI-LIMS platforms for end-to-end workflow automation.

The cell line development services market is expanding rapidly, driven by increased biopharmaceutical production, rising demand for monoclonal antibodies, and advancements in gene therapy and regenerative medicine. Outsourcing trends among biotech and pharma companies, as well as growing applications in vaccine manufacturing and cancer research, are fueling market growth.

The sector is dominated by contract research and manufacturing organizations (CROs and CDMOs) with expertise in stable cell line creation, regulatory compliance, and scalable manufacturing.

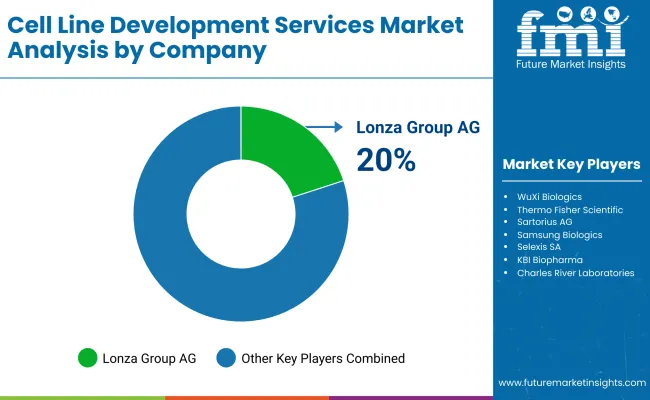

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lonza Group AG | 20-24% |

| WuXi Biologics | 16-20% |

| Thermo Fisher Scientific | 14-18% |

| Sartorius AG | 8-12% |

| Samsung Biologics | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lonza Group AG | Offers proprietary GS Xceed expression system for stable and high-yielding mammalian cell line development. |

| WuXi Biologics | Provides comprehensive cell line development platforms and regulatory-compliant biologics manufacturing services. |

| Thermo Fisher Scientific | Supplies cell line development reagents, transfection systems, and custom cell engineering services. |

| Sartorius AG | Develops media, bioreactor systems, and services to support rapid and scalable cell line development. |

| Samsung Biologics | Offers end-to-end cell line development and biologics production solutions under its contract manufacturing model. |

Key Company Insights

Other Key Players (20-30% Combined) Other companies contributing to the Cell Line Development Services market include:

These companies drive innovation in cell engineering, offer integrated development-to-manufacturing workflows, and support cell line customization for various biotherapeutic pipelines.

Media and Reagents, Equipment, Accessories and Consumables and Development Service

Mammalian Cell Lines, Microbial Cell Lines, Insect Cell Lines and Others

Biopharmaceutical Companies, Contract Research Organization, Academics and Research Institutes and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for cell line development services market was USD 7,280.1 million in 2025.

The cell line development services market is expected to reach USD 14,594.5 million in 2035.

Advances in cell culture technologies, automation, and gene-editing tools like CRISPR have significantly improved efficiency, boosting market growth.

The top key players that drives the development of Cell Line Development Services market are, Lonza Group AG, WuXi Biologics, Thermo Fisher Scientific, Sartorius AG and Samsung Biologics.

Mammalian cell type of cell line development services market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Type, 2023 to 2033

Figure 19: Global Market Attractiveness by Application, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Type, 2023 to 2033

Figure 39: North America Market Attractiveness by Application, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cell Line Development Market Analysis – Growth & Industry Outlook 2025 to 2035

Stable Cell Line Development Market Size and Share Forecast Outlook 2025 to 2035

Online Laundry Services Market Size and Share Forecast Outlook 2025 to 2035

Insect Cell Lines Market - Growth, Applications & Forecast 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Airline A-la-carte Services Market Analysis by Product Type, Carrier Type and Region from 2025 to 2035

Online Food Delivery Services Market Outlook - Growth, Demand & Forecast 2025 to 2035

Cell Culture Media & Cell Lines Market Size and Share Forecast Outlook 2025 to 2035

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Monocrystalline Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Cryopreservation Cell Lines Market

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Lined Dip Pipes Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Linear Regulator ICs (LDOs) Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA