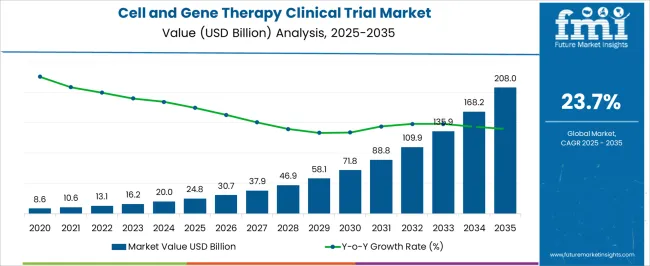

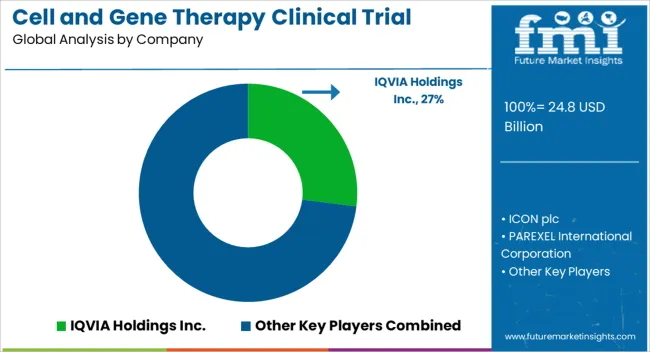

The Cell and Gene Therapy Clinical Trial Market is estimated to be valued at USD 24.8 billion in 2025 and is projected to reach USD 208.0 billion by 2035, registering a compound annual growth rate (CAGR) of 23.7% over the forecast period.

| Metric | Value |

|---|---|

| Cell and Gene Therapy Clinical Trial Market Estimated Value in (2025 E) | USD 24.8 billion |

| Cell and Gene Therapy Clinical Trial Market Forecast Value in (2035 F) | USD 208.0 billion |

| Forecast CAGR (2025 to 2035) | 23.7% |

The Cell and Gene Therapy Clinical Trial market is expanding steadily, fueled by ongoing advancements in regenerative medicine, molecular biology, and personalized healthcare. Significant attention has been drawn to the ability of cell and gene therapies to address previously untreatable or rare genetic disorders, making them a focal point of modern clinical development. Investor presentations and biopharma press releases have highlighted a rise in clinical trial volumes globally, driven by increased funding, supportive regulatory frameworks, and accelerated approval pathways.

These therapies are being prioritized for their potential to provide curative outcomes, shifting the healthcare approach from symptom management to disease modification. As indicated in scientific journals and conference summaries, partnerships between research institutions and biotech companies are also accelerating pipeline progress.

Future market growth is expected to be supported by scalable manufacturing processes, adaptive clinical trial designs, and the expansion of clinical infrastructure in emerging regions These elements collectively are establishing a strong growth foundation for the global cell and gene therapy trial ecosystem.

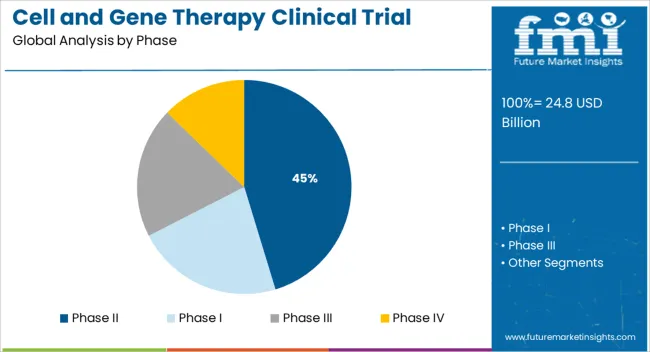

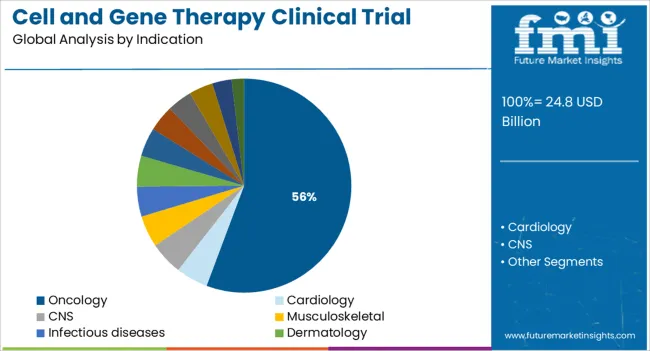

The market is segmented by Phase and Indication and region. By Phase, the market is divided into Phase II, Phase I, Phase III, and Phase IV. In terms of Indication, the market is classified into Oncology, Cardiology, CNS, Musculoskeletal, Infectious diseases, Dermatology, Endocrine, metabolic, genetic, Immunology & inflammation, Ophthalmology, Hematology, Gastroenterology, and Other Indications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Phase II segment is projected to account for 45.3% of the Cell and Gene Therapy Clinical Trial market revenue share in 2025, making it the leading trial phase segment. This position has been supported by the increasing number of cell and gene therapy candidates progressing from early safety testing to mid-stage efficacy evaluation. Clinical development pipelines disclosed by major biotechnology firms have indicated a growing concentration of investigational therapies in Phase II, reflecting successful completion of Phase I trials and readiness for broader evaluation.

Regulatory authorities have also encouraged advancement into Phase II through expedited review designations, reducing transition timelines. The segment’s growth has been reinforced by enhanced trial design methodologies, biomarker-based patient selection, and strong sponsor engagement.

Industry updates and scientific event discussions have noted that Phase II trials are being leveraged to generate robust preliminary efficacy data, which in turn informs pivotal Phase III planning These factors have collectively elevated the prominence of Phase II within the clinical development landscape.

The oncology segment is anticipated to dominate the Cell and Gene Therapy Clinical Trial market with a 55.7% revenue share in 2025, securing its role as the largest therapeutic area. This leadership has been shaped by the high unmet clinical need in cancer treatment, along with the potential of cell and gene therapies to deliver durable responses in both solid tumors and hematologic malignancies. Clinical trial registries and corporate development pipelines have shown a sharp rise in oncology-focused investigational therapies, with T-cell engineering, tumor-infiltrating lymphocytes, and oncolytic vectors being actively pursued.

Investment disclosures and conference proceedings have confirmed that oncology continues to attract the majority of clinical trial funding in the sector. The complexity of cancer biology has also necessitated the development of innovative therapeutic platforms that align with the personalized mechanisms of action provided by these therapies.

Regulatory bodies have prioritized oncology trials for fast-track evaluation due to their potential to address life-threatening conditions As a result, oncology has remained the principal driver of cell and gene therapy clinical trial activity.

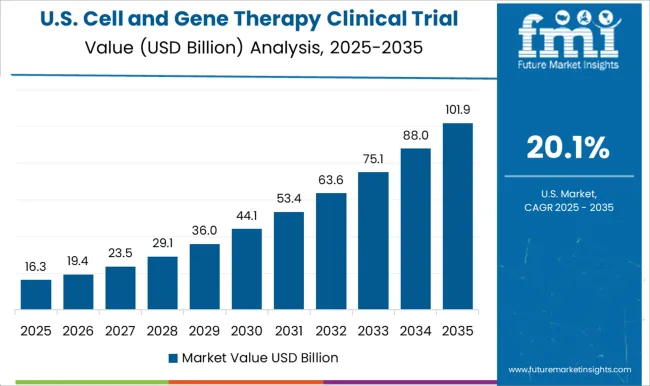

As per the Cell and Gene Therapy Clinical Trial Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Cell and Gene Therapy Clinical Trial Market increased at around 21.9% CAGR.

Gene therapy is a revolutionary treatment method that includes inserting one or more corrected genes into patient cells that have been developed in the lab to repair disorders.

As an alternative therapy option or tailored medicine, CGT holds significant potential. Furthermore, as compared with small-molecule medicines, they have a higher success rate as cell and gene therapy is centered on the diagnosis of definite disease instead of macro-level like small-molecule treatment.

Cell and gene therapy is a promising treatment option for a variety of ailments, including cancer and rare genetic disorders. It exemplifies the life sciences industry's new wave of innovation. Even though just a few early medicines have received FDA clearance in the United States, there are numerous potential therapies under development around the world. Increasing funding, investments in research and development, and product launches are boosting market growth.

Other factors influencing gene therapy market growth include increased research spending, rising cancer incidence, speedier product approvals, and increased commercialization of cell and gene treatments.

The global market is being transformed by the development of efficient and selective gene targeting and delivery techniques, as well as the growing knowledge of disease path mechanisms. The most common indications are currently human cancers and monogenic disorders.

A rise in the number of genetic defects and cancers, as well as explicit gene modification techniques and greater financial support for gene therapy in clinical trials, are the key trends.

However, cell and gene therapy developers face challenges in several key areas, including enabling patient access, managing supply chain and manufacturing operations, and developing a healthcare provider network, as with any new and innovative disruptive technology. The high operational expenses associated with cell and gene therapy manufacturing, on the other

Cell treatment is centered on ailments at the cellular level, which includes the restoration of a specific cell population or using cells as therapeutic carriers. Gene therapy seeks to alter the course of numerous inherited and acquired issues at the genetic level. The global cell and gene therapy market is projected to grow due to the rising prevalence of cardiovascular diseases and the introduction of effective recommendations.

However, a number of development difficulties, including safety and efficacy concerns, lengthy clinical trial procedures, stringent regulatory environment, and high costs, are expected to limit cell and gene therapy acceptability, thus choking market expansion.

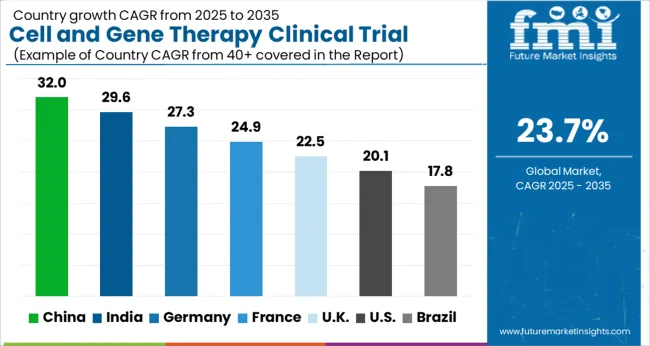

North America held the highest market of around 50% in 2024. Increased prevalence of chronic illnesses, surged investment in research and development activities, and active engagement and support from the government have been the prominent drivers of the gene therapy market.

Furthermore, in the United States, the regulatory approval procedure is improving and becoming more beneficial for CGT vendors. To speed up the approval process, the FDA has given CGTs orphan drug status, breakthrough designation, accelerated approvals, and RMAT designations.

High economic status and high healthcare spending drive the CGT market in North America. Sponsorship and financial funding for CGT products come mostly from National Health Institutes, companies, academic institutes, and hospitals.

Rising medical tourism, a greater emphasis on healthcare, the incidence of uncommon chronic illnesses, and increased research and development activities in East Asia and South Asia are projected to fuel demand for gene treatments throughout the forecast period.

The United States is expected to account for the largest market of USD 208 Billion by 2035. It holds a dominant position in the global cell and gene therapy market, owing to the high prevalence of genetic disorders.

Demand for cell and gene therapy is also expected to rise as research and development activities expand. Several novel cell and gene therapies are being developed for a variety of ailments, with the majority of them aimed at cancer and cardiovascular disease treatments. These medications either are in clinical development or are awaiting FDA approval.

The market in the UK is projected to reach USD 4 Billion by 2035. Growing at a CAGR of 24.3% from 2025 to 2035, the market in the country is expected to gross an absolute dollar opportunity of USD 3.5 Billion.

The market in Japan is expected to grow at a CAGR of 32.4% during the forecast period to reach a valuation of USD 7.4 Billion by 2035. From 2025 to 2035, the market is expected to gross an absolute dollar opportunity of USD 6.9 Billion.

The market in South Korea is expected to reach USD 2.8 Billion by 2035. The market is expected to grow with a CAGR of 25.8% from 2025 to 2035, with an absolute dollar opportunity of USD 2.5 Billion.

The market through Oncology indication is forecasted to grow at a CAGR of 27.9% from 2025 to 2035. Oncology has been a focus of considerable study for gene therapy processes and approaches. More than 60% of ongoing gene therapy clinical studies are aimed at cancer. Because of the significant frequency of cancer disorders, particularly in poor and middle-income nations, the category is projected to rise at a promising rate.

In addition, the success of CAR-T cell treatments in the treatment of hematological malignancies has paved the path for increased investment in CGTs in oncology. Biotech and pharmaceutical corporations are both investing in this method to treat various forms of cancer on a global scale.

Some of the key players in the cell and gene therapy market include IQVIA Holdings Inc., Medpace Holdings Inc., Gilead Sciences, Dendreon, Vericel, Novartis, and Amgen.

Some of the recent developments of key Cell and Gene Therapy Clinical Trial providers are as follows:

Similarly, recent developments related to companies' Cell and Gene Therapy Clinical Trial services have been tracked by the team at Future Market Insights, which are available in the full report.

The global cell and gene therapy clinical trial market is estimated to be valued at USD 24.8 billion in 2025.

The market size for the cell and gene therapy clinical trial market is projected to reach USD 208.0 billion by 2035.

The cell and gene therapy clinical trial market is expected to grow at a 23.7% CAGR between 2025 and 2035.

The key product types in cell and gene therapy clinical trial market are phase ii, phase i, phase iii and phase iv.

In terms of indication, oncology segment to command 55.7% share in the cell and gene therapy clinical trial market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulite Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cell Isolation Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Waste Aspirator Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Media Market Size and Share Forecast Outlook 2025 to 2035

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Supplements Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Media & Cell Lines Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Market Size and Share Forecast Outlook 2025 to 2035

Cell Freezing Media Market Size and Share Forecast Outlook 2025 to 2035

Cellulase Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA