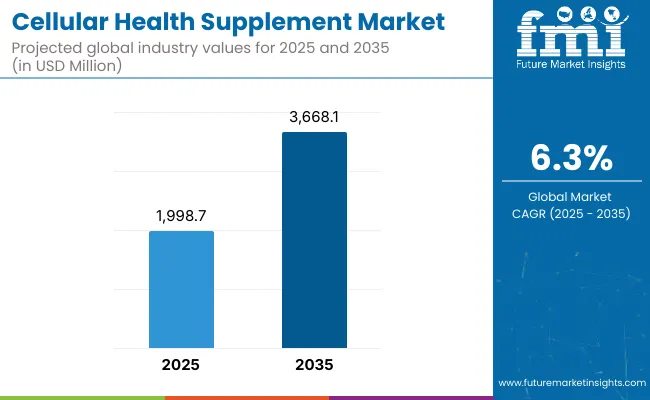

The Cellular Health Supplement Market is expected to record a valuation of USD 1,998.7 million in 2025 and USD 3,668.1 million in 2035, marking a rise of USD 1,669.4 million, which equals a growth of 77% over the decade. This expansion represents a compound annual growth rate (CAGR) of 6.3% and reflects a 1.83X increase in market size.

Cellular Health Supplement Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,998.7 million |

| Market Forecast Value in (2035F) | USD 3,668.1 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

During the first half of the forecast period, from 2025 to 2030, the market is anticipated to grow from USD 1,998.7 million to USD 2,652 million, adding nearly USD 654 million, which accounts for 43% of the total decade growth.

This growth phase is likely to be driven by heightened clinical interest in mitochondrial health and accelerated uptake across digital-first nutraceutical platforms. Early adoption has been facilitated by health-literate consumers in North America and Asia, supported by scientific publications that validate cellular function markers.

The second half, from 2030 to 2035, is projected to contribute an additional USD 886 million, equating to 57% of total growth. The shift is expected to be influenced by precision diagnostics, personalized supplement stacks, and multi-ingredient synergy innovations tailored to individual cellular profiles.

Advanced delivery formats and software-driven regimen tracking tools are expected to raise adherence levels, thus increasing per capita intake volumes and improving lifetime customer value for brands.

Between 2020 and 2024, the Cellular Health Supplement Market scaled steadily, laying the groundwork for an estimated USD 1,998.7 million valuation in 2025. Growth was propelled by rising awareness of mitochondrial decline, NAD⁺ biology, and cellular resilience pathways. Ingredient-led brand differentiation, particularly within NAD⁺ boosters and polyphenols, defined early market leadership.

During this phase, hardware-centric legacy strategies were replaced by integrated digital ecosystems. Software-enabled platforms tracking biomarkers and guiding supplement regimens began capturing user attention, though they contributed under 10% to the revenue mix.

By 2035, market demand is forecasted to reach USD 3.67 billion, with innovation accelerating through AI-based personalization, subscription DTC platforms, and diagnostics-linked formulations. Competitive advantage is expected to be earned through precision, clinical trust, and ecosystem scalability where formulation alone will no longer suffice.

Growth in the Cellular Health Supplement Market is being driven by rising scientific validation around cellular aging, mitochondrial dysfunction, and oxidative stress as root causes of chronic health decline. Greater awareness of longevity pathways such as AMPK, mTOR, and sirtuins has been created through academic publications and wellness media, prompting demand for preventive bioactive interventions. Consumer behavior has shifted toward proactive aging and vitality management, supported by expanding access to diagnostic tools that assess cellular biomarkers.

Trust has been reinforced by clinical research supporting NAD+ precursors, polyphenols, and mitochondrial enhancers. Supplement formulations have been increasingly integrated into holistic wellness protocols via direct-to-consumer models and practitioner channels.

Functional food convergence and digital health tracking have accelerated recurring usage. Regulatory bodies have gradually clarified frameworks for health claims, enabling more consistent product positioning. As ingredient innovation and personalized nutrition advance, continued growth is expected to be sustained across both developed and emerging wellness-focused economies.

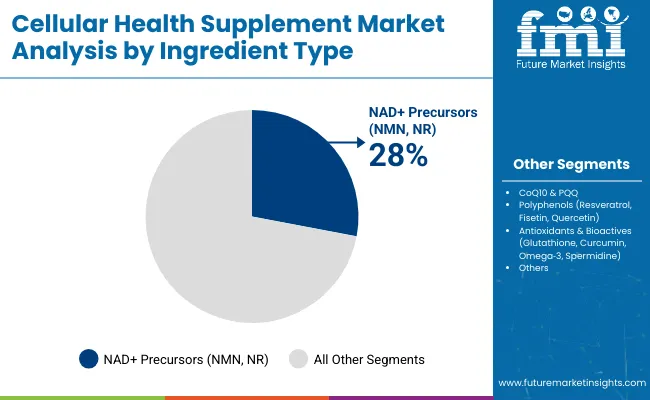

The Cellular Health Supplement Market has been segmented across key dimensions to reflect diverse demand drivers and functional priorities. Ingredient types have been categorized into NAD+ precursors, CoQ10 & PQQ, polyphenols, and broader antioxidant bioactives, each targeting distinct cellular mechanisms.

From a health function standpoint, segmentation has been structured around longevity, energy metabolism, cognitive performance, cardiovascular stability, immune modulation, and metabolic support. In terms of product format, market share has been distributed among capsules, softgels, powders, liquids, and gummies, aligning with evolving consumer preferences for convenience, bioavailability, and formulation compatibility.

This multidimensional segmentation has enabled stakeholders to tailor strategies by biological need-state, ingredient efficacy, and delivery innovation positioning the category as one of the most personalized and functionally targeted in the broader nutraceutical landscape.

| Ingredient Type | Market Value Share, 2025 |

|---|---|

| NAD+ Precursors (NMN, NR) | 28% |

| CoQ10 & PQQ | 22% |

| Polyphenols (Resveratrol, Fisetin, Quercetin) | 18% |

| Other Antioxidants & Bioactives (Glutathione, Curcumin, Omega 3, Spermidine) | 32% |

The ingredient landscape has been led by NAD+ precursors, which are projected to capture 28% of market value by 2025. Their dominance has been reinforced by evidence linking NAD+ levels with mitochondrial energy, DNA repair, and sirtuin activation.

Polyphenols including resveratrol, quercetin, and fisetin have also witnessed elevated inclusion rates due to their senolytic and anti-inflammatory effects. Meanwhile, broader antioxidant and bioactive groups, comprising glutathione, curcumin, omega-3s, and spermidine, have collectively captured the largest share at 32%.

These formulations have been favored for their multi-pathway action across oxidative stress reduction, inflammation management, and membrane integrity. CoQ10 and PQQ, contributing 22%, have sustained demand due to their roles in ATP synthesis and cellular redox cycling. As novel bioactives gain regulatory approval and clinical validation, continuous portfolio optimization is expected across this segment.

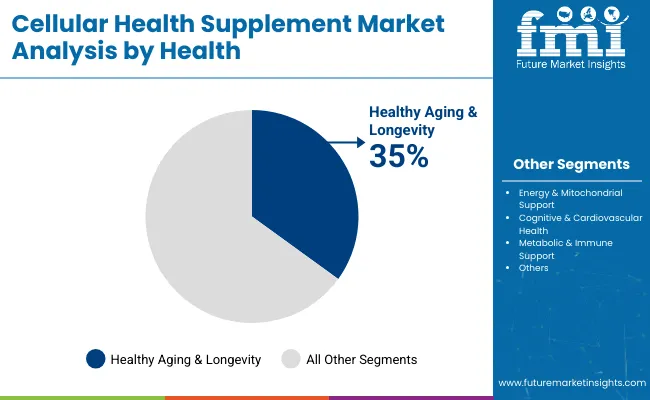

| Health Function | Value Share % 2025 |

|---|---|

| Healthy Aging & Longevity | 35% |

| Energy & Mitochondrial Support | 25% |

| Cognitive & Cardiovascular Health | 20% |

| Metabolic & Immune Support | 20% |

In 2025, Healthy Aging & Longevity is forecasted to account for 35% of the total market value, driven by widespread interest in biological age reversal and healthspan optimization. Cellular supplements have been increasingly adopted as core interventions in longevity routines, fueled by consumer interest in NAD+ repletion, autophagy activation, and telomere maintenance.

Energy and mitochondrial support are expected to capture 25%, with demand being fueled by rising fatigue-related conditions and increased public understanding of mitochondrial dysfunction. Cognitive and cardiovascular health, contributing 20%, have gained relevance through aging-related cognitive decline and endothelial stress.

Immune and metabolic support have jointly held another 20%, driven by demand for homeostasis, metabolic flexibility, and defense against age-induced immunosenescence. As functional segmentation deepens, multi-claim formulations are projected to become the default, supporting cross-function wellness strategies.

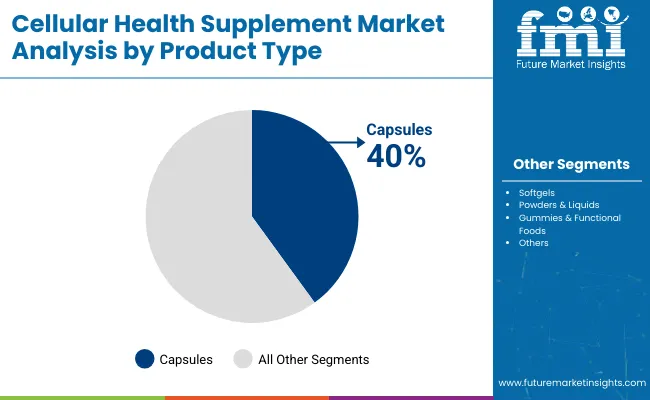

| Product Format | Value Share % 2025 |

|---|---|

| Capsules | 40% |

| Softgels | 25% |

| Powders & Liquids | 20% |

| Gummies & Functional Foods | 15% |

Capsules have been projected to contribute 40% of market value by 2025, driven by their familiarity, dosing accuracy, and compatibility with both dry and microencapsulated ingredients. The format has been widely accepted among both retail consumers and clinicians for its ease of formulation and scalability.

Softgels, accounting for 25%, have remained popular for lipid-soluble compounds such as CoQ10 and omega-3s, offering improved bioavailability. Powders and liquids, comprising 20%, have been favored for customizable routines, often integrated into smoothies and health beverages.

Gummies and functional foods, capturing 15%, have gained traction among younger consumers and supplement-averse demographics. Despite lower market share, they have been identified as high-growth segments. As format innovation evolves around absorption kinetics and compliance enhancement, capsules and softgels are expected to retain dominance while emerging formats capture niche segments.

Adoption of cellular health supplements has accelerated despite scientific complexity and consumer skepticism, as growing interest in longevity, mitochondrial renewal, and proactive aging continues to expand across functional nutrition, clinical wellness, and digital biomarker-linked supplement ecosystems worldwide.

Scientific Validation of NAD+ and Cellular Pathways

Rapid growth has been supported by increasing scientific validation surrounding NAD+ restoration, sirtuin activation, and autophagy as modifiable factors in cellular aging. These mechanisms have been prioritized in both academic research and commercial formulation pipelines.

Clinical trials have confirmed improvements in energy metabolism, DNA repair, and mitochondrial density driving practitioner endorsement and consumer confidence. Demand has been amplified by integrative medicine protocols and the rise of longevity clinics, where NAD+ boosters are increasingly being positioned as foundational interventions. As evidence-based marketing becomes a strategic differentiator, products backed by peer-reviewed data are expected to capture significant long-term market share.

Integration with Personalized Health Platforms

A major trend has been the integration of cellular health supplements into AI-driven personalized health ecosystems. Supplement recommendations have been increasingly guided by biomarker feedback, wearable data, and digital diagnostics. Platforms that link genetic predispositions to cellular pathways are being leveraged to enhance precision and user trust.

As longevity-focused consumers adopt bio-individual wellness strategies, personalization is expected to evolve from optional to essential. Brands capable of embedding cellular supplements into dynamic, feedback-loop-driven wellness plans are likely to gain competitive advantage, especially as real-time health optimization becomes a consumer expectation.

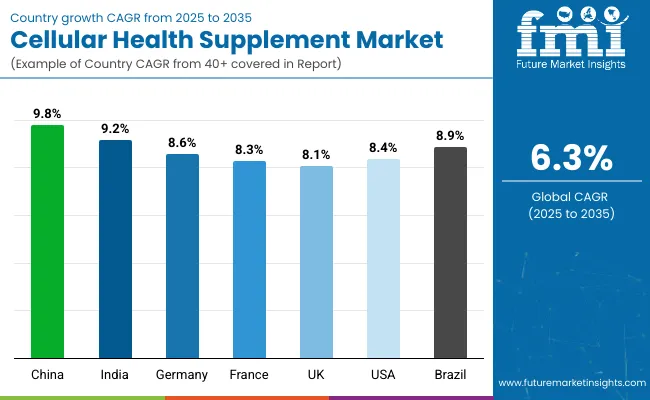

| Countries | CAGR |

|---|---|

| China | 9.80% |

| India | 9.20% |

| Germany | 8.60% |

| France | 8.30% |

| UK | 8.10% |

| USA | 8.40% |

| Brazil | 8.90% |

The global Cellular Health Supplement Market has exhibited varying adoption trajectories across major economies, shaped by demographic trends, healthcare innovation, and the regulatory environment surrounding preventive nutrition. Asia-Pacific has emerged as the fastest-growing region, led by China at a projected CAGR of 9.8% and India at 9.2% from 2025 to 2035.

This momentum has been driven by an aging population, rising chronic fatigue cases, and increased consumer education surrounding cellular energy and longevity. In China, widespread digital health integration and consumer trust in science-backed formulations have further propelled adoption, while India’s growth has been catalyzed by urban preventive health movements and expanding nutraceutical access through online retail.

Europe has maintained a strong outlook, anchored by Germany (8.6%), France (8.3%), and the UK (8.1%). Growth in these countries has been reinforced by clinical channel endorsements, aging demographics, and increased funding for longevity research. Preventive care integration into national health systems is expected to enhance adoption.

North America continues to demonstrate robust maturity, with the USA growing at 8.4% CAGR. Here, demand has been shaped by the integration of supplements into personalized longevity stacks and biohacking protocols. Brazil, growing at 8.9%, is expected to benefit from growing middle-class health consciousness and practitioner-led education.

| Year | USA Cellular Health Supplement Market |

|---|---|

| 2025 | 350 |

| 2026 | 379 |

| 2027 | 411 |

| 2028 | 445 |

| 2029 | 482 |

| 2030 | 522 |

| 2031 | 565 |

| 2032 | 612 |

| 2033 | 663 |

| 2034 | 719 |

| 2035 | 779 |

The Cellular Health Supplement Market in the United States is projected to grow at a CAGR of 8.4% from 2025 to 2035, supported by rising adoption of longevity interventions and bio-optimized nutritional strategies. Demand has been increasingly influenced by personalized wellness regimens, where supplements targeting mitochondrial health, NAD+ repletion, and telomere preservation are being prioritized.

Clinical practitioners have incorporated cellular supplements into anti-aging and integrative medicine protocols, while digital wellness platforms have enabled broad consumer access. Advanced diagnostics and wearable biomarker integrations have elevated personalized dosing models, which are expected to drive retention and repeat purchase behavior. Brands have been differentiating through third-party certifications, clinical study backing, and doctor-formulated positioning.

The Cellular Health Supplement Market in the United Kingdom is projected to grow at a CAGR of 8.1% between 2025 and 2035, supported by high consumer awareness, an aging population, and the strong presence of evidence-backed nutraceutical brands. Demand has been reinforced by NHS-aligned preventive care campaigns and a rising shift toward clinically supervised longevity protocols. Practitioners have increasingly prescribed supplements focused on mitochondrial function and oxidative stress reduction.

Health-focused retail channels and digital-first supplement platforms have expanded accessibility, while compliance with EFSA claims has enhanced product trust. As personalization becomes embedded in consumer health journeys, cellular health supplements are expected to play a foundational role in maintaining vitality and reducing biological age markers.

The Cellular Health Supplement Market in India is expected to expand at a CAGR of 9.2% from 2025 to 2035, supported by rising urbanization, disposable income growth, and greater health literacy among younger demographics. Increased digital penetration has enabled broad access to longevity-focused supplements via online channels and DTC brands.

Practitioner-led awareness in Tier 1 cities and corporate wellness programs has accelerated early adoption. The shift from curative to preventive care has encouraged demand for NAD+ boosters, mitochondrial enhancers, and antioxidants. As Ayurveda-modern hybrid formulations gain popularity, global and domestic brands are expected to intensify portfolio localization strategies.

China’s Cellular Health Supplement Market is forecasted to grow at a CAGR of 9.8%, making it the fastest-growing market globally from 2025 to 2035. Accelerated demand has been driven by aging demographics, high digital engagement, and strong consumer acceptance of science-backed nutraceuticals.

Cross-border e-commerce and regulatory facilitation under the “Blue Hat” registration have enabled market access for international brands. Cellular rejuvenation products have been actively promoted via influencer channels, health platforms, and biotech-aligned pharmacies. AI-based health monitoring apps are expected to play a growing role in supplement personalization. Clinical credibility and functional labeling will likely remain pivotal in long-term brand differentiation.

| Countries | 2025 |

|---|---|

| UK | 12% |

| Germany | 18% |

| Italy | 10% |

| France | 14% |

| Spain | 8% |

| BENELUX | 7% |

| Nordic | 6% |

| Rest of Europe | 25% |

| Countries | 2035 |

|---|---|

| UK | 13% |

| Germany | 17% |

| Italy | 10% |

| France | 14% |

| Spain | 9% |

| BENELUX | 7% |

| Nordic | 7% |

| Rest of Europe | 23% |

Germany’s Cellular Health Supplement Market is projected to grow at a CAGR of 8.6% between 2025 and 2035, driven by an aging population, widespread supplement literacy, and strong clinical integration of preventive nutrition. The market has been reinforced by practitioner-led adoption within naturopathy and integrative care clinics, where mitochondrial and antioxidant formulations have been positioned as foundational protocols.

Pharmacies and regulated e-commerce platforms have served as the primary channels for distribution, while trust in pharmacy-onlylabeling has bolstered premium positioning. Institutional R&D funding in longevity science is expected to expand innovation pipelines. EU-compliant claims and traceability standards will likely play a continued role in building consumer trust and brand loyalty.

| Ingredient Type | Japan Market Share 2025 (%) |

|---|---|

| NAD+ Precursors (NMN, NR) | 42% |

| CoQ10 & PQQ | 25% |

| Polyphenols (Resveratrol, Fisetin, Quercetin) | 18% |

| Other Antioxidants & Bioactives (Glutathione, Curcumin, Omega 3) | 15% |

The Cellular Health Supplement Market in Japan is projected at USD 179.8 million in 2025. Ingredient adoption is led by NAD+ precursors at 42%, significantly ahead of CoQ10 & PQQ at 25%, underscoring Japan’s prioritization of mitochondrial health and energy optimization.

This leadership has been driven by widespread clinical education around NAD+ pathways and their direct link to aging biomarkers. CoQ10, already integrated into cardiovascular support routines, has sustained popularity due to its traditional alignment with Japanese heart health practices.

Polyphenols account for 18%, fueled by interest in anti-inflammatory and senolytic mechanisms, while broader antioxidant blends hold 15%, reflecting moderate uptake. Japanese consumers have favored ingredients backed by peer-reviewed trials and precision-formulated products tailored to individual genetic and metabolic profiles. As personalized supplementation and smart diagnostics gain momentum, further growth in NAD+ formulations is expected.

| Health Function | South Korea Market Share 2025 (%) |

|---|---|

| Healthy Aging & Longevity | 38% |

| Energy & Mitochondrial Support | 27% |

| Cognitive & Cardiovascular Health | 20% |

| Metabolic & Immune Support | 15% |

The Cellular Health Supplement Market in South Korea is expected to reflect highly specialized demand across longevity and energy-related functions. In 2025, Healthy Aging & Longevity is projected to lead at 38%, supported by the nation’s advanced aging demographics and the strong cultural alignment with long-term wellness.

Government-backed health education and integration with anti-aging clinics have reinforced consumer confidence in cellular-level interventions targeting biological age and mitochondrial decline.

Energy & Mitochondrial Support, contributing 27%, has been prioritized due to rising urban fatigue, workplace burnout, and competitive academic environments. Cognitive and cardiovascular support, holding 20%, has seen growing relevance through stress-related neurovascular issues among working-age adults. Metabolic and immune support comprises 15%, sustained by functional formulations targeting insulin sensitivity and immune resilience.

| Global pioneers | Global Value Share 2025 |

|---|---|

| Tru Niagen ( ChromaDex ) | 4.5% |

| Others | 95.5% |

The Cellular Health Supplement Market is moderately fragmented, with multinational brands, clinical-grade formulators, and DTC wellness specialists competing across ingredient categories and distribution models. Global pioneers such as ChromaDex (TruNiagen), Thorne, and Life Extension have been recognized for their science-backed formulations, clinical trial visibility, and early investments in NAD+ and mitochondrial support segments. Their strategies have emphasized evidence-based claims, personalized stack integration, and physician-channel partnerships, particularly in North America and parts of Asia.

Established mid-sized players such as NOW Foods, Jarrow Formulas, and Doctor’s Best have catered to value-driven and retail-oriented consumer segments. These brands have been favored for their broad ingredient portfolios, strong Amazon presence, and reliability among budget-conscious buyers. Growth has been supported through third-party certifications and transparent sourcing.

Specialist DTC brands such as Elysium Health, HUM Nutrition, and Gundry MD have built differentiation via personalization, subscription models, and digital biomarker feedback systems. Their ability to link cellular supplements to broader lifestyle goals has allowed for stronger engagement among younger, tech-savvy audiences.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,998 Million |

| Component | Ingredients (NAD+ Precursors, CoQ10, Polyphenols, Antioxidants), Delivery Systems (Capsules, Softgels, Powders, Liquids, Gummies), Diagnostics Integration (Biomarker-driven platforms, Genomic Nutrition Tools) |

| Health Function | Healthy Aging & Longevity, Energy & Mitochondrial Support, Cognitive & Cardiovascular Health, Metabolic & Immune Support |

| Product Format | Capsules, Tablets, Softgels, Powders, Liquid Formulations, Gummies, Functional Foods & Beverages |

| Application | Healthy Aging, Energy & Vitality, Cognitive Health, Cardiovascular Health, Metabolic Health, Immune Support |

| Sales Channel | Pharmacies & Drugstores, Health & Nutrition Stores, Online Retail, Direct to Consumer (DTC) Brands, Practitioner / Clinic Distribution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Elysium Health, Tru Niagen (ChromaDex), Life Extension, Thorne, Gundry MD, GNC, NOW Foods, Doctor’s Best, Jarrow Formulas, HUM Nutrition |

The global Cellular Health Supplement Market is estimated to be valued at USD 1,998.7 million in 2025, supported by rising awareness of cellular aging and the growing use of NAD⁺ and mitochondrial-focused supplements.

The market size for the Cellular Health Supplement Market is projected to reach USD 3,668.1 million by 2035, as demand strengthens for personalized, biomarker-driven formulations and anti-aging interventions.

The Cellular Health Supplement Market is expected to grow at a CAGR of 6.3% between 2025 and 2035, adding approximately USD 1,669.4 million in incremental value over the decade.

The key product formats in the Cellular Health Supplement Market are capsules, softgels, powders, liquids, gummies, and functional foods & beverages, with capsules accounting for the highest value share due to ease of use and superior shelf stability.

In 2025, the Healthy Aging & Longevity segment is expected to lead, accounting for 38% of South Korea’s market and a comparable share globally, driven by increased focus on NAD⁺ optimization, DNA repair, and biological age reversal.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cellular Vehicle-To-Everything (C-V2X) Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Module Market Size and Share Forecast Outlook 2025 to 2035

Cellular Blinds & Shades Market Size and Share Forecast Outlook 2025 to 2035

Cellular Rubber Market Growth - Trends & Forecast 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Cellular Nutrition Market Analysis by Product Type, End User, Form, Function, Sales Channel and Region from 2025 to 2035

Cellular Reprogramming Tools Market – Demand & Forecast 2025 to 2035

Cellular Epigenetics Market

Microcellular Foam Market Size and Share Forecast Outlook 2025 to 2035

Extracellular Matrix Proteins Market

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Repeaters for Cellular Network Market Forecast and Outlook 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA