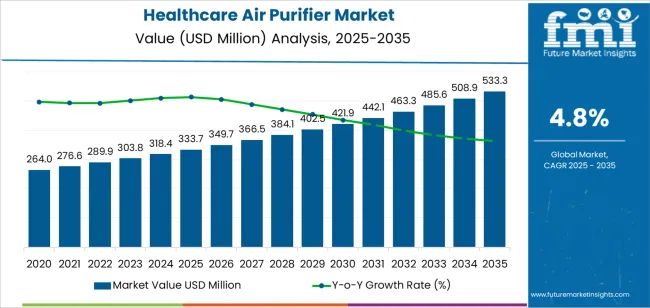

The global healthcare air purifier market is forecasted to grow from USD 333.7 million in 2025 to approximately USD 533.3 million by 2035, recording an absolute increase of USD 199.6 million over the forecast period. This translates into a total growth of 59.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.8% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.6X during the same period, supported by increasing healthcare-associated infection control requirements globally, growing adoption of advanced air filtration technologies in medical facilities, and rising investments in hospital infrastructure modernization across developed and emerging healthcare markets. The market's expansion reflects the fundamental shift in healthcare facility management toward comprehensive infection prevention protocols and enhanced indoor air quality standards. Healthcare systems in North America and Europe continue to invest in medical-grade air purification systems that meet stringent regulatory requirements while supporting improved patient safety outcomes.

Asia Pacific markets demonstrate accelerating adoption as hospital construction expands and healthcare quality standards mature. The growing emphasis on airborne pathogen control and particulate matter reduction drives demand for filtration systems that can support clinical-grade air quality while maintaining operational efficiency across diverse medical environments.

Technical advancements in filtration technologies and air purification systems enable more sophisticated infection control protocols that support diverse healthcare applications and extended operational requirements. Major medical facilities increasingly prioritize solutions that offer consistent performance across different clinical scenarios while meeting stringent safety and efficacy standards. The market benefits from established clinical evidence supporting air purification effectiveness combined with ongoing research into enhanced filtration approaches. Supply chain considerations favor systems that provide reliable performance and simplified maintenance protocols for healthcare facility management teams operating under demanding environmental control conditions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 333.7 million |

| Market Forecast Value (2035) | USD 533.3 million |

| Forecast CAGR (2025-2035) | 4.8% |

| HEALTHCARE INFRASTRUCTURE EXPANSION | INFECTION CONTROL REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

| Global Healthcare Facility Growth Continuous expansion of hospital construction and medical facility upgrades across established and emerging markets driving demand for air quality control systems. Patient Safety Priorities Growing emphasis on healthcare-associated infection prevention and indoor environmental quality creating demand for advanced filtration technologies. Healthcare Investment Focus Increasing healthcare system investments in facility infrastructure and quality improvement programs supporting adoption of medical-grade air purification solutions. |

Sophisticated Filtration Requirements Modern healthcare facilities require air purification systems delivering precise particulate control and enhanced pathogen removal capabilities. Clinical Efficacy Demands Medical institutions investing in filtration solutions offering consistent clinical performance while maintaining operational efficiency standards. Quality and Reliability Standards Healthcare facilities requiring certified systems with proven track records for critical infection control applications. |

Healthcare Facility Standards Regulatory requirements establishing performance benchmarks favoring medical-grade air purification systems. Air Quality Protocol Standards Quality standards requiring superior filtration efficiency and resistance to operational stresses in clinical environments. Clinical Compliance Requirements Diverse regulatory requirements and quality standards driving need for sophisticated air quality control systems. |

| Category | Segments Covered |

|---|---|

| By Installation Type | Floor-Standing Type, Wall-Mounted Type, Others |

| By Application | Hospital, Clinic, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

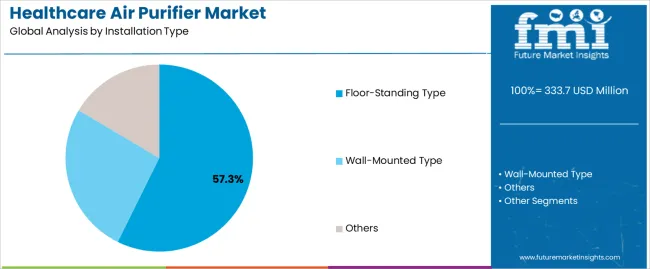

| Floor-Standing Type | Leader in 2025 with 57.3% market share expected to maintain dominance through 2035. Optimal configuration for large clinical spaces including operating rooms, intensive care units, and patient wards with flexible placement options. Momentum: steady-to-strong driven by hospital construction and renovation projects. Watchouts: space constraints in smaller facilities and maintenance accessibility requirements. |

| Wall-Mounted Type | Secondary format serving space-constrained clinical environments including examination rooms, treatment areas, and outpatient facilities. Growing adoption in clinics and smaller medical practices prioritizing floor space optimization. Momentum: moderate growth in outpatient settings and specialty care facilities. Watchouts: installation complexity and limited air circulation coverage compared to floor-standing units. |

| Others | Includes ceiling-mounted systems, portable units, and integrated HVAC solutions for specialized medical applications. Limited adoption due to installation requirements and clinical protocol preferences. Momentum: selective growth in surgical suites and specialized treatment environments. Watchouts: higher installation costs and facility infrastructure compatibility requirements. |

| Segment | 2025 to 2035 Outlook |

|---|---|

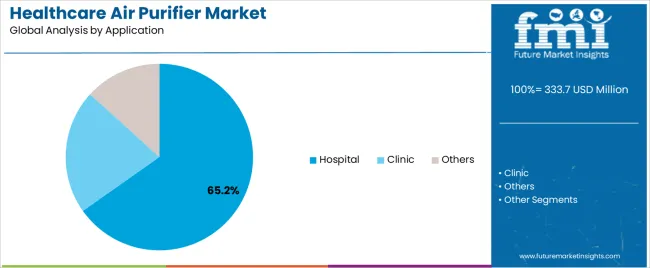

| Hospital | Dominant segment at 65.2% market share in 2025 representing primary deployment environment across inpatient facilities. Comprehensive infection control requirements spanning operating rooms, isolation units, patient wards, and emergency departments. Momentum: steady growth driven by hospital expansion and infection prevention initiatives. Watchouts: budget constraints and capital equipment procurement cycles in healthcare systems. |

| Clinic | Growing segment focused on outpatient medical facilities, urgent care centers, and specialty practice locations. Supporting infection control in high-traffic patient areas with diverse clinical activities. Momentum: strong growth driven by outpatient facility expansion and ambulatory care development. Watchouts: cost sensitivity in smaller practices and maintenance resource limitations. |

| Others | Includes long-term care facilities, rehabilitation centers, dental offices, and specialized medical environments. Supporting air quality requirements in diverse healthcare settings beyond traditional hospital and clinic applications. Momentum: moderate expansion as infection control awareness spreads across healthcare spectrum. Watchouts: varying regulatory requirements and facility-specific installation challenges. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Healthcare-Associated Infection Control Continuing emphasis on infection prevention and patient safety across healthcare facilities driving demand for air purification systems. Airborne Pathogen Awareness Increasing recognition of airborne transmission risks and environmental contamination creating demand for advanced filtration technologies. Healthcare Facility Modernization Growing investments in hospital infrastructure and facility upgrades supporting adoption of comprehensive air quality control systems. |

High Initial Capital Costs Equipment investment requirements affecting procurement decisions and implementation timelines in healthcare facilities. Maintenance Complexity Filter replacement and system maintenance requiring ongoing operational costs and trained facility management staff. Installation Challenges Facility infrastructure requirements and installation complexity affecting deployment in existing healthcare buildings. |

Advanced Filtration Technologies Integration of HEPA filtration, activated carbon systems, and UV-C technologies enabling superior air quality control and pathogen reduction. Smart Monitoring Systems Development of intelligent sensors, air quality monitoring, and automated filter replacement alerts supporting operational efficiency. Energy Efficiency Innovation Enhanced motor technologies providing improved energy performance, reduced operational costs, and sustainability benefits compared to conventional systems. Portable Solutions Integration of mobile air purification units and flexible deployment systems supporting temporary infection control needs and facility adaptability. |

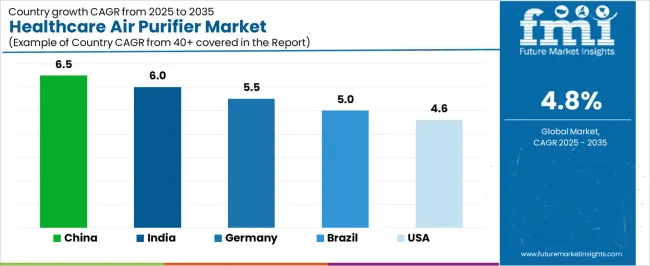

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| Brazil | 5.0% |

| United States | 4.6% |

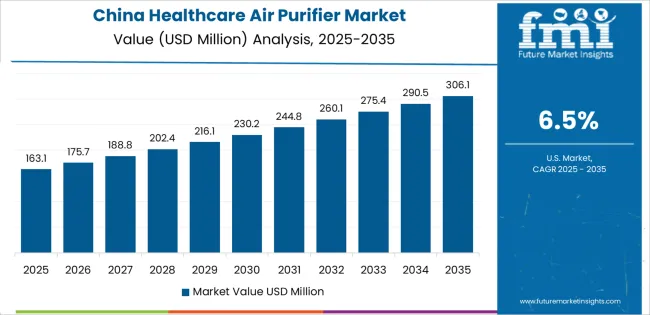

Revenue from healthcare air purifiers in China is projected to exhibit strong growth with a market value of USD 122.7 million by 2035, driven by expanding hospital construction programs and comprehensive healthcare facility modernization creating substantial opportunities for air purification system providers across major medical centers, specialty hospitals, and community healthcare facilities. The country's rapid healthcare infrastructure development and expanding medical quality standards are creating significant demand for medical-grade air purification systems. Major healthcare institutions and hospital chains are establishing comprehensive infection control protocols to support large-scale patient care operations and meet growing demand for clinical-grade air quality.

Revenue from healthcare air purifiers in India is expanding to reach USD 168.6 million by 2035, supported by healthcare system expansion and comprehensive medical facility development creating sustained demand for air quality control systems across diverse hospitals and emerging medical centers. The country's growing healthcare infrastructure and expanding quality standards are driving demand for systems that provide consistent clinical performance while supporting cost-effective procurement requirements. Healthcare institutions and hospital administrators are investing in infection control technologies to support growing patient volumes and quality improvement initiatives.

Demand for healthcare air purifiers in Germany is projected to reach USD 248.2 million by 2035, supported by the country's leadership in healthcare facility management and advanced infection control protocols requiring sophisticated air purification systems for diverse clinical environments and complex medical procedures. German healthcare institutions are implementing high-quality air quality control systems that support clinical best practices, operational efficiency, and comprehensive safety standards. The market is characterized by focus on clinical excellence, regulatory compliance, and adherence to stringent medical device and facility standards.

Revenue from healthcare air purifiers in Brazil is growing to reach USD 263.9 million by 2035, driven by healthcare system modernization programs and increasing medical facility development creating sustained opportunities for system providers serving both public healthcare facilities and private hospital networks. The country's expanding healthcare infrastructure and growing medical device market are creating demand for air purification systems that support diverse clinical requirements while maintaining quality standards. Healthcare institutions and facility managers are developing procurement strategies to support operational efficiency and infection control protocol compliance.

Demand for healthcare air purifiers in the United States is projected to reach USD 276.6 million by 2035, expanding at a CAGR of 4.6%, driven by clinical innovation excellence and established healthcare infrastructure supporting advanced infection control protocols and comprehensive facility management systems. The country's mature healthcare market and stringent regulatory environment are creating demand for air purification systems that support clinical performance and regulatory compliance standards. Healthcare institutions and facility management organizations are maintaining comprehensive quality protocols to support diverse medical facility requirements.

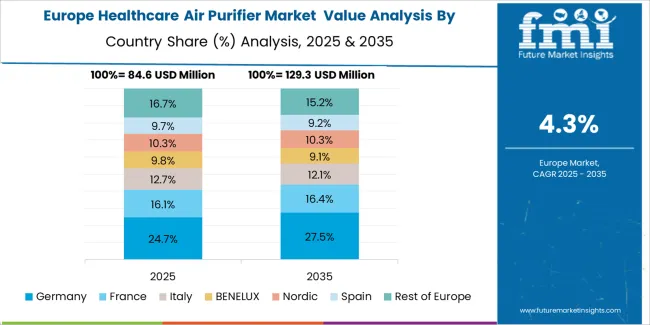

The healthcare air purifier market in Europe is projected to grow from USD 98.2 million in 2025 to USD 156.8 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 31.4% market share in 2025, declining slightly to 31.0% by 2035, supported by its advanced healthcare infrastructure and major hospital networks including university medical centers and specialty clinics.

France follows with a 22.1% share in 2025, projected to reach 22.6% by 2035, driven by comprehensive hospital modernization programs and infection control initiatives. The United Kingdom holds a 18.7% share in 2025, expected to maintain stability at 18.5% by 2035 with continued NHS facility upgrade investments. Italy commands a 15.3% share, while Spain accounts for 12.5% in 2025. The Rest of Europe region is anticipated to maintain its collective share at approximately 11% through 2035, with increasing adoption in Nordic countries and Central European medical facilities implementing enhanced air quality protocols.

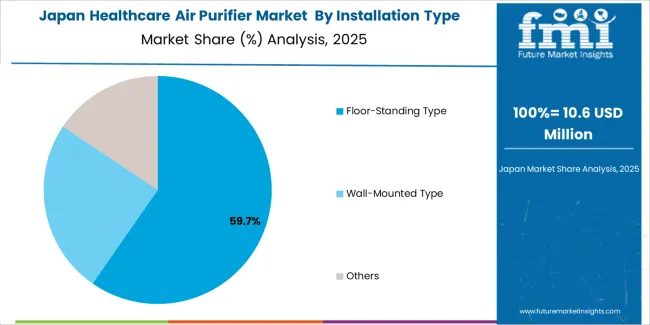

Japanese healthcare air purifier operations reflect the country's exacting quality standards and sophisticated healthcare facility protocols. Major hospitals and medical centers maintain rigorous supplier qualification processes that often exceed international standards, requiring extensive documentation, performance testing, and facility validation that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports optimal patient safety outcomes.

The Japanese market demonstrates unique air quality requirements, with significant emphasis on ultra-fine particulate filtration and precise airflow control specifications tailored to established clinical protocols. Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes comprehensive quality management and performance verification requirements that surpass most international standards.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese healthcare facilities typically maintain long-term supplier relationships spanning years, with contract negotiations emphasizing performance consistency and technical support over price competition.

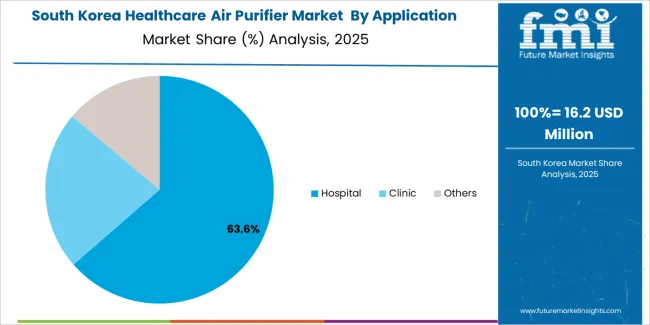

South Korean healthcare air purifier operations reflect the country's advanced healthcare infrastructure and technology-oriented facility management approach. Major medical centers including Seoul National University Hospital and Samsung Medical Center drive sophisticated air purification system procurement strategies, establishing relationships with international suppliers to secure consistent quality and regulatory compliance for healthcare facilities.

The Korean market demonstrates particular strength in integrating air purification systems with smart building technologies, with leading hospitals combining air quality monitoring with facility management systems and automated environmental controls. Regulatory frameworks emphasize medical device safety and performance standards, with Ministry of Food and Drug Safety requirements for comprehensive documentation and quality assurance.

Supply chain efficiency remains critical given Korea's mix of domestic manufacturing and international equipment procurement. Healthcare institutions increasingly pursue long-term contracts with both local and international manufacturers to ensure reliable access while managing regulatory compliance requirements.

Profit pools concentrate in medical-grade filtration technology development and certified healthcare facility systems where clinical validation, regulatory compliance, and facility management relationships command sustained margins. Value migrates from residential-grade air purifiers to application-specific healthcare systems with documented infection control efficacy and comprehensive regulatory approvals. Several competitive archetypes define market dynamics: established air quality companies leveraging healthcare facility relationships and regulatory expertise; specialized medical air purification developers with proprietary filtration technologies and clinical validation partnerships; commercial HVAC manufacturers expanding into medical-grade solutions; and international distributors serving regional healthcare networks with established product portfolios. Switching costs remain substantial given facility qualification requirements, infection control protocol integration, and facility management training needs, stabilizing supplier relationships for proven systems. Market entry barriers include regulatory approval timelines, clinical validation requirements, and established procurement relationships within healthcare facility networks. Consolidation occurs selectively as larger facility equipment companies acquire specialized air purification technology platforms to expand healthcare portfolio offerings. Digital facility management influences commodity equipment procurement while specialized healthcare systems remain relationship-driven given clinical performance criticality. Strategic imperatives include securing healthcare facility partnerships with comprehensive technical support, establishing multi-regional regulatory approvals and performance certifications, and developing application-specific systems addressing infection control needs across diverse clinical environments and facility types.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established air quality companies | Regulatory expertise, healthcare facility relationships | Multi-product portfolios, clinical validation infrastructure, global distribution networks |

| Specialized medical air purification developers | Proprietary filtration technologies, infection control partnerships | Novel filtration development, hospital collaborations, targeted clinical studies |

| Commercial HVAC manufacturers | Facility system integration, maintenance networks | Building system compatibility, service infrastructure, facility management partnerships |

| International distributors | Regional market access, local regulatory knowledge | Multi-country certifications, healthcare facility relationships, technical support capabilities |

| Items | Values |

|---|---|

| Quantitative Units | USD 333.7 million |

| Product | Floor-Standing Type, Wall-Mounted Type, Others |

| Application | Hospital, Clinic, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, China, Brazil, India, and other 40+ countries |

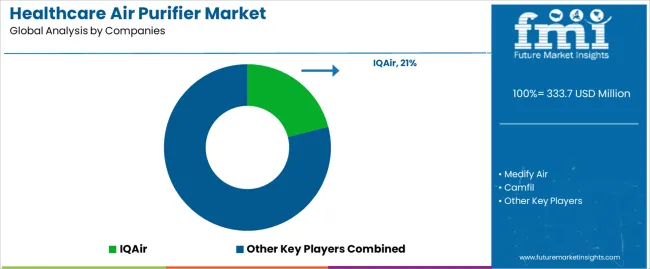

| Key Companies Profiled | IQAir, Medify Air, Camfil, AAF International, MedicAir, Aerobiotix, ISO-Aire, Atlas Copco, airinspace, AirQuality, Cairn Technology, MayAir Group, Omni CleanAir, RGF Environmental, Fantech, Air Impurities Removal Systems, Rensair, TION Ltd, CFULL, Oransi |

| Additional Attributes | Dollar sales by installation type/application, regional demand (NA, EU, APAC), competitive landscape, hospital vs. clinic adoption, filtration technology innovation, and smart monitoring systems driving infection control improvement, facility management efficiency, and clinical safety standards |

Installation Type

The global healthcare air purifier market is estimated to be valued at USD 333.7 million in 2025.

The market size for the healthcare air purifier market is projected to reach USD 533.3 million by 2035.

The healthcare air purifier market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in healthcare air purifier market are floor-standing type, wall-mounted type and others.

In terms of application, hospital segment to command 65.2% share in the healthcare air purifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA