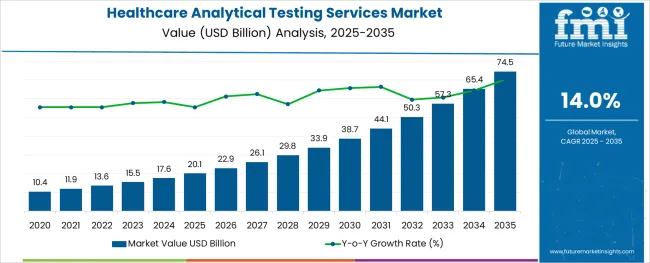

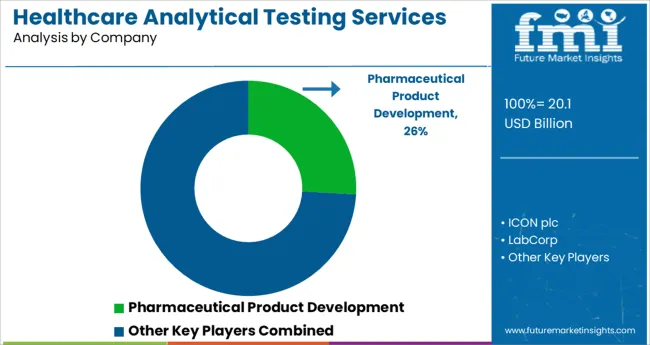

The Healthcare Analytical Testing Services Market is estimated to be valued at USD 20.1 billion in 2025 and is projected to reach USD 74.5 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Product Type and region. By Product Type, the market is divided into Medical Device and Pharmaceutical. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type and region. By Product Type, the market is divided into Medical Device and Pharmaceutical. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Healthcare manufacturers and researchers dealing with a highly regulated and competitive market are turning to outsourcing their analytical testing to testing service providers. Outsourcing is a solution to the problem of a lack of resources and expertise a company might face if they choose to conduct their testing in-house.

There is also a cost-benefit since there is a reduction in fixed capital requirements and operating costs since laboratories can be contacted as and when necessary.

Due to the nature of their products, companies are willing to ensure high-quality testing even when under strict budgets. Several organizations use outsourcing as a means to perform routine tests in order to reduce the time spent in the production process for a more efficient and timely rollout of products.

Further, the use of reputed agencies lends further credibility to products due to the lower chances of an internal bias. The combination of these factors is giving a significant boost to the market.

Product recalls are a key concern in the healthcare industry, with the estimated cost of a recall to a manufacturer being over USD 600 million on average. Estimates place around half of the recall costs to pharmaceutical companies that actually occur due to this business interruption. The high-risk and sensitive nature of healthcare products means that ethics are also a key concern.

Even a single flaw can lead to severe consequences on actual human life, and thus ensuring near-perfect safety is essential for both companies and official regulatory bodies. This means that there are highly strict monitoring guidelines and regulatory processes in place for both new and existing products.

Efficient and thorough testing is vital to meeting these requirements. This nature of the products and the attempts to reduce recall are expected to be significant drivers for demand in the future as well.

The WHO reports that healthcare-acquired infections are a prominent cause for concern. Ensuring that the packaging selected for healthcare products is efficient is an essential component of producing these products.

Even if products themselves are sterilized, the manufacturers must ensure through testing that the product will remain the same even through changes in the environment, human handling, and various other parts of the production and distribution process. They must also test for changes in the efficacy of the packing over time under varied conditions the final object is likely to be subject to.

A growing concern in recent years is Extractable and Leachable Testing. Extractables, which migrate from the product under stressed conditions, and Leachables, which migrate from the product under normal conditions, are extremely harmful since they can cause a change in the product itself.

Since they directly interact with a pharmaceutical or medical product at any stage of the production process, they are in the spotlight of regulatory concern, with regulations demanding more thorough tests than the base ISO testing covers.

Before stringent rules were in place, Extractables and Leachables caused significant adverse events in the healthcare environment, For example, in 2002 the FDA had to release a notification regarding the presence of DEHP, which is a widely used plasticizer in PVC products.

Traces of DEHP were found in Total Parenteral Nutrition fat emulsion infusion lines. Vanillin was another such substance, which was found in inhalation solutions within LDPE containers. A foil overwrap had to be introduced to prevent the migration of this substance once it was identified, which led to time delays and significant costs to recover from.

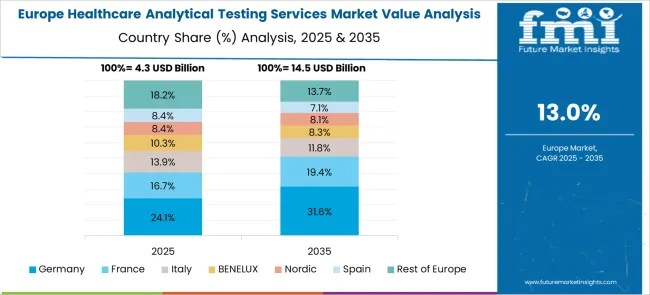

Europe is an emerging region for the demand in the Healthcare Analytical Testing Services market. Regulations for medical devices in the European Union are under the MDR or Medical Device Regulation, which is currently in an adjustment period till 2025 after coming into effect in 2024. With the growing healthcare expenditure of the European countries, the revenue through healthcare analytical testing services is also expected to swell.

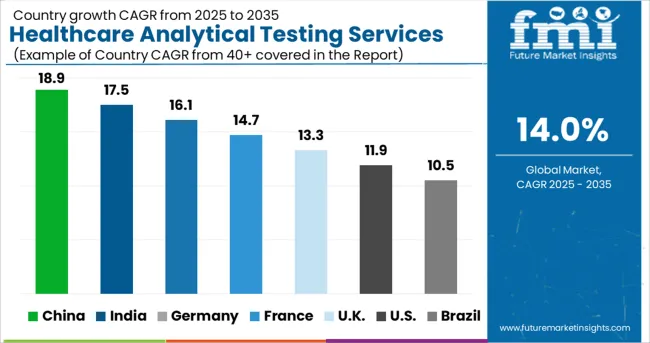

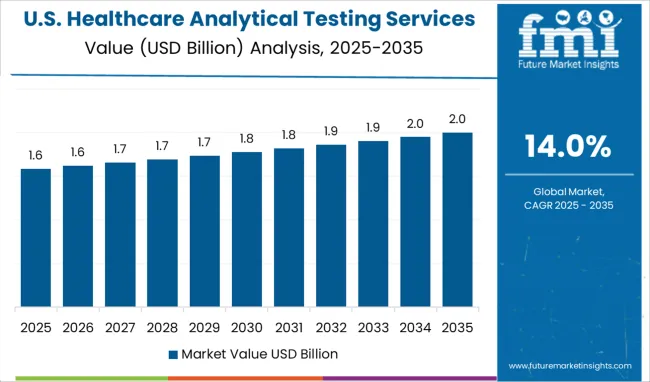

The United States is the nucleus of Global Medical Device Testing demand, having witnessed a CAGR of 12.6% from 2020 to 2024, and with a market value of USD 74.5 billion by 2035 at a CAGR of 14.5% from 2025 to 2035.

Medical devices in the USA are categorized by the FDA from CLASS I to class III based on the risk they pose. Testing differs amongst classes, with the higher classes requiring far more stringent testing. The FDA regulates pharmaceuticals as well, with the main regulatory standard being the Current Good Manufacturing Practices or GMPs regulation.

The healthcare analytical testing services market in the United Kingdom is projected to reach a valuation of USD 2.2 billion by 2035. The Healthcare Analytical Testing Services market in the country is expected to gross an absolute dollar opportunity of USD 20.1 billion from 2025 to 2035, with a CAGR of 14%.

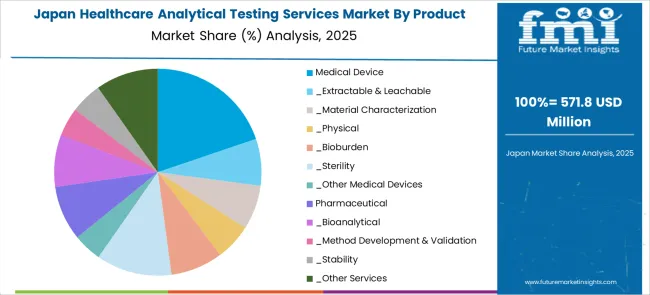

The Healthcare Analytical Testing Services market in Japan is expected to gross an absolute dollar opportunity of USD 2.2 billion from 2025 to 2035. The market is projected to reach a valuation of USD 2.7 billion by 2035, growing at a CAGR of 18.6% from 2025 to 2035.

The Healthcare Analytical Testing Services market in South Korea is expected to reach a valuation of USD 987.4 million by 2035. The market in the country is expected to register an absolute dollar opportunity of USD 17.6 million between 2024 and 2035.

China is a key country for demand, having witnessed a CAGR of 16.8%, with an absolute dollar opportunity of USD 3.1 billion and a forecasted 2035 market size of USD 4.2 billion a CAGR of 13.9%.

The demand is largely due to the strict regulatory demands by authorities. The regulation of healthcare products is handled by the National Medical Products agency, which was formerly the China Food and Drug Administration of CFDA, and is a part of the State Administration for Market Regulation.

Pharmaceuticals are leading market demand, with a forecasted CAGR of 13.2%. The testing of pharmaceutical products is a highly complex and lengthy process, which requires sophisticated technology and a wide range of resources. In recent years, the increased scrutiny of final products has led to an increase in manufacturers and researchers turning to test services to ensure that their drugs have regulatory compliance.

Healthcare Analytical Testing Service providers are focused on maintaining the quality of their services and finding efficient methods to continue testing in order to help their clients meet regulatory guidelines.

The key companies operating include Eurofins Scientific, Pace Analytical Services, LLC, Intertek Group, Toxikon, Inc., SGS SA, Syneos Health, Charles River Laboratories International Inc., Labcorp, ICON plc, WUXI Apptec, and Pharmaceutical Product Development

Some of the recent development in the Healthcare Analytical Testing Services Market are as follows

Similarly, recent developments related to companies manufacturing Healthcare Analytical Testing Services have been tracked by the team at Future Market Insights, which is available in the full report.

The global healthcare analytical testing services market is estimated to be valued at USD 20.1 billion in 2025.

It is projected to reach USD 74.5 billion by 2035.

The market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types are medical device, _extractable & leachable, _material characterization, _physical, _bioburden, _sterility, _other medical devices, pharmaceutical, _bioanalytical, _method development & validation, _stability and _other services.

segment is expected to dominate with a 0.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA