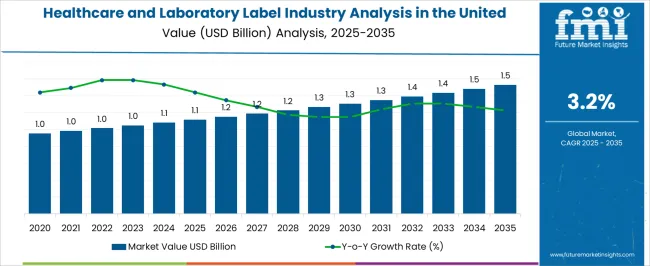

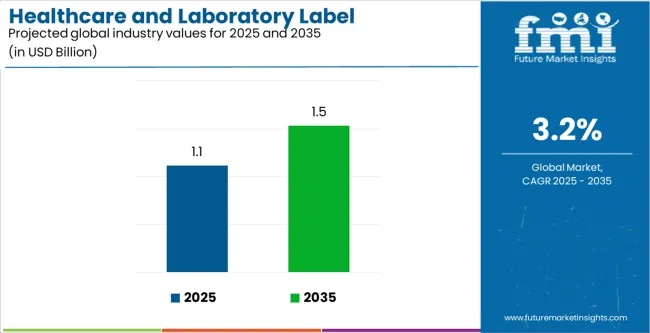

The Healthcare and Laboratory Label Industry Analysis in the United States is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Healthcare and Laboratory Label Industry Analysis in the United States Estimated Value in (2025 E) | USD 1.1 billion |

| Healthcare and Laboratory Label Industry Analysis in the United States Forecast Value in (2035 F) | USD 1.5 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The United States healthcare & laboratory label industry recorded a CAGR of 1.3% between 2020 and 2025.

Over the forecast period, healthcare & laboratory label demand in the United States is anticipated to rise at 3.2% CAGR.

The table presents the expected CAGR for the United States healthcare and laboratory label industry over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the field is predicted to surge at a CAGR of 2.7%, followed by a slightly higher growth rate of 3.7% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to lower slightly to 3.0% in the first half and remain relatively steady at 3.4% in the second half.

| Particular | Value CAGR |

|---|---|

| H1 | 2.7% (2025 to 2035) |

| H2 | 3.7% (2025 to 2035) |

| H1 | 3.0% (2025 to 2035) |

| H2 | 3.4% (2025 to 2035) |

The section below shows the paper segment is set to lead in terms of material type. It is estimated to thrive at a 3.5% CAGR between 2025 and 2035. Based on printing technology, the direct thermal segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 2.1% during the forecast period.

| Segment | Value-based CAGR (2025 to 2035) |

|---|---|

| Paper (Material Type) | 3.5% |

| Direct Thermal (Printing Technology ) | 2.1% |

Manufacturing companies operating in the field of healthcare & laboratory labels are developing innovative solutions catering to specific products or applications. Key players in the industry are expanding their presence & manufacturing capabilities and moving toward adopting and offering sustainable solutions to customers. They are expanding by collaborating with flexible packaging manufacturers to provide innovative labeling solutions.

Recent activities and developments implemented by leading players in the industry

The global healthcare and laboratory label industry analysis in the united states is estimated to be valued at USD 1.1 billion in 2025.

The market size for the healthcare and laboratory label industry analysis in the united states is projected to reach USD 1.5 billion by 2035.

The healthcare and laboratory label industry analysis in the united states is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in healthcare and laboratory label industry analysis in the united states are polyolefin, polyethylene terephthalate (pet), polyvinyl chloride (pvc), paper and others.

In terms of printing technology, thermal transfer segment to command 42.5% share in the healthcare and laboratory label industry analysis in the united states in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Solenoid Valve Market Growth – Trends & Forecast 2024-2034

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Growth – Trends & Forecast 2024-2034

U.S. Phlebotomy Equipment Market Analysis – Trends, Growth & Forecast 2024-2034

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

End-of-line Packaging Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

United States Distributed Antenna System (DAS) Market Growth – Trends & Forecast 2024-2034

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Cold Laser Therapy Market Outlook – Trends, Demand & Forecast 2025-2035

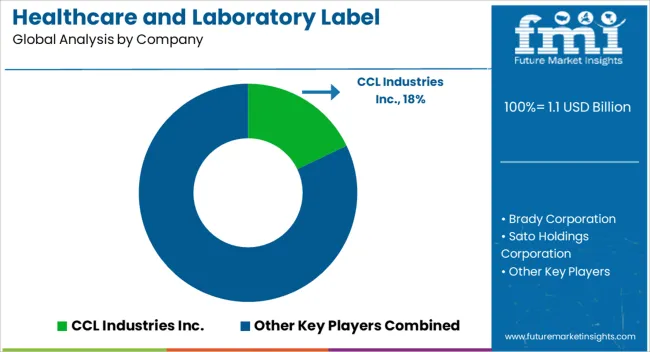

Leading Providers & Market Share in Healthcare & Laboratory Labels

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA