Healthcare and laboratory label market growth in industries, it focuses on precision tracking, regulatory compliance, and resilience of labeling solution. The new and advanced material is innovating through designs as ready automation or sustainability solutions by the manufacturer catering to the specific requirements of a hospital, diagnostics laboratory, or pharmaceutical company. It is set to cross more than USD 11219.8 million by 2035 and would be achieved with a 2.7% CAGR.

Global adoption of healthcare and laboratory labels is driven by increased focus on patient safety, regulatory compliance, and operational efficiency. Companies are delivering solutions addressing these needs with a focus on eco-friendliness and technological advancement.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 11219.8 million |

| CAGR (2025 to 2035) | 2.7% |

Summary

SWOT analysis depicts strategies and strengths of the top market players. Innovative companies such as Avery Dennison, Brady Corporation, and 3M keep ahead with the help of innovative ideas, sustainable initiatives, and strong manufacturing bases. Raw material price fluctuation and dynamic standards of regulation can be the chances for developed labeling solutions and overseas expansion.

Avery Dennison

Avery Dennison leads the market by its durable, automation-compatible labeling solutions. With its strength in global presence and concentration on eco-friendly material, this company is way ahead in the market. However, high production cost for premium product is a challenge. This company would explore opportunities in developing recyclable and RFID-enabled labels, while regional players threatening them are competition.

Brady Corporation

Brady Corporation is a strong player in making long-lasting, customizable labels for healthcare and laboratory applications. Its main strength lies in the emphasis it gives to precision and compliance. The lack of penetration into emerging markets will be a constraint to growth. Opportunities include further expansion into Asia-Pacific and smart labeling technologies, and regulatory changes might affect operations.

3M

3M is known for its innovative, sustainable labeling solutions. The company has strong R&D capabilities and focuses on eco-friendly designs. Premium labels may be expensive, though, and thus limit the market share. Bio-based materials are an opportunity, but fluctuating raw material prices and regulatory complexities are challenges.

| Category | Market Share (%) |

|---|---|

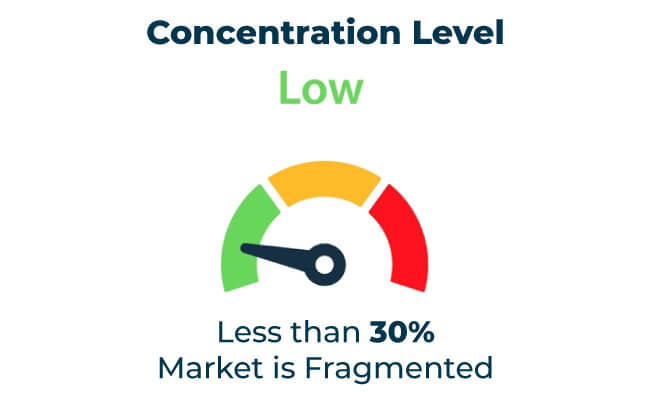

| Top 3 Players (Avery Dennison, Brady, 3M) | 16% |

| Rest of Top 5 Players (Zebra Technologies, Sato Holdings) | 06% |

| Next 5 of Top 10 Players | 07% |

Type of Player & Industry Share

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 29% |

| Next 20 Players | 45% |

| Remaining Players | 26% |

North America enforces strict standards on labeling to ensure safety and compliance in healthcare and laboratory settings. Europe leads with policies promoting sustainability and digitalization in tracking systems. Asia-Pacific is witnessing rapid growth due to increased investment in healthcare infrastructure, creating opportunities for tailored labeling solutions.

Emerging markets in Asia-Pacific, Africa, and Latin America present substantial growth potential. Rising demand for advanced healthcare and laboratory systems in these regions drives the need for high-quality, compliant labeling solutions. Exporters who focus on sustainability and innovation can expand their global reach.

The regional analysis of the healthcare and laboratory labels market highlights dynamic growth patterns shaped by regulatory compliance, sustainability goals, and advancements in healthcare infrastructure. Each region offers unique opportunities for manufacturers to align their solutions with local demands and standards.

| Region | North America |

|---|---|

| Market Share (%) | 40% |

| Key Drivers | Focuses on regulatory compliance and advanced labeling technologies. |

| Region | Europe |

|---|---|

| Market Share (%) | 35% |

| Key Drivers | Leads with sustainable and innovative labeling solutions. |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 20% |

| Key Drivers | Experiences rapid growth due to healthcare expansion and modernization. |

| Region | Other Regions |

|---|---|

| Market Share (%) | 10% |

| Key Drivers | Demand grows for affordable, durable labeling solutions in emerging markets. |

The healthcare and laboratory labels market will continue to grow through advancements in sustainable materials, smart technologies, and regulatory compliance. Companies focusing on eco-friendly practices, precision labeling, and global market expansion will strengthen their positions. Collaboration with healthcare providers and policymakers will drive further adoption.

Summary

This section provides a detailed breakdown of the key players in the healthcare and laboratory labels market by tier. Tier 1 companies like Avery Dennison, Brady Corporation, and 3M lead with innovative, sustainable solutions and strong global presence. Tier 2 and Tier 3 players focus on niche applications and regional dominance, offering opportunities for growth through innovation and sustainability.

| Tier | Key Companies |

|---|---|

| Tier 1 | Avery Dennison, Brady, 3M |

| Tier 2 | Zebra Technologies, Sato Holdings |

| Tier 3 | Labelmaster, Lintec Corporation |

The healthcare and laboratory labels market is positioned for strong growth as compliance, sustainability, and technological advancements drive demand. Companies prioritizing innovative designs, eco-friendly materials, and global expansion will lead the industry. Collaboration with stakeholders in healthcare and diagnostics will unlock new opportunities.

Key Definitions

Abbreviations

Methodology

This report integrates primary research, secondary data, and expert insights. Findings are validated through interviews with industry professionals and end-users to ensure accuracy and reliability.

The healthcare and laboratory labels market includes the development and use of precise, durable, and sustainable labeling solutions for hospitals, diagnostic labs, and pharmaceutical companies. These labels prioritize compliance, efficiency, and environmental responsibility.

Healthcare and laboratory labels are used for tracking patients, managing medication, and ensuring accurate identification in diagnostic labs.

Manufacturers use recyclable and eco-friendly materials while adopting energy-efficient production methods to minimize waste.

North America and Europe lead due to advanced labeling technologies and strict compliance standards, while Asia-Pacific is rapidly growing.

Challenges include high material costs, regulatory complexities, and recycling infrastructure gaps.

RFID-enabled labels, recyclable materials, and automation-compatible designs are driving innovation in the healthcare and laboratory labels market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Competitive Overview of Labels Companies

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among USA Labels Providers

Market Share Breakdown of Foil Labels Manufacturers

Korea Healthcare and Laboratory Label Market Analysis by Material, End-User, and Province through 2035

Competitive Landscape of In-Mold Labels Providers

Competitive Breakdown of Braille Labels Manufacturers

Market Share Breakdown of Multi-Part Labels Manufacturers

Market Share Distribution Among Shrink Sleeve Labels Providers

Market Share Distribution Among Cut and Stack Labels Providers

Market Share Insights of Leading Specialty Labels Packaging Providers

Market Share Breakdown of Repositionable Labels Manufacturers

Competitive Overview of Plastic Healthcare Packaging Providers

Market Leaders & Share in Oxygen Indicator Labels Manufacturing

Market Share Breakdown of 3D-Printed Stickers & Labels Manufacturers

Examining Market Share Trends in Inspection and Inventory Labels

Evaluating Time Temperature Indicator Labels Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA