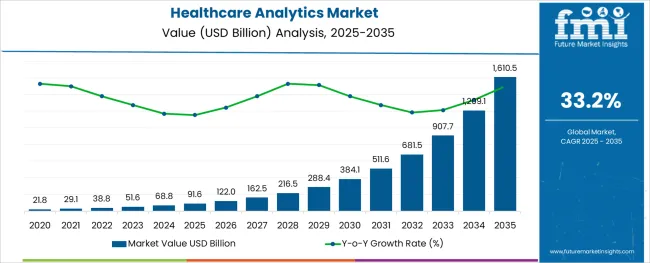

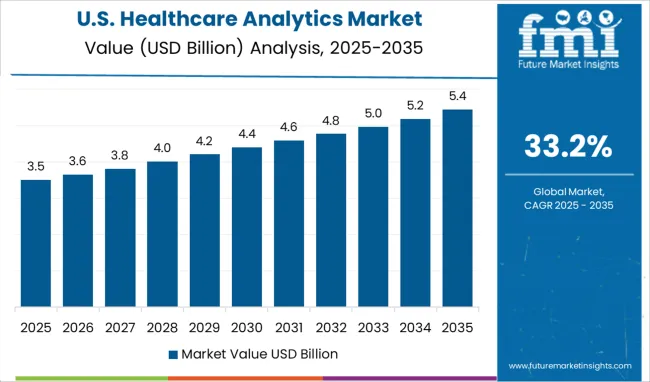

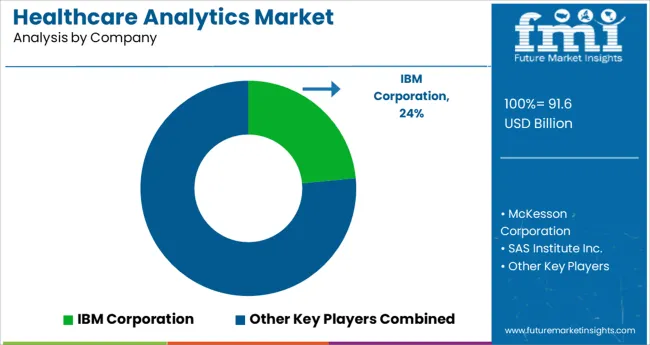

The Healthcare Analytics Market is estimated to be valued at USD 91.6 billion in 2025 and is projected to reach USD 1610.5 billion by 2035, registering a compound annual growth rate (CAGR) of 33.2% over the forecast period.

The healthcare analytics market is experiencing accelerated growth as healthcare systems, payers, and providers increasingly rely on data-driven insights to enhance patient care outcomes, operational efficiency, and financial performance.

The growing volume of healthcare data generated from electronic health records, wearable devices, and remote monitoring solutions has intensified the demand for advanced analytics platforms capable of transforming raw data into actionable intelligence.

As healthcare organizations navigate rising operational costs, regulatory pressures, and the shift towards value-based care models, analytics solutions have emerged as essential tools for risk stratification, disease management, and clinical decision support.

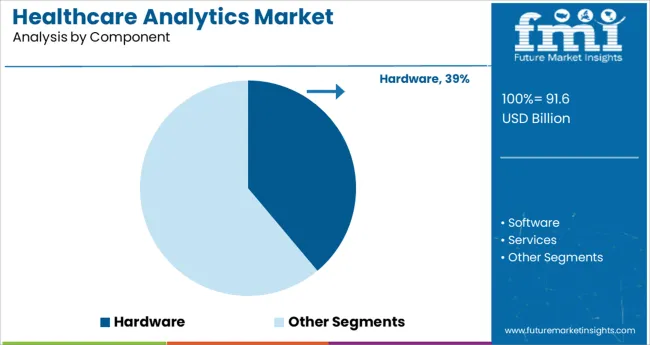

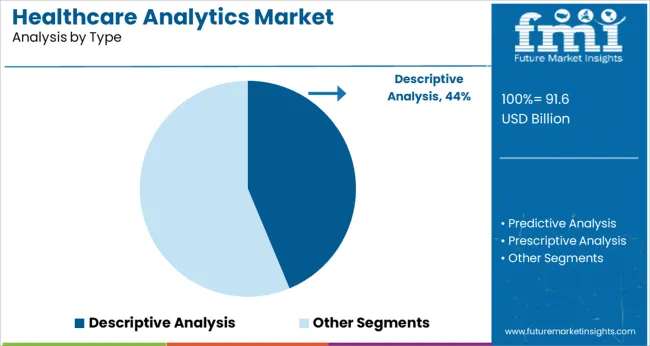

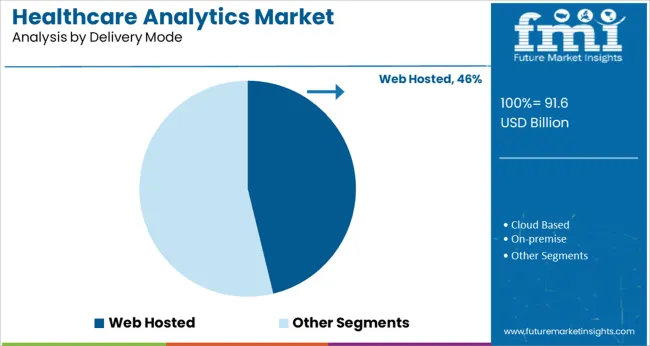

The market is segmented by Component, Type, Delivery Mode, and Application and region. By Component, the market is divided into Hardware, Software, and Services. In terms of Type, the market is classified into Descriptive Analysis, Predictive Analysis, and Prescriptive Analysis. Based on Delivery Mode, the market is segmented into Web Hosted, Cloud Based, and On-premise.

By Application, the market is divided into Clinical, Financial, and Operational & Administrative. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment held a substantial 38.9% share of the healthcare analytics market, maintaining its leadership within the component category.

This dominance has been supported by the critical role hardware infrastructure plays in managing, storing, and processing large volumes of healthcare data across integrated clinical and administrative systems.

Hospitals, diagnostic centers, and research institutions continue to invest in high-performance servers, data storage devices, and network equipment to support analytics workloads and ensure the seamless handling of sensitive patient information.

Within the type category, the descriptive analysis segment emerged as the market leader with a 43.7% share, reflecting its foundational role in the healthcare analytics landscape.

This segment's growth has been driven by the widespread application of descriptive analytics in summarizing historical healthcare data, identifying utilization trends, and uncovering operational inefficiencies.

Healthcare providers and payers rely heavily on descriptive tools to generate standardized reports, performance dashboards, and operational summaries that support evidence-based decision-making.

The web hosted segment dominated the delivery mode category with a 46.2% market share, underscoring its position as the preferred deployment model in the healthcare analytics market.

The increasing adoption of web hosted analytics solutions has been driven by their cost-effectiveness, scalability, and ease of integration with existing healthcare IT systems.

Providers, payers, and research institutions are steadily transitioning towards web hosted platforms to support real-time data access, remote collaboration, and cloud-based storage without the significant upfront infrastructure investments associated with on-premises solutions.

As per the Healthcare Analytics Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Healthcare Analytics Market increased at around 24.2% CAGR.

Rapid revenue growth in today's industry is predicted by the implementation of user-based analytics, with the ability to predict market trends using analysis of prescriptive and predictive solutions.

The healthcare industry is rapidly being affected by social media websites and the internet in an effort to encourage patient participation in their healthcare to gather data. The market for analytics data concerning patient welfare is slowly being stimulated by the growing demand for consumer analysis.

Advanced analytical tools tailored to the unique needs of healthcare facilities and businesses offering financial, clinical, operational, and administrative services are bringing growth to the healthcare field. An overriding factor in the growth of the market for healthcare analytics is the use of data mining techniques and big data analytics to study high-risk patients and deliver the most appropriate care. Predictive analytics applications are also being used to solve an array of challenges including risk assessment.

Web-based solutions are gaining in popularity in the fields of revenue cycle management (RCM) and medical management. There is a growing need for highly individualized medicine, and data analytics programs help to achieve this goal. For instance, by using patient-specific health information, such as electronic medical records (EMRs), mHealth, and eHealth records. Furthermore, health data mining has started to use artificial intelligence solutions wrapped in data analytics to enable tailored treatment plans, which is projected to create demand for analytical solutions in healthcare.

The growing use of analytics in the healthcare industry and government initiatives to boost the use of electronic health records (EHRs) in healthcare clinics have fostered the growth of the healthcare analytics market. Furthermore, the rising competition among healthcare organizations to reduce unnecessary expenses is boosting the market growth.

Factors such as complicated implementation procedures and lack of highly skilled labor are believed to curb healthcare analytics’ market expansion. On the other hand, the use of cloud-based analytics across many healthcare providers and the increase in the adoption of augmented analytics within the medical sector are anticipated to open up lucrative opportunities for the expansion of the market.

Healthcare analytics, typically known as clinical data analytics, is a type of analytics that aids in healthcare delivery, based on the real-time application of data to determine an individual's future treatment course. It can provide analysis on a matter of macro- and micro-level types.

The introduction of big data in the healthcare industry has played a major role in the development of healthcare analytics, which is propelling the market forward. In addition, the growth of the overall industry is assisted by a rise in health issues, an increase in disposable income, and a large increase in the senior citizen populace.

However, the expanding market will likely be hindered by the high prices and complexities of software development, as well as data integrity and privacy issues. In addition, technological developments and favorable government plans should create promising economic opportunities.

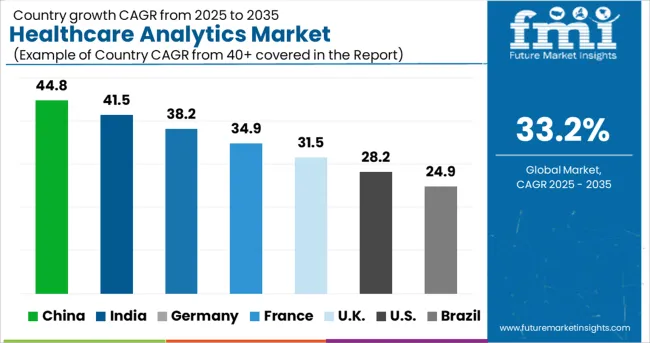

In 2024, North America held the largest share of the global healthcare analytics market. Government support for the healthcare sector's development, a high level of awareness about rare disorders, easy access to high-quality medical facilities, and attractive reimbursement policies are some of the important drivers for regional market growth.

Due to the growing healthcare expenditure of Japan and China and factors such as the introduction of generic Temozolomide, and the growing geriatric population, Asia Pacific is projected to grow at the fastest rate throughout the projection period.

The USA is expected to have the highest market share of USD 1610.5 Billion by the end of 2035. The plaintiffs of healthcare companies have benefited from the accessibility of innovative healthcare products and the increase in interest of healthcare fraternities in analytics due to favorable rules and improved rates of the latest illnesses.

The descriptive Analysis segment is forecasted to grow at the highest CAGR of over 30% from 2025 to 2035. This growth is due to the escalating demand for enhanced analyses based on historical patterns and datasets to generate data-enriched insight that will help organizations better understand the current situation.

Market participants forecast future market outcomes using data mining technologies on descriptive data silos. Trifecta and Accenture, for example, collaborated in December 2024 to supply high-quality data mining solutions for enhanced drug development operations. Companies employ descriptive analytics to turn raw data and patterns into interpretable data-driven insights that help them better understand past business performance, consumer behavior, and market impacts. Given the cheaper cost of obtaining descriptive datasets compared to predictive and prescriptive analyzed datasets, descriptive analysis is projected to rise dramatically in the future years.

Healthcare Analytics Software commanded the largest revenue as well as CAGR of nearly 37%, during the forecast period. Because they lack the skills and resources to deploy analytics, healthcare, and life science organizations outsource these services to other premier analytical solutions companies. Furthermore, the services sector is predicted to increase at the quickest rate in the next years. Multi-package services are being introduced by outsourcing businesses to life science companies, and this is projected to contribute to the segment's growth throughout the projection period. The healthcare business is experiencing a surge in demand for analytical solutions as a result of the increased workload.

For handling patient records, healthcare infrastructure is evolving and incorporating analytical and AI-based technologies. Due to the outsourcing of services for short-term and long-term contracts, the services category is predicted to develop at the quickest rate over the forecasted period. Social media analytics, manufacturing process, preventative maintenance, benchmarking, promotional spending, and predictive analysis for medical device failure are all included in these packages.

Players in the market are constantly developing improved analytical solutions as well as extending their product offerings. To help healthcare organizations implement data analysis solutions and preserve competitive advantage in the market, the companies are focused on their alliances, technology collaborations, and product launch strategies.

Some of the recent developments of key Healthcare Analytics providers are as follows:

Similarly, recent developments related to companies' Healthcare Analytics services have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | billion for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Covered | United States of America, Canada, Brazil, Mexico, Germany, the UK, France, Spain, Italy, Russia, China, Japan, South Korea, India, Australia, South Africa, Saudi Arabia, UAE, and Israel. |

| Key Market Segments Covered | Component, Type, Delivery Mode, Application, Region |

| Key Companies Profiled | IBM Corporation; McKesson Corporation; SAS Institute Inc.; Optum Inc.; Oracle; IQVIA; Cerner Corporation; Truven Health Analytics, Inc. |

| Pricing | Available upon Request |

The global healthcare analytics market is estimated to be valued at USD 91.6 billion in 2025.

It is projected to reach USD 1,610.5 billion by 2035.

The market is expected to grow at a 33.2% CAGR between 2025 and 2035.

The key product types are hardware, software and services.

descriptive analysis segment is expected to dominate with a 43.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA