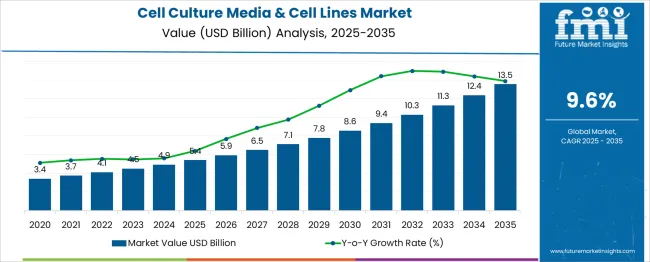

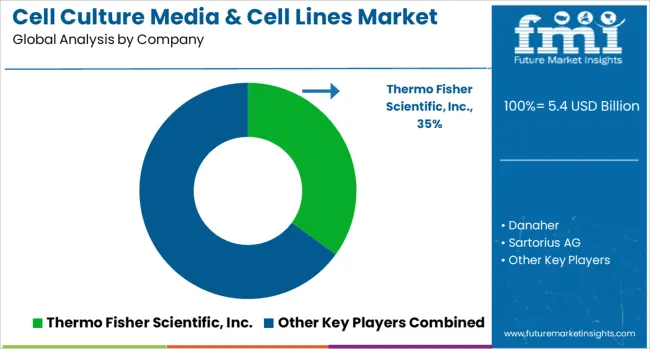

The global cell culture media & cell lines market is projected to grow from USD 5.4 billion in 2025 to approximately USD 13.5 billion by 2035, recording an absolute increase of USD 8.14 billion over the forecast period. This translates into a total growth of 150.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 9.6% between 2025 and 2035. The overall market size is expected to grow by nearly 2.51X during the same period, supported by the rising adoption of cell-based therapies and increasing demand for biopharmaceutical production across global healthcare markets.

Between 2025 and 2030, the cell culture media & cell lines market is projected to expand from USD 5.4 billion to USD 8.25 billion, resulting in a value increase of USD 2.85 billion, which represents 35.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising investment in cell therapy research, increasing adoption of personalized medicine approaches, and growing demand for biologics production that requires specialized cell culture systems. Research institutions and biopharmaceutical companies are expanding their cell culture capabilities to support advanced therapeutic development programs.

From 2030 to 2035, the market is forecast to grow from USD 8.25 billion to USD 13.54 billion, adding another USD 5.29 billion, which constitutes 65.0% of the overall ten-year expansion. This period is expected to be characterized by advancement of automated cell culture systems, development of serum-free and chemically-defined media formulations, and expansion of cell line engineering technologies for enhanced therapeutic applications. The growing adoption of regenerative medicine and tissue engineering approaches will drive demand for specialized cell culture products and services.

Between 2020 and 2025, the Cell Culture Media & Cell Lines market experienced accelerated expansion, driven by pandemic-induced research activity, increasing investment in vaccine development, and growing recognition of cell-based therapeutic potential. The market developed as biopharmaceutical companies recognized the importance of robust cell culture systems for producing complex biologics and cell therapies. Regulatory agencies began establishing guidelines for cell culture manufacturing that emphasized quality control and standardization requirements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5.4 billion |

| Forecast Value in (2035F) | USD 13.5 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

Market expansion is being supported by the rapid advancement of cell-based therapies and corresponding need for specialized culture media and authenticated cell lines that ensure reproducible research outcomes. Modern biopharmaceutical development relies heavily on cell culture systems for producing monoclonal antibodies, vaccines, and gene therapies that require precise environmental control and nutrient optimization. The increasing complexity of therapeutic molecules and personalized medicine approaches necessitate sophisticated cell culture technologies that can support diverse cellular requirements.

The growing emphasis on reducing animal testing and implementing alternative research methods is driving demand for advanced cell culture models that provide physiologically relevant experimental systems. Regulatory agencies and pharmaceutical companies are prioritizing in vitro testing approaches that utilize human-derived cell lines and organ-on-chip technologies. Investment in regenerative medicine research and tissue engineering applications continues to create opportunities for specialized cell culture products and services.

The growing development of serum-free and chemically-defined media formulations is enabling more consistent and reproducible cell culture results while reducing variability associated with animal-derived components. Advanced media formulations provide precise nutrient control and eliminate batch-to-batch variations that can affect experimental outcomes and therapeutic production. These formulations are particularly valuable for regulatory compliance in biopharmaceutical manufacturing and clinical applications where consistency and traceability are essential requirements.

Modern cell culture laboratories are incorporating automated systems that provide precise environmental control, real-time monitoring, and standardized protocols that improve reproducibility and reduce manual handling requirements. Advanced bioreactor systems and automated feeding protocols enable scalable cell culture operations that support both research applications and commercial production requirements. These technological improvements are particularly important for cell therapy manufacturing where consistent cell quality and viability are critical for therapeutic efficacy.

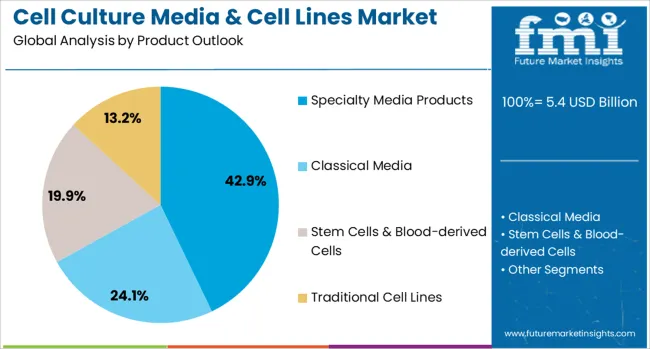

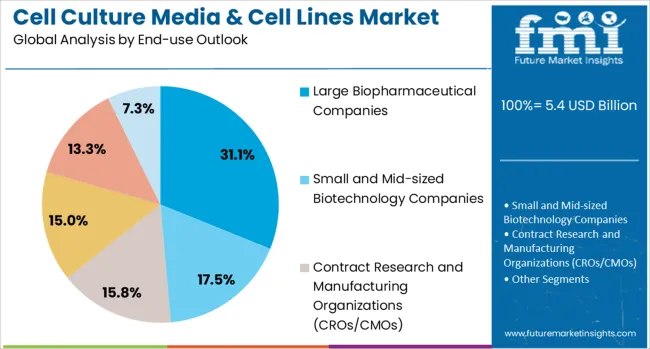

The market is segmented by product type, application category, end-use sector, and region. By product type, the market is divided into specialty media products, classical media, stem cells & blood-derived cells, traditional cell lines, and other products. Based on application category, the market is categorized into biopharmaceutical production, diagnostics, drug screening and development, tissue engineering and regenerative medicine, and other applications. In terms of end-use sector, the market is segmented into large biopharmaceutical companies, small and mid-sized biotechnology companies, contract research and manufacturing organizations, research and academic institutes, hospitals and diagnostic laboratories, and other end users. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Specialty media products are projected to account for 42.9% of the Cell Culture Media & Cell Lines market in 2025. This leading share is supported by increasing demand for application-specific media formulations that optimize cell growth and productivity for particular research or production requirements. Specialty media products include serum-free formulations, chemically-defined media, and condition-specific formulations that address unique cellular needs. The segment benefits from growing sophistication in cell culture applications and increasing emphasis on reproducibility and regulatory compliance in biopharmaceutical development.

Biopharmaceutical production applications are expected to represent 45.6% of cell culture market demand in 2025. This dominant share reflects the critical role of cell culture systems in manufacturing monoclonal antibodies, vaccines, recombinant proteins, and cell-based therapies that require precise culture conditions and scalable production processes. Modern biopharmaceutical companies rely on advanced cell culture technologies for producing complex therapeutic molecules that cannot be synthesized through traditional chemical methods. The segment benefits from increasing investment in biologics development and growing demand for personalized medicine approaches.

Large biopharmaceutical companies are projected to contribute 31.1% of the market in 2025, representing organizations with comprehensive research and development capabilities that require diverse cell culture products for multiple therapeutic programs. These companies typically maintain extensive cell culture facilities and invest heavily in advanced technologies that support drug discovery, development, and manufacturing operations. Large biopharmaceutical companies drive demand for high-quality cell culture products and services that meet stringent regulatory requirements and support large-scale production operations.

The cell culture media & cell lines market is advancing rapidly due to increasing investment in cell-based therapies and growing demand for biologics production across global healthcare markets. However, the market faces challenges including complex regulatory requirements, high product development costs, and technical difficulties associated with maintaining cell line authenticity and stability. Technological advancement and standardization efforts continue to influence product development and market adoption patterns.

The growing development of cell therapy and regenerative medicine applications is creating demand for specialized cell culture products that support therapeutic cell expansion, differentiation, and quality control throughout manufacturing processes. Advanced cell therapy products require sophisticated culture systems that maintain cell identity and functionality while enabling scalable production. These applications are particularly valuable for treating previously untreatable conditions and providing personalized therapeutic options for patients with specific genetic profiles.

Modern cell culture operations are incorporating advanced quality control and authentication technologies that ensure cell line identity, detect contamination, and monitor cellular characteristics throughout culture periods. Molecular authentication methods and real-time monitoring systems provide comprehensive quality assurance that meets regulatory requirements and supports reproducible research outcomes. These technologies are essential for maintaining confidence in research results and ensuring therapeutic product safety and efficacy.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 13% |

| India | 12% |

| Germany | 11.1% |

| France | 10.1% |

| UK | 9.1% |

| USA | 8.2% |

| Brazil | 7.2% |

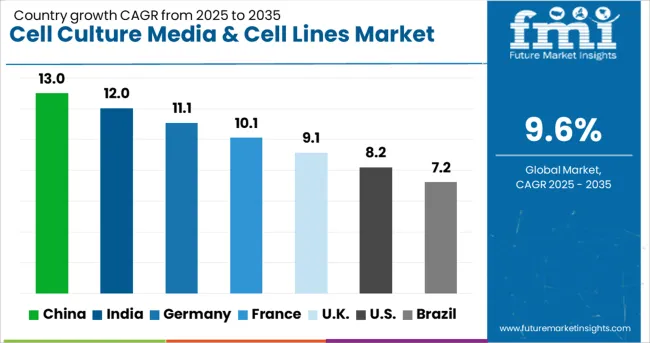

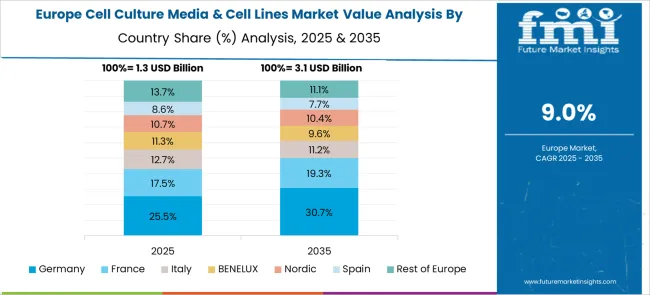

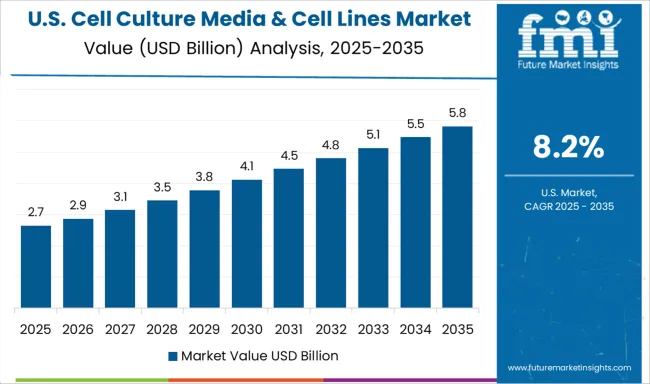

The global cell culture media & cell lines market is projected to grow at a CAGR of 9.6% (2025–2035), with notable regional variations. China leads with the fastest CAGR of 13%, fueled by government investment in biotechnology infrastructure and rapid biopharmaceutical expansion. India follows at 12%, driven by pharmaceutical manufacturing growth and international collaborations. Germany maintains strong growth at 11.1%, leveraging precision biotechnology and advanced manufacturing systems. France records a 10.1% CAGR, supported by integrated pharmaceutical research and academic-industry partnerships. The UK grows at 9.1%, emphasizing cell therapy innovation and regulatory excellence. The USA, while a mature market, expands steadily at 8.2%, supported by advanced research and large-scale commercial production. Brazil demonstrates more modest growth at 7.2%, underpinned by healthcare infrastructure development and gradual biotechnology adoption.

Revenue from cell culture media & cell lines in China is projected to exhibit the highest growth rate with a CAGR of 13% through 2035, driven by massive government investment in biotechnology infrastructure, rapidly expanding biopharmaceutical industry, and increasing emphasis on domestic therapeutic development capabilities. The country's growing biotechnology sector and expanding research institutions are creating significant demand for advanced cell culture products and specialized media formulations. Major pharmaceutical companies and research organizations are establishing comprehensive cell culture facilities that support both basic research and commercial production applications.

Government biotechnology development programs are supporting establishment of advanced cell culture laboratories and training programs that enhance domestic research capabilities throughout major metropolitan and emerging biotechnology regions.

Revenue from cell culture media & cell lines in India is expanding at a CAGR of 12%, supported by growing pharmaceutical manufacturing capacity, increasing investment in biotechnology research, and expanding contract research organization capabilities that serve global biopharmaceutical development programs. The country's established pharmaceutical industry and growing biotechnology sector are creating opportunities for advanced cell culture applications in drug development and production. Research institutions and pharmaceutical companies are investing in cell culture capabilities that support both domestic therapeutic development and international collaboration programs.

Technology transfer programs and international partnerships are enabling Indian organizations to access advanced cell culture technologies and establish manufacturing capabilities that meet global quality standards throughout diverse therapeutic applications.

Revenue from cell culture media & cell lines in Germany is growing at a CAGR of 11.1%, driven by emphasis on precision biotechnology, advanced manufacturing systems, and comprehensive quality control standards that support high-value therapeutic development applications. German biotechnology companies and research institutions are implementing sophisticated cell culture technologies that emphasize reproducibility, regulatory compliance, and advanced analytical capabilities. The country's established pharmaceutical industry and strong engineering capabilities are enabling development of innovative cell culture systems and automated production technologies.

Research and development programs are emphasizing advanced cell culture applications including organ-on-chip technologies, personalized medicine approaches, and regenerative medicine applications that require sophisticated culture systems and specialized media formulations.

Revenue from cell culture media & cell lines in France is expanding at a CAGR of 10.1%, supported by integration of cell culture technologies with existing pharmaceutical research infrastructure, government support for biotechnology development, and emphasis on therapeutic innovation that addresses specific disease areas and patient populations. French pharmaceutical companies and research institutions are leveraging established research capabilities to develop advanced cell culture applications in drug discovery and development. Academic-industry partnerships are facilitating technology transfer and collaborative research programs that enhance cell culture capabilities.

Research programs are emphasizing development of French biotechnology expertise, international collaboration initiatives, and therapeutic development programs that address priority healthcare needs throughout French and European markets.

Revenue from cell culture media & cell lines in the UK is projected to grow at a CAGR of 9.1%, driven by innovative cell therapy development programs, regulatory excellence initiatives, and comprehensive research capabilities that support advanced therapeutic applications and clinical translation programs. British research institutions and biotechnology companies are implementing sophisticated cell culture systems that meet stringent regulatory requirements and support innovative therapeutic development. The country's established regulatory framework and research excellence are enabling development of cell therapy applications and regenerative medicine programs.

Technology development programs are emphasizing advanced cell culture applications, regulatory compliance systems, and international collaboration initiatives that enhance British biotechnology capabilities and therapeutic development programs throughout domestic and global markets.

Demand for cell culture media & cell lines in the USA is expanding at a CAGR of 8.2%, driven by advanced research applications, comprehensive commercial production capabilities, and extensive investment in biotechnology development that supports diverse therapeutic applications and manufacturing requirements. American biotechnology companies and research institutions are implementing sophisticated cell culture technologies that emphasize scalability, automation, and regulatory compliance for both research and commercial applications. The country's established biotechnology infrastructure and extensive research capabilities are enabling development of innovative cell culture products and therapeutic applications.

Technology companies are developing advanced cell culture systems, automated production capabilities, and analytical technologies that support comprehensive therapeutic development and manufacturing programs throughout American biotechnology markets.

Demand for cell culture media & cell lines in Brazil is growing at a CAGR of 7.2%, supported by expanding healthcare infrastructure, increasing biotechnology investment, and growing pharmaceutical manufacturing capabilities that create opportunities for cell culture applications in research and production. Brazilian research institutions and pharmaceutical companies are gradually establishing cell culture capabilities that support domestic therapeutic development and contract manufacturing services. Government healthcare programs are supporting biotechnology development initiatives that enhance research capabilities and manufacturing capacity.

Infrastructure development programs are emphasizing biotechnology education, laboratory modernization, and international collaboration initiatives that enhance Brazilian cell culture capabilities throughout research institutions and pharmaceutical manufacturing facilities.

The cell culture media & cell lines market is defined by competition among biotechnology companies, pharmaceutical suppliers, and specialized research organizations. Companies are investing in advanced media formulations, authenticated cell line development, quality control systems, and automated culture technologies to deliver reliable, standardized, and innovative cell culture solutions. Strategic partnerships, technological advancement, and regulatory compliance are central to strengthening product portfolios and market presence.

Thermo Fisher Scientific Inc. offers comprehensive cell culture product portfolios including specialized media formulations, cell lines, and culture systems with emphasis on quality and reproducibility. Danaher provides advanced cell culture technologies through multiple business units that support research and manufacturing applications. Sartorius AG delivers innovative bioprocessing solutions including cell culture media, bioreactor systems, and process control technologies. Merck KGaA offers extensive cell culture product lines with emphasis on regulatory compliance and manufacturing scalability.

FUJIFILM Corporation provides cell culture products and services through its biotechnology divisions with focus on regenerative medicine applications. Lonza delivers comprehensive cell culture solutions including custom media development and contract manufacturing services. STEMCELL Technologies offers specialized products for stem cell research and cell therapy applications. PromoCell GmbH provides human cell culture systems with emphasis on primary cells and specialized media. ATCC maintains extensive authenticated cell line collections and quality control standards. AllCells offers primary human cells and specialized culture services for research applications.

| Items | Values |

|---|---|

| Quantitative Units | USD 5.4 billion |

| Product Type | Specialty Media Products, Classical Media, Stem Cells & Blood-derived Cells, Traditional Cell Lines, Other Products |

| Application Category | Biopharmaceutical Production, Diagnostics, Drug Screening and Development, Tissue Engineering and Regenerative Medicine, Other Applications |

| End-use Sector | Large Biopharmaceutical Companies, Small and Mid-sized Biotechnology Companies, Contract Research and Manufacturing Organizations, Research and Academic Institutes, Hospitals and Diagnostic Laboratories, Other End Uses |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, France, Brazil |

| Key Companies Profiled | Thermo Fisher Scientific Inc., Danaher, Sartorius AG, Merck KGaA, FUJIFILM Corporation, Lonza, STEMCELL Technologies, PromoCell GmbH, ATCC, AllCells |

| Additional Attributes | Dollar sales by product type, application category, and end-use sector, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established biotechnology companies and specialized suppliers, researcher preferences for specialized versus classical media formulations, integration with automated cell culture systems and process control technologies, innovations in serum-free media development and cell line authentication methods, and adoption of quality control solutions with contamination detection and cellular characterization capabilities. |

The global cell culture media & cell lines market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the cell culture media & cell lines market is projected to reach USD 13.5 billion by 2035.

The cell culture media & cell lines market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in cell culture media & cell lines market are specialty media products, classical media, stem cells & blood-derived cells and traditional cell lines .

In terms of application outlook , biopharmaceutical production segment to command 45.6% share in the cell culture media & cell lines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulite Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cell Isolation Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Market Size and Share Forecast Outlook 2025 to 2035

Cellulase Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cellulose Esters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA