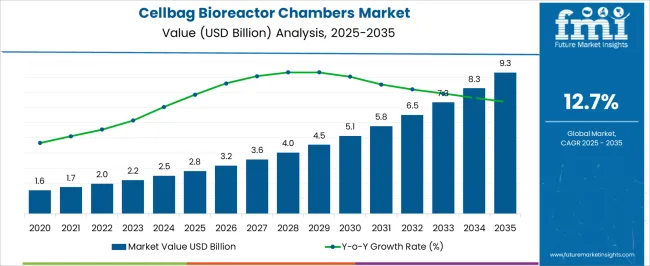

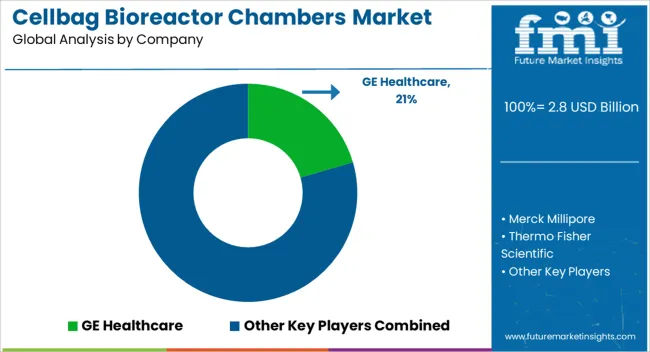

The Cellbag Bioreactor Chambers Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period.

| Metric | Value |

|---|---|

| Cellbag Bioreactor Chambers Market Estimated Value in (2025 E) | USD 2.8 billion |

| Cellbag Bioreactor Chambers Market Forecast Value in (2035 F) | USD 9.3 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

The Cellbag Bioreactor Chambers market is witnessing substantial growth, driven by the rising demand for scalable and efficient bioprocessing solutions in the biopharmaceutical industry. Increasing production of monoclonal antibodies, vaccines, and recombinant proteins has accelerated the adoption of advanced bioreactor systems that ensure consistent yield and quality. Flexible, single-use bioreactor chambers offer reduced contamination risks, faster turnaround times, and simplified cleaning and validation processes compared with traditional stainless steel systems.

The integration of advanced monitoring, process control, and automation technologies further enhances operational efficiency and reproducibility. Growing investment in biologics research, coupled with the expansion of contract manufacturing organizations and pharmaceutical companies, is driving the need for adaptable bioreactor platforms capable of handling different scales and applications.

Regulatory emphasis on good manufacturing practices, process validation, and product quality is also encouraging adoption of reliable and flexible bioreactor systems As demand for biologics continues to rise globally, the Cellbag Bioreactor Chambers market is expected to experience sustained growth, supported by technological innovations and process optimization.

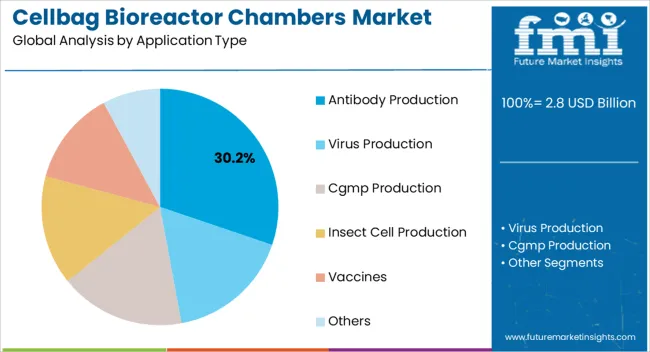

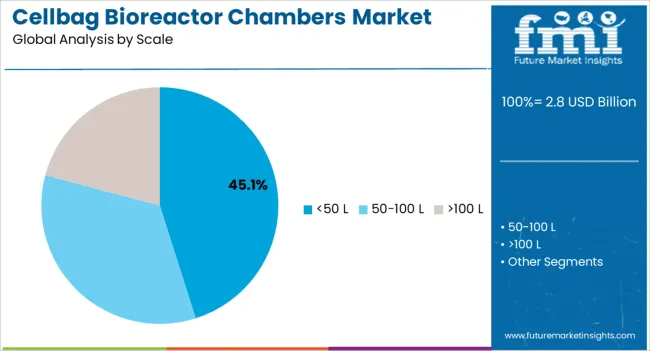

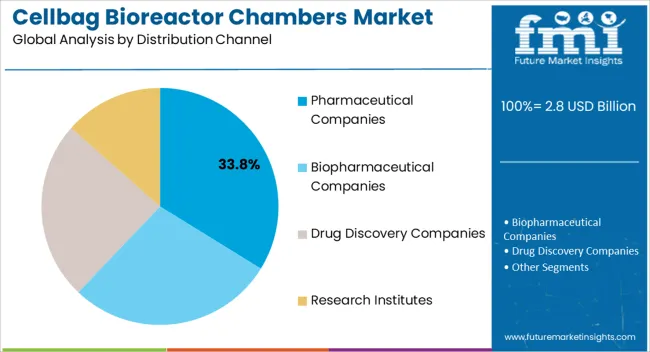

The cellbag bioreactor chambers market is segmented by application type, scale, distribution channel, and geographic regions. By application type, cellbag bioreactor chambers market is divided into Antibody Production, Virus Production, Cgmp Production, Insect Cell Production, Vaccines, and Others. In terms of scale, cellbag bioreactor chambers market is classified into <50 L, 50-100 L, and >100 L. Based on distribution channel, cellbag bioreactor chambers market is segmented into Pharmaceutical Companies, Biopharmaceutical Companies, Drug Discovery Companies, and Research Institutes. Regionally, the cellbag bioreactor chambers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The antibody production segment is projected to hold 30.2% of the market revenue in 2025, establishing it as the leading application area. Its growth is being driven by the increasing global demand for monoclonal antibodies for therapeutic, diagnostic, and research purposes. Cellbag bioreactor chambers enable controlled cultivation of mammalian cells, ensuring high yield, reproducibility, and product quality, which are critical for antibody manufacturing.

Automation and real-time monitoring capabilities allow precise control of culture conditions, reducing variability and contamination risks. The scalability and flexibility of these chambers also allow adaptation to changing production volumes and process requirements.

Rising investments in biologics research, clinical trials, and commercial production further support segment growth As pharmaceutical companies and contract manufacturers seek efficient, reliable, and compliant platforms for antibody production, the adoption of Cellbag bioreactor chambers is expected to remain strong, reinforcing this segment’s market leadership and driving continuous innovation in bioprocessing technologies.

The <50 L scale segment is anticipated to account for 45.1% of the market revenue in 2025, making it the leading scale category. Its growth is being supported by the increasing use of small-scale bioreactors in early-stage development, process optimization, and preclinical studies. These compact chambers allow efficient evaluation of cell growth, productivity, and process parameters before scaling up to commercial production.

The flexibility and cost-effectiveness offered by small-scale systems reduce material usage, shorten production cycles, and accelerate research timelines. Integration with advanced sensors, control systems, and automation enhances reproducibility and data accuracy, supporting regulatory compliance and quality assurance.

Rising adoption of single-use systems in contract research organizations, academic institutions, and biopharmaceutical companies is further driving segment growth As organizations prioritize rapid, reliable, and scalable bioprocessing solutions, the <50 L scale segment is expected to remain dominant, providing a critical foundation for product development and process standardization in antibody and biologics manufacturing.

The pharmaceutical companies distribution channel segment is projected to hold 33.8% of the market revenue in 2025, establishing it as the leading distribution channel. Growth in this segment is being driven by direct adoption of Cellbag bioreactor chambers for commercial and clinical-scale production of biologics, including monoclonal antibodies, vaccines, and recombinant proteins. Pharmaceutical companies prefer single-use, flexible bioreactor systems that offer high reproducibility, ease of validation, and reduced contamination risks.

Integration with advanced process monitoring and automation platforms enables real-time control of critical culture parameters, ensuring consistent product quality. Strong R&D pipelines, expansion of manufacturing capacities, and strategic investments in biopharmaceutical production are further supporting adoption through this channel.

As regulatory compliance and quality assurance remain top priorities, pharmaceutical companies continue to prioritize reliable and scalable bioreactor solutions The segment is expected to maintain its market leadership, supported by the increasing demand for biologics, continuous innovation in bioprocessing technology, and the need for efficient, future-ready production platforms.

Disposable Bioreactors are used for cell cultivation because they improve process flexibility, decrease turn over time and eliminate the cleaning and sterilization process. In these bioreactors cells are grown in a pre-sterilized, inflated chamber called cell bag bioreactor.

The culture in the cell bags are agitated by shaking the cellbag attached to the bioreactor tray. Media or culture are exposed to the required temperature by means of heater located below the tray. Gases are supplied through the headspace that is filled with mixture of ambient air, CO2, N2, and additional oxygen can be supplied to support high cell concentration.

These cellbag bioreactors are attached with sensors that optically measures the level of O2 dissolved and pH of the culture medium. Cellbag bioreactors are majorly used in bio production process, research and development, process development, and in preclinical trails where small amount of biologics are often required for testing. Cellbag bioreactors have several inlets and outlets for introduction of air, and sampling ports for sample introduction.

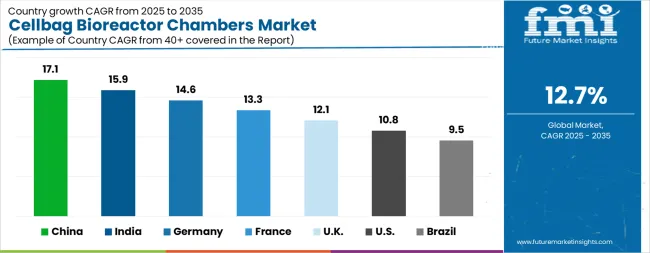

| Country | CAGR |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| France | 13.3% |

| UK | 12.1% |

| USA | 10.8% |

| Brazil | 9.5% |

The Cellbag Bioreactor Chambers Market is expected to register a CAGR of 12.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 17.1%, followed by India at 15.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 9.5%, yet still underscores a broadly positive trajectory for the global Cellbag Bioreactor Chambers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.6%. The USA Cellbag Bioreactor Chambers Market is estimated to be valued at USD 1.0 billion in 2025 and is anticipated to reach a valuation of USD 2.9 billion by 2035. Sales are projected to rise at a CAGR of 10.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 152.5 million and USD 97.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Application Type | Antibody Production, Virus Production, Cgmp Production, Insect Cell Production, Vaccines, and Others |

| Scale | <50 L, 50-100 L, and >100 L |

| Distribution Channel | Pharmaceutical Companies, Biopharmaceutical Companies, Drug Discovery Companies, and Research Institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GE Healthcare, Merck Millipore, Thermo Fisher Scientific, Danaher Corporation, Sartorius Stedim Biotech, JW Therapeutics, and Atara Biotherapeutics |

The global cellbag bioreactor chambers market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the cellbag bioreactor chambers market is projected to reach USD 9.3 billion by 2035.

The cellbag bioreactor chambers market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in cellbag bioreactor chambers market are antibody production, virus production, cgmp production, insect cell production, vaccines and others.

In terms of scale, <50 l segment to command 45.1% share in the cellbag bioreactor chambers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airlift Bioreactors Market - Growth & Forecast 2025 to 2035

Rocking Bioreactors Market

Microbial Bioreactors Market

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Small-Scale Bioreactors Market Analysis by Product, Capacity, End-User, and Region through 2035

Continuous Flow Bioreactors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Portable Bioprocessing Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA