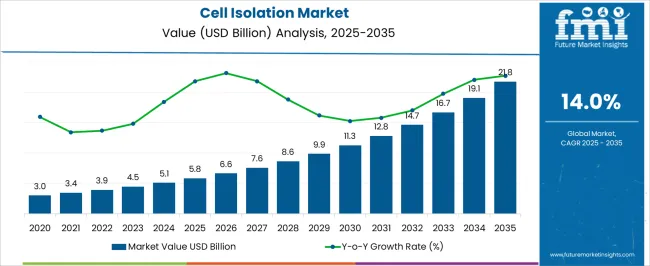

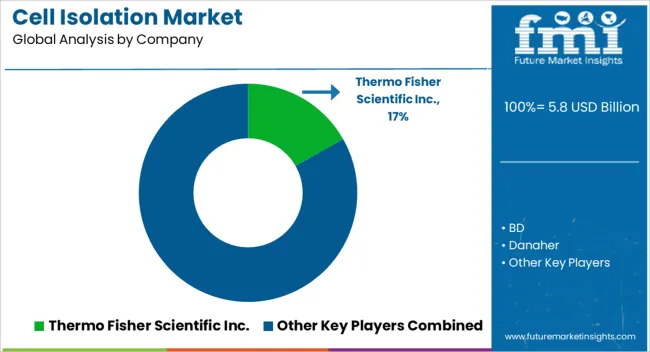

The Cell Isolation Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 21.8 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period.

| Metric | Value |

|---|---|

| Cell Isolation Market Estimated Value in (2025 E) | USD 5.8 billion |

| Cell Isolation Market Forecast Value in (2035 F) | USD 21.8 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The cell isolation market is expanding steadily, fueled by advancements in cell biology research, regenerative medicine, and biopharmaceutical production. Growing demand for precision medicine and cell-based therapies has heightened the need for efficient and reliable cell isolation techniques. The market benefits from increased funding for life sciences research, rising prevalence of chronic diseases, and expanding applications of stem cell and immunotherapy approaches.

Current trends show a strong focus on developing high-throughput technologies that minimize contamination and improve purity levels. Consumable-driven recurring revenue streams are also reinforcing growth.

Looking forward, the adoption of automation, microfluidics, and AI-powered cell analysis tools is expected to redefine isolation efficiency. With strong contributions from both academic and commercial sectors, the market outlook remains highly positive, particularly as cell-based research continues to expand in drug discovery and clinical applications.

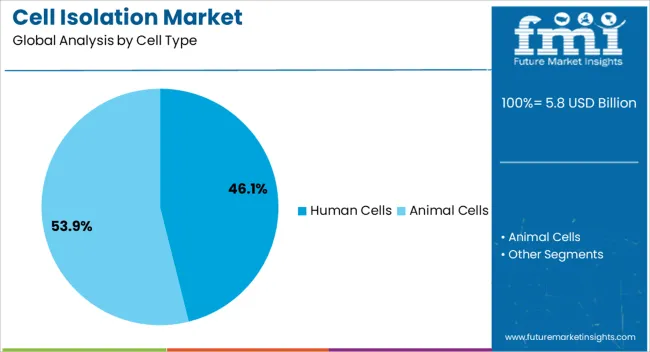

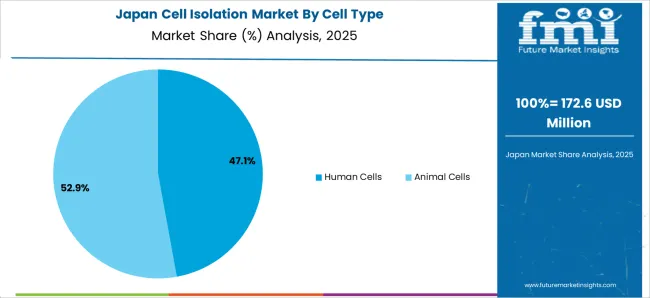

The human cells segment leads the cell type category with approximately 46.10% share, reflecting the growing application of human-derived cells in biomedical research and clinical therapies. Increased use of stem cells, immune cells, and primary cells in drug testing and regenerative medicine has strengthened demand.

Human cells provide higher translational value compared to animal models, making them a preferred choice for precision medicine initiatives. The segment’s growth is reinforced by rising prevalence of chronic diseases and the need for advanced treatment modalities.

Academic institutions and pharmaceutical companies are actively expanding research on human cells to accelerate therapeutic development. With regulatory support for clinical trials involving cell-based therapies, the human cells segment is expected to sustain its dominant position.

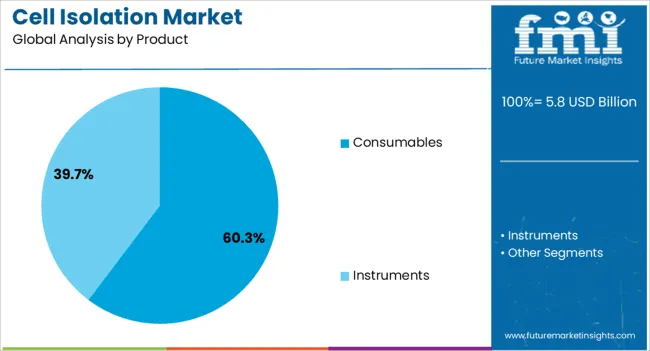

The consumables segment dominates the product category with approximately 60.30% share, supported by recurring demand for reagents, kits, and laboratory consumables required in cell isolation procedures. This segment benefits from the continuous use of disposables in both manual and automated workflows, ensuring consistent revenue generation for suppliers.

Growing adoption of cell-based therapies and bioprocessing techniques has increased the need for high-quality consumables that enhance yield and purity. Advances in microfluidic chips, separation media, and cell isolation kits have improved process efficiency and reproducibility, further driving demand.

The consumables segment’s leadership is expected to continue, given its critical role in both research and clinical-grade cell isolation applications.

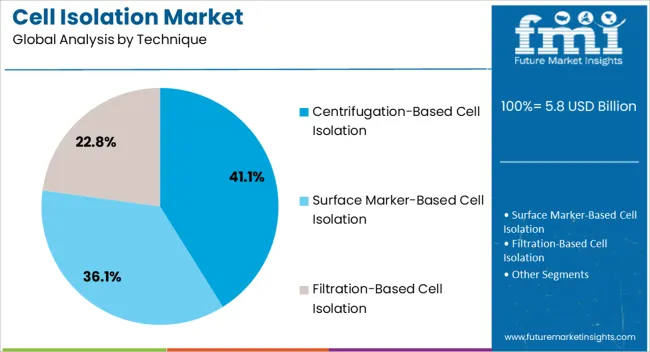

The centrifugation-based cell isolation segment holds approximately 41.10% share of the technique category, making it a widely adopted method due to its simplicity, cost-effectiveness, and efficiency. This technique is commonly used in laboratories for separating cells based on size and density, supporting applications in research and clinical sample preparation.

Its established role in processing blood, stem cells, and immune cells ensures broad usage across academic, clinical, and biopharma settings. The method’s compatibility with large sample volumes and minimal infrastructure requirements further supports its appeal.

Despite advancements in magnetic and microfluidic isolation technologies, centrifugation continues to be the standard for routine cell separation. With ongoing use in both discovery research and clinical workflows, this technique is expected to retain its substantial share.

The scope for global cell isolation market insights expanded at an 18.9% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 14.1% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 18.9% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 14.1% |

Between 2020 and 2025, the global market experienced substantial growth, marked by a CAGR of 18.9%. This period witnessed a surge in demand for advanced cell isolation technologies, driven by increased focus on personalized medicine, rising prevalence of chronic diseases, and continuous advancements in biomedical research.

The market expansion during these years reflected the dynamic nature of the biomedical sector, with researchers and healthcare professionals increasingly relying on precise cell isolation methods to propel their studies and therapeutic developments.

The industry is expected to maintain robust growth, albeit at a slightly moderated pace, with a forecasted CAGR of 14.1% from 2025 to 2035. This projection indicates a positive trajectory, suggesting sustained demand for cell isolation technologies.

Factors contributing to this forecasted growth include an ongoing emphasis on personalized medicine, the persistent rise in chronic diseases globally, and the evolution of innovative isolation techniques.

As the market enters the forecast period, the anticipated expansion underscores the enduring significance of cell isolation in advancing biomedical research and meeting the evolving needs of the healthcare industry.

| Attributes | Details |

|---|---|

| Drivers |

|

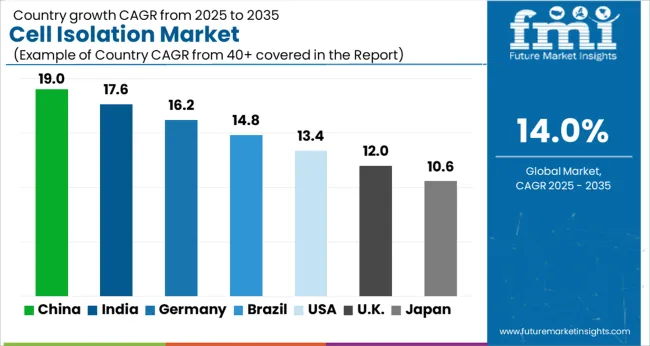

The table below highlights CAGRs from the five countries spearheaded by the United States, Japan, China, the United Kingdom, and South Korea. The market in South Korea is dynamic and rapidly advancing, poised for significant growth with a 15.7% CAGR by 2035. Embracing innovation, the country thus, contributes to diverse industries, showcasing a thriving landscape in its economic evolution.

In the United States, the market experiences significant utilization due to the robust biomedical research infrastructure and a thriving healthcare industry.

The demand for cell isolation technologies is driven by extensive research in cancer biology, regenerative medicine, and personalized medicine.

The United States is a global hub for cutting-edge research. Adopting advanced cell isolation methods is pivotal for exploring disease mechanisms, developing targeted therapies, and advancing clinical applications.

The strong emphasis on technological innovation and its leading position in life sciences contribute to the widespread use of cell isolation technologies. The country focuses on precision medicine and advanced healthcare solutions propels the demand for precise cell isolation methods.

The commitment to regenerative medicine and its aging population drive the need for efficient cell isolation techniques in therapeutic applications. This makes it a key market for the continued growth of cell isolation technologies.

The market in China is experiencing substantial growth due to the expanding biomedical research landscape and increasing investments in healthcare infrastructure of the country.

The large population and rising incidences of chronic diseases fuel the demand for advanced cell isolation methods for research and clinical applications. The commitment to scientific innovation and the integration of cell isolation technologies in disease studies contribute to the major utilization within the country.

The prominence of scientific research, particularly in fields like genomics and precision medicine, drives the extensive use of cell isolation technologies.

The well-established healthcare system of the country and focus on translational research contribute to the high demand for advanced cell isolation methods.

The commitment to staying at the forefront of biomedical advancements ensures a sustained need for precise cell isolation techniques in various research and clinical applications.

The dynamic research environment and technological innovation contribute to the significant adoption of cell isolation technologies. The growing interest in personalized medicine, regenerative medicine, and biotechnology fuels the demand for advanced cell isolation methods.

The strategic investments in research and development and a focus on advancing healthcare solutions position cell isolation technologies as crucial tools for advancing scientific understanding and clinical applications within the country.

The table below provides an overview of the cell isolation landscape on the basis of cell type and product type. Human cells are projected to lead the cell type market at a 13.9% CAGR by 2035, while consumables in the product type category are likely to expand at a CAGR of 13.6% by 2035.

The increasing emphasis on personalized medicine and the intricate study of human biology propels the prominence of human cells in the cell isolation landscape. The driving force behind the substantial growth of consumables in the market lies in the integral role these materials play in supporting isolation processes.

| Category | CAGR by 2035 |

|---|---|

| Human Cells | 13.9% |

| Consumables | 13.6% |

The cell isolation landscape is categorized based on cell types, with human cells emerging as a prominent segment poised for substantial growth. Projections indicate a CAGR of 13.9% for human cells by 2035.

This signifies a robust and sustained demand for technologies specifically tailored to isolating human cells for various biomedical research and clinical applications.

The increasing focus on personalized medicine and the intricate study of human cell behavior drive the demand for advanced cell isolation techniques, positioning human cells as a pivotal and evolving segment within the broader market.

The market is further delineated based on product types, with consumables significantly shaping the landscape. Projections suggest a noteworthy CAGR of 13.6% for consumables by 2035, highlighting their integral role in cell isolation processes.

Consumables encompass a range of materials essential for cell isolation protocols, including reagents, buffers, and disposable instruments. The consistent demand for these consumables is attributed to the ongoing advancements in isolation technologies and the increasing adoption of automated systems.

As consumables witness sustained growth, they underscore the crucial support infrastructure required for efficient and scalable cell isolation processes across diverse applications in research, diagnostics, and therapeutic development.

The cell isolation market boasts a dynamic and competitive landscape characterized by prominent players striving for innovation and market dominance.

The key players engage in strategic collaborations, mergers, and acquisitions to expand their product portfolios and geographic presence. The competitive arena is further fueled by the influx of new entrants, fostering a climate of innovation and pushing established players to adapt swiftly to emerging trends, ensuring sustained growth in this dynamic market.

Emphasis is placed on automation and user-friendly solutions to enhance efficiency. Strategic partnerships with research institutions and healthcare organizations are integral to market strategies, facilitating the integration of novel technologies into diverse applications.

Some recent developments in the cell isolation domain are as follows:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 5.1 billion |

| Projected Market Valuation in 2035 | USD 19.1 billion |

| CAGR Share from 2025 to 2035 | 14.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | By Cell Type, By Product, By Technique, By End-user, By Application, By Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; BD; Danaher; Terumo Corp.; STEMCELL Technologies Inc.; Bio-Rad Laboratories Inc.; Merck KGaA; Agilent Technologies Inc.; Corning Inc.; Akadeum Life Sciences |

The global cell isolation market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the cell isolation market is projected to reach USD 21.8 billion by 2035.

The cell isolation market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in cell isolation market are human cells and animal cells.

In terms of product, consumables segment to command 60.3% share in the cell isolation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulite Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Waste Aspirator Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Media Market Size and Share Forecast Outlook 2025 to 2035

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Supplements Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Media & Cell Lines Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Market Size and Share Forecast Outlook 2025 to 2035

Cell Freezing Media Market Size and Share Forecast Outlook 2025 to 2035

Cellulase Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA