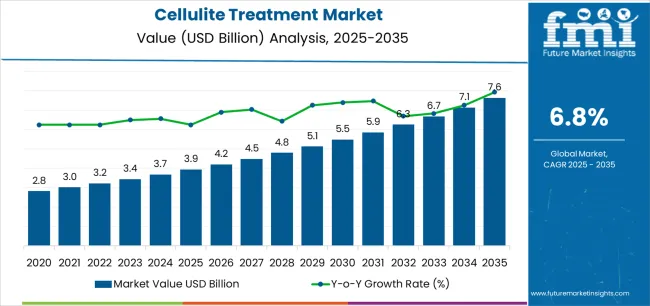

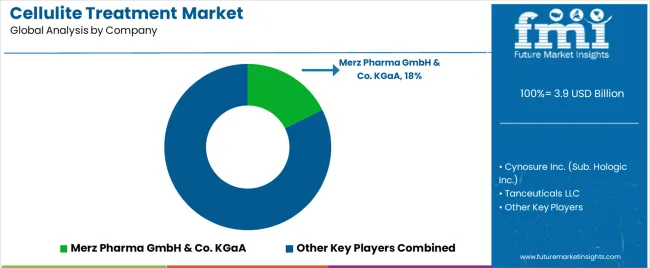

The Cellulite Treatment Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The cellulite treatment market is experiencing robust growth driven by increasing aesthetic consciousness, advancements in non-invasive technologies, and the rising preference for outpatient cosmetic procedures. Current market dynamics reflect a shift toward safe, convenient, and minimally invasive options that offer effective results with shorter recovery times. Growing disposable income levels, expanding access to cosmetic dermatology, and strong influence from social media trends are contributing to higher treatment adoption rates.

Continuous innovation in energy-based devices and targeted formulations has improved treatment outcomes, enhancing patient satisfaction and procedural consistency. The future outlook remains positive as consumer demand for personalized and technologically advanced treatments expands across both developed and emerging markets.

Strategic collaborations between device manufacturers and clinical service providers are further supporting accessibility and awareness Overall, sustained product innovation, regulatory approvals, and growing clinical validation are expected to strengthen market stability and foster consistent revenue growth across global aesthetic care networks.

| Metric | Value |

|---|---|

| Cellulite Treatment Market Estimated Value in (2025 E) | USD 3.9 billion |

| Cellulite Treatment Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

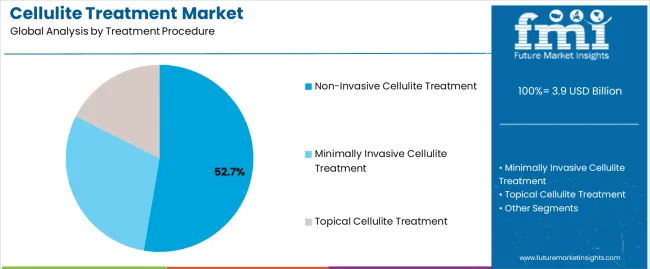

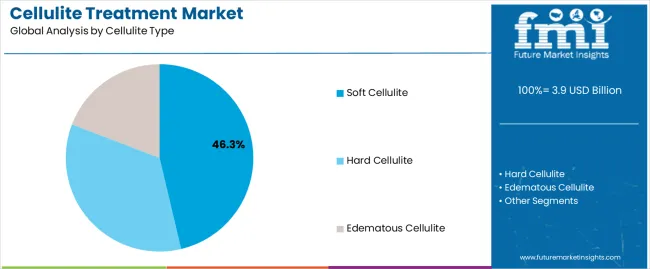

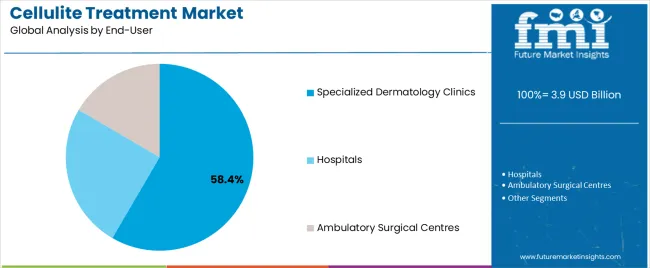

The market is segmented by Treatment Procedure, Cellulite Type, and End-User and region. By Treatment Procedure, the market is divided into Non-Invasive Cellulite Treatment, Minimally Invasive Cellulite Treatment, and Topical Cellulite Treatment. In terms of Cellulite Type, the market is classified into Soft Cellulite, Hard Cellulite, and Edematous Cellulite. Based on End-User, the market is segmented into Specialized Dermatology Clinics, Hospitals, and Ambulatory Surgical Centres. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The non-invasive cellulite treatment segment, accounting for 52.70% of the treatment procedure category, is leading due to its ability to deliver visible results without surgical intervention. Growth has been driven by rising patient preference for safe, pain-free, and quick recovery treatments. Advancements in laser, radiofrequency, and ultrasound technologies have enhanced treatment precision and long-term efficacy.

Clinics and dermatologists are increasingly adopting these systems due to reduced procedural risk and operational efficiency. The segment has also benefited from regulatory clearances and wider commercial availability of FDA-approved devices.

Marketing efforts emphasizing non-surgical body contouring have increased consumer confidence With continuous R&D investment and growing adoption in aesthetic centers, the non-invasive treatment category is expected to maintain its dominant share and expand further as awareness and affordability improve globally.

The soft cellulite segment, representing 46.30% of the cellulite type category, has remained dominant due to its high prevalence and responsiveness to modern treatment modalities. It is typically associated with skin laxity and localized fat accumulation, making it highly treatable through energy-based and topical therapies.

Increased availability of customized treatment plans targeting this cellulite form has enhanced clinical outcomes and patient satisfaction. The segment’s growth has also been supported by preventive care trends and early intervention approaches among younger demographics.

Rising consumer focus on wellness and body aesthetics has further reinforced adoption Technological innovations in non-invasive devices and topical formulations continue to optimize results, ensuring the soft cellulite category retains its leading position within the global cellulite treatment market.

The specialized dermatology clinics segment, holding 58.40% of the end-user category, has emerged as the leading contributor owing to its advanced infrastructure, expert clinical supervision, and broad access to next-generation treatment technologies. Patients prefer these clinics for their expertise, precision diagnostics, and access to tailored therapy protocols.

The growing number of certified dermatologists and aesthetic specialists has enhanced procedural credibility, fostering greater patient trust and retention. Clinics are increasingly partnering with equipment manufacturers for technology upgrades, training, and service standardization.

Competitive pricing, combined with flexible treatment packages, has made specialized clinics accessible to a wider consumer base Continued investment in facility expansion and innovation-driven care models is expected to sustain leadership, ensuring specialized dermatology clinics remain the cornerstone of cellulite treatment service delivery worldwide.

With an emphasis on the anticipated advancements in the cellulite treatment market, this part offers a thorough study of the sector during the previous five years. The market's historical CAGR has been a strong 8.4%, and it is becoming increasingly limited. Up to 2035, the industry is expected to grow persistently at a 7.2% CAGR.

| Attributes | Details |

|---|---|

| Cellulite Treatment Market Historical CAGR for | 8.4% |

Cellulite treatment options are expensive and ineffective, making reaching a wider consumer base difficult, particularly in emerging markets. Some treatments have short-term effects or no discernible effect, causing consumer distrust and limiting the cellulite treatment market expansion.

Critical aspects that are anticipated to impact the demand for cellulite treatment through 2035.

Market players are going to desire to be prudent and flexible over the anticipated period since these challenging attributes position the industry for accomplishment in subsequent decades.

Social Media Influences the Demand for Cellulite Treatments

Influencer marketing and social media platforms have become crucial in shaping consumer perceptions and driving demand for cellulite treatments. Influencers often share personal experiences, before-and-after photos, and testimonials, often with large followings, creating trust and credibility around cellulite treatment options.

The visual nature of social media makes it effective for showcasing the effectiveness of cellulite treatments as they document their treatment journeys, address common concerns, encourage exploration, and develop the demand for cellulite treatment.

Social media influencers also educate their followers about cellulite causes, treatment modalities, and expected outcomes, empowering them to make informed decisions and develop the growth of the cellulite treatment market on online platforms.

Social media influencers often collaborate with healthcare professionals to offer exclusive discounts or promotions, promoting the growth of the cellulite treatment market.

Social media's viral nature enhances influencer marketing campaigns, making them crucial for cellulite treatment providers and manufacturers, fostering brand awareness and driving market growth.

Growing Incidence of Obesity Energies Global Demand for Cellulite Treatment

The global cellulite treatment market is booming due to the increasing prevalence of obesity, which leads to the development and exacerbation of cellulite, a condition characterized by dimpled or lumpy skin texture, often affecting areas like the thighs, buttocks, and abdomen.

Obesity rates worldwide have increased, leading to increased cellulite prevalence. This correlation has increased the demand for cellulite treatment options to improve appearance and self-confidence.

Cellulite treatment options include non-invasive techniques like radiofrequency, laser therapy, and cryolipolysis, as well as invasive procedures like liposuction and surgical cellulite removal, targeting underlying factors to reduce visible signs and improve skin texture, developing demand for cellulite treatments.

The obesity epidemic and cellulite treatment market are thriving due to increased body positivity and wellness. Providers offer holistic treatments that combine diet, exercise, and lifestyle modifications for optimal results, propelling the growth of the cellulite treatment market.

The rising prevalence of obesity, changing consumer tastes, technological improvements, and social norms that support firmer, smoother skin all contribute to the ongoing expansion of the global cellulite treatment market.

Emphasis on Aesthetic Appeal and Fitness Awareness among Youth Develops Demand for Cellulite Treatment

The cellulite treatment industry is expected to grow significantly due to the increasing emphasis on aesthetic appeal and fitness awareness among youth. The development of the cellulite treatment market is driven by advancements in cosmetic technology, such as non-invasive techniques like radiofrequency, acoustic wave therapy, and laser therapy, which target underlying causes of cellulite formation without surgery or downtime.

The increasing prevalence of fitness awareness and healthy lifestyle trends has LED to a growing interest in cellulite treatment as part of a comprehensive body sculpting and wellness approach, propelling the growth of the cellulite treatment market.

The normalization of cosmetic procedures in mainstream culture is anticipated to reduce stigma and reduce barriers to seeking cellulite treatment, developing the demand for cellulite treatment in the forthcoming decade.

This section offers in-depth analyses of particular cellulite treatment market sectors. The two main topics of the research are the segment with the Non-Invasive cellulite treatment procedure and the specialized dermatology clinics segment as end user.

Through a comprehensive examination, this section attempts to provide a fuller knowledge of these segments and their relevance in the larger context of the cellulite treatment industry.

| Attributes | Details |

|---|---|

| Top Treatment Procedure | Non-Invasive Cellulite Treatment |

| Market share in 2025 | 37% |

The demand for non-invasive cellulite treatments is on-demand, registering a significant market share of 37% in 2025; the following aspects display the development of non-invasive cellulite treatments:

| Attributes | Details |

|---|---|

| Top End User | Specialized Dermatology Clinics |

| Market share in 2025 | 51% |

Specialized dermatology clinics demand progression in cellulite treatments, acquiring a noticeable 51% market share in 2025. The development of demand for cellulite treatment from specialized dermatology clinics from the following drivers:

This section anticipates examining the markets for cellulite treatment in some of the most important countries on the global stage, such as the United States, Canada, India, Germany, and the United Kingdom. Through in-depth research, explore the several aspects influencing these nations' acceptability and demand for cellulite treatment solutions.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 4.5% |

| United Kingdom | 3.62% |

| Germany | 3.77% |

| Canada | 5.0% |

| India | 8.30% |

The United States healthcare sector is developing the demand for cellulite treatments with a CAGR of 4.5% from 2025 to 2035. Here are a few of the major trends:

The demand for cellulite treatment in the United Kingdom is expected to develop at a CAGR of 3.62%. The following factors are propelling the medical industry's expanding demand for healthcare development:

The cellulite treatment industry in Germany demands advancements in cellulite operation, and the demand for cellulite treatment is predicted to extend at a CAGR of 3.77% between 2025 and 2035. Some of the primary trends in the industry are:

The demand for cellulite treatment in India is expected to register a CAGR of 8.30% from 2025 to 2035. Some of the primary trends are:

The cellulite treatment industry in Canada is expected to register a CAGR of 5.0% by 2035. Among the primary drivers are:

The global cellulite treatment industry is shaped by market players investing in research, development, and expansion. The key establishments, including pharmaceutical companies, medical device manufacturers, aesthetic clinics, and wellness centers, focus on emerging trends, consumer preferences, and technological innovations.

The companies develop advanced cellulite treatment modalities and devices, such as radiofrequency, acoustic wave therapy, laser therapy, and cryolipolysis, targeting underlying factors contributing to cellulite formation while minimizing discomfort and downtime.

The organizations also explore novel treatment approaches, such as combination therapies and personalized treatment plans, to enhance treatment outcomes and differentiate in the competitive landscape.

Marketers also use marketing and promotional strategies to raise awareness about cellulite treatment options and educate consumers about available solutions.

The market players collaborate with healthcare professionals, aesthetic experts, and opinion leaders to endorse their products and build consumer trust. Market expansion efforts involve geographical expansion, product diversification, and strategic acquisitions.

The enterprises invest in training and development programs for healthcare professionals to ensure the successful adoption and implementation of cellulite treatment technologies and procedures. Prominent market players are crucial in shaping the outlook of the global cellulite treatment industry, driving continued growth and advancement.

Recent Developments in the Cellulite Treatment Industry

The global cellulite treatment market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the cellulite treatment market is projected to reach USD 7.6 billion by 2035.

The cellulite treatment market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in cellulite treatment market are non-invasive cellulite treatment, minimally invasive cellulite treatment and topical cellulite treatment.

In terms of cellulite type, soft cellulite segment to command 46.3% share in the cellulite treatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Draining Cellulite Treatments Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA