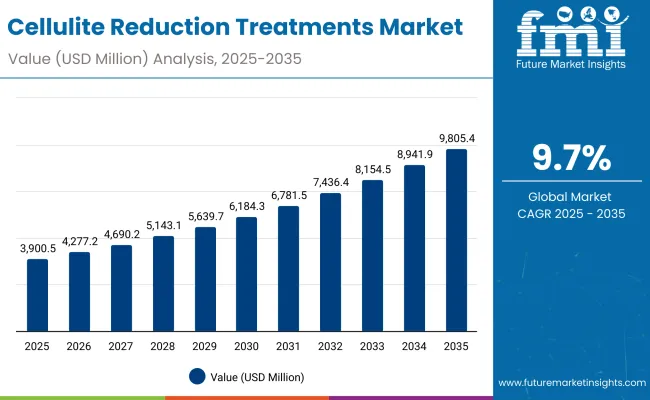

A valuation of USD 3,900.50 Million in 2025 has been projected for the Cellulite Reduction Treatments Market, with expansion expected to push the figure to USD 9,805.40 Million by 2035. Over the ten-year horizon, an absolute increase of nearly USD 5,905 Million is anticipated, reflecting a CAGR of 9.70% and more than a twofold rise in overall market value. The trajectory underscores the category’s resilience as routine-driven beauty care merges with evidence-based approaches, enabling structured long-term adoption.

Cellulite Reduction Treatments Market Key Takeaways

| Metric | Value |

|---|---|

| Cellulite Reduction Treatments Market Estimated Value in (2025E) | USD 3,900.50 Million |

| Cellulite Reduction Treatments Market Forecast Value in (2035F) | USD 9,805.40 Million |

| Forecast CAGR (2025 to 2035) | 9.70% |

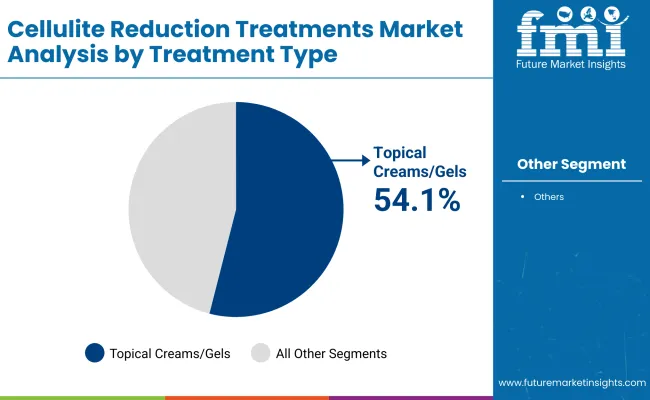

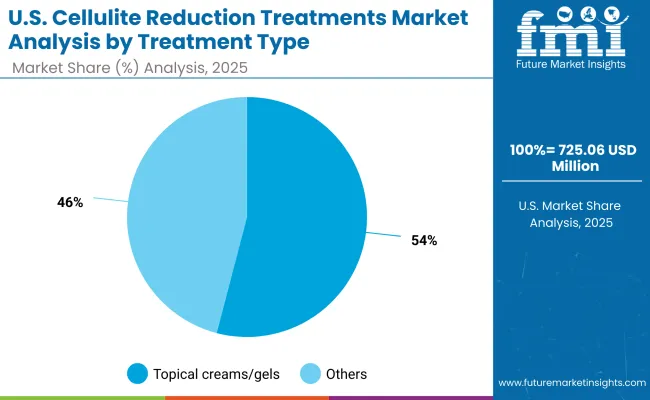

During the initial five-year period from 2025 to 2030, the market is forecast to climb from USD 3,900.50 Million to USD 6,184.30 Million, generating an additional USD 2,283.80 Million. This phase is expected to account for approximately 39% of the total decade’s growth, underpinned by rising demand for accessible at-home solutions supported by professional recommendations. Growth during this interval is projected to be led by topical creams and gels, which are estimated to contribute 54.10% of market share in 2025, owing to consistent repeat purchase behavior and high consumer acceptance.

From 2030 to 2035, the market is anticipated to accelerate further, expanding from USD 6,184.30 Million to USD 9,805.40 Million. This surge of USD 3,621.10 Million will represent about 61% of total growth, signaling faster adoption of digitally enabled channels and protocol-based regimens combining firming, toning, and complementary formats.

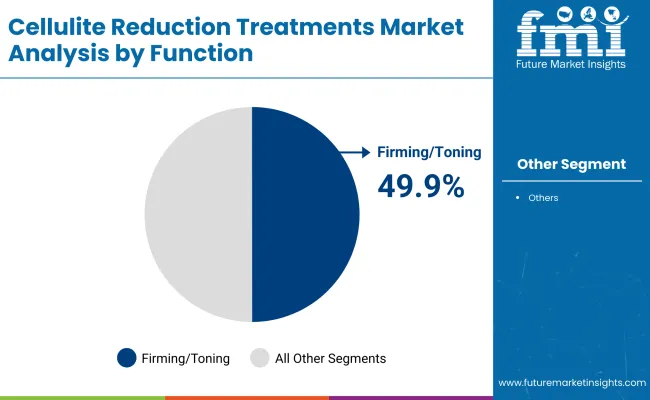

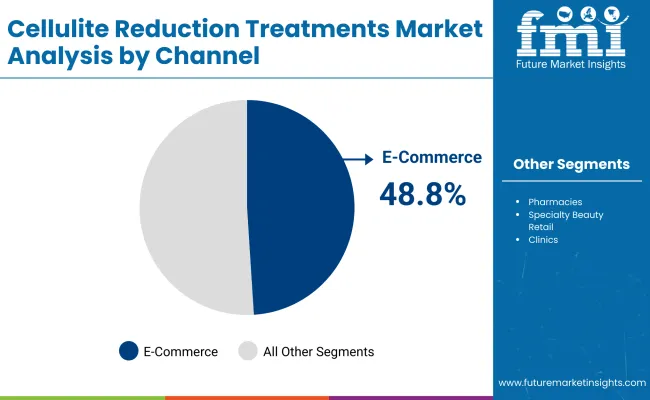

By function, firming/toning solutions are forecast to hold a 49.90% share in 2025, supported by clinical substantiation and consumer preference for visible outcomes. Meanwhile, e-commerce is expected to capture 48.80% share in 2025, with momentum set to intensify as digital discovery and social commerce increasingly drive market expansion.

From 2025 to 2035, the market is anticipated to expand strongly, with growth driven by routine-oriented personal care and rising adoption of protocol-based regimens combining topical formats and professional adjuncts. The competitive environment is expected to remain fragmented, as the leading player captures only 8.40% share in 2025, highlighting opportunities for brand differentiation.

Online channels are forecast to strengthen influence, as e-commerce already accounts for 48.80% share in 2025. Regional momentum is projected to be fastest in India and China, with double-digit CAGRs supported by expanding beauty e-commerce ecosystems and rising disposable incomes. Europe and the United States are expected to sustain steady demand, anchored by mature dermatology and pharmacy retail networks. The decade ahead is likely to be defined by innovation in formulation efficacy, digital commerce acceleration, and stronger clinical validation, positioning the category for enduring growth.

Growth in the Cellulite Reduction Treatments Market is being supported by evolving consumer behavior, technological improvements, and expanding access to digital retail channels. Rising awareness of body aesthetics and skin health has been reinforced by social media and influencer-driven education, creating sustained demand for visible results.

Clinical validation of firming and toning benefits has been emphasized, strengthening trust in formulations and adjunctive protocols. Expanding e-commerce platforms have accelerated product discovery and routine adoption, while bundled regimens supported by dermatology and aesthetic clinics have been promoted to enhance adherence.

Emerging markets such as China and India are witnessing rapid uptake due to rising disposable incomes and wider access to specialized beauty channels. Demand is also being influenced by innovations in plant extract and caffeine-based formulations, aligning with consumer preference for natural and evidence-backed solutions. As digital commerce matures and clinic-supported offerings become standardized, the category is expected to sustain long-term growth momentum.

The Cellulite Reduction Treatments Market has been segmented by treatment type, function, and channel, each shaping distinct growth pathways. By treatment type, adoption has been driven by topical applications, which continue to dominate due to accessibility and affordability. By function, the market reflects balanced demand, though firming and toning benefits are increasingly emphasized for visible results.

By channel, digital platforms have emerged as critical growth enablers, with e-commerce steadily gaining ground against traditional outlets. Each of these segments is expected to evolve under the influence of clinical validation, consumer preference for convenience, and the growing role of digital discovery in beauty and personal care.

| Treatment Type | Market Value Share, 2025 |

|---|---|

| Topical creams/gels | 54.1% |

| Others | 45.9% |

Topical creams and gels are projected to command 54.1% share in 2025, valued at USD 2,127.3 Million, while others are expected to contribute 45.9% at USD 1,789.73 Million. This dominance is anticipated due to their affordability, accessibility, and integration into daily skincare routines. Their role is expected to be reinforced by strong brand loyalty and consistent consumer demand.

Enhanced formulations with clinically supported actives are forecasted to strengthen efficacy perceptions and long-term usage. With repeat purchase cycles supporting revenue stability, this segment is expected to remain the backbone of the category. While the others category will provide meaningful contribution, consumer adoption is expected to be concentrated on topical-led formats, ensuring their continued lead in the treatment landscape.

| Function | Market Value Share, 2025 |

|---|---|

| Firming/toning | 49.9% |

| Others | 50.1% |

Firming and toning are estimated to hold 49.9% share in 2025 at USD 1,930.3 Million, while others are projected to account for 50.1% at USD 1,952.22 Million. Despite near parity, the firming and toning category is expected to emerge as a core driver of market expansion, supported by consumer interest in visibly improved skin elasticity and texture.

Adoption is anticipated to strengthen as clinical evidence and targeted messaging increase trust in outcomes. The category is expected to gain further traction through protocol-based routines that combine firming benefits with hydration or anti-inflammatory effects. Meanwhile, the others category is projected to deliver stable growth, broadening market scope through diversified benefits, though its appeal is expected to be more fragmented compared to firming-led solutions.

| Channel | Market Value Share, 2025 |

|---|---|

| E-commerce | 48.8% |

| Others | 51.2% |

E-commerce is anticipated to represent 48.8% of value in 2025 at USD 1,890.9 Million, while others are projected to contribute 51.2% at USD 1,995.16 Million. Digital platforms are expected to shape consumer behavior through convenience, personalization, and influencer-driven campaigns. Online sales are projected to grow as mobile penetration, subscription services, and social commerce accelerate engagement.

Greater reliance on virtual consultations, authentic reviews, and clinical content is forecasted to enhance trust in digital-first purchases. While pharmacies and specialty stores within the others category will continue to hold importance, their share is expected to gradually decline as consumers increasingly prefer flexible, digital-first purchase pathways. This dynamic positions e-commerce as the structural growth engine of the market over the coming decade.

Complex consumer expectations, heightened scrutiny of clinical efficacy, and digital transformation pressures are reshaping the Cellulite Reduction Treatments Market, where adoption is being influenced as much by regulatory vigilance and channel evolution as by functional innovation and consumer willingness to experiment.

Convergence of Clinical Validation and Consumer Marketing A critical driver is expected to be the merging of clinical validation with consumer-facing communication. Treatments supported by dermatologist-led trials, imaging-based outcomes, or peer-reviewed endorsements are projected to command greater credibility in an environment where trust remains decisive.

This validation is anticipated to not only reassure consumers but also encourage repeat adoption by aligning aesthetic aspirations with scientific substantiation. Strategic messaging that translates complex clinical data into digestible consumer narratives is expected to bridge gaps in understanding and sustain differentiation. Over the next decade, growth momentum is likely to favor brands that can standardize outcome evidence and pair it with accessible digital storytelling, positioning clinical rigor as a marketing asset rather than a regulatory obligation.

Fragmentation of Standards Across Global Markets A major restraint is expected to stem from fragmented regulatory and marketing standards across geographies. Requirements for labeling, permissible claims, and ingredient approvals vary significantly between the United States, Europe, and Asia, complicating cross-border scalability. This lack of uniformity is anticipated to slow multinational expansion and elevate compliance costs.

While consumers in some markets prioritize natural actives, others emphasize clinically proven synthetic compounds, further challenging global portfolio harmonization. The absence of standardized benchmarks for outcome measurement also risks inconsistent consumer experiences, potentially eroding confidence. Unless harmonized frameworks or self-regulated industry standards emerge, the category is projected to face slower international rollout, with fragmentation acting as a barrier to economies of scale and seamless global branding.

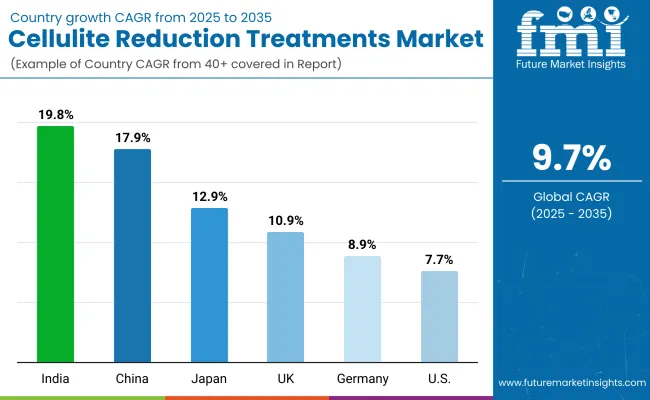

| Country | CAGR |

|---|---|

| China | 17.9% |

| USA | 7.7% |

| India | 19.8% |

| UK | 10.9% |

| Germany | 8.9% |

| Japan | 12.9% |

The global Cellulite Reduction Treatments Market is expected to display varied growth momentum across countries, shaped by healthcare access, beauty retail maturity, and consumer readiness for evidence-based body treatments. India is projected to emerge as the fastest-growing market with a CAGR of 19.8%, supported by rapid digital commerce penetration, expanding middle-class incomes, and increasing acceptance of advanced skincare routines.

China, with a CAGR of 17.9%, is anticipated to follow closely, as digital-first ecosystems and clinic-led beauty protocols reinforce adoption. Japan is expected to grow at 12.9%, benefiting from its established consumer culture around routine-driven beauty care and integration of device-friendly solutions.

In Europe, moderate yet steady expansion is anticipated, led by the UK at 10.9%, Germany at 8.9%, and the broader European market at 8.3%. Growth in these regions is expected to be underpinned by pharmacy and specialty retail networks, combined with regulatory emphasis on product safety and transparency.

The USA, while showing a more mature profile at 7.7% CAGR, is projected to sustain demand through premiumization, oMillioni-channel dermatology, and steady clinical endorsements. This geographic divergence reflects how cultural preferences, digital sophistication, and clinical frameworks are expected to determine the pace and direction of cellulite reduction adoption worldwide.

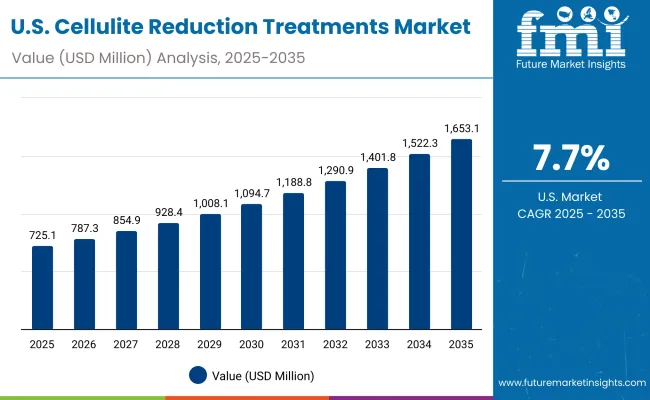

| Year | USA Cellulite Reduction Treatments Market (USD Million) |

|---|---|

| 2025 | 725.06 |

| 2026 | 787.34 |

| 2027 | 854.98 |

| 2028 | 928.43 |

| 2029 | 1,008.19 |

| 2030 | 1,094.79 |

| 2031 | 1,188.84 |

| 2032 | 1,290.97 |

| 2033 | 1,401.87 |

| 2034 | 1,522.30 |

| 2035 | 1,653.08 |

The United States Cellulite Reduction Treatments Market is projected to grow at a CAGR of 8.9% from 2025 to 2035, expanding from USD 725.06 Million in 2025 to USD 1,653.08 Million by 2035. Growth is expected to be reinforced by the rising influence of e-commerce platforms, combined with clinic-led endorsements that enhance credibility and long-term adherence.

Premiumization trends are forecast to encourage higher per capita spending, as topical creams and gels remain dominant within treatment preferences. Integration of clinical validation with consumer-facing retail strategies is anticipated to sustain adoption, particularly as demand shifts toward evidence-backed, protocol-based regimens. Digital-first engagement, subscription models, and influencer-led marketing are projected to further accelerate uptake.

The United Kingdom Cellulite Reduction Treatments Market is projected to grow at a CAGR of 10.9% between 2025 and 2035, supported by steady consumer engagement with premium skincare and established retail pharmacy networks. Growth is expected to be shaped by strong demand for clinically validated topical regimens and digital-first purchase behavior. The shift toward evidence-based messaging in beauty care is anticipated to strengthen trust, while the expansion of subscription-based online retail models is likely to reinforce adherence. Regulatory clarity on product labeling and claims is projected to maintain consumer confidence.

The India Cellulite Reduction Treatments Market is forecast to expand at a CAGR of 19.8% from 2025 to 2035, making it the fastest-growing country market globally. Growth is anticipated to be driven by rapid e-commerce penetration, rising disposable incomes, and increased urban adoption of advanced body-care routines.

The integration of locally relevant ingredients with international formulations is expected to enhance resonance among consumers. Social commerce platforms are projected to accelerate awareness and conversion, particularly in tier-II and tier-III cities. Clinic-based partnerships are anticipated to expand reach, reinforcing evidence-backed adoption and aspirational purchasing.

The China Cellulite Reduction Treatments Market is projected to grow at a CAGR of 17.9% during 2025 to 2035, driven by strong digital ecosystems and expanding aesthetic clinic networks. The country’s advanced e-commerce infrastructure is anticipated to play a central role in shaping awareness and sustained adoption.

Clinical protocols embedded within beauty ecosystems are expected to reinforce trust, with integration of advanced actives likely to secure wider adoption. The convergence of social media, live commerce, and dermatologist-led endorsements is forecast to maintain high engagement levels. International and domestic brands are expected to compete through differentiated positioning and localized campaigns.

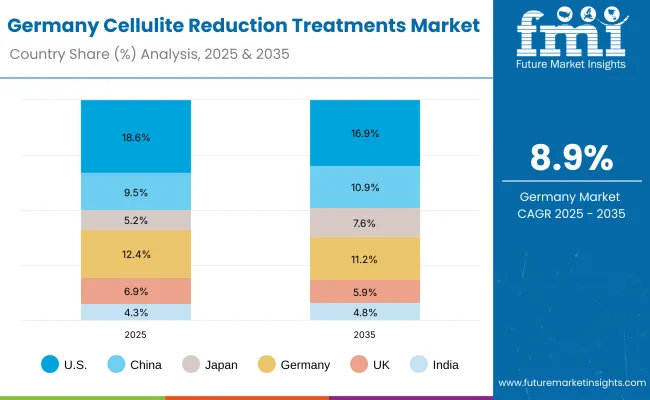

| Countries | 2025 |

|---|---|

| USA | 18.6% |

| China | 9.5% |

| Japan | 5.2% |

| Germany | 12.4% |

| UK | 6.9% |

| India | 4.3% |

| Countries | 2035 |

|---|---|

| USA | 16.9% |

| China | 10.9% |

| Japan | 7.6% |

| Germany | 11.2% |

| UK | 5.9% |

| India | 4.8% |

The Germany Cellulite Reduction Treatments Market is forecast to register a CAGR of 8.9% between 2025 and 2035, anchored by the strength of pharmacy channels and consumer preference for safety-certified formulations. Growth is expected to be steady, supported by regulatory alignment with EU-wide standards and rising interest in dermo-cosmetic solutions.

A growing focus on clinically endorsed products is anticipated to encourage long-term adoption, while e-commerce is projected to gradually expand its role alongside established specialty retailers. The market outlook is expected to be influenced by conservative consumer behavior, favoring transparency, efficacy, and incremental innovation.

| USA by Treatment Type | Market Value Share, 2025 |

|---|---|

| Topical creams/gels | 54.1% |

| Others | 45.9% |

The United States Cellulite Reduction Treatments Market is projected at USD 725.06 Million in 2025. Topical creams and gels contribute 54.1% with USD 392.4 Million, while other formats account for 45.9% with USD 332.69 Million. This clear topical dominance reflects consumer preference for accessible, routine-friendly products supported by strong brand trust and ease of integration into daily care.

Formulation innovation with clinically validated actives such as caffeine and plant extracts is expected to reinforce topical leadership. Unlike device-based or procedural formats, topical solutions offer recurring revenue potential through high-frequency purchases, ensuring sustained category momentum.

Others, although significant, are projected to capture secondary adoption, often linked to adjunctive or experimental use cases. Over the coming decade, competitive positioning in the USA market is expected to be defined by how effectively brands align evidence-based efficacy with consumer convenience and digital-first engagement.

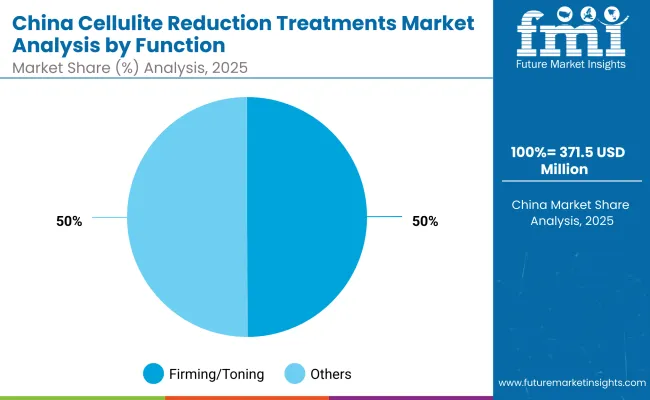

| China by Function | Market Value Share, 2025 |

|---|---|

| Firming/toning | 49.9% |

| Others | 50.1% |

The China Cellulite Reduction Treatments Market is projected at USD 371.53 Million in 2025. Firming and toning solutions contribute 49.9% with USD 185.6 Million, while other functions hold 50.1% with USD 185.95 Million, indicating a near-balanced functional split. The close distribution highlights a market where both visible toning outcomes and broader skin-health benefits are valued equally by consumers.

Firming and toning products are expected to gain traction due to strong alignment with aspirations for body confidence and smoothness, supported by clinic-led education and dermatologist-backed messaging. The others category, incorporating hydration, smoothing, and complementary benefits, is anticipated to remain critical as multi-benefit regimens become more common.

With China’s strong digital commerce ecosystem, both categories are forecast to expand rapidly, but firming-led solutions are expected to achieve greater brand loyalty through outcome-oriented positioning.

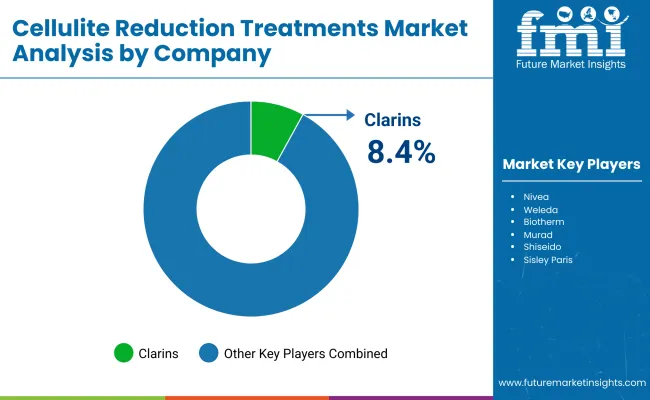

| Company | Global Value Share 2025 |

|---|---|

| Clarins | 8.4% |

| Others | 91.6% |

The Cellulite Reduction Treatments Market is moderately fragmented, with premium beauty houses, dermo-cosmetic specialists, and clinic-affiliated brands competing across consumer and professional channels. Global beauty leaders such as Clarins, Shiseido, and Nivea are understood to hold meaningful shares, aided by extensive retail footprints, consistent brand equity, and clinically communicated claims.

Their strategies are expected to emphasize evidence-backed formulations, regimen bundling, and oMillionichannel activation that links e-commerce with pharmacy and specialty beauty retail.Established mid-tier players-including Murad, Dermalogica, Sisley Paris, Biotherm, Mustela, Palmer’s, and Weleda-are projected to scale through targeted benefits (firming, smoothing) and dermatologist-endorsed education.

Portfolio refreshes with caffeine and plant-extract actives, plus subscription and loyalty mechanics, are anticipated to lift repeat purchase.Clinic-adjacent propositions and niche brands are expected to expand through protocol integration, where at-home topicals are paired with in-clinic guidance or device-assisted regimens.

Differentiation is shifting from single-product claims toward program design-measurable outcomes, safe-use guidance, and digital coaching-supported by authentic reviews and creator education.Competitive intensity is likely to increase as Asia-focused challengers deploy social commerce and localized campaigns. Over the decade, winners are expected to be those that couple credible clinical evidence with convenient routines and seamless online replenishment.

Key Developments in Cellulite Reduction Treatments Market

| Item | Value |

|---|---|

| Market Size (2025) | USD 3,900.50 Million |

| Market Size (2035) | USD 9,805.40 Million |

| Growth (2025 to 2035) | USD 5,904.90 Million absolute increase |

| Forecast CAGR (2025 to 2035) | 9.70% |

| Treatment Type | Topical creams/gels; Others |

| Treatment Type Leader (2025) | Topical creams/gels - 54.10% share (USD 2,127.30 Million ) |

| Function | Firming/toning; Others |

| Function Split (2025) | Firming/toning - 49.90% (USD 1,930.30 Million ); Others - 50.10% (USD 1,952.22 Million ) |

| Channel | E-commerce; Others (pharmacies, specialty beauty retail, clinics) |

| Channel Split (2025) | E-commerce - 48.80% (USD 1,890.90 Million ); Others - 51.20% (USD 1,995.16 Million ) |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Africa |

| Key Companies Profiled | Clarins; Nivea; Weleda; Biotherm; Murad; Shiseido; Sisley Paris; Dermalogica; Mustela; Palmer’s |

| Competitive Snapshot (2025) | Market leader: Cl arins - 8.40% global value share; Others - 91.60% |

| USA Market Trajectory | USD 725.06 Million (2025) → USD 1,653.08 Million (2035) |

| China 2025 Functional Split | Firming/toning - 49.90% (USD 185.60 Million ); Others - 50.10% (USD 185.95 Million ) |

| Additional Attributes | Dollar sales by treatment type, function, and channel; protocol-based adoption with clinic support; digital commerce acceleration and subscription replenishment; evidence-backed formulations (e.g., caffeine, plant extracts); fragmented competition with premiumization; regional growth led by India (19.80% CAGR) and China (17.90% CAGR). |

The global Cellulite Reduction Treatments Market is estimated to be valued at USD 3,900.50 Million in 2025.

The market size for the Cellulite Reduction Treatments Market is projected to reach USD 9,805.40 Million by 2035.

The Cellulite Reduction Treatments Market is expected to expand at a CAGR of 9.70% between 2025 and 2035.

The key treatment types in the Cellulite Reduction Treatments Market are topical creams/gels and other formats such as oils, serums, and device-linked adjuncts.

In terms of treatment type, topical creams and gels are expected to command 54.10% share of the Cellulite Reduction Treatments Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulite Treatment Market Size and Share Forecast Outlook 2025 to 2035

Draining Cellulite Treatments Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Sodium Reduction Ingredient Business

Methane Reduction Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Kickback Reduction Tool Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Pathogen Reduction Systems Market

Salt Content Reduction Ingredients Market Size & Trends 2035

Non-Surgical Fat Reduction Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Enzymatic Acrylamide-Reduction Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Selective Catalytic Reduction Systems Market Growth – Trends & Forecast 2025 to 2035

The Dyslexia Treatments Market Is Segmented by Drug Type and Distribution Channel from 2025 to 2035

Dark Circle Treatments Market Size and Share Forecast Outlook 2025 to 2035

Foot Fungus Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Zygomycosis Treatments Market

Ingrown Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Acne Scarring Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Conditioning Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA