Global salt content reduction ingredients market is predicted to be substantially growing from 2025 to 2035 due to the increasing awareness among people about the hazards of high sodium intake, and initiatives on behalf of governments to cut salt content from food products.

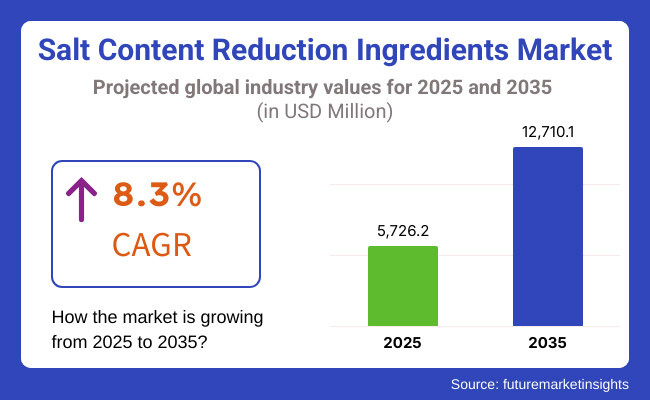

In 2025, the market is estimated at USD 5,726.2 million, further reaching to USD 12,710.1 million by 2035 reflecting a CAGR of 8.3% during the same period. This market is anticipated to flourish due to the advancements in food science, increasing requirement of new salt substitutes, and a growing demand for clean-label and functional food products.

Increasing awareness regarding hypertension, cardiovascular diseases and obesity, due to the high intake of salt consumption urges consumers to seek low-sodium food components. Food manufacturers are getting creative, using mineral salts, amino acids and yeast extracts to formulate fresh versions that maintain flavour while reducing sodium usage. Sodium limits are becoming stringent across the globe, allowing for great growth opportunities in the market.

Rising incidences of high blood pressure, heart disease, and obesity among the population is driving demand for low-salt containing foods. This trend gives companies a chance to create products with reduced salt. To keep the taste and quality of these low-sodium options, manufacturers are turning to alternatives like potassium chloride, amino acids, yeast extracts, and mineral salts to replace regular salt.

Technologies such as microencapsulation and flavour modulation enhance salt-reduction solutions by allowing salt levels to be lowered without compromising taste. Strict sodium reduction regulations from organizations like the USA Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) are anticipated to drive the growth of the global market for sodium reduction ingredients.

With growing awareness about healthy eating and government limits on salt in processed foods, the market for ingredients that reduce salt is poised to expand. Innovations in food science, such as microencapsulation and taste modulation, are enhancing the effectiveness of salt substitutes. Additionally, the increasing demand for foods labelled as clean and health-focused is driving manufacturers to explore natural and plant-based alternatives, contributing to the market's growth.

The North American market for salt-reducing ingredients is expanding quickly due to rising awareness of sodium's health risks and strict regulations. The USA Food and Drug Administration (FDA) has set voluntary goals to cut sodium, leading food companies to develop healthier products. With more people facing high blood pressure and heart issues, demand for low-sodium ingredients has increased.

To keep flavor while lowering sodium, companies are turning to technologies like potassium-chloride mixes and umami-enhancing ingredients. There's also a rising interest in clean-label and functional foods. This effort to reduce sodium in processed foods is boosting the market, with Canada taking the lead by enforcing similar government measures.

In Europe, there's a high demand for ingredients that help lower salt in foods because of strict government regulations aimed at reducing salt consumption. Countries like the UK, Germany, and France have put in place strong measures, including the European Union's Salt Reduction Framework, which requires food manufacturers to cut down on salt in processed foods. People in Europe who are health-conscious prefer foods with reduced salt and natural ingredients.

This has led companies in the bakery, dairy, and meat sectors to change their product formulations by using alternatives like mineral salts, yeast extracts, and amino acids to comply with these rules. Furthermore, the rising popularity of plant-based and health-focused foods is encouraging new developments in salt reduction methods. As a result, the salt reduction market in Europe is expanding more rapidly than in other regions, benefiting from supportive regulations and increased consumer demand.

The Asia-Pacific region is expected to see rapid growth in the market for ingredients that reduce salt. This growth is driven by increasing health awareness and shifts in dietary habits. Countries such as China, Japan, and India are dealing with high rates of hypertension and heart disease, which has led to a rising interest in low-sodium foods. Efforts like China's Healthy China 2030 and Japan's sodium reduction initiatives are prompting food manufacturers to explore innovative salt alternatives.

Additionally, urbanization and an expanding middle class are increasing demand in the processed food sector. New technologies in flavor modulation and umami-enhancing ingredients allow manufacturers to lower sodium content without compromising taste. As regulations tighten and consumers become more health-conscious, the Asia-Pacific region is poised to become a leading market for salt-reduction ingredients.

The market for ingredients that reduce salt in foods is steadily growing in regions like Latin America, the Middle East, and Africa. This growth is driven by greater health awareness and the introduction of new regulations. In Latin America, Brazil and Mexico are taking steps to combat obesity and high blood pressure by promoting lower salt consumption.

In the Middle East, where high-salt diets are common, there is a rising demand for foods with reduced salt content, particularly in Gulf Cooperation Council (GCC) countries. Africa's market is still developing, but as more people move to cities and change their eating habits, the demand for low-sodium options is expected to increase. While regulations vary across regions, major global food companies are at the forefront of adopting salt-reduction ingredients, setting the stage for ongoing growth in this sector.

Challenges

Taste and Consumer Acceptance

One of the major concerns for manufacturers offering salt replacement ingredients in the salt reduction ingredients market is attributable to salt induced content increase. Flavour enhancement, texture, and preservation make sodium one of the hardest nutrients to reduce without sacrificing product quality. Another popular salt substitute, potassium chloride, is known to have a bitter or metallic aftertaste and is not generally favourable with consumers.

Manufacturers, therefore, would need to implement a more complex strategy, leveraging taste modulation technologies and ingredient combinations to the taste of salt without sacrificing their sensory experience. Building these solutions at no extra cost and in a scalable way is a massive pain point for food producers, particularly in price-sensitive markets.

High Reformulation Costs and Regulatory Compliance

Food manufacturers spend considerable time and money re-developing food products to conform to sodium reduction recommendations. Alternative ingredient integration is tricky since they must replicate the sensory profile of their analogues, kept in mind the fact that many processed food formulations depend heavily on salt for flavour-boosting and preservation.

Salt substitutes are effective salt replacements but are expensive to produce and can require (R&D) investments for the necessary new food processing technologies, potentially making the end products less profitable due to the higher price. In addition, the requirements for sodium reduction are not homogenous across regions, forcing companies to wallow through an array of regulatory regimes.

For instance, the European Union sets a separate target for sodium than the USA FDA, making it difficult for global manufacturers to standardize their products. For companies operating in the space, ensuring compliance while maintaining product integrity and affordability represents a substantial financial and logistical burden.

Opportunities

Advancements in Flavour Modulation and Clean-Label Solutions

Technological innovations such as flavours modulation and clean-label ingredients present the most lucrative opportunities. These advanced techniques have more empowered manufacturers with the right tools to design salt substitutes that may taste, act, and perform like sodium once more but without compromising on flavours. Microencapsulation, umami enhancers and bitterness blockers are making individual manufacturers sensory taste and texture similar to salt.

In response to change in consumer preferences towards clean-label and natural food products, demand for plant-based and minimally processed food alternatives are emerging as the norm. Yeast extracts, amino acids and minerals extracted from seaweed are familiar, even fashionable, as a proven and natural method of reducing salt.

Moreover, Manufacturers who are investing in R & D to improve the taste, texture, and overall acceptability of low-sodium formulations would capture a larger market share over the coming years.

Rising Demand for Low-Sodium Diets and Functional Foods

Sodium intake has decreased significantly in the past decade due to growing awareness of its various health effects such as, hypertension, cardiovascular diseases and obesity with an increased salt reduction ingredients market acquire consumers. Excessive sodium, according to National Institute of Health (NIH), can lead to high blood pressure, heart attacks and strokes, resulting in governments and health organizations worldwide rolling out public awareness campaigns to raise awareness and push for sodium reduction, and thus increasing the demand for sodium reduced food products.

Another major growth area is the growing functional food market including heart-healthy and diet-specific foods. There is a growing search among consumers for products that have health benefits, including low-sodium snacks, dairy alternatives, and meat substitutes. This shift in dietary preferences is encouraging food manufacturers to develop innovative low-sodium offerings across various product categories, making sodium reduction a crucial aspect of future food industry trends and product development strategies.

The salt content reduction ingredients market has witnessed significant growth from 2020 to 2024, driven by increasing consumer awareness towards health hazards due to excessive salt consumption. These include regulatory pressure from health agencies such as the World Health Organization (WHO) and Food and Drug Administration (FDA) to lower sodium across many products (food manufacturers are encouraged to reformulate foods to lower sodium content).

Furthermore, the rising prevalence of lifestyle ailments like hypertension and cardiovascular diseases had been a primary driver for the search of alternative contents which can not only enhance taste, but at the same time, minimize sodium in body.

Looking ahead to the 2025 to 2035 period, the market indicates a transformative flow, as new and innovative technologies such as AI-based food formulation, bio-based sodium substitutes, and advancements in taste-modulating systems potentially emerge. A stricter regulatory regime along with a deeper knowledge of ingredient science will pave the way for this industry to evolve towards a future landscape in which consumer taste priorities reflect health preferences.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments set voluntary sodium reduction targets and mandatory labeling. |

| Technological Advancements | Use of potassium chloride and flavor enhancers to maintain taste. |

| Industry-Specific Demand | Processed foods, snacks, and fast food reformulation. |

| Sustainability & Circular Economy | Initial exploration of sustainable salt alternatives. |

| Production & Supply Chain | Reliance on standard supply chains and ingredient procurement. |

| Market Growth Drivers | Health awareness, government initiatives, and rising demand for low-sodium diets. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter global policies, mandatory sodium limits, and front-of-pack labeling requirements. |

| Technological Advancements | AI-driven food formulation, nanotechnology for targeted flavor release, and fermentation-derived sodium substitutes. |

| Industry-Specific Demand | Growth into plant based foods, alternative proteins, and personalized nutrition. |

| Sustainability & Circular Economy | Increased focus on bio-based and upcycled sodium substitutes, reducing carbon footprint. |

| Production & Supply Chain | Demand forecasting driven by AI, localized production, and precision fermentation. |

| Market Growth Drivers | Innovation in clean-label solutions, consumer preference and regulations for functional foods. |

The USA salt content reducing ingredients market is gradually growing as consumer preferences shift towards healthier meals and regulation to minimize sodium consumption. The Food and Drug Administration (FDA) has established pasta sodium reduction goals, which have pushed food producers to use other types of seasoning such as potassium chloride, seaweed extracts, and umami enhancers.

Additionally, the increasing population who want to live healthily and the growing number of cardiac ailments also spur the growth of the market. Large food manufacturers and fast-feeder brands reformulate products for consumer tastes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

The UK market for salt reduction ingredients is expanding due to strict government regulations and public health campaigns such as the Public Health England (PHE) sodium reduction initiative. The food and beverage industry is reformulating its products to meet tough targets set to reduce health risks associated with sodium.

Such innovations in potassium-based salt replacers and natural flavor enhancers are now being explored. Growing consumer demand for clean-label and low-sodium products is yet another driving factor for manufacturers to resort to natural sources for alternatives. The healthy dietary habits are quite successful as the closer work of the regulatory authorities with the food production industry puts behind consumer concerns.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.1% |

The European Union's market for salt reduction ingredients is expanding as regulatory bodies enforce sodium intake reduction policies under the European Food Safety Authority (EFSA). Countries including Germany, France, and the Netherlands are taking the lead on reformulating processed foods, driving demand for alternatives like mineral salts, yeast extracts, and plant-derived flavor enhancers.

This growth is fueled by increasing health awareness and consumer preferences for organic and functional foods. Also, food manufacturers are pouring resources into R&D to keep taste profiles while lowering sodium levels.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.3% |

Japan’s market for salt reduction ingredients is growing due to increasing government efforts to lower sodium intake and combat hypertension. Such measures led to adoption of amino acid-based flavor enhancers, fermented seasonings and other alternatives, spurred on by dietary guidelines from the Ministry of Health, Labour and Welfare advocating reduced salt consumption.

Market growth is also supported by increasingly popular umami-rich, low-sodium solutions in traditional cuisine. As well, interest in functional food ingredients that preserve taste while reducing sodium and other food groups is garnering interest from consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

South Korea is experiencing strong growth in the salt reduction ingredients market, driven by increased government regulations and public health campaigns targeting high sodium intake in traditional Korean cuisine. The Ministry of Food and Drug Safety (MFDS) has initiated programs encouraging food manufacturers to implement lower-sodium formulations.

Fermentation-based flavor enhancers, potassium chloride substitutes, and seaweed-derived solutions have attracted a lot of investments. Clean-label salt-reduction alternatives are also gaining traction as consumers demand healthier, more functional foods.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.6% |

Yeast Extracts Dominate Due to Their Clean-Label Appeal

Yeast extracts are often used in salt reduction processes because they can increase the umami taste at lower sodium levels. These naturals contain glutamic acid, which creates a savory depth akin to MSG, but with a clean-label edge. They are widely consumed, leading to the increased demand for yeast extracts by the consumers, and have market growth potential due to the rising consumer preferences for natural food enhancers, particularly in processed foods and ready-to-eat meals.

The growing regulation to lower sodium in food, especially in North America and Europe, has encouraged food manufacturers to adopt yeast-based solutions. The ingredient is particularly popular in soups, sauces and snack foods, where flavor intensity is key. The salt reduction landscape is set to shift, with yeast extracts being one of the most promising solutions in the marketplace as the clean-label movement continues to open up in favour of salt reduction.

Mineral Salts Offer a Functional Alternative to Sodium Chloride

Calcium chloride (CaCl₂) and potassium chloride (KCl) are examples of mineral salts used broadly as sodium substitutes in processed foods. They are widely used as functional alternatives to table salt, providing improved taste, texture, and preservation profiles. Potassium chloride is a highly used substitute because it preserves salty notes while reducing sodium levels.

However, it often possesses an unpleasant metallic or bitter aftertaste that necessitates flavor masking or blending with other flavor enhancers such as yeast extracts or hydrolysed vegetable proteins. The increasing awareness of hypertension and cardiovascular diseases, along with the regulatory initiatives taken for example WHO sodium reduction guidelines worldwide, have fueled the use of mineral salts in food reformulation strategies.

Meat and Poultry Lead Due to Flavor and Preservation Needs

Decreasing sodium levels in meat and poultry goods is one of the (key) areas of focus (for manufactures) because sodium aids in flavor enhancement, preservation, and moisture retention. Low-sodium processed meats are in demand due to growing consumer health consciousness and regulatory mandates aimed at high sodium content. Yeast extracts and mineral salts are commonly used to preserve umami richness with reduced sodium content.

Hydrolyzed vegetable proteins (HVP) and nucleotide-rich ingredients, such as disodium inosinate, also provide a punch of meaty flavor without sacrificing taste. North American and European markets lead in such formulation trends, spurred by stringent sodium reduction policies. This salt reduction strategy is being used in the plant-based meat alternatives segment as well as the popularity of plant-based meat alternatives grow.

Sauces and Seasonings Drive Innovation in Sodium Reduction

Sauces and seasonings are one of the top food categories contributing to sodium intake, so they are a treatment target for reformulation. Demand for low-sodium condiments has boomed, fueled by consumer health consciousness and government mandates. Yeast extracts, glutamates and mineral salts are often used to conserve flavours’ depth and complexity while curtailing sodium.

Potassium chloride can be used at the table as a direct salt substitute, and peptides-based compounds adjust taste perception. And global brands are getting busy innovating in this space reimagining everything from soy sauce to dressings and spice blends for sodium-conscious shoppers. This trend is particularly strong in Asia-Pacific and North America, where flavor intensive cuisines rely on time-consuming sodium-reduction strategies that cannot compromise traditional flavours.

The salt content reduction ingredients market is expected to grow at a double-digit growth due to the increasing concern about health due to the presence of excess sodium content in the food served which is driving consumers towards the reduction of salt content in food, regulations of government about salt reduction in processed food is another factor driving salt replacement market in processed food.

Growth in sodium replacement technologies, increasing demand for low sodium food products, and growing consumer awareness of hypertension and cardiovascular diseases are the key driving factors of the market.

Some of the major global players in the market are Cargill, Kerry Group, Koninklijke DSM N.V., Tate & Lyle, Givaudana, Sensient Technologies Corporation, etc. You are also trained on latest market trends including new and existing companies innovating solution ingredients and formulations to achieve salt reduction without compromising taste, including but not limited to; mineral-based salt replacers, traditional flavor enhancers, and enzyme-based solutions.

Other trends in the industry include mergers & acquisitions, new product launches, and partnerships with food manufacturers for developing healthier options. Furthermore, the dietary regulatory measures by the FDA, EFSA, and WHO aimed at reducing sodium consumption are propelling the market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill | 15-20% |

| Kerry Group | 12-16% |

| Koninklijke DSM N.V. | 10-14% |

| Tate & Lyle | 8-12% |

| Givaudan | 5-9% |

| Sensient Technologies Corp. | 3-7% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill | Developing mineral-based salt replacers and potassium chloride automotive solutions. Emphasizes safe food and regulation compliance. |

| Kerry Group | Clean-label sodium reduction technologies and taste modulation solutions expert Projects on natural flavor boosters. |

| Koninklijke DSM N.V. | Produces yeast extracts and enzyme-based sodium reduction ingredients. Focuses on functional and nutritional benefits. |

| Tate & Lyle | Provides starch-based and sodium replacement fibers. Engaged in research on alternative ingredients. |

| Givaudan | Provides flavor masking technologies and botanical extracts for salt reduction. Focuses on sensory optimization. |

| Sensient Technologies Corp. | Focuses on natural and synthetic seasonings to improve flavor in low-sodium products. |

Key Company Insights

Cargill

Cargill is a global leader in salt reduction solutions, offering a wide range of potassium chloride-based Cargill is a worldwide leader in salt reduction solutions, with potassium chloride-based ingredients and mineral-enhanced salt replacers. It works with regulatory agencies and food manufacturers on innovative sodium reduction strategies that maintains food safety and compliance.

There’s major R&D at Cargill, much of it focused on taste profiles, and the company has come up with proprietary blends that function like salt without losing flavor. Amidst all these challenges, Cargill is accelerating its sustainability agenda through a network of new partnerships through the responsible sourcing of raw materials and optimizing production processes to meet the increasing demand for healthy and sustainable food ingredients.

Kerry Group

Kerry Group specializes in advanced taste modulation products and developed natural flavor enhancers that enable food manufacturers to reduce sodium content without sacrificing taste. Specialising in nutritional fortification and wellness trends, the company's ingredients help improve sodium reduction but also positively impact overall health.

Alongside proprietary umami-enhancing solutions, DSM’s unique portfolio enables manufacturers to reduce sodium content while still creating rich, savoury flavours. As a venture backed company, DSM works with guide partners and the scientific community in building next generation ingredients that adhere to regulatory guidelines. By adopting sustainable production processes, DSM provides its high-performance solutions with minimal environmental impact.

Koninklijke DSM N.V.

DSM is renowned for its enzyme-based and yeast extract solutions, improving the functional and sensory properties of low-sodium products. Providing dietary fortification and health benefits, its components are sodium-reduction friendly and have applications based on nutrition trends.

Part of DSM’s unique portfolio of proprietary umami-enhancing solutions, these enable manufacturers to achieve sodium reduction while preserving rich, savoury taste. Among DSMs core strengths is a partnership with leading industry and scientific bodies to create new-to-world, compliant ingredients. Underlining their commitment to sustainability, DSM adopts sustainable production practices and aims to reduce their environmental footprint while maintaining the highest standards in their solution output.

Tate & Lyle

Tate & Lyle takes a starch- and fiber-based approach to its sodium reduction products, focusing on food texture and mouthfeel to enable less-salty products. Its large research and development efforts at focused on next-generation sodium substitutes that preserve product integrity and consumer satisfaction.

Tate & Lyle’s offering includes innovative ingredients with clean-label capabilities, in response to the growing trend for more transparent and natural formulations. They work with food manufacturers and research organizations to improve sodium reduction solutions. With its global distribution networks and in-depth expertise in regulatory matters, Tate & Lyle is in a strong position to compete in this space.

Givaudan

Givaudan also offers botanical extracts and masking technologies that help minimize the sensory impact of salt reduction. Z Karea invests in flavor science innovation, advanced aroma compounds and natural plant extracts to develop sodium-reduction solutions. Givaudan’s strategy involves cross-modal flavor augmentation, enhancing perception of taste without adding more sodium.

It works hand in hand with food and beverage producers to provide customized solutions with regional and product-specific requirements. On top of that, Givaudan also prioritizes sustainability and responsible sourcing of exotic food ingredients, ensuring that its offerings align not only with global health trends but also consumers' growing desire for natural ingredients in their foods.

Sensient Technologies Corp.

Sensient specializes in flavor enhancement technologies for processed foods, leveraging expertise in synthetic and natural flavor compounds to meet evolving regulatory standards. Its portfolio features masking agents, taste modulators and aroma enhancers, supporting manufacturers as they keep desirable taste profiles while decreasing sodium content.

Sensient’s scientific work is all about better-tailoring taste perception to humans and creating solutions that mimic the intricacy of salt. The company collaborates with food manufacturers worldwide to provide specialty unique manufactured sodium reducing ingredients that help them comply with sodium reduction requests. Sensient Companies, a leader in food technology innovation, continues to leave its mark in the food and beverage space.

In terms of Product Type, the industry is divided into Yeast Extracts, Glutamates (Monosodium/Potassium), High Nucleotide Ingredients (Disodium Inosinate, Calcium Inosinate, etc.), Hydrolyzed Vegetable Protein (HVP), Mineral Salts (KCl, K2SO4, CaCl2, etc.),

Others (Peptide Based Compounds, etc.)

In terms of Application, the industry is divided into Dairy Products, Bakery Products, Fish Derivatives, Meat and Poultry, Beverages, Sauces and Seasonings, s

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Salt Content Reduction Ingredients market is projected to reach USD 5,762.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.3% over the forecast period.

By 2035, the Salt Content Reduction Ingredients market is expected to reach USD 12,710.1 million.

The Yeast Extracts segment is expected to dominate the market, due to their strong umami flavor, natural taste enhancement, clean-label appeal, and ability to maintain palatability while reducing sodium in processed foods.

Key players in the Salt Content Reduction Ingredients market include Cargill, Kerry Group, Koninklijke DSM N.V., Tate & Lyle, Givaudan.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Kilo Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Kilo Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Salt Meter Market

Salt Hydrate Market

Basalt Rock Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fibre Market Size & Forecast 2024-2034

Sea Salt Market Analysis – Size, Share & Forecast 2024 to 2034

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Lemon Salt Market Trends - Citrus-Infused Seasoning Demand 2025 to 2035

Cesium Salts Market Size and Share Forecast Outlook 2025 to 2035

Smoked Salt Market Trends - Growth, Demand & Forecast 2025 to 2035

Ginger Salt Market Trends – Flavor Innovation & Industry Demand 2025 to 2035

Analyzing Celtic Salt Market Share & Industry Leaders

Pretzel Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Gourmet Salt Market Size and Share Forecast Outlook 2025 to 2035

Gourmet Salts Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Vanilla Salt Market Insights - Sweet & Savory Fusion Trends 2025 to 2035

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA