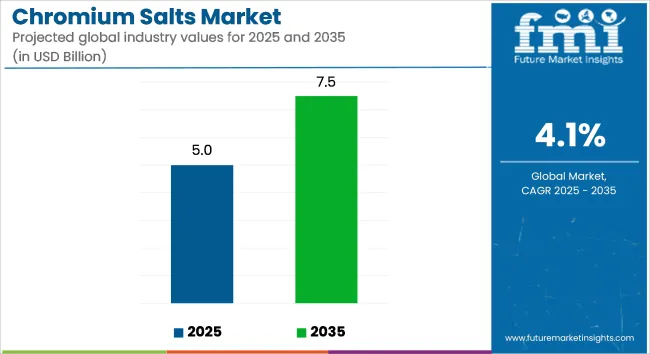

The global chromium salts market is estimated at USD 5.0 billion in 2025 and reach USD 7.5 billion by 2035, reflecting a CAGR of 4.1% during the forecast period. Market expansion is being driven by increasing industrial demand across sectors such as dyes and pigments, leather tanning, metallurgy, and catalysis.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.0 billion |

| Industry Value (2035F) | USD 7.5 billion |

| CAGR (2025 to 2035) | 4.1% |

Chromium salts are being utilized for their chemical versatility and functional properties, including corrosion resistance, color stability, and catalytic reactivity. In the leather industry, chromium(III) sulfate is being applied extensively for tanning processes to improve leather durability and flexibility. The metal treatment industry is using chromium salts to enhance surface hardness, wear resistance, and aesthetic finishes in automotive and aerospace components.

Chromic chloride is being deployed in electroplating applications, where it functions as a catalyst in surface coating and corrosion resistance. Chromium nitrate is being used in dyeing operations and as a rust inhibitor in industrial treatments, while chromic sulfate remains a primary input in leather processing.

Despite broad industrial applicability, concerns regarding hexavalent chromium compounds are prompting regulatory scrutiny and driving research into safer alternatives. Environmental and occupational health impacts associated with certain chromium compounds are leading manufacturers to focus on trivalent chromium formulations and adopt process innovations that reduce toxicity and waste generation.

The demand for chromium-based pigments in paints, coatings, and textile dyes continues to grow, particularly in applications where high weatherability and color retention are essential. In structural metals and industrial fabrication, chromium salts are being preferred for enhancing longevity and corrosion resistance under harsh conditions.

Research and development efforts are being directed toward improving the efficiency of chromium recycling and reducing environmental footprint. Additionally, increased compliance requirements under frameworks such as REACH in Europe and TSCA in the United States are shaping procurement standards and material usage.

The chromium salts market is expected to maintain steady growth through 2035, supported by its critical role in performance-based industrial applications and ongoing advancements in safer, high-purity chromium formulations for regulated end-use environments.

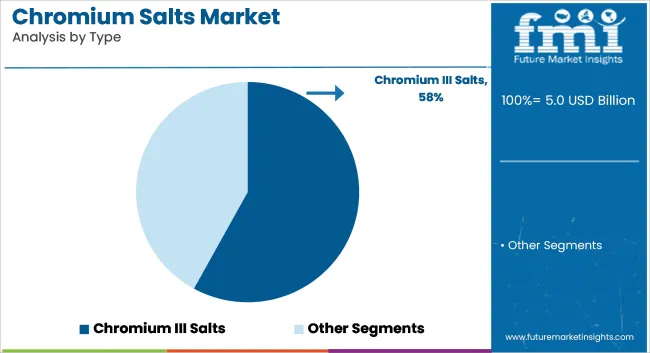

Chromium(III) salts are estimated to account for approximately 58% of the global chromium salts market share in 2025 and are projected to grow at a CAGR of 4.2% through 2035. Among these, chromium(III) sulfate and chromium(III) chloride are widely used in leather tanning processes due to their high reactivity with collagen and lower toxicity compared to chromium(VI) salts.

As environmental and occupational safety regulations tighten, especially in the EU and North America, chromium(III) compounds are increasingly replacing hexavalent chromium in several end-use industries. Tanning remains the largest consumer of chromium(III) salts, supported by consistent demand from South Asia’s leather manufacturing hubs and global fashion and footwear sectors.

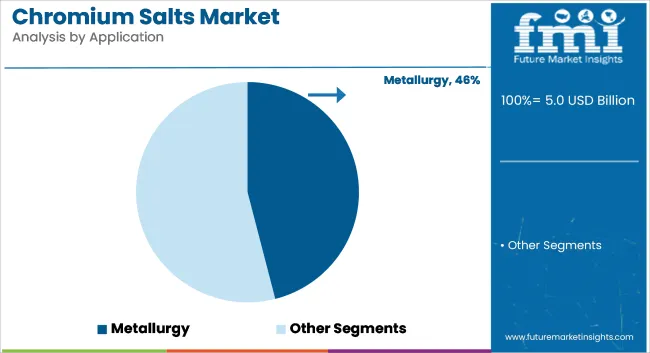

The metallurgy segment is projected to hold approximately 46% of the global chromium salts market share in 2025 and is expected to grow at a CAGR of 4.3% through 2035. Chromium salts are essential in producing corrosion-resistant alloys, electroplated components, and stainless steel, offering improved hardness, wear resistance, and surface finish. Electroplating processes in automotive, electronics, and industrial machinery sectors continue to drive demand, particularly for chromium(VI) compounds where stringent performance is required.

However, regulatory substitution pressures are steering manufacturers toward trivalent formulations with equivalent anti-corrosive properties. Additionally, the aerospace and refractory materials sectors contribute to steady chromium salt consumption due to the material's high-temperature stability and oxidation resistance. As industrial infrastructure expands globally, the metallurgy segment remains the core demand center for chromium-based chemistries.

Hexavalent chromium compounds are applied widely in electroplating, leather tanning, and chemical processing among many other uses; thus, its manufacture is risky for several health and environmental concerns. Such dangerous exposure due to chromium compounds were from respiratory and dermatological disorders up to cancers; therefore, the production and handling have been highly controlled in the significant industrial markets.

Government regulations across the world are imposing tighter restrictions on chromium-based emissions, waste disposal, and permissible exposure levels. Manufacturers face a major challenge in high compliance and adaptation costs, necessitating investments in safer chemical processing techniques and alternative formulations.

The rising focus on green chemistry solutions presents a major opportunity for the chromium salts market. Companies are actively investing in trivalent chromium compounds as a safer alternative to hexavalent chromium, which reduces toxicity and environmental impact while maintaining strong performance in metal treatment and leather processing applications.

New technological developments have paved ways for the recycling and re-use of chromium compounds, thus avoiding the issues related to waste disposal and making the system cost-effective. Other research projects include developing bio-based, biodegradable alternatives for chromium in industries like textiles, wood preservation, and automotive coating to meet the sustainability goals.

United States chromium salts market is steadily growing due to their wide application in metal finishing, leather tanning, pigments, and wood preservation. Their use in increasing demand for stainless steel and chrome plating in automotive and aerospace industries is acting as a major growth driver. Moreover, environmental regulations are influencing the shift toward eco-friendly chromium compounds, thus boosting opportunities for the development of advanced products.

In the following years, application of chromium salts in catalysts for chemical processes and increasing growth in the construction and automotive sectors should be the contributors to this growth.

Rising Demand from Metal Finishing Industry: The USA metal finishing industry is over USD 30 billionchromium salts are highly utilized by this industry in order to maintain corrosion resistance as well as desired aesthetic properties.

| Country | CAGR (2025 to 2035) |

|---|---|

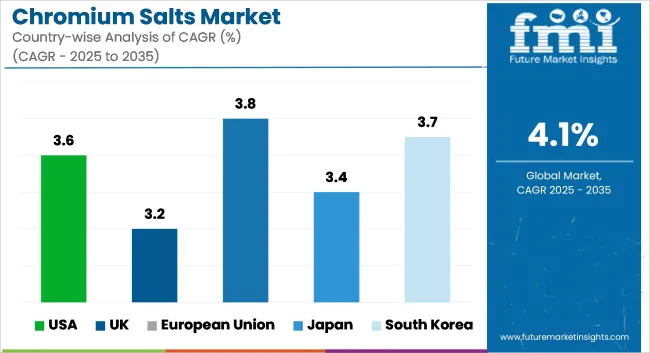

| USA | 3.6% |

the market for chromium salts in the UK is growing due to the demand from automobile, construction, and chemical segments. REACH has strict regulations, and this has led the market to opt more for trivalent chromium compounds, leading to positive innovation through the use of environmentally friendly products. Chrome-based pigments demand in the coatings industry is also propelling the market upward; the aerospace industry is also expanding.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.2% |

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.8% |

Demand from electronic components, automotive production, and specialty chemicals is the main driver of the chromium salts market in Japan. High-precision metal finishing for electronic and automotive applications fuels the market growth in Japan. Furthermore, developments in surface treatment technology and awareness about the environment are compelling consumers to switch towards low-toxicity chromium-based compounds.

Environmental consciousness in the manufacturing process of Japan, and stringent regulations against pollution, compel the industries to come up with eco-friendly applications of chrome.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

South Korea's chromium salts market is growing due to rising automotive manufacturing, electronics, and industrial coatings. Technological growth and green industrial practices in the country push for trivalent chromium compound use, whereas huge demand from construction and chemical processing industries also supports market growth.

Government incentives for sustainable manufacturing and investments in high-performance metal finishing technologies are key market drivers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

Key players are improving the quality and purity of chromium salts to meet industrial demands while focusing on environmentally friendly processes. Innovations aim to reduce toxic by-products and enhance waste management, driven by regulatory pressures. As sustainability becomes a priority, companies are investing in alternative production methods and eco-friendly chromium salts to align with the growing demand for greener industrial solutions.

The overall market size for Chromium Salts Market was USD 5.0 Billion in 2025.

The Chromium Salts Market is expected to reach USD 7.5 Billion in 2035.

The increasing demand from various industries such as dyes and pigments, leather tanning, metallurgy, and catalysts fuels Chromium Salts Market during the forecast period.

The top 5 countries which drives the development of Chromium Salts Market are USA, UK, Europe Union, Japan and South Korea.

Chromium III salts to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

Chromium Polynicotinate Market Size and Share Forecast Outlook 2025 to 2035

Chromium Trioxide Market Size and Share Forecast Outlook 2025 to 2035

Chromium Picolinate Market Size and Share Forecast Outlook 2025 to 2035

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cesium Salts Market Size and Share Forecast Outlook 2025 to 2035

Gourmet Salts Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Inorganic Salts Market Size and Share Forecast Outlook 2025 to 2035

Phosphate Salts Market Size and Share Forecast Outlook 2025 to 2035

Quenching Fluids & Salts Market Size and Share Forecast Outlook 2025 to 2035

Sodium, Potassium and Calcium Salts Market Analysis by Agriculture, Pharmaceuticals and Personal Care Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA