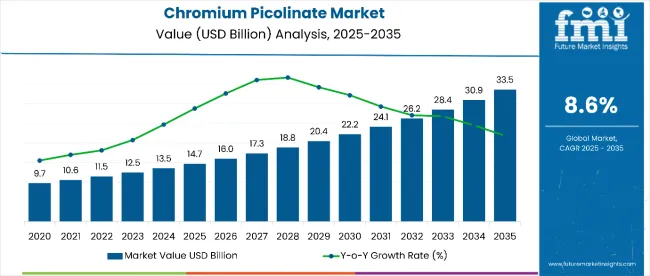

The chromium picolinate market is valued at USD 14.7 billion in 2025 and is anticipated to grow to USD 33.5 billion by 2035, exhibiting a CAGR of 8.6%.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 14.7 billion |

| Forecast Value in (2035F) | USD 33.5 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

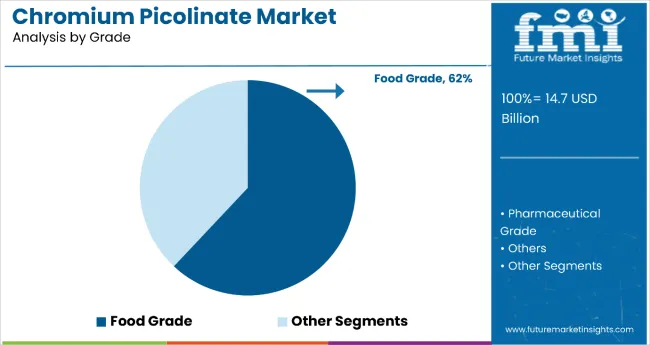

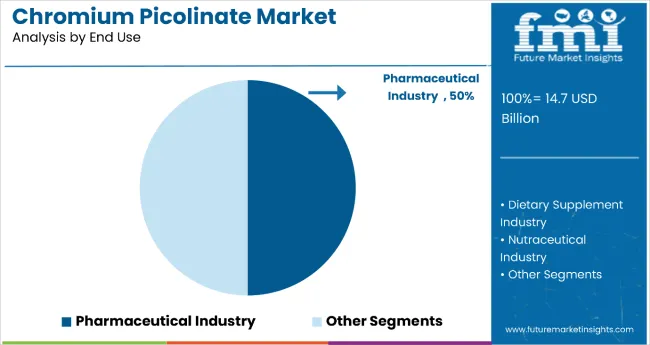

This growth reflects an absolute dollar opportunity of USD 18.8 billion, driven primarily by increasing health awareness and rising demand for dietary supplements that aid in weight management and diabetes control. The pharmaceutical segment accounts for 50% of the market, while the food-grade segment leads with 62%, highlighting diverse applications in health and nutrition.

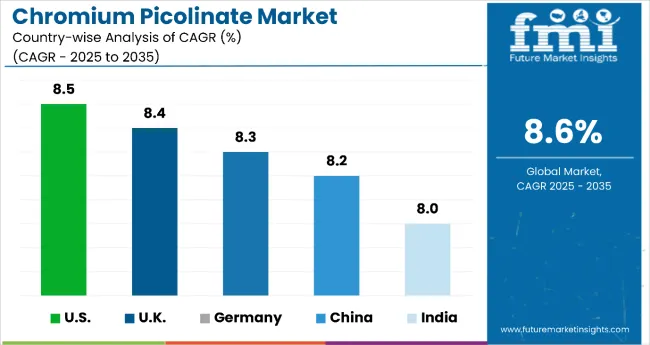

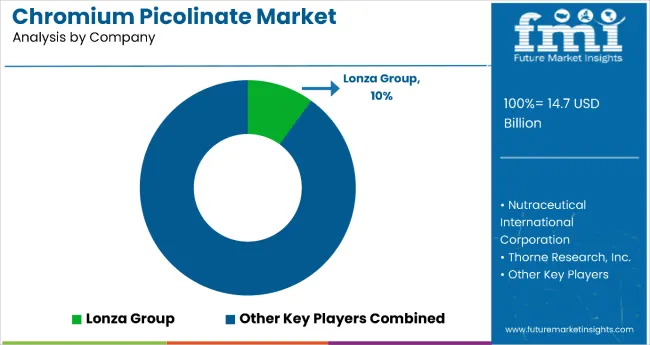

By 2030, the market is expected to reach around USD 22.2 billion, supported by steady growth across key regions. The US, UK, Germany, China, and India are anticipated to lead the market expansion with CAGRs between 8.0% and 8.5%. Major companies such as Lonza Group, holding a 10% market share, are focusing on capacity expansion and product innovation. Increasing consumer preference for natural supplements and the rise of e-commerce channels further fuel the market’s growth globally.

Companies such as Lonza Group, Merck KGaA, and Mubychem Group are strengthening their market positions through strategic investments in advanced manufacturing technologies and innovative product development. Growing consumer focus on health and wellness is driving expansion into pharmaceutical supplements, sports nutrition, and functional food applications. Market growth is supported by increasing regulatory approvals, emphasis on product safety, and the rising popularity of bioavailable chromium picolinate formulations.

The market holds approximately 50% share within the pharmaceutical industry segment, driven by its effectiveness in glucose metabolism and diabetes management supplements. It accounts for around 62% of the food grade segment, reflecting growing consumer demand for health supplements and fortified foods. The market is also influenced by significant regional contributions, with the US (8.5%), UK (8.4%), Germany (8.3%), China (8.2%), and India (8.0%) representing key growth territories. The Lonza Group commands a leading 10% share among manufacturers, bolstered by innovation and extensive distribution networks.

The market is evolving due to rising health consciousness and increasing incidence of metabolic disorders globally. Advances in manufacturing processes ensure high purity and bioavailability, making chromium picolinate a preferred ingredient in nutraceuticals and dietary supplements. Strategic partnerships between raw material suppliers and supplement manufacturers are driving product development and geographic expansion. Regulatory compliance and consumer demand for traceable, high-quality ingredients continue to reshape supply chains and support premium market positioning.

Chromium picolinate’s proven efficacy in supporting glucose metabolism, insulin sensitivity, and weight management makes it a preferred ingredient in pharmaceutical and nutraceutical formulations. Its role in enhancing nutrient absorption and regulating lipid profiles further contributes to its growing popularity. Additionally, ongoing clinical studies continue to validate its safety and effectiveness, encouraging wider adoption across health-focused industries.

Increasing consumer awareness of metabolic health and rising prevalence of diabetes and obesity are driving demand for chromium picolinate-based supplements, especially in food-grade and pharmaceutical applications. Innovations in manufacturing ensure high purity and bioavailability, enhancing product performance and safety.

As health-conscious consumers seek effective, natural supplements for blood sugar control and energy metabolism, the chromium picolinate market outlook remains strong. With companies focusing on regulatory compliance and sustainable sourcing, chromium picolinate is well-positioned to grow across dietary supplements, functional foods, and pharmaceutical sectors.

The market is segmented by grade, end use, and region. By grade, the market is divided into food grade, pharmaceutical grade, and others (industrial grade and cosmetic grade). Based on end use, the market is segmented into food & beverage industry, dietary supplement industry, nutraceutical industry, pharmaceutical industry, and others (animal feed and personal care products). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The food grade segment dominates the chromium picolinate market with a commanding 62% share in 2025, driven by growing consumer preference for functional foods and dietary supplements fortified with chromium picolinate, recognized for its benefits in glucose metabolism and weight management. Food-grade chromium picolinate is extensively used in food and beverage products such as energy bars, meal replacements, and fortified drinks, enabling manufacturers to target health-conscious consumers seeking natural metabolic enhancers.

Rising awareness of diabetes management and obesity prevention fuels demand, supported by regulatory approvals for functional food applications. Manufacturers are investing in innovative, bioavailable formulations that maintain chromium stability during processing and storage, positioning the segment for steady growth as health-focused product portfolios expand.

The pharmaceutical industry holds a significant 50% share of the chromium picolinate market, reflecting its critical role in formulations supporting glucose metabolism, insulin sensitivity, and weight management, key factors in managing diabetes and metabolic disorders. Pharmaceutical companies are increasingly incorporating chromium picolinate into treatments for type 2 diabetes, metabolic syndrome, and obesity-related conditions.

Beyond pharmaceuticals, the compound is gaining traction in nutraceutical and dietary supplement industries, catering to consumers seeking natural bioactive compounds for wellness and preventive health. While the food & beverage and other sectors (personal care, animal feed, cosmetics) contribute to the market, their shares remain comparatively smaller.

Between 2025 and 2035, increasing prevalence of metabolic disorders such as diabetes, obesity, and insulin resistance has propelled the adoption of chromium picolinate in pharmaceutical and nutraceutical formulations. Pharmaceutical companies are prioritizing bioactive compounds that improve glucose metabolism and insulin sensitivity, positioning chromium picolinate as a critical ingredient in advanced therapeutic and preventive products.

Efficacy and Safety Concerns Pose Market Challenges

Despite its benefits, the market faces challenges due to regulatory scrutiny over safety concerns linked to long-term high-dose consumption. Some studies have raised questions about potential toxicity, which can limit product approvals and consumer acceptance. Additionally, inconsistent quality and lack of standardized formulations across manufacturers create barriers to widespread adoption. High competition from alternative supplements for metabolic health, such as magnesium and cinnamon extracts, also restrains market growth, making it essential for producers to ensure rigorous quality control and clinical validation.

Rising Demand for Weight Management Supplements Fuels Growth

The market is evolving with increased focus on clinical-backed formulations and combination supplements targeting multifactorial metabolic conditions. There is growing consumer preference for clean-label, natural-origin chromium sources, driving manufacturers to invest in sustainable and traceable supply chains. Innovation in delivery forms, such as liposomal and time-release capsules, is enhancing bioavailability and patient compliance.

| Countries | CAGR |

|---|---|

| USA | 8.5% |

| UK | 8.4% |

| Germany | 8.3% |

| China | 8.2% |

| India | 8.0% |

The market is experiencing strong growth across all key countries, with CAGR values ranging from 8.0% to 8.5% between 2025 and 2035. The USA leads slightly with the highest CAGR of 8.5%, supported by advanced R&D infrastructure and high consumer demand for metabolic health supplements. Close behind, the UK is projected to grow at 8.4%, driven by robust healthcare systems and increasing consumer awareness. Germany follows with an 8.3% CAGR, benefiting from a mature healthcare sector and an aging population requiring metabolic and cardiovascular support. China’s market expands at 8.2%, fueled by rising middle-class incomes and strong manufacturing capabilities. India shows a promising CAGR of 8.0%, propelled by a young, health-conscious population and growing e-commerce penetration despite regulatory challenges.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA chromium picolinate market leads with a strong CAGR of 8.5% from 2025 to 2030, driven by rising consumer focus on metabolic health and weight management. Increasing prevalence of diabetes and obesity has accelerated demand for chromium supplements. The country’s advanced R&D infrastructure supports innovation in nutraceutical formulations, boosting product efficacy and diversity. Regulatory oversight from the FDA ensures high-quality standards, building consumer trust. Moreover, widespread online and retail distribution channels expand accessibility. Leading supplement manufacturers continuously invest in product development and marketing to meet growing consumer demand. This robust ecosystem positions the USA as a critical hub for both production and consumption in the market.

The UK chromium picolinate demand is projected to grow at a CAGR of 8.4% from 2025 to 2035, driven by increasing consumer interest in metabolic health and weight management supplements. Rising awareness of diabetes and obesity management is fueling demand. The country’s well-established healthcare system and strong regulatory framework ensure high-quality product standards, fostering consumer trust. Additionally, growth in online retail and specialty health stores enhances product availability. Innovation in nutraceutical formulations by key players is expanding product offerings. The UK is positioned as a significant market for both consumption and production in Europe.

Sales of chromium picolinate in Germany are expected to grow at a CAGR of 8.3%, driven by a mature healthcare system and a population with high health awareness. The country’s aging demographic increases demand for supplements supporting metabolic and cardiovascular health. Strict regulatory policies ensure product safety and high quality, fostering strong consumer confidence. Germany’s robust pharmaceutical and nutraceutical sectors support research and innovation, driving product development. Responsible sourcing and ethical manufacturing practices are gaining importance among consumers. Moreover, established retail networks and increasing online sales contribute to widespread market penetration. These factors make Germany a key European market for Chromium Picolinate with steady growth prospects.

Revenue from chromium picolinate in China is projected to grow at a CAGR of 8.2%, driven by increasing health awareness among its population and rapid urbanization. Rising cases of lifestyle-related diseases such as diabetes are encouraging supplement use. China’s strong manufacturing base supports both domestic consumption and export, making it a significant global supplier. However, regulatory frameworks are evolving to ensure quality and safety, which may initially slow expansion but ultimately enhance market credibility. The growing middle class with higher disposable incomes fuels demand for dietary supplements. Additionally, government health initiatives promote preventive care, further expanding market potential. China is quickly becoming a pivotal player in production capacity and global supply chains for Chromium Picolinate.

Sales of chromium picolinate in India are witnessing rapid expansion with an expected CAGR of 8.0%, led by rising health consciousness and increased spending on dietary supplements. The country’s young population is driving demand for weight management and fitness supplements. Government initiatives promoting nutrition and wellness are strengthening market growth. Additionally, rapid growth of e-commerce platforms is increasing product accessibility across urban and semi-urban regions. However, regulatory challenges and limited consumer awareness pose hurdles that manufacturers are addressing through educational campaigns. The expanding nutraceutical industry, combined with cost-effective manufacturing, makes India a key growth market and emerging export hub for Chromium Picolinate.

The market is moderately consolidated, with key players focusing on high-purity compound manufacturing and specialized formulation expertise. Lonza Group, holding a significant 10% market share, leads in supplying pharmaceutical-grade chromium picolinate used in dietary supplements and therapeutic products. Their strengths include advanced manufacturing processes and strict regulatory adherence.

Other major players like Nutrition 21 and Inter Health Nutraceuticals emphasize research-backed formulations and innovation to enhance bioavailability and efficacy. Companies such as Gnosis by Lesaffre and Zhejiang Tianyu Pharmaceutical prioritize large-scale production and cost-efficient extraction techniques, catering primarily to food-grade and nutraceutical sectors.

Regional manufacturers focus on local market needs by offering customized chromium picolinate products with consistent quality and supply reliability. Entry barriers remain high due to the complex synthesis process, regulatory approval challenges, and stringent quality standards, making purity, efficacy, and certifications critical competitive factors in this market.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 14.7 billion |

| Grade | Food Grade, Pharmaceutical Grade, and Others (industrial and cosmetic grade) |

| End Use | Food & Beverage Industry, Dietary Supplement Industry, Nutraceutical Industry, Pharmaceutical Industry, and Others (Cosmetics, Animal Nutrition, a nd Personal Care Products) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Amsal Chem Private Limited, Merck KGaA, Mubychem Group, Celtic Chemicals Ltd., Resonance Specialities Ltd., Yihan Industrial Co., Ltd., Sellwell (Group) Chemical Factory, Cambridge Commodities Limited, Chemlock Metals Corporation, Oceanic Laboratories Pvt. Ltd., Anmol Chemicals Group, Salvi Chemical Industries Ltd. |

| Additional Attributes | Rising demand in pharmaceutical and nutraceutical applications, growing adoption in dietary supplements and functional foods, increasing focus on weight management and glucose metabolism, advancements in formulation technologies, regulatory compliance and quality standardization |

The global chromium picolinate market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the chromium picolinate market is projected to reach USD 32.2 billion by 2035.

The chromium picolinate market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in chromium picolinate market are food grade, pharmaceutical grade and others (industrial and cosmetic grade).

In terms of end use, dietary supplement industry segment to command 38.2% share in the chromium picolinate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chromium Boride Powder Market Size and Share Forecast Outlook 2025 to 2035

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

Chromium Polynicotinate Market Size and Share Forecast Outlook 2025 to 2035

Chromium Trioxide Market Size and Share Forecast Outlook 2025 to 2035

Chromium Salts Market Trends - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA