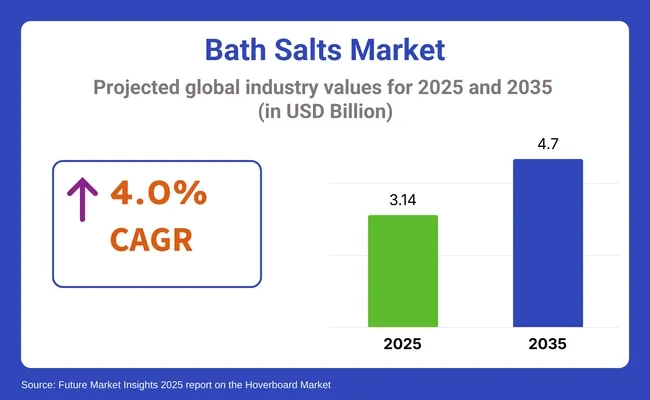

The bath salts market is estimated to generate a market size of USD 3.14 billion in 2025 and is expected to reach USD 4.70 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.0% during the forecast period. Bath salts, known for their therapeutic benefits, are used in bath water to promote relaxation, relieve muscle tension, and improve skin health. The increasing interest in wellness, self-care, and alternative therapeutic practices is driving the demand for bath salts, particularly in the personal care and wellness sectors.

A key driver of the market’s growth is the rising awareness about the benefits of natural and therapeutic bath products. Consumers are becoming more conscious of the ingredients in their personal care products, leading to a preference for bath salts made from natural minerals such as Epsom salt, Himalayan pink salt, and sea salt. Additionally, the growing trend of home wellness treatments, including at-home spas and stress-relief routines, is propelling the demand for products like bath salts, which offer a cost-effective alternative to professional spa treatments.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 3.14 billion |

| Market Size in 2035 | USD 4.70 billion |

| CAGR (2025 to 2035) | 4.0% |

Recent developments in the market include innovations in bath salt formulations, such as the addition of essential oils, botanical extracts, and exfoliating agents that provide added skin benefits. These enhanced formulations are attracting health-conscious consumers who seek multifunctional products.

On March 15, 2025, Bathorium launched a new line of therapeutic bath soaks designed to promote relaxation and skin rejuvenation. The collection features natural ingredients such as Dead Sea salts, Epsom salts, and essential oils, aiming to enhance the bathing experience and support wellness routines. This was officially announced in the company's press release.

As the bath salts market continues to expand, increasing consumer demand for wellness-oriented products and the growing trend of holistic health will drive the continued growth of this segment

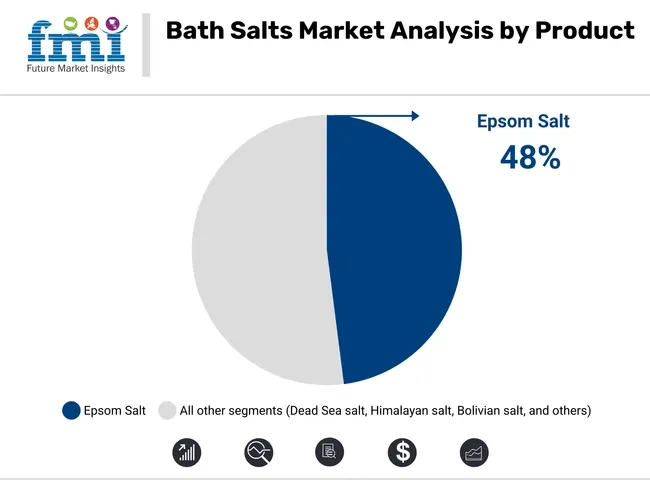

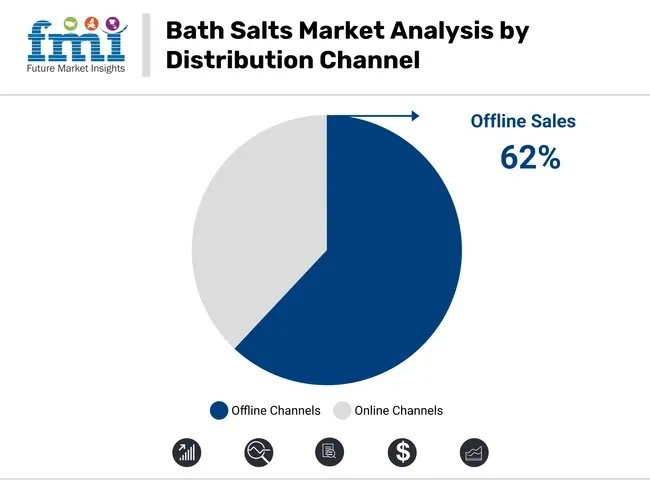

In 2025, the Epsom salt segment will hold 48%, while offline sales are projected to capture 62.0% of the distribution channel market share. Key players include Church & Dwight, San Francisco Salt Company, and Dr. Teal’s.

The Epsom salt segment is projected to capture 48% of the product market share in 2025. Known for its high magnesium sulfate content, Epsom salts are widely used for muscle relaxation, detoxification, and skin soothing. Brands like Dr. Teal’s and San Francisco Salt Company promote its natural healing properties, boosting consumer preference.

Increasing awareness of self-care and spa treatments is driving demand globally. Its versatility for bath soaks, foot soaks, and exfoliation supports consistent consumption. As consumers seek natural wellness products, Epsom salt remains a key driver in the bath salts market.

The offline sales segment is expected to hold 62% of the distribution channel market share in 2025. Traditional retail outlets such as supermarkets, pharmacies, and specialty wellness stores remain the primary purchasing venues for bath salts. Church & Dwight and other manufacturers maintain strong relationships with retailers to ensure product availability and in-store promotions.

Consumers often prefer tactile inspection and immediate purchase, especially for premium and bulk products. Despite online growth, offline channels offer personalized customer service and impulse buying opportunities. The offline segment’s deep market penetration ensures it remains vital for reaching diverse consumer bases globally.

The bath salts market thrives on rising wellness trends and affordable self-care rituals, yet struggles with ingredient transparency issues and seasonal buying habits that limit consistent, long term demand.

Wellness and selfcare trends drive broad usage

The increasing consumer focus on wellness and mindful self-care is significantly boosting demand for bath salts. As stress reduction and mental well-being rise as priorities, users are incorporating aromatic, mineral-rich salts into routine rituals. These products appeal as affordable home spa experiences, offering relaxation, muscle relief, and sensory indulgence.

The appeal is amplified through social media, lifestyle influencers, and influencer-driven packaging aesthetics. Bath salts are often bundled with body oil, candles, and skincare products, enhancing cross category sales. Natural and organic formulations further resonate with health conscious buyers, expanding adoption beyond traditional stores to online subscription platforms.

Ingredient transparency concerns and buying seasonality limit growth

Despite broad appeal, the market is constrained by increasing demand for ingredient clarity and environmental responsibility. Consumers are wary of artificial fragrances, synthetic colorants, and plastic microbeads, triggering scrutiny over long term skin and ecological impact.

Brands lacking transparent sourcing or sustainable packaging may struggle to earn repeated purchases. Additionally, bath salts often see seasonal usage-peak demand around holidays and colder months, followed by quieter periods. Many consumers consider them as indulgent extras, not daily essentials, making it a challenge for brands to drive year round engagement. Without consistent messaging on value and safety, sustaining steady market growth remains difficult.

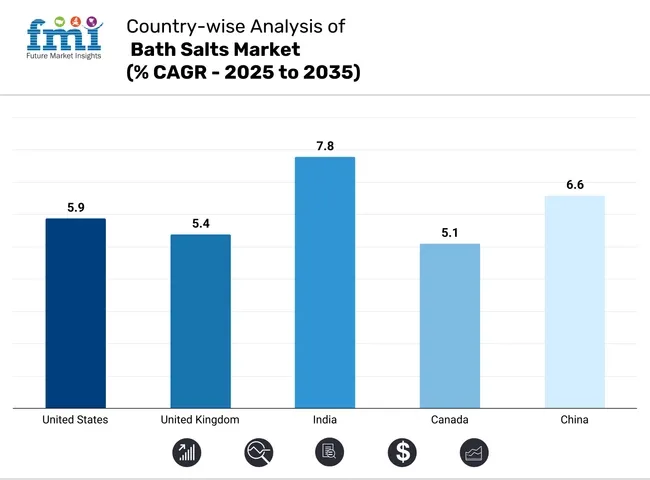

The bath salts market is flourishing due to wellness trends, aromatherapy demand, and rising disposable incomes. The USA, UK., India, Canada, and China are leading in both production and consumer adoption.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

| United Kingdom | 5.4% |

| India | 7.8% |

| Canada | 5.1% |

| China | 6.6% |

The United States bath salts market is projected to grow at a CAGR of 5.9% through 2035, led by rising self-care trends and consumer demand for natural, therapeutic wellness. Major brands like Dr Teal’s, Village Naturals Therapy, and Herbivore Botanicals dominate premium Epsom and Himalayan salt blends.

The USA consumer base favors lavender, eucalyptus, and CBD-infused variants, often used for stress relief, sore muscle recovery, and sleep improvement. Retail expansion via Amazon and Ulta has fueled category accessibility. With fitness-conscious and mental wellness-focused consumers, the USA remains a top market for functional and indulgent bath salt formulations.

The United Kingdom’s bath salts market is growing at a CAGR of 5.4% through 2035, underpinned by a strong spa culture and the rise of clean, sustainable beauty products. Brands such as Westlab, Neal’s Yard Remedies, and REN Clean Skincare offer mineral-rich formulas with essential oils and detox ingredients.

The UK public prioritizes organic certifications and eco-friendly packaging, aligning with global sustainability trends. Online wellness platforms and boutique retailers have boosted the accessibility of bath salts for home spa experiences. With high product penetration across wellness communities, the UK plays a key role in Europe’s evolving natural bath care segment.

India’s bath salts market is advancing rapidly at a CAGR of 7.8% through 2035, driven by Ayurveda-led wellness demand and rising urban middle-class interest in affordable luxury. Domestic brands like Khadi Natural, Soulflower, and Forest Essentials offer rose, turmeric, and sandalwood-infused salts tailored for detox, stress relief, and skin rejuvenation.

Growing popularity of self-care rituals among millennials and Gen Z, especially in metro cities, supports strong volume growth. E-commerce platforms like Nykaa and Amazon expand nationwide reach. India’s unique fusion of traditional ingredients and modern wellness positioning is establishing it as a rising powerhouse in therapeutic bath salt production.

Canada’s bath salts market is growing steadily at a CAGR of 5.1% through 2035, supported by high demand for organic body care and wellness rituals suited to its colder climate. Local players like Buck Naked Soap Company and Bathorium offer magnesium-rich soaks, aromatherapy blends, and eco-packaged products.

Wellness routines incorporating bath salts for muscle recovery and seasonal mood regulation are popular. Retailers like Well.ca and Indigo promote clean beauty trends, while spas and boutique hotels integrate luxury bath products into their offerings. Canada’s consumer preference for ethically sourced, high-efficacy bath soaks contributes to a stable and health-conscious market outlook.

China’s bath salts market is forecasted to expand at a CAGR of 6.6% through 2035, driven by the growing middle class, social media-influenced wellness trends, and beauty-from-within concepts. Domestic companies like CHANDO and Herborist are introducing bath salts featuring goji berries, green tea, and pearl powder.

Younger consumers view bath salts as part of skincare and mental health routines. Urban centers like Shanghai and Beijing lead in premium product demand, while online platforms such as Tmall and JD.com support mass distribution. China’s blending of traditional Chinese medicine with modern spa rituals is fueling significant growth in the premium bath salt category.

The bath salts market combines large-scale producers, established mid-sized brands, and boutique innovators. Tier 1 leaders-PDC Brands, Dead Sea Ltd., and SaltWorks-dominate retail channels with broad product lines and extensive distribution. Tier 2 firms such as SAN FRANCISCO SALT Co, Enviromedica, Bathorium, The Midwest Sea Salt Company, Better Bath Better Body, Yareli Bath & Beauty, and The Seaweed Bath Co. deliver wellness-focused blends targeting skin health and aromatherapy.

Tier 3 players operate in niche segments, offering artisanal, ecoconscious formulations. While Tier 1 brands benefit from scale, the market remains fragmented as consumer demand for unique, ingredient specific, and wellness-oriented bath salt experiences continues to grow.

Recent Bath Salts Industry News

Salt Works launched two new all natural bath salt lines in June 2025, featuring Dead Sea salt and essential oils-with no artificial colors or additives-according to a press release on its official site. The announcement emphasizes clean-label positioning, targeting health-conscious consumers seeking simple, natural blends for at-home spa rituals. This move underscores the rising consumer preference for purity and transparency in personal care products and reflects a broader trend toward wellness-driven self-care solutions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.14 billion |

| Projected Market Size (2035) | USD 4.70 billion |

| CAGR (2025 to 2035) | 4.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Epsom salt, Dead Sea salt, Himalayan salt, Bolivian salt, others |

| Distribution Channels Analyzed (Segment 2) | Offline (supermarkets/hypermarkets, specialty stores, pharmacies/drug stores), online |

| End-Use Types Analyzed (Segment 3) | Residential, commercial |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Bath Salts Market | PDC Brands; Dead Sea Ltd.; SAN FRANCISCO SALT CO; Enviromedica; Bathorium; The Midwest Sea Salt Company Inc.; Better Bath Better Body LLC; Yareli Bath & Beauty; SaltWorks; The Seaweed Bath Co. |

| Additional Attributes | dollar sales, CAGR trends, product segmentation by type and end use, regional demand patterns, distribution channel trends |

The segmentation is into Epsom salt, Dead Sea salt, Himalayan salt, Bolivian salt, and others.

The segmentation is into offline channels (supermarkets/hypermarkets, specialty stores, pharmacies/drug stores) and online channels.

The segmentation is into residential and commercial.

The market is expected to reach USD 3.14 billion in 2025.

Sales in the market are projected to grow steadily, reaching approximately USD 4.70 billion by 2035.

India is anticipated to lead with a CAGR of 7.8% during the forecast period.

The offline sales segment dominates the industry by distribution channel type.

Major companies include PDC Brands, Dead Sea Ltd., SAN FRANCISCO SALT CO, Enviromedica, Bathorium, The Midwest Sea Salt Company Inc., Better Bath Better Body LLC, Yareli Bath & Beauty, SaltWorks, The Seaweed Bath Co.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bath Toy Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Bath Linen and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Vanities Market Analysis - Growth, Trends and Forecast from 2025 to 2035

Bathtub Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Bath Rugs & Mats Market Growth - Trends & Industry Outlook 2025 to 2035

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

Bath Bomb Market Growth – Size, Trends & Forecast 2024-2034

Pet Bathing Supplies Market Growth - Trends & Forecast to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Plastic Bathtub Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Medicated Bath Additive Market Size and Share Forecast Outlook 2025 to 2035

Preoperative Bathing Solution Market Analysis by End User into Intensive Care Unit, Surgical Wards and Medical Wards Through 2035.

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA