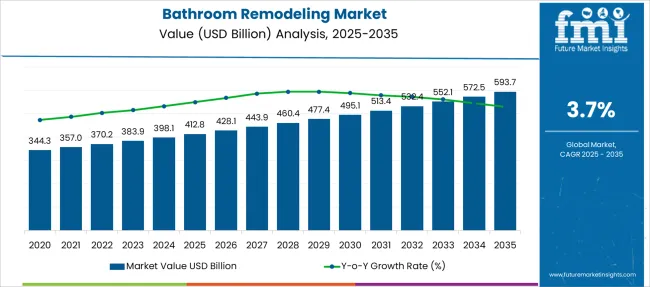

The Bathroom Remodeling Market is estimated to be valued at USD 412.8 billion in 2025 and is projected to reach USD 593.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Bathroom Remodeling Market Estimated Value in (2025 E) | USD 412.8 billion |

| Bathroom Remodeling Market Forecast Value in (2035 F) | USD 593.7 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The bathroom remodeling market is undergoing significant growth driven by increasing consumer focus on home improvement, rising disposable incomes, and evolving lifestyle preferences favoring modern and sustainable design elements. Investment in enhancing residential spaces is being fueled by desires to improve comfort, functionality, and property value.

The adoption of advanced materials and innovative installation techniques has improved the appeal and durability of remodeled bathrooms. Growing awareness of water efficiency and eco-friendly products is influencing remodeling choices, aligning with broader environmental concerns.

The market is expected to benefit from increased urbanization, aging housing stocks requiring upgrades, and rising DIY trends supported by digital platforms. Collaborations between manufacturers, contractors, and retailers are facilitating customized solutions and streamlined supply chains, setting the stage for sustained expansion and diversification.

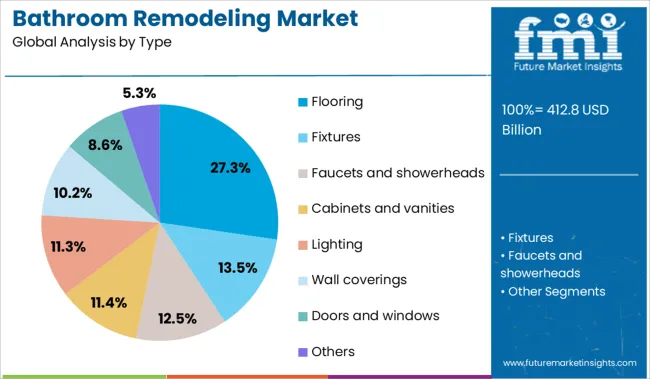

The market is segmented by Type, Material, End Use, and Distribution Channel and region. By Type, the market is divided into Flooring, Fixtures, Toilets, Sinks, Bathtubs, Showers, Others, Faucets and showerheads, Cabinets and vanities, Lighting, Wall coverings, Doors and windows, and Others.

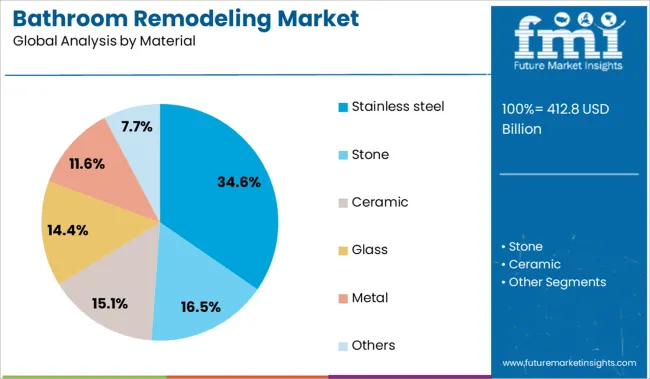

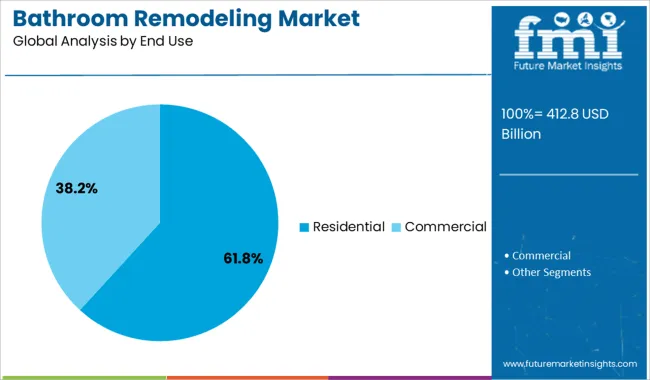

In terms of Material, the market is classified into Stainless steel, Stone, Ceramic, Glass, Metal, and Others. Based on End Use, the market is segmented into Residential and Commercial. By Distribution Channel, the market is divided into Indirect sales and Direct sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Within the type segment, flooring holds a 27.30% revenue share in 2025, making it a leading focus area in bathroom remodeling. This prominence is attributed to its critical role in defining both aesthetics and functionality of the space.

Flooring solutions have been developed to offer enhanced durability, slip resistance, and moisture protection, addressing core consumer concerns. Advances in materials and installation technologies have allowed flooring options to adapt to a variety of design preferences while meeting stringent safety standards.

The capacity to combine style with practicality has made flooring a preferred investment point, contributing to higher returns in remodeling projects. Additionally, flooring's influence on overall bathroom ambiance supports its continued prominence in renovation decisions.

The material segment is led by stainless steel, accounting for 34.60% of market revenue in 2025. This leadership is supported by stainless steel's inherent corrosion resistance, durability, and modern aesthetic appeal, which align well with bathroom environments exposed to moisture and frequent use.

Its hygienic properties and ease of maintenance have increased its adoption in both fixtures and accessories. The versatility of stainless steel in design applications, from faucets to countertops, has further reinforced its market position.

Increased consumer preference for long-lasting, sustainable materials combined with industry shifts toward premium product offerings have propelled stainless steel to the forefront of material choices within the remodeling market.

The residential segment dominates the end use category with a 61.80% revenue share in 2025, driven by homeowners' increasing investment in personalizing and upgrading their living spaces. Rising urban populations, a growing middle class, and expanding awareness of the benefits of remodeling for comfort and property value have fueled demand.

Residential remodeling projects are frequently prioritized to incorporate energy-efficient fixtures, modern designs, and smart technology integration, reflecting changing lifestyle expectations. The segment's dominance is also reinforced by favorable financing options and support from home improvement retailers, which have lowered barriers to remodeling.

These factors collectively contribute to the residential segment's strong market leadership.

Increasing home improvement activity, aging housing stock, and lifestyle upgrades are boosting bathroom remodel demand. Opportunities lie in modular designs, smart fixtures, contractor partnerships, and emerging rental and multi‑unit segments.

Homeowners and property managers are seeking bathroom remodeling as older homes require modernization and maintenance. Aging plumbing, fixtures, tiles, and outdated layouts prompt investments in upgrades that improve comfort, safety, and aesthetics. Rising interest in upgraded bathrooms with walk-in showers, heated floors, and contemporary finishes reflects trends in daily comfort and resale value. Home improvement shows and DIY social content also influence consumer choices. Renovation demand is particularly strong in multi-family housing and rental units where owners aim to attract tenants or boost rental rates. Wells or systems in older buildings and code-based updates create repeat remodeling cycles. The outcome is a growing appetite for reliable, visually appealing bathroom renovation projects.

The bathroom remodeling market offers growth through prefabricated tubs, showers, and vanity modules that speed installation and cut labor time. Adoption of smart fixtures motion-activated faucets, programmable showers, and leak detectors can appeal to convenience-driven buyers. Collaboration with contractors, designers, and plumbing suppliers enables streamlined design‑build packages attractive to renovators. Subscription plans or renovation financing make premium updates more accessible. Entry into multi-unit housing, vacation rental upgrades, and aging-in-place installations presents new customer segments. Offering bundled services that include design, materials, and installation under one package adds value. Ensuring warranty coverage, local installation networks, and post-renovation support helps build credibility and repeat referrals among both homeowners and professionals.

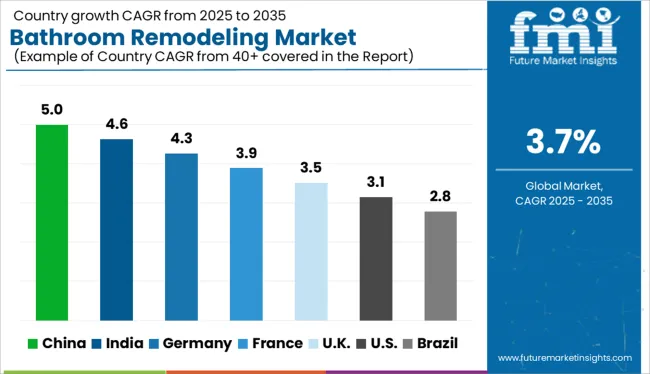

| Countries | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

The global bathroom remodeling market is projected to grow at a CAGR of 3.7% from 2025 to 2035, supported by rising urbanization, aging housing stock, and increasing consumer focus on wellness-centric home upgrades. Among BRICS economies, China leads with a 5.0% CAGR, driven by urban redevelopment projects, growing middle-class disposable income, and adoption of smart sanitary fixtures. India follows at 4.6%, with growth stemming from tier-2 and tier-3 city renovations, housing schemes, and expanding access to indoor plumbing. Within OECD countries, Germany shows a 4.3% CAGR, reflecting energy-efficient retrofits and accessibility-focused remodeling. The United Kingdom (3.5%) aligns with mature market trends emphasizing design over expansion, while the United States (3.1%) reflects stable remodeling activity tied to home equity and aging-in-place solutions. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The bathroom remodeling market in China is expanding at a CAGR of 5.0%, supported by strong urbanization, smart home integration, and evolving consumer aesthetics. Rapid growth in middle-class housing, especially in tier-2 and tier-3 cities, is leading to increased spending on modern, tech-enabled bathroom upgrades. Chinese consumers are prioritizing energy-efficient fixtures, water-saving systems, and aesthetic uniformity in high-rise apartment projects. Developers and home improvement brands are aligning with consumer demand for minimalist, Japanese-inspired layouts and smart toilets.

Bathroom remodeling market in India is projected to grow at a CAGR of 4.6%, fueled by rising disposable incomes, improving urban housing quality, and changing perceptions of wellness spaces. Renovation in Tier-1 cities and premium apartment complexes is increasingly including branded sanitaryware, concealed piping, and wall-mounted fixtures. Indian homeowners are also investing in space-saving fittings, ventilated dry-wet separations, and anti-slip flooring solutions. Regional brands are scaling operations in semi-urban areas through influencer-led design outreach.

Germany is expected to register a CAGR of 4.3% in bathroom remodeling, bolstered by energy-efficient housing upgrades and strict environmental regulations. The market is increasingly characterized by demand for barrier-free designs, particularly in aging households. Manufacturers are responding with wall-hung sanitary systems, walk-in showers, and temperature-controlled fittings. Government-backed refurbishment incentives are supporting eco-efficient upgrades in older multifamily buildings. Design preferences continue to favor matte finishes, ambient lighting, and smart water monitoring.

The bathroom remodeling market in the United Kingdom is forecast to grow at a CAGR of 3.5%, with demand supported by aging infrastructure and renewed investment in energy-efficient housing. Renovation activity has risen in suburban and semi-rural regions, where homeowners are upgrading legacy plumbing systems, wall panels, and lighting. Compact bathroom conversions, integrated storage, and luxury finishes are gaining preference among mid-income households. Online marketplaces and visual design tools are enabling consumers to make faster upgrade decisions.

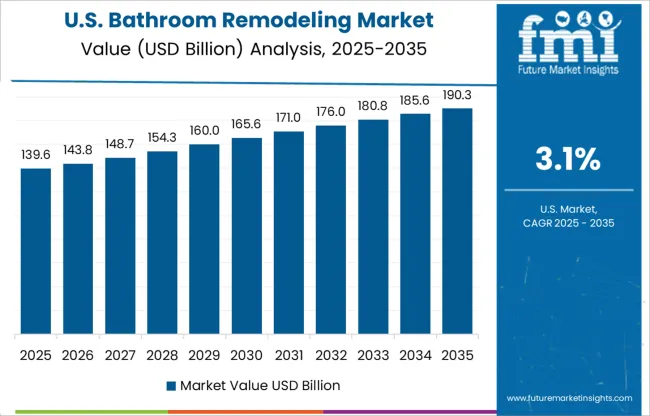

The bathroom remodeling market in the United States is growing at a CAGR of 3.1%, reflecting a steady rise in home improvement across aging suburban neighborhoods. Homeowners are investing in bathroom expansions, smart ventilation systems, and lighting automation. There's a growing shift toward spa-inspired layouts that incorporate freestanding bathtubs, frameless glass showers, and antimicrobial surfaces. High interest rates have slowed new construction but pushed more households to renovate instead of relocate, fueling demand in both rural and metro zones.

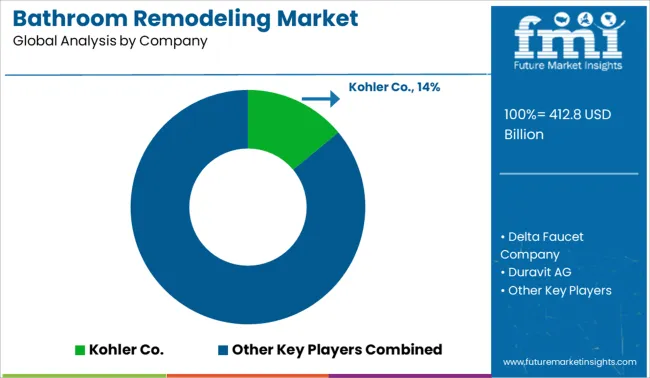

The bathroom remodeling market is highly fragmented, driven by a diverse mix of global and regional players competing on design innovation, water efficiency, smart technology, and brand appeal. Kohler Co. leads with a 14.0% market share, owing to its comprehensive product range, premium aesthetics, and strong presence in both residential and hospitality sectors. Tier 1 players like LIXIL Corporation, Grohe, and Hansgrohe focus on high-end fixtures and smart bathroom technologies. Tier 2 companies such as Jaquar Group, Hindware Homes, and Elkay Manufacturing serve emerging markets with cost-effective, durable solutions. Tier 3 brands like Gessi and Teka Group offer niche luxury products. Market growth is propelled by rising home renovation trends, urban housing demand, and consumer preference for wellness-oriented, tech-integrated bathrooms.

On April 22, 2025, Houzz Inc. announced via its press site that homeowner demand for major bathroom renovations remains robust, with median spending on large primary bathroom remodels steady at USD 25,000, highlighting continued investment in bathroom updates

| Item | Value |

|---|---|

| Quantitative Units | USD 412.8 Billion |

| Type | Flooring, Fixtures, Toilets, Sinks, Bathtubs, Showers, Others, Faucets and showerheads, Cabinets and vanities, Lighting, Wall coverings, Doors and windows, and Others |

| Material | Stainless steel, Stone, Ceramic, Glass, Metal, and Others |

| End Use | Residential and Commercial |

| Distribution Channel | Indirect sale and Direct sale |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kohler Co., Delta Faucet Company, Duravit AG, Elkay Manufacturing Company, Gessi S.p.A., Grohe AG, Hansgrohe SE, Hindware Homes, Ideal Standard International, Jaquar Group, LIXIL Corporation, Masco Corporation, Moen Incorporated, Roca Sanitario S.A., and Teka Group |

| Additional Attributes | Dollar sales by remodel type, fixture category, and property type; regional demand driven by housing trends, renovation cycles, and disposable income levels; innovation in water-saving fixtures, smart technologies, and eco-efficient materials; cost dynamics influenced by labor availability and supply chain fluctuations; environmental impact of material waste and recycling; and emerging use cases in aging-in-place designs and wellness-oriented bathroom upgrades. |

The global bathroom remodeling market is estimated to be valued at USD 412.8 billion in 2025.

The market size for the bathroom remodeling market is projected to reach USD 593.7 billion by 2035.

The bathroom remodeling market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in bathroom remodeling market are flooring, fixtures, toilets, sinks, bathtubs, showers, others, faucets and showerheads, cabinets and vanities, lighting, wall coverings, doors and windows and others.

In terms of material, stainless steel segment to command 34.6% share in the bathroom remodeling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Vanities Market Analysis - Growth, Trends and Forecast from 2025 to 2035

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA