In 2025, the bathroom furniture market is valued at USD 24.0 billion and is projected to reach USD 43.8 billion by 2035, growing at a CAGR of 6.2%. The absolute dollar opportunity over this period is USD 19.8 billion, representing the additional market potential from 2025 to 2035. This growth reflects increasing demand for modern bathroom furnishings and renovations across residential and commercial segments. Companies can leverage this opportunity by expanding product lines, enhancing distribution networks, and targeting high-growth regions.

The incremental market expansion provides a clear financial incentive for strategic investment and business planning over the decade. From a business perspective, the USD 19.8 billion absolute dollar opportunity highlights significant revenue potential for both established players and new entrants. With the market gradually increasing from USD 24.0 billion in 2025 to USD 43.8 billion in 2035 at a CAGR of 6.2%, firms can plan phased investments and scale operations strategically.

By focusing on key markets, optimizing supply chains, and improving product accessibility, stakeholders can capture incremental revenue. This predictable growth trajectory allows companies to strengthen market positioning, expand reach, and achieve sustained profitability throughout the ten-year period.

| Metric | Value |

|---|---|

| Bathroom Furniture Market Estimated Value in (2025 E) | USD 24.0 billion |

| Bathroom Furniture Market Forecast Value in (2035 F) | USD 43.8 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

A breakpoint analysis for the bathroom furniture market highlights critical thresholds where growth accelerates or strategic adjustments become necessary. With the market valued at USD 24.0 billion in 2025 and projected to reach USD 43.8 billion by 2035 at a CAGR of 6.2%, early breakpoints appear around USD 28.8–30.6 billion. These levels represent the initial phase of strong market expansion, indicating rising demand for bathroom furniture and renovation projects.

Recognizing these breakpoints allows companies to allocate resources efficiently, expand distribution, and optimize marketing strategies to capture incremental revenue during periods of accelerated growth, ensuring early-mover advantages. Later-stage breakpoints occur between USD 36.6–41.3 billion as the market approaches maturity and competition intensifies. Surpassing these thresholds may require businesses to refine pricing strategies, enhance operational efficiency, and differentiate product offerings to sustain growth momentum. Monitoring these breakpoints enables companies to anticipate shifts in consumer demand and adjust production, distribution, and sales strategies accordingly. By aligning strategic actions with these critical thresholds, stakeholders can maximize revenue potential, strengthen market positioning, and navigate the steady growth trajectory from 2025 to 2035 with informed precision.

The market is experiencing robust growth, driven by increasing consumer focus on home improvement and interior aesthetics. Rising urbanization, expanding residential construction activities, and growing disposable incomes in emerging and developed markets are shaping the current scenario.

The trend toward modern, space-efficient bathroom designs and the integration of smart storage solutions further strengthen the market outlook. Demand for customizable and durable bathroom furniture is growing, supported by advancements in materials and finishes that combine functionality with style.

Increasing preference for renovation over new construction, along with the growing influence of lifestyle media, is expected to create sustained growth opportunities The shift toward eco-friendly and easy-to-maintain products is also opening new avenues for innovation and adoption in the bathroom furniture sector.

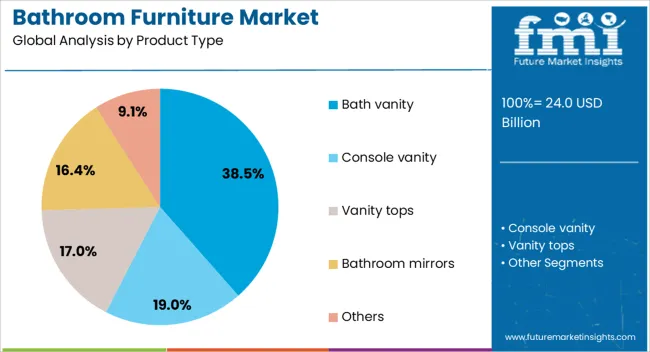

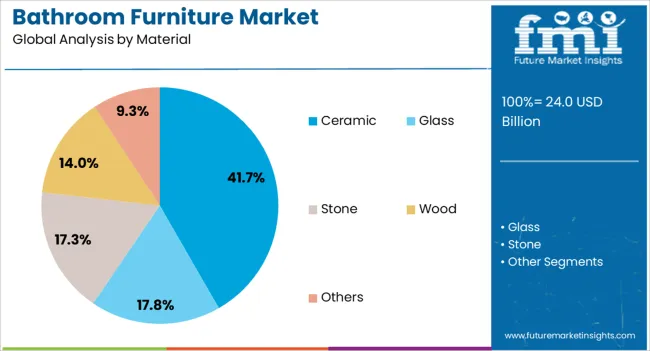

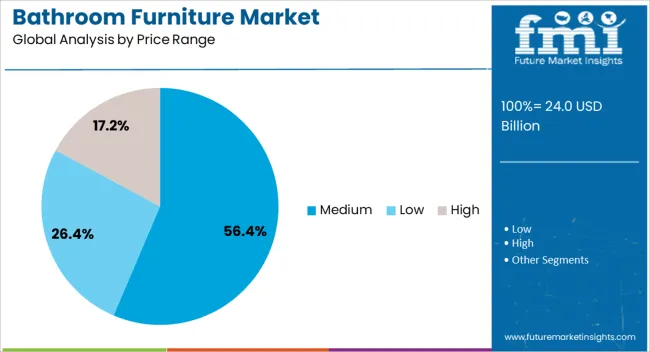

The bathroom furniture market is segmented by product type, material, price range, application, distribution channel, and geographic regions. By product type, bathroom furniture market is divided into Bath vanity, Console vanity, Vanity tops, Bathroom mirrors, and Others. In terms of material, bathroom furniture market is classified into Ceramic, Glass, Stone, Wood, and Others. Based on price range, bathroom furniture market is segmented into Medium, Low, and High.

By application, bathroom furniture market is segmented into Residential, Commercial, and Others. By distribution channel, bathroom furniture market is segmented into Offline and Online. Regionally, the bathroom furniture industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bath vanity product type is expected to hold 38.5% of the Bathroom Furniture market revenue share in 2025, establishing it as the leading product category. This prominence is being attributed to its multifunctional appeal, combining storage, aesthetics, and space utilization, which meets the evolving needs of modern bathrooms.

Bath vanities are preferred for their ability to enhance bathroom organization and provide a centerpiece that complements interior design themes. The growing trend of customized vanities tailored to consumer preferences, along with the availability of a wide range of styles and finishes, has driven demand.

Furthermore, the integration of smart features such as built-in lighting and power outlets is boosting their attractiveness. The segment’s growth is being supported by increasing renovation projects and new residential developments that prioritize functional yet stylish bathroom solutions.

The ceramic material segment is projected to account for 41.7% of the Bathroom Furniture market revenue share in 2025, making it the dominant material choice. This leadership is being driven by ceramic’s durability, ease of cleaning, and resistance to moisture and staining, which are critical qualities in bathroom environments.

Ceramic materials are also favored for their aesthetic versatility, allowing for a range of finishes and colors that suit contemporary and traditional bathroom styles. The growing awareness about hygiene and the demand for low-maintenance surfaces have further supported the adoption of ceramic-based furniture components.

As consumers seek long-lasting and sustainable materials, ceramic’s eco-friendly profile and recyclability have contributed to its expanding market share The segment’s growth is also being propelled by manufacturers’ innovations in ceramic formulations, enhancing both performance and design flexibility.

The medium price range segment is anticipated to hold 56.4% of the Bathroom Furniture market revenue share in 2025, positioning it as the largest pricing tier. This leading position is being influenced by the balance it offers between affordability and quality, catering to the broadest consumer base across middle-income households.

Products in this segment provide desirable aesthetics and durable materials without the premium cost associated with luxury furniture. The availability of a wide variety of styles and features at medium price points has made it accessible to both first-time buyers and those undertaking renovations.

Additionally, the growth of organized retail channels and e-commerce platforms has improved product accessibility and price transparency, further supporting this segment. The segment’s expansion is also fueled by rising consumer awareness of value-for-money products that do not compromise on design or functionality.

The bathroom furniture market is growing due to rising residential construction, home remodeling, and increasing consumer focus on aesthetics and functionality. Europe and North America lead in premium modular units, smart storage solutions, and durable materials. Asia-Pacific shows rapid growth driven by urbanization, rising disposable income, and the expansion of mid- to high-end housing. Manufacturers differentiate through design, material quality, space optimization, and multifunctionality. Market expansion is supported by lifestyle trends, bathroom modernization projects, and growing e-commerce penetration, with regional preferences influencing product design and marketing strategies.

Bathroom furniture varies in material, wood, MDF, PVC, metal, and stone, impacting durability, maintenance, and aesthetic appeal. Europe and North America prioritize moisture-resistant, long-lasting materials suitable for premium homes, emphasizing engineered wood and treated metals. Asia-Pacific often adopts cost-effective materials for mass-market furniture, balancing durability with affordability. Differences in material quality affect product lifespan, consumer satisfaction, and purchase decisions. Leading manufacturers invest in durable, eco-friendly materials with high-end finishes, while regional producers focus on affordability and local material availability. These contrasts shape adoption, brand positioning, and competitiveness across premium and volume-driven markets.

Compact and modular designs are crucial for maximizing space and functionality. North America and Europe favor modular units, floating vanities, and configurable storage solutions suitable for urban apartments and luxury bathrooms. Asia-Pacific markets prioritize simple, practical designs for smaller bathrooms, often targeting mid-range budgets. Differences in design flexibility affect usability, aesthetics, and consumer preference. Manufacturers offering modular, ergonomic, and customizable furniture capture premium segments, while regional suppliers cater to functional, cost-effective solutions. Design contrasts influence regional adoption, repeat purchases, and differentiation between high-end and mass-market offerings.

Bathroom furniture is sold through specialty stores, home improvement retailers, e-commerce platforms, and direct-to-consumer channels. Europe and North America rely on multi-channel strategies, including high-end showrooms, online customization, and professional installation services. Asia-Pacific emphasizes large retail chains, local distributors, and online marketplaces targeting emerging urban consumers. Differences in distribution affect pricing, availability, and brand visibility. Global suppliers use multi-channel strategies with logistics support to strengthen penetration, while regional producers focus on local accessibility. Distribution contrasts influence adoption rates, consumer reach, and long-term market growth.

Demand for bathroom furniture is shaped by lifestyle preferences, home renovation cycles, and urban living trends. Europe and North America emphasize contemporary, stylish, and multifunctional furniture aligned with luxury and smart home concepts. Asia-Pacific growth is driven by rising urbanization, middle-class expansion, and modernization of existing residential units, often with a focus on practicality and affordability. Differences in lifestyle and renovation behavior impact product development, marketing, and regional adoption. Suppliers offering designs tailored to consumer expectations gain competitive advantages, while regional producers meet basic functional requirements. Understanding these contrasts allows optimized product offerings, marketing strategies, and regional expansion plans.

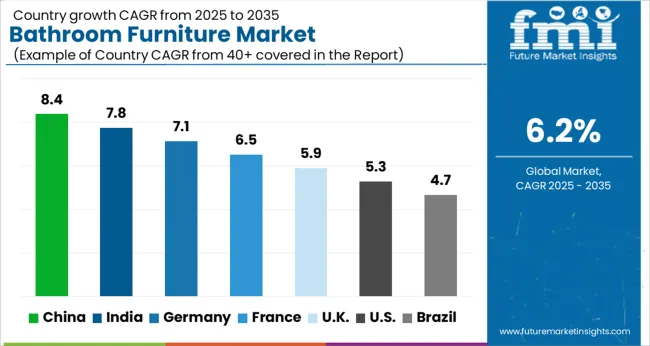

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

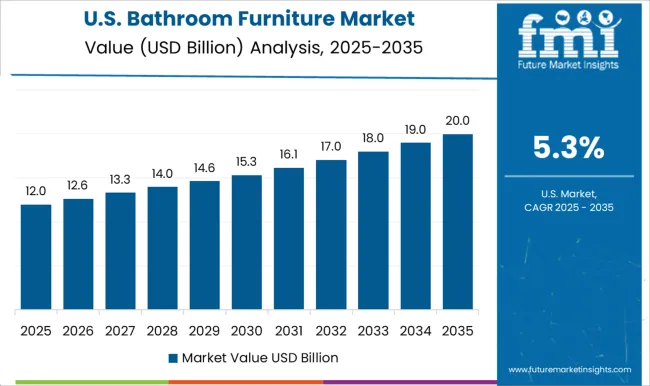

| USA | 5.3% |

| Brazil | 4.7% |

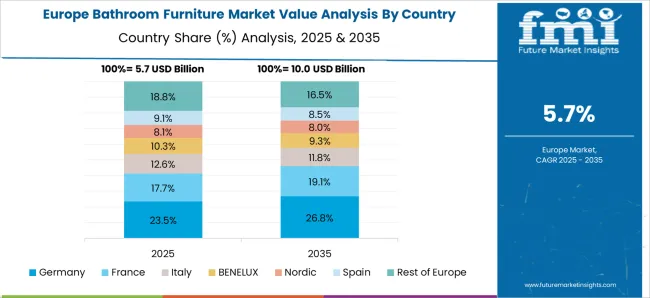

The global bathroom furniture market was projected to grow at a 6.2% CAGR through 2035, driven by demand in residential, commercial, and hospitality sectors. Among BRICS nations, China recorded 8.4% growth as large-scale production facilities were commissioned and compliance with product quality and safety standards was enforced, while India at 7.8% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 7.1% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 5.9% relied on moderate-scale operations for residential and commercial bathroom furnishings. The USA, expanding at 5.3%, remained a mature market with steady demand across residential and commercial segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Bathroom furniture market in China is growing at a CAGR of 8.4%. Between 2020 and 2024, growth was driven by rising urbanization, increasing disposable income, and demand for modern and space-efficient bathroom solutions. Manufacturers focused on modular, multifunctional, and high-quality materials such as wood, MDF, and moisture-resistant composites. E-commerce and retail chains expanded accessibility across tier-1 and tier-2 cities. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of smart, eco-friendly, and customizable bathroom furniture, along with expansion of residential and commercial real estate projects. Rising interior design trends, lifestyle upgrades, and preference for contemporary aesthetics will further support market growth. China remains a leading market due to large urban population, real estate development, and rising consumer preference for premium bathroom solutions.

Bathroom furniture market in India is growing at a CAGR of 7.8%. Historical period 2020 to 2024 saw growth supported by rising urban housing, increasing disposable income, and growth in real estate and hospitality sectors. Consumers preferred modular, space-efficient, and affordable bathroom furniture made from durable and moisture-resistant materials. Manufacturers focused on ergonomic, multifunctional, and aesthetic designs. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of eco-friendly, smart, and customizable furniture, along with expansion of premium residential and commercial projects. Increasing awareness of interior design trends, lifestyle upgrades, and organized retail penetration will further boost adoption. India is projected to maintain strong growth due to growing urban population, rising middle-class purchasing power, and real estate development.

Bathroom furniture market in Germany is growing at a CAGR of 7.1%. Between 2020 and 2024, growth was supported by rising consumer preference for modern, high-quality, and sustainable bathroom furniture, along with real estate development and renovation projects. Manufacturers focused on moisture-resistant, modular, and multifunctional furniture made from eco-friendly and durable materials. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of smart, customizable, and energy-efficient solutions integrated with sustainable interior design practices. Consumer focus on aesthetics, functional design, and premium quality will further support adoption. Germany remains a key European market due to high disposable income, strong real estate sector, and sustainability-driven purchasing behavior.

Bathroom furniture market in the United Kingdom is growing at a CAGR of 5.9%. During 2020 to 2024, adoption was driven by residential renovation projects, urban housing development, and growing awareness of modern interior design trends. Manufacturers focused on modular, safe, and aesthetic furniture suitable for compact spaces and contemporary designs. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of eco-friendly, customizable, and smart solutions integrated into new residential and commercial projects. Expansion of organized retail and e-commerce channels, along with rising consumer preference for functional and stylish furniture, will further support market development. The United Kingdom market demonstrates stable growth with emphasis on design, quality, and sustainability.

Bathroom furniture market in the United States is growing at a CAGR of 5.3%. Historical period 2020 to 2024 saw growth fueled by increasing home renovation projects, urban housing expansion, and rising demand for modern, multifunctional furniture. Manufacturers focused on durable, moisture-resistant, and modular solutions with aesthetic appeal. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of smart, customizable, and eco-friendly bathroom furniture integrated into residential and commercial projects. Growing interest in contemporary interior design, organized retail expansion, and lifestyle upgrades will further support market expansion. The United States market demonstrates consistent growth with emphasis on quality, design, and functional innovation.

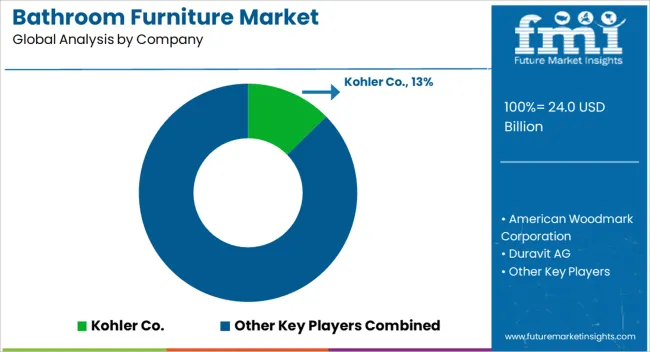

The bathroom furniture market is supplied by Kohler Co., American Woodmark Corporation, Duravit AG, Geberit Group, Hansgrohe SE, Ideal Standard International, Jaquar Group, LIXIL Corporation, Masco Corporation, Porcelanosa Group, Roca Group, Roper Rhodes Ltd., ROYO Group, TOTO Ltd., and Villeroy & Boch. Competition is influenced by design aesthetics, material quality, modularity, and ease of installation. Kohler and Duravit brochures highlight premium vanities, mirrors, and storage units with corrosion-resistant coatings. Hansgrohe and Geberit datasheets detail integrated faucets, water-saving features, and functional hardware systems. LIXIL and Jaquar emphasize customizable units, compact designs, and ergonomic solutions.

Observed patterns show rising demand for multifunctional and space-optimized furniture for residential and commercial bathrooms. Supplier strategies focus on innovation, market segmentation, and distribution efficiency. American Woodmark and Masco target mid-range markets with durable, cost-effective products. Porcelanosa, ROYO Group, and Villeroy & Boch prioritize luxury designs with high-quality finishes and coordinated collections. TOTO and Ideal Standard invest in smart storage solutions, modularity, and seamless integration with bathroom fixtures. Observed practices include e-commerce channels, partnerships with interior designers, and after-sales support to strengthen brand presence and adoption..

| Item | Value |

|---|---|

| Quantitative Units | USD 24.0 Billion |

| Product Type | Bath vanity, Console vanity, Vanity tops, Bathroom mirrors, and Others |

| Material | Ceramic, Glass, Stone, Wood, and Others |

| Price Range | Medium, Low, and High |

| Application | Residential, Commercial, and Others |

| Distribution channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kohler Co., American Woodmark Corporation, Duravit AG, Geberit Group, Hansgrohe SE, Ideal Standard International, Jaquar Group, LIXIL Corporation, Masco Corporation, Porcelanosa Group, Roca Group, Roper Rhodes Ltd., ROYO Group, TOTO Ltd., and Villeroy & Boch |

| Additional Attributes | Dollar sales vary by product type, including vanities, cabinets, mirrors, and shelving units; by material, spanning wood, MDF, metal, and acrylic; by application, such as residential bathrooms, hotels, and commercial facilities; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising home renovation activities, demand for modern and modular designs, and increasing disposable income. |

The global bathroom furniture market is estimated to be valued at USD 24.0 billion in 2025.

The market size for the bathroom furniture market is projected to reach USD 43.8 billion by 2035.

The bathroom furniture market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in bathroom furniture market are bath vanity, console vanity, vanity tops, bathroom mirrors and others.

In terms of material, ceramic segment to command 41.7% share in the bathroom furniture market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Vanities Market Analysis - Growth, Trends and Forecast from 2025 to 2035

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Furniture Polish Wipes Market Size and Share Forecast Outlook 2025 to 2035

Furniture Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Furniture Polish Market Analysis by Product Type, Source, End Use, Sales Channel, and Region Through 2035

Furniture Packaging Market Trends & Industry Growth Forecast 2024-2034

Pet Furniture Market Analysis - Growth & Trends 2025 to 2035

Cat Furniture and Scratchers Market Analysis – Trends, Growth & Forecast 2025 to 2035

Market Leaders & Share in the Pet Furniture Industry

Metal Furniture Market Size and Share Forecast Outlook 2025 to 2035

Patio Furniture Market Analysis - Trends & Growth Forecast 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA