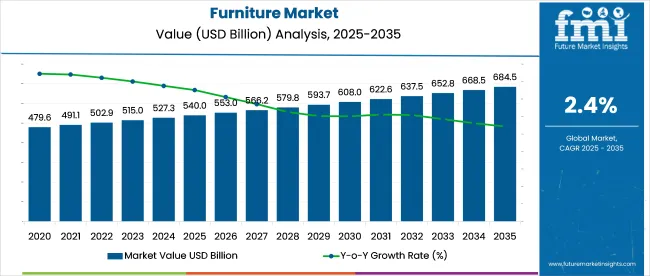

The global furniture market is expected to reach USD 684.5 billion by 2035 from its 2025 base of USD 540 billion with a forecasted CAGR of 2.4% from 2025 to 2035. The industry benefits from strong consumer sentiment in residential renovation, growing demand for multifunctional pieces, and evolving design preferences across indoor and outdoor categories.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 540 Billion |

| Market Size (2035) | USD 684.5 Billion |

| CAGR (2025 to 2035) | 2.4% |

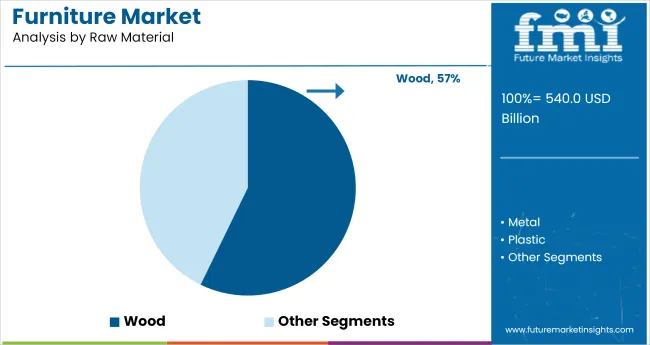

In 2025, wood emerges as the leading raw material, accounting for 57% of global sales due to its durability, traditional appeal, and aesthetic versatility across both residential and hospitality applications. Other raw materials such as metal and engineered plastics continue to gain relevance, especially in modular and lightweight designs for commercial settings.

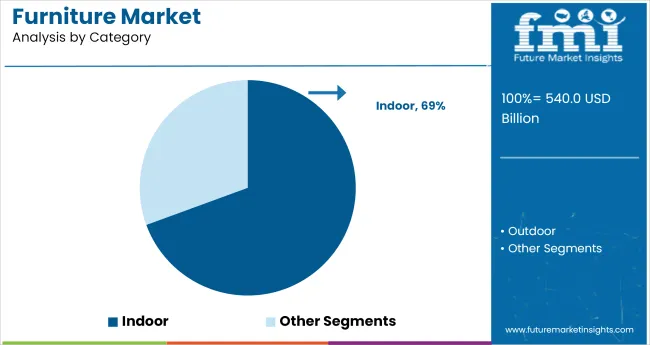

In terms of usage category, indoor furniture contributes 69% of the global revenue in 2025. Products like beds, sofas, tables, and wardrobes dominate, especially in urban households where frequent renovations and functional preferences shape buying behavior. Outdoor furniture continues to expand gradually, driven by increased patio furnishing, garden setups, and balcony usage in temperate zones and resort-based hospitality.

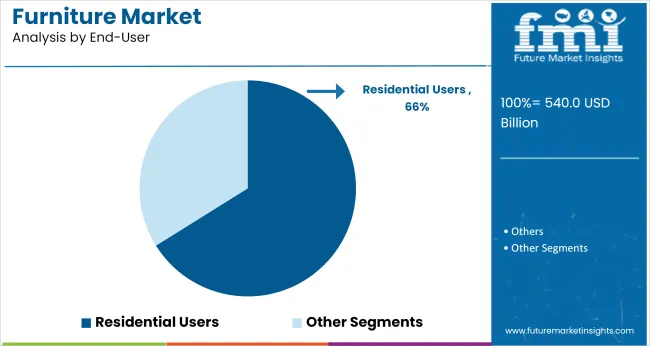

Residential end-users command a 66% share in 2025, making it the primary driver of revenue across both developed and emerging markets. Rising disposable incomes, enhanced access to e-commerce platforms, and increasing residential construction-especially in Asia Pacific and the Gulf region-are propelling this demand.

As per IKEA’s 2025 Sustainability Report, 97% of its wood is now FSC-certified or recycled, with VOC emissions reduced by 8% and logistics emissions down 12% YoY. IKEA is also transitioning to bio-based adhesives and aims for an 80% reduction in logistics emissionsby 2030. These efforts reflect a growing industry emphasis on low-emission materials, quality assurance, and efficient sourcing, particularly in North America and Europe.

The furniture market captures 42% of the interior design and decoration market and 38% within home and living, driven by sustained demand for functional and aesthetic furnishings across residential and mixed-use developments. In the hospitality and commercial infrastructure sector, a 34% share reflects bulk procurement across hotels, offices, and institutional facilities.

A 29% contribution to the wood and wood-based products market highlights high material dependency, particularly for hardwood and engineered panels. Within the broader consumer goods market, furniture comprises just 11%, indicating lower frequency of purchase. Its 8% share in construction materials and 5% in real estate links to post-occupancy capital spend.

The furniture market is segmented by raw material into wood, metal, plastic, and others, with wood leading due to high consumer preference for durability and design versatility. Category-wise, indoor furniture dominates, driven by demand for living room, bedroom, and modular office setups. Among end users, the residential sector holds the largest share, accounting for over 60% of total demand globally.

Wood is projected to command 57% of the global furniture market by 2025, but it faces competition from plastic and metal in cost-sensitive and commercial use-cases. Hardwood (e.g., oak, walnut) continues to dominate premium ranges for durability and aesthetics, while engineered wood (MDF, particleboard) supports budget and modular solutions.

In contrast, metal is gaining traction in institutional and outdoor furniture for its strength and low maintenance, particularly in healthcare and educational spaces. Plastic furniture, while declining in high-end indoor use, is still preferred in low-income and semi-outdoor environments due to price and portability. Sustainability drives a growing shift to FSC-certified wood, especially in the EU and North America.

Indoor furniture leads with 69% of market share in 2025, supported by demand for bedroom sets, living room units, and home-office setups. Rising urban density boosts demand for modular, multifunctional furniture in small apartments. Meanwhile, outdoor furniture is a fast-growing but still niche segment, especially in luxury real estate, hospitality, and premium homes.

Climate-resilient finishes and water-resistant woods are expanding its use cases. Still, indoor products generate higher repeat purchases and customization demand. The contrast lies in volume versus value - indoor furniture drives mass volume; outdoor focuses on premium, seasonal, and hospitality-led orders.

Residential applications account for 66% of total market value in 2025. This includes homeowners and renters purchasing furniture for living, bedroom, and study purposes. Urban millennials favor minimalist, smart furniture that blends aesthetics and storage. In contrast, commercial and institutional buyers prioritize durability and functionality over design.

Hotels, offices, and schools increasingly demand standardized, stackable, and easy-to-clean furniture, often made from metal or composite materials. The residential segment leads innovation, while the commercial segment favors cost-efficiency and regulatory compliance (e.g., fire retardant certifications).

Material-conscious buying, connected features, and layout flexibility are reshaping the furniture market. Buyers are prioritizing natural builds, functional add-ons, and customizable formats suited to evolving lifestyle and space needs.

Natural Material Preference Shaping Buying Behavior

Consumers are showing a strong preference for furniture made from natural and responsibly sourced materials. Brands are introducing items built with reclaimed wood, fast-growing timbers, and low-impact finishes. Buyers are asking for furniture free from harmful chemicals, encouraging the use of water-based coatings and solid wood frames. Furniture makers are also focusing on reusability and long-lasting designs. This shift is changing product development strategies, store assortments, and marketing messaging to meet new consumer standards.

Connected Features Becoming Everyday Expectations

Furniture with built-in features is being requested by buyers who seek ease and comfort in their living spaces. Items like coffee tables with USB ports, beds with reading lights, and desks with charging docks are now standard in many product lines. Households are selecting products that serve more than one use, such as sofas that become beds or dining tables with hidden storage. This demand is influencing furniture designers to blend form with everyday functionality.

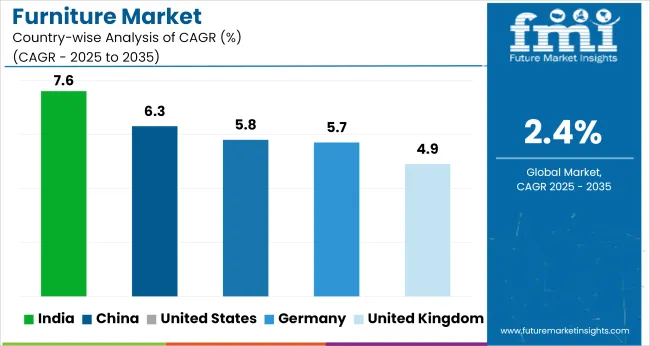

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| United Kingdom | 4.9% |

| Germany | 5.7% |

| China | 6.3% |

| India | 7.6% |

While the global furniture market is projected to grow at a modest 2.39% CAGR from 2025 to 2035, BRICS and emerging economies are setting a distinctly faster pace. India leads all major markets with a 7.6% CAGR-over three times the global average-driven by rising residential construction, a booming online furniture segment, and formalization of unorganized carpentry networks. China follows at 6.3%, with strong export recovery, rising domestic customization demand, and regional hub expansion in Tier 3 cities.

The United States, an OECD member, is forecast at 5.8%, led by aging home replacements, modular designs, and growth in urban rental housing. Germany and the United Kingdom trail slightly, growing at 5.687% and 4.93% respectively, reflecting higher market maturity, slower household formation, and tighter sustainability regulations.

In contrast, India’s growth premium of +217% over the global average signals a long runway, especially as organized retail penetration remains under 25% compared to over 70% in the USA. The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The furniture market in the United States is projected to expand at a CAGR of 5.8% from 2025 to 2035, supported by lifestyle shifts toward compact living and mobile-friendly interiors. Over 60% of renters now prefer modular options to accommodate space limitations and job mobility. Renovation-driven upgrades remain common among aging homeowners focused on comfort and safety.

Digital-first platforms contribute more than 30% of total sales, offering fast customization. Growth in suburban housing also boosts demand for adaptable furniture formats. The domestic supply base is scaling to serve regional preferences and faster fulfillment across key urban zones.

Projected to grow at a CAGR of 4.93% between 2025 and 2035, the furniture industry in the United Kingdom is being reshaped by hybrid work culture and import substitutions. Nearly 28 % of buyers now opt for refurbished or upcycled furniture, aligning with practical reuse. Compact apartments in cities demand functional yet stylish solutions, while home offices drive growth in ergonomic product lines.

Local manufacturers now fulfill 45% of internal demand, aided by Brexit-induced import limitations. Modular and tool-free assembly furniture is gaining popularity among mobile renters and young professionals across London, Manchester, and Birmingham.

The furniture sector in China is expected to grow at a CAGR of 6.3% from 2025 to 2035, driven by dual momentum in domestic and export markets. More than 40% of new launches cater to tier-3 and tier-4 cities where compact spaces and price sensitivity influence designs.

Export volume rebounded by 12% post-2024, particularly from the European Union. Localized production hubs in Shandong and Guangdong have improved fulfillment speeds and lowered logistics costs. Smart layouts, embedded storage, and dual-purpose components dominate catalogues, meeting the evolving expectations of space-conscious households and value-focused international clients.

Recording a projected CAGR of 7.6% from 2025 to 2035, the furniture market in India is expanding due to rapid urbanization, rising income levels, and digital retail adoption. Organized brands are replacing fragmented carpentry services by offering cost-effective, ready-to-assemble products with modern aesthetics.

Less than 25% of the market is formal, offering immense headroom for growth. E-commerce platforms see over 20% annual increases in order volume, especially in tier-2 and tier-3 cities. Infrastructure schemes such as Smart Cities and PLI initiatives support localized production, allowing brands to deliver fast, affordable furniture tailored to small-space living.

Expected to expand at a CAGR of 5.7% from 2025 to 2035, the furniture industry in Germany is guided by quality assurance, minimalism, and environmental compliance. Over 70 % of new designs meet formal certification standards, responding to buyer demand for safety and durability.

In cities such as Berlin and Hamburg, space constraints have driven growth in convertible and stackable furniture options. Circular production increased by 22% in 2024, with institutions driving large-scale procurement. Manufacturers continue to lead in the European mid-premium segment by integrating engineering precision with clean-line product aesthetics.

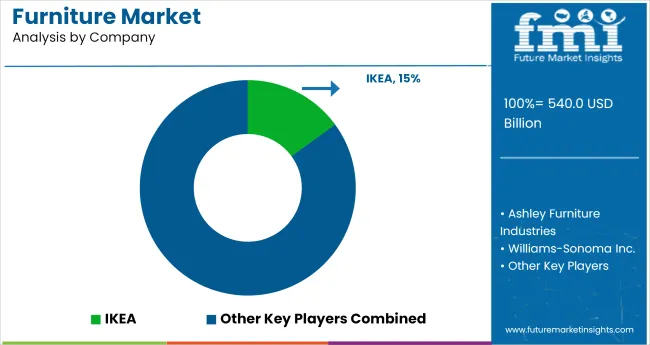

Leading Company - IKEA

Market Share - 15%

The global furniture market is dominated by leading players such as IKEA, Ashley Furniture Industries, and Williams-Sonoma Inc., known for their large-scale manufacturing, design innovation, and omnichannel retail presence. These dominant companies drive growth through affordable modular designs, sustainable sourcing, and global supply chains.

Key players including Steelcase Inc., Herman Miller Inc. (MillerKnoll), and HNI Corporation focus on ergonomic solutions, commercial furniture, and workspace innovation. Emerging players such as Godrej Interio, Häfele, La-Z-Boy Inc., and Okamura Corporation cater to regional markets with custom offerings, smart furniture solutions, and rising e-commerce integration. Growth is supported by urbanization, lifestyle upgrades, and demand for multifunctional designs.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 540 Billion |

| Projected Industry Size (2035) | USD 684.5 Billion |

| CAGR (2025 to 2035) | 2.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Billion for Value, Million Units for Volume |

| Raw Material Segments (Segment 1) | Wood, Metal, Plastic, Others |

| Category Segments (Segment 2) | Indoor, Outdoor |

| End-User Segments (Segment 3) | Residential, Others (Commercial, Institutional, Hospitality) |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, Italy, China, India, Japan, Australia, Brazil, Mexico, South Korea, South Africa, Saudi Arabia, UAE |

| Key Players Influencing the Market | IKEA, Ashley Furniture Industries, Williams-Sonoma Inc., Steelcase Inc., Herman Miller Inc. (MillerKnoll), HNI Corporation, Godrej Interio, Häfele, La-Z-Boy Inc., Okamura Corporation |

| Additional Attributes | Includes dollar sales, segment share, growth in modular, e-commerce penetration, demand for sustainable raw materials, home-office trends, and expansion of organized furniture retail |

This segment is categorized into wood, metal, plastic, and other materials.

The segmentation includes indoor and outdoor categories.

This segment covers residential users and other end-use sectors such as commercial or institutional applications.

The regional segmentation includes North America, Latin America, Europe, the Middle East and Africa, East Asia, South Asia, and Oceania.

The Industry is expected to be valued at USD 540 billion in 2025.

The Industry is forecast to reach USD 684.5 billion by 2035.

The Industry is projected to grow at a CAGR of 2.4% over the forecast period.

Indoor segment holds 69% of the Industry share in 2025.

IKEA is the leading company with a 15% Industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Furniture Polish Wipes Market Size and Share Forecast Outlook 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Furniture Polish Market Analysis by Product Type, Source, End Use, Sales Channel, and Region Through 2035

Furniture Packaging Market Trends & Industry Growth Forecast 2024-2034

Cat Furniture and Scratchers Market Analysis – Trends, Growth & Forecast 2025 to 2035

Pet Furniture Market Analysis - Growth & Trends 2025 to 2035

Market Leaders & Share in the Pet Furniture Industry

Metal Furniture Market Size and Share Forecast Outlook 2025 to 2035

Patio Furniture Market Analysis - Trends & Growth Forecast 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Camping Furniture Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Bedroom Furniture Market

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Contract Furniture Market Analysis by Product Type, End-users, Distribution Channel, and Region from 2025 to 2035.

Entryway Furniture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA