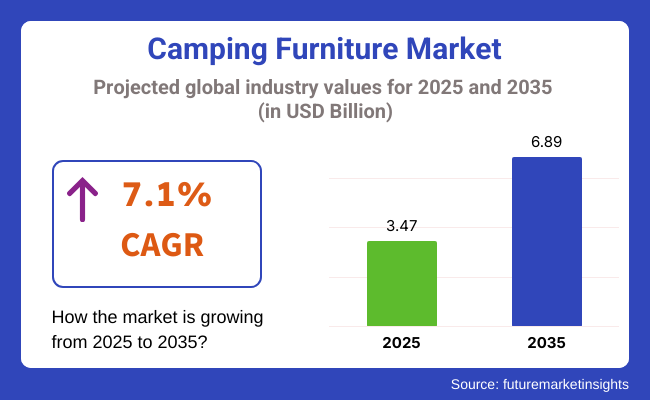

The global camping furniture market size was valued at USD 3.47 billion in 2025 and is expected to grow at a 7.1% CAGR from 2025 to 2035. The industry is expected to reach USD 6.89 billion by 2035. A key driver for this growth is the rising consumer interest in outdoor recreational activities, driven by increasing awareness of physical and mental health benefits associated with nature-based experiences.

There were innovations in product design, materials, and portability. Lightweight aluminum frames, foldable construction, and modular features have become standard offerings, catering to the growing demand for convenience and functionality. As consumers prioritize comfort and easy setup, ergonomic design elements are becoming a decisive factor in purchasing decisions.

Environmental sustainability is also shaping product development, with brands integrating recyclable materials, biodegradable fabrics, and eco-conscious manufacturing methods. This aligns with the values of environmentally conscious outdoor enthusiasts who are willing to invest in gear that aligns with their sustainability ethos. As regulations tighten and consumer awareness rises, sustainability is transforming from a differentiator into an expectation.

Digital retail and influencer-driven marketing strategies have further accelerated sales penetration. The rise of adventure content creators and social media-driven outdoor culture has promoted the aesthetic and practical appeal of premium camping setups. This digital amplification is particularly influential among millennials and Gen Z, who represent a significant share of new entrants into the camping lifestyle.

Geographic expansion is also notable, with Asia-Pacific emerging as a key growth region due to urban stress factors and the increasing popularity of weekend getaways. Markets in North America and Europe remain dominant, but product customization and rental-based outdoor gear services are opening new channels for revenue generation globally. The outlook for camping furniture remains robust, driven by the fusion of leisure trends and innovation-led mobility solutions.

It is forecasted that camping chairs and stools will account for 48.6% of the total share of camping furniture, whereas tables will capture only 14.8% of the share.

Camping furniture is characterized by chairs and stools, which primarily differ by their role: providing comfort and portability when going outdoors. Built to be lightweight for easy carrying and fast setting up, products with these qualities are essential for campers seeking convenience. Common types include folding chairs, camping stools, and lounge chairs, which offer preferences for easy use, comfort, and compact storage.

Popularly known brands like Coleman, REI, and GCI Outdoor are into innovation by including features like cup holders, reclining functions, and built-in storage for their models in this segment. A rise in adventure tourism and wellness vacations further fuels growth in camping and outdoor recreational interests.

Tables amount to yet a smaller share of the whole at 14.8%, but they're often packaged with chairs or stools to provide that important surface for dining and food preparations or other activities at the campsite. Portable, foldable, and lightweight camping tables do exist, but their need is usually lower than that for other seating comfort and convenience items.

However, camping tables from brands such as REI and Coleman that boast easy assembly, stability, and compactness continue to be available for that rare occasion when an individual goes camping with family or friends and requires a surface for dining and cooking.

The camping furniture market is expected to see maximum contribution from offline sales, as offline sales are projected to account for 69.5% of the total share in 2025. Online sales would capture the remaining 30.5%.

As a result of the nature of camping products, offline sales remain the dominant distribution channel because camping is usually first viewed and then purchased. For example, camping chairs and tables are essential factors in determining comfort, durability, and ease of use concerning the intuition of the product.

Expected frontrunners will be brick-and-mortar stores such as REI, Dick's Sporting Goods, and Walmart, which will showcase the tested furniture in person to meet consumers' quality and usability benchmarks. The affiliated stores mentioned usually have an immediacy of availability; hence, this is also important for customers who are buying a camping product in a rush. All in all, in-store promotional campaigns and expert staff advice at times become very significant for these strong offline sales.

With a 30.5% revenue share, online sales will be driven by the growth in E-commerce and by increasing convenience to shop from home. Key players in the space are platforms such as Amazon and eBay, as well as specialized outdoor retailers like Backcountry and the REI online store.

Major contributors to the increase in online sales are convenience in comparing prices, home delivery, and customer access to reviews. Furthermore, e-commerce has contributed to the expansion of the variety of products available. It makes it easy for consumers to find camping furniture that they would otherwise not have seen in stores near them.

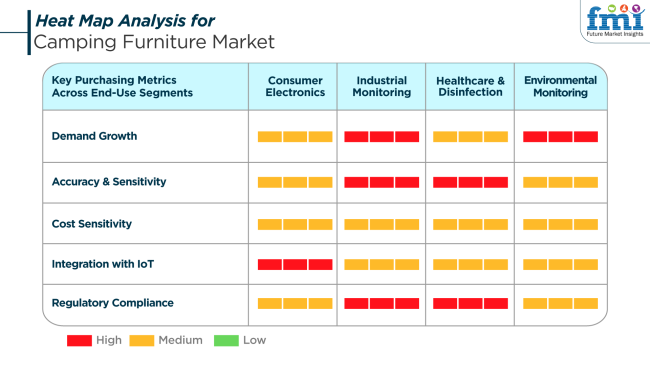

Key Purchasing Metrics Across End-Use Segments

A wide product choice across various end-use contexts reflects evolving user preferences and technical standards. In consumer electronics-linked use cases-like smart furniture for outdoor experiences-there is growing emphasis on integrating solar charging panels and IoT connectivity. These hybrid products, often sought by tech-savvy outdoor enthusiasts, combine convenience with innovation, resulting in strong demand but moderate cost sensitivity.

Industrial and environmental monitoring applications, although less conventional for camping furniture, are growing niche segments. In fieldwork and remote inspection scenarios, rugged and foldable furniture is used to support workforce mobility, requiring very high regulatory compliance and material durability.

The demand in these sectors is significantly influenced by functionality and adaptability to tough environments. Healthcare and disinfection-focused outdoor settings, such as field hospitals or remote medical camps, emphasize high hygiene standards and ergonomic design. Here, material selection, ease of cleaning, and compact transportability are critical decision-making parameters. As such, these segments demand precision in quality, although budget constraints still shape procurement volumes and vendor selection.

The industry exhibits growth but is exposed to a range of operational and strategic risks that may moderate expansion. One of the most pressing concerns is supply chain volatility, especially regarding raw material costs for aluminum, fabrics, and eco-sustainable components. These disruptions, often driven by geopolitical tensions or climate-linked disasters, can inflate production costs and delay delivery schedules.

Another key risk involves fluctuating consumer behavior tied to macroeconomic cycles. During economic downturns or periods of inflation, discretionary spending on leisure and outdoor gear tends to decline, directly impacting sales volumes. This cyclical sensitivity necessitates agile inventory and pricing strategies to sustain profitability through demand fluctuations. In addition, an increasing reliance on online channels and influencer ecosystems brings digital risk into focus.

Poor online reviews, misinformation, or product recalls can quickly tarnish a brand's reputation in this socially amplified space. Companies must, therefore, invest in robust digital engagement, quality assurance, and responsive customer service frameworks to mitigate reputational threats and ensure consumer trust in a highly visual and feedback-driven environment.

During 2020 to 2024, the global camping furniture market experienced continuous growth, fueled by increasing participation in outdoor recreational activities and growing camping popularity. Customers required convenient, durable, and comfortable units of furniture to enhance outdoor activities. Innovations with lightweight materials, folding varieties, and multi-function pieces of furniture addressed various requirements of campers.

During 2025 to 2035, the industry will see many innovations. Technology innovation is expected to develop smart camping chairs with built-in features such as solar power charging ports, speakers, and temperature management systems. Sustainability is going to become a focal area, with players investing in greener materials and manufacturing processes. Besides, the incorporation of camping furniture in holistic outdoor living solutions will further increase their appeal, making them a vital part of contemporary camping experiences.

Comparative Market Shift Analysis: Camping Furniture Market 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus: Greater focus on portability, toughness, and comfort. | Technological Integration: Integration of intelligent features such as solar power charging and onboard speakers. |

| Material Innovations: Deploy lightweight and collapsible materials to allow ease of mobility. | Sustainability Initiatives: Adopt eco-friendly materials and manufacturing processes. |

| Customer Demographics: Exclusively marketed to recreational campers and outdoor men. | Expanded Demographics: Larger customer base of high-technology knowledgeable campers and earth-friendly customers. |

| Distribution Channels: Expansion of websites, making them easier to access. | Built-In Outdoor Solutions: Integration of camping furniture into packaged outdoor living solutions. |

| Key Drivers: Growing outdoor activity participation and need for improved camping experiences. | High-Tech Outdoor Living: Intelligent camping furniture as part of complete outdoor living environments. |

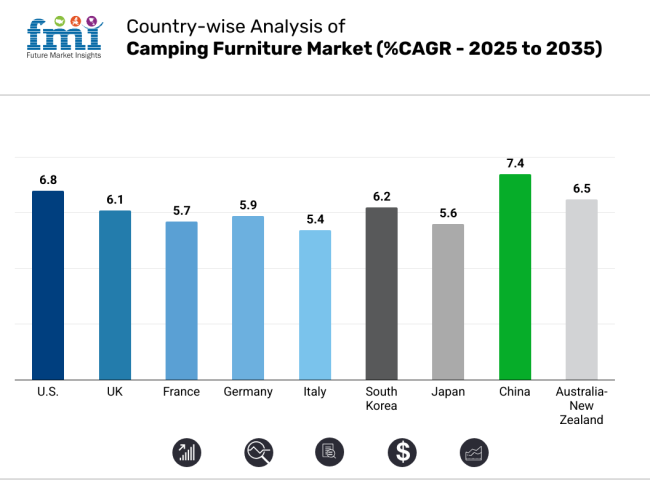

The USA will register a growth of 6.8% CAGR throughout the study. The high incidence of outdoor recreational activities, established camping culture, and high disposable income among the population are some of the most pivotal factors driving growth. The increasing trend towards glamping and RV camping trips has been driving demand for portable and multifunctional furniture. An increase in green consumerism is driving product innovation towards eco-friendly materials and ergonomically designed products.

The availability of leading manufacturers and robust retail distribution in digital and physical channels increases product availability and visibility. Ongoing innovation in collapsible chairs, modular tables, and light materials reinforces growth. Growing focus on outdoor experiences after the pandemic has further cemented camping as a recreational preference, increasing demand through seasonal and off-season travel. The shift towards high-end outdoor equipment also drives the upswing in premium camping furniture segments.

The UK is anticipated to register a growth of 6.1% CAGR throughout the study. An increased interest in staycations and weekend camping has increased the demand for camping furniture. The increasing trend of eco-tourism and "staycation" culture continues to drive the sale of foldable chairs, portable tables, and mobile kitchen installations. Positive government initiatives towards outdoor leisure and access to protected parks aid growth.

Local players are increasingly emphasizing green and space-saving furniture that appeals to environmentally conscious customers. The UK's high level of smartphone penetration and e-commerce growth also facilitates digital engagement and easy consumer access to varied product ranges. Higher involvement in group activities like music festivals and outdoor events adds further impetus to growth by creating a parallel demand for mobile comfort products.

France is anticipated to develop at 5.7% CAGR throughout the study. France has a large camping culture, with coastal and inland areas providing extensive opportunities for camping. There is support from a large number of registered campsites and a growing culture of nature escapes. Consumer trends towards health- and wellness-focused outdoor activities provide a thrust for product adoption.

Furniture tastes highlight practicality and smallness in view of touring arrangements and sparse carrying capacity within leisure vehicles. France's dominant artisanal and environmentally conscious industrial foundation facilitates the entry of robust and eco-friendly furniture. Heavy volumes of tourism to picturesque areas like Provence and the French Alps create high levels of demand for the product through diverse consumer markets involving local thrill-seekers and foreign travelers.

Germany is predicted to develop at 5.9% CAGR throughout research. Germany's organized camping network, combined with a road culture and environmentally conscious lifestyle, drives high product penetration. The industry is boosted by demand for durability, quality, and functional design appropriate for use outdoors for extensive periods.

German customers value ergonomics, weather resistance, and portability in outdoor furniture for camping purposes, driving demand for multifunctional products. Traditional home and lifestyle brands are using this clientele to introduce outdoor-focused ranges of furniture.

Furthermore, the rise in nature holidays and low-impact holidays further enhances sales, specifically in stores that have maintained a balanced mix of products through the intensified import of high-quality global brands.

Italy is anticipated to grow at 5.4% CAGR throughout the study. Increased interest in lifestyle tourism, including agri-tourism and rural outdoor accommodations, has been driving the trend for camping furniture. Italy's pleasant climate and wide-open countryside provide ample camping grounds, particularly in central and southern areas.

Italian consumers prefer lightweight, good-looking products that resonate with local design values. The industry gains momentum among family-centric and adventure-driven consumer bases, driving demand for modular tables, adjustable lounge chairs, and space-saving kitchen utilities. Increased investments in camping resorts and environmental retreats support demand for commercially quality outdoor furnishings.

South Korea is anticipated to expand at 6.2% CAGR over the period under review. The increasing popularity of outdoor activities like car camping and minimalist camping stays is propelling demand for mobile and design-oriented camping furniture. Innovation is something that South Korean consumers admire, and hence, they have embraced technology-infused furniture like solar charging tables or temperature control seating.

A robust culture of online opinions and influencer-driven marketing propels brand exposure and product discovery. Small residential spaces in urban environments further mean demand for collapsible and multifunctional camping products, as consumers prioritize space efficiency even in outdoor settings. Manufacturers are counteracting with lightweight materials, stylish designs, and weather-resistant functionality attuned to domestic tastes.

Japan is anticipated to expand at 5.6% CAGR throughout the study. Camping culture in Japan, focused on single and simple outdoor activity, hugely increases the demand for stylish and compact camping furniture. Consumer attraction is based on silent design, multipurpose nature, and convenient storage, consistent with more extensive cultural ideals of simplicity and neatness.

An older population that has the power and available time to try outdoor activities drives consistent growth. Japanese manufacturers also spend a lot on quality, so there are high build standards and material usage. Online platforms with interactive product content also fuel growth by making it easy for consumers to discover and buy.

China is expected to grow at 7.4% CAGR during the study period. China is experiencing rapid growth in outdoor lifestyle adoption, with urban populations increasingly engaging in camping, RV travel, and hiking-based tourism. There is a growing demand across mid-range and premium categories of camping furniture, particularly among millennials and Gen Z consumers seeking experiential leisure.

Government incentives for local tourism and park infrastructure fuel growth. Brands are introducing diversified product offerings suited to new and experienced campers alike, with an emphasis on modularity and sustainable materials. Robust digital retailing ecosystems and social commerce also drive pan-urban product visibility and acceptance in both Tier 1 and Tier 2 cities.

The Australia-New Zealand region is likely to grow at 6.5% CAGR throughout the study. Both nations have a strong culture of outdoor lifestyle, which is deeply rooted in the behavior, with beachside vacations, off-grid touring, and year-round camping contributing heavily to recreational activity. There is a strong demand for durable, easy-to-assemble, and comfortable furniture solutions.

Local producers concentrate on high-quality outdoor materials suitable for handling erratic weather patterns. Expansion is further facilitated by growth in domestic holidays, particularly in rural and beach areas. Buyers' focus on portability and convenience guarantees consistent demand for light, storage-integrated seating and recliners. Availability in-store through specialty adventure stores and website channels boosts coverage and access.

The outdoor camping furniture industry is extremely fragmented, with numerous well-established players competing for their revenue share based on developing innovative, sturdy, and light products for adventure seekers. Major players are leveraging the increased popularity of outdoor leisure activities, including camping, hiking, and picnicking, to develop sophisticated designs that focus on comfort, portability, and user-friendly features.

Coleman Company, Inc., with its rich tradition of outdoor equipment, has a monopoly in the industry with products that appeal to a broad base of consumers, from the casual camper to the extreme adventurer. ALPS Mountaineering is dedicated to providing value for money and high-quality products that will appeal to price-sensitive buyers in North America and Europe.

Oase Outdoors ApS, on the other hand, has carved out a niche with its Scandinavian designs, which offer long-lasting, practical camping furniture that responds to the demands of the modern camper. Companies like GCI Outdoor and Johnson Outdoors are gaining traction with innovative products like ergonomic seating and space-saving solutions targeting convenience and comfort.

Other new entrants like Helinox are also gaining consumers with minimalist, high-performance camp furniture for the serious backpacker. Alternatively, companies like REI Co-op and Kamp-Rite continue to be competitive in specialty segments with a strong emphasis on green materials and specialty camping gear.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Coleman Company, Inc. | 18-22% |

| ALPS Mountaineering | 12-15% |

| Oase Outdoors ApS | 10-13% |

| Johnson Outdoors Inc | 8-10% |

| GCI Outdoor | 7-9% |

| Other Players | 30-35% |

Key Company Insights

Coleman Company, Inc. is leading in the market with an average market share of 18-22%. The company's long history of making quality, reliable camping gear has kept it on top. Its extensive distribution system and comprehensive line of products, including chairs, tables, and sleeping cots, keep Coleman the first choice among frequent campers as well as occasional campers.

ALPS Mountaineering enjoys a good 12-15% market share through its reputation for delivering affordable, sturdy camping furniture appealing to price-conscious buyers. It has a solid base in North American and European markets and has gained a competitive advantage by continually delivering high-quality goods at affordable prices. Oase Outdoors ApS maintains about 10-13% market share, focusing on Scandinavian aesthetics and functional, long-lasting furniture.

The firm's dedication to quality and innovation, along with innovative products such as ultra-light chairs and multipurpose camping tables, has helped it establish a strong market position. Johnson Outdoors Inc. enjoys a market share estimated at 8-10% that is reinforced by its strong brand portfolio of Eureka! and Jet boil. Its focus on light, compact outdoor recreation solutions has allowed it to establish a competitive niche in the marketplace.

GCI Outdoor retains a market share of approximately 7-9%, highly appreciated for its ergonomically shaped, innovative collapsible chairs and tables. Having patented technologies such as the Eazy-Set system, GCI continues to attract campers who appreciate convenience as well as comfort.

The market is segmented into Chairs & Stools, Tables, Cots & Hammocks, and Others.

The market is divided into Online and Offline channels.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Portable camping chairs & stools dominate the global market with a 47.90% market share.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camping and Caravanning Market Analysis - Size, Share, and Forecast 2025 to 2035

Leading Providers & Market Share in Camping and Caravanning Industry

Furniture Polish Wipes Market Size and Share Forecast Outlook 2025 to 2035

Furniture Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Furniture Polish Market Analysis by Product Type, Source, End Use, Sales Channel, and Region Through 2035

Furniture Packaging Market Trends & Industry Growth Forecast 2024-2034

Cat Furniture and Scratchers Market Analysis – Trends, Growth & Forecast 2025 to 2035

Pet Furniture Market Analysis - Growth & Trends 2025 to 2035

Market Leaders & Share in the Pet Furniture Industry

Metal Furniture Market Size and Share Forecast Outlook 2025 to 2035

Patio Furniture Market Analysis - Trends & Growth Forecast 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Bedroom Furniture Market

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA