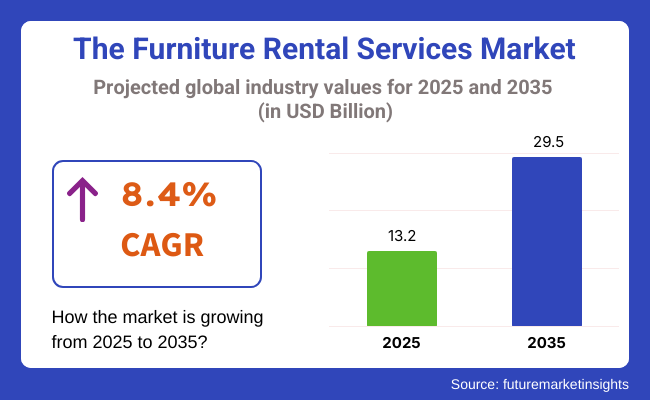

The furniture rental services market size was USD 13.2 billion in 2025 and is expected to grow at an 8.4% CAGR during the period from 2025 to 2035. The global furniture rental services industry valuation is expected to reach USD 29.5 billion by 2035. The high-volume key driver behind this growth is the rising adoption of flexible living solutions among millennials and working professionals, primarily in urban areas.

With the growing mobility of housing and the increasing popularity of the sharing economy, consumers are looking towards access-based ownership, and it is spurring the increase in demand for rentable furniture. The industry is undergoing a radical transformation influenced by the digitization of rental sites, simplification of booking, subscription-style business models, and rapid delivery offerings.

These technological advancements are decreasing traditional pain points when it comes to furniture rentals and is exceptionally compatible with digitally born consumer expectations. Moving towards sustainable living has also increased interest in rental models, creating sustainability and circular usage patterns.

Corporate and commercial sectors are also drawing on furniture rental services to accommodate dynamic office layouts and shifting occupancy needs. Businesses are avoiding high-capital investments in permanent furniture setups, instead preferring the flexibility and cost-effectiveness of rental solutions to meet temporary office expansions, pop-ups, and events.

Moreover, growing urbanization across developing economies is encouraging younger groups to adopt furnished rental apartments, driving the demand for subscription-based furniture leasing. These trends are commonplace in city centers across the Asia-Pacific and North America, where young professionals are more than willing to sacrifice flexibility, convenience, and affordability for traditional ownership.

With rising consumer consciousness, market players are also enhancing service offerings with respect to tailored packages, short- and long-term leasing, and buy-back options. All these tactics are expected to tap further market potential, with operators eyeing more tier 2 and tier 3 cities and mature metropolitan hubs. Overall, these emerging market forces position the furniture rental services market for stable and ongoing expansion up to 2035.

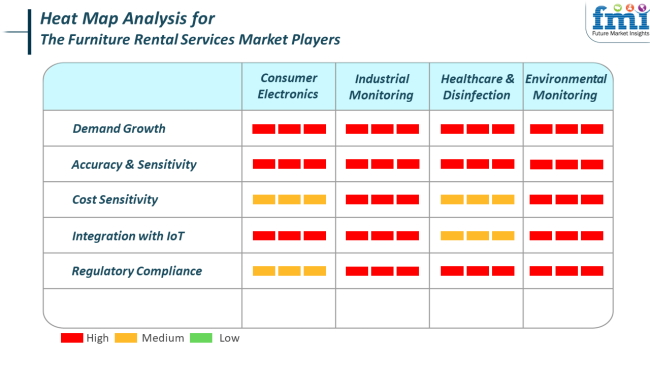

As the furniture rental services industry becomes more digitized, end-use applications are becoming increasingly varied and sector-specific, demanding tailored value propositions. Consumer electronics firms seek high-demand, technology-enabled setups that can flexibly accommodate evolving home office needs. Service providers integrated IoT functionality and smart furniture features in urban environments.

In industrial monitoring, modularity and compliance are dominant factors influencing purchase criteria. Organizations prioritize high accuracy, regulatory adaptability, and fast deployment over aesthetics. These preferences drive High demand growth in this segment, especially for project-based rentals and temporary operational sites.

In healthcare and disinfection environments, the demand is centered on hygienic, sterilizable furnishings with precise functionality and adherence to stringent health regulations. These sectors demand high accuracy and regulatory alignment but tend to be less concerned with aesthetic integration or home-style personalization compared to residential segments.

The furniture rental services industry has a promising growth trajectory but faces a range of potential risks that could impact its scalability. One primary challenge is the dependency on urbanization and workforce mobility, which can fluctuate due to macroeconomic shifts, housing affordability issues, or remote work normalization. Should these trends plateau or reverse, consumer appetite for rental solutions may weaken.

Operational risks also present a barrier, particularly in logistics management, warehousing, and asset lifecycle costs. Maintaining high-quality furniture inventory and ensuring timely delivery, assembly, and retrieval across dispersed urban regions require robust infrastructure and continuous reinvestment. Companies failing to optimize these backend operations may experience margin erosion and customer dissatisfaction.

Lastly, regulatory uncertainties and consumer data privacy risks linked to digital rental platforms could affect long-term trust and scalability. As these platforms collect and manage sensitive user data, any breach or misuse could result in reputational harm and legal complications. Ensuring compliance with data regulations and maintaining cybersecurity standards is crucial to the market’s sustained credibility and growth.

Between 2020 and 2024, the Furniture Rental Service sales grew significantly, fueled by rising urbanization, a growth in the gig economy, and a desire for flexible living styles. The COVID-19 pandemic also contributed to the demand for home office furniture rental in the form of a rapid rise in the rate of work from home.

Firms such as Rentomojo and Furlenco took advantage of this by embracing subscription models, offering consumers hassle-free and cost-effective furniture choices. Sustainability too joined the fray, and people decided to choose renting alternatives to prevent wastage and damage to the environment.

In moving to 2025 to 2035, the industry will also keep changing due to advanced technology and the behavior of consumers. IoT and AI integration will ensure customized suggestions for furniture and smart inventory management. Innovation in the circular economy will also increase demand for furniture rental as a sustainable option compared to owning it. Apart from that, further adoption of co-living and coworking spaces will drive short-term and flexible renting demand for furniture. Companies will introduce more customizable and modular furniture to suit shifting consumers' needs.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Urbanization, growth of the gig economy, remote working trends, and green concerns. | Increased tech improvements, increased take-up of the circular economy, and growth in co-living/coworking spaces. |

| Development of rental online platforms and subscription business models. | Artificial intelligence personalization, internet of things-smart furniture, and improved stockholding systems. |

| Monthly plans with limited customization. | Flexible, on-demand rentals with modular and customizable furniture. |

| Waste reduction through rentals and reuse. | Applying circular economy principles and eco-friendly materials to furniture design. |

| Affordable, convenient, and speedy delivery. | Personalized experiences, smart furniture solutions, and green practices. |

| Logistics management, furniture quality control, and customer retention. | Transforming with rapid technology changes, responding to diverse consumer tastes, and ensuring sustainability. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.1% |

| UK | 7.4% |

| France | 6.9% |

| Germany | 6.6% |

| Italy | 6.3% |

| South Korea | 6.7% |

| Japan | 6.0% |

| China | 8.5% |

| Australia-NZ | 7.1% |

The USA will grow at 8.1% CAGR over the period under study. The growth in the region is influenced by changing lifestyle choices, high mobility in cities, and increasing demand among millennial and Gen Z users for more flexibility than ownership. Large metropolitan regions are seeing increasing interest in rental services for residential and corporate furniture as housing and relocation trends increase.

A strong network of startups and established players is enabling quick delivery, simple customization, and short-term-to-long-term rental agreements, which helps enhance consumer experience and adoption remarkably. Advances in technology, such as app-based rental platforms and AI-powered personalization services, are also fueling growth.

Corporate domains are increasingly taking up rental options for coworking and temporary office configurations, stimulated by the adoption of hybrid work models. Also, growing environmental awareness is driving the practice of a circular economy, which has furniture renting as a low-carbon solution to conventional acquisition.

Good economic times and high logistics infrastructure facilities also help with the overall trend of the industry in the USA, making it one of the major marketplaces worldwide in terms of the provision of furniture rental services during the prediction period.

The UK is anticipated to expand at 7.4% CAGR over the study period. Demand is driven by shifting consumer trends, especially among young professionals and students looking for short-term accommodation options in urban areas. The convenience provided by rental services fits well with the lifestyle of an expanding renter population, resulting in higher traction in both home and office furniture industries.

Apart from this, furniture leasing is becoming an affordable proposition with real estate dynamics, such as increasing property rates and rental levels. Government-sanctioned green goals and the awareness of saving waste are propelling eco-friendly options, pushing the rental strategy forward.

Corporate India is another key driver, with startups and SMEs opting to create temporary offices by renting furniture. Technological innovation in the retail sector, combined with effective reverse logistics, is increasing user convenience and service availability. The UK is also supported by collaborations between rental providers and property developers to facilitate furnished rentals as part of turnkey housing systems. This synergistic arrangement is likely to continue promoting growth in the next decade.

France will be growing at a 6.9% CAGR during the period under study. Growth is driven by a cultural trend toward minimal living and greater urban mobility. Urban consumers, especially those in Paris and other key cities, are tending toward dynamic lifestyles centered around functionality and convenience, supporting the increasing demand for subscription-based furniture rentals. The student housing and expatriate community form a strong user base, with a growing preference for fully furnished rental apartments.

E-commerce platforms dedicated to furniture rental are streamlining the process through digital catalogs, online contracts, and customer-friendly return policies. The corporate industry is also adapting to this model, with coworking spaces and temporary project offices relying on rental furniture to minimize upfront investments.

Moreover, national sustainability goals are prompting the uptake of circular economy ideologies, and furniture rental is becoming an essential activity in eliminating product lifecycle waste. Service providers are improving offerings by introducing additional value-added services such as maintenance, upgrades, and flexible replacements.

Germany will grow at a 6.6% CAGR over the forecast period. Industrial precision and an organized regulative framework helped enable the emergence of furniture renting as a formalized and replicable business opportunity. Metropolitan locations like Berlin, Munich, and Frankfurt are reporting increasing flexible residence offerings, with furniture renting being part of the secondary solution. Expatriates, along with on-the-move businesspeople, decisively contribute to the demand for upscale rental, offering matching functional requirements and design sensitivities.

There is a prominent focus on durability and quality framing the expectations of customers, hence the push among providers for premium, modular solutions. Larger corporations, as well as institutions, have also changed toward more versatile workspace design, relying on renting furniture to deliver transitory yet adjustable office environments.

Smart technology integration and the adoption of eco-principles by furniture products are taking off with a strong complement to Germany's efforts towards sustainable practice. Rental providers are taking advantage of this trend by providing eco-certified products and open sourcing, which attracts environmentally aware consumers and businesses as well.

Italy is anticipated to expand at 6.3% CAGR over the study period. Growth in sales is being fueled by shifting housing patterns, particularly among young professionals and families in urban areas. Urban centers such as Milan and Rome are witnessing growing demand for short-term and furnished rental housing, and furniture rental is proving to be a convenient and appealing option. Design tastes and aesthetic sensibilities continue to be robust among Italian consumers, prompting rental firms to provide modern and fashionable collections.

Tourism and hospitality industries are also contributing significantly to sales growth, with owners of vacation rentals utilizing furniture leasing businesses to maintain properties without ongoing capital investment. Italy's emphasis on the preservation of culture and sustainable design is promoting innovation in modular and recyclable furniture that corresponds to rental concepts.

Furthermore, increased awareness of saving costs and benefits of all-encompassing service packages is paving the way to change consumer psyches from an ownership mindset toward usage. Promotional strategy and online presence are assisting suppliers with reaching technophile segments, translating into sustained demand interest during the forecast period.

The study forecasts South Korea to achieve a 6.7% CAGR over the study period. Highly urbanized society and hectic life are making the ground fertile for flexible consumption patterns, such as furniture rental. As there is growing housing mobility and space shortages in urban cities like Seoul, consumers are looking for flexible, space-saving furniture solutions that don't demand long-term commitment.

Younger age groups, such as university students and early career professionals, are a high-demand base for short-term rental options. The addition of intelligent features in rental furniture, like ergonomic designs and tech-friendly configurations, is increasing attraction, particularly in home workspaces.

Retail digitalization and app-based rental platforms provide simplified experiences and varied customization choices. Moreover, the growing popularity of sustainable usage fuel adoption in the industry. Collaborative business models that include interior design services, property managers, and e-commerce platforms are also increasing the reach and usability of rental services. Further growth is expected, underpinned by a tech-savvy, convenience-driven population.

Japan is projected to grow at 6.0% CAGR throughout the study. Market forces are influenced by population trends such as an aging population, high residential turnover, and small-sized dwellings in urban areas. Such factors are making consumers adopt efficient and convenient furnishing solutions.

Furniture rental is becoming popular among students, expatriates, and contract workers who have frequent changes of residences and need easy-to-move furnishing solutions. The cultural desire for minimalism and optimal space efficiency comes easily together with modular and rental furniture solutions.

Additionally, furniture rental is being incorporated into relocation and real estate services as bundled solutions to facilitate transition for new tenants. The business community is approaching rental furniture cautiously for satellite offices and temporary workplaces, especially in reaction to the growing mainstreaming of remote and hybrid workplace arrangements.

Technology integration and customer-focused business models are strong differentiators, with providers concentrating on easy-to-use platforms, subscription-based pricing, and furniture maintenance services to enhance user satisfaction and retention.

China will grow at 8.5% CAGR over the study period. The swift growth of urbanization, increasing disposable incomes, and the digital economy are the primary forces driving demand in the country. A massive population of young renters and digital natives is driving the uptake of flexible living solutions, such as online furniture rental websites. Increased competition in the housing industry and rising demand for furnished rental properties are driving higher adoption of such services.

Technology-enabled services like virtual showrooms, AI-driven customization, and on-demand delivery are becoming mainstream offerings by top players. In the business sector, small enterprises and startups are opting for rented furniture to reduce operational expenses while retaining functional and fashionable office spaces.

Policies focusing on sustainability are promoting reuse models, which match rental-based furniture models. Furthermore, government-backed smart city programs are opening possibilities for combined rental platforms that target residential and commercial real estate developers. This intersection of industry demand and digital transformation makes China a High-value and rapidly changing region for furniture rental services.

The Australia-New Zealand region will grow at 7.1% CAGR over the study period. Demand is supported by increasing intercity migration, a robust expatriate community, and growing numbers of students and temporary residents who are looking for ready-to-move housing solutions. Furniture rental services are gaining traction as convenient alternatives to purchasing, especially in cities where the cost of living is comparatively high.

The focus on waste reduction and sustainability is significantly contributing to market direction. Consumers increasingly prefer rental services that provide circular economy advantages like reusing products, recycling, and environmentally friendly materials. Firms are spending on digital platforms and logistics infrastructure for prompt delivery and return efficiency, enhancing the reliability of services.

The business community is also feeling demand from coworking operators and pop-up firms requiring temporary furnishing. Resilient tourism and real estate sectors also lead to steady demand for flexible furnishing solutions, cementing the region's status as a favorable market during the forecast period.

Wood remains the industry leader in the furniture rental business, accounting for an estimated 40-45% of the total industry by material. Wood is strong, versatile, and has a natural appearance that is appealing to both residential and commercial customers. Wooden beds, tables, desks, and bookshelves remain in demand. Major players such as Furlenco, CORT (a Berkshire Hathaway Company), and Rentomojo have wood-based catalogs with a concentration on modular and Scandinavian-style furniture.

The segment also benefits from the trend of sustainability, as individuals choose renewable materials and reusability. From 2025 to 2035, the wood furniture rental segment is likely to record a CAGR of 9.1%, with the rising urban population and increased demand for mid-premium lifestyle rentals.

Secondary materials, including metal, plastic, glass and composite products, collectively hold up the other 55-60% of the revenue share, with metal furnishings at the helm. Metal-furnished products-mainly for office chairs, tables and kitchen cupboards-are extensively used in commercial settings due to their high usage and ease of maintenance.

Plastic furniture is also gaining acceptance in temporary let and outdoor usage, while glass and composite products provide modernistic hues to city centers. Operators such as Cityfurnish and Feather cater to individuals with adaptive lifestyles in the form of multi-material furniture packages. The segment is projected to grow at a CAGR of 8.5% during the forecast period, owing to affordability, minimal design, and less weighty logistics compared to solid wood furniture.

Residential rentals dominate the furniture rental services market with an estimated share of 65-70% in overall application-based demand. Factors driving the demand for these services are urban migration, temporary dwellings, increasing numbers of students, and accommodating accommodation among young professionals.

Companies such as Rent-A-Center, CasaOne, and Brook Furniture Rental are cashing in on this by offering customizable living room, bedroom, and home office rental packages. Subscription packages and digital interfaces have significantly improved customer experience and service convenience. The home segment is estimated to expand at a CAGR of 10.3% during 2025 to 2035, with the highest momentum in metro cities and college towns across Asia-Pacific, North America, and certain regions of Europe.

Commercial applications include the secondary segment and represent about 30-35% of overall demand. Businesses-such as coworking facilities, corporate offices, hospitality firms, and event organizers-rent furniture frequently to reduce capital expenditure and retain design flexibility.

Demand is particularly strong for office desks, ergonomic chairs, and modular conference tables. Firms like CORT, Bristol, and OfficeRentals furnish this space with tailored packages for short-term projects, relocations, and seasonal needs. As companies adopt hybrid work patterns and flexible space design, commercial furniture rentals offer operational and financial flexibility. From 2025 to 2035, this segment shall grow at a CAGR of 8.9%, backed by expansion in startups, business travel accommodations, and coworking facilities.

The global furniture rental services market is characterized by a mixture of regional and international players, and many of these players have adopted subscription-based models to serve the growing demand for flexible and short-term furniture solutions.

There has been a sharp rise in online platforms for the sale of home and office furniture, where companies such as Feather, RentoMojo, and Furlenco are leading the way with technology-enabled services. These firms have adopted user-friendly digital platforms for customers with easy access to furniture selection with delivery and pick-up on-demand.

Aaron's LLC and Rent-A-Center dominate in North America with rent-to-own and rental services. They have large nationwide physical networks and a dense customer base. However, newer players like The Everset and Fernished Inc. are targeting the younger tech-savvy consumer with curated home furniture packages shipped directly to users' homes. Some regional players, such as Furlenco and RentoMojo, are expanding their business into emerging regions like India, where demand for consumables in affordable quality home furnishings is growing at a rapid pace.

Luxe Modern Rentals emphasizes high-end luxury furniture rentals for a short period geared toward high-income classes; on the other hand, Fashion Furniture Rental is well known for its large inventories and flexible rental terms for both residential and business clients.

Increased urbanization and people's demands for more convenience, affordability, and sustainability keep fuelling revenue growth. Hence, a visible shift toward eco-friendly, subscription-based models is being adopted by consumers who value environmental protection.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Feather | 8-12% |

| Aaron’s LLC | 7-11% |

| Rent-A-Center | 7-10% |

| Brook Furniture Rental Inc. | 5-7% |

| The Everset | 4-6% |

| Other Players | 55-69% |

| Company Name | Offerings & Activities |

|---|---|

| Feather | Subscription-based furniture rentals, with emphasis on modern and eco-friendly designs. |

| Aaron’s LLC | Rent-to-own and rental services with a broad portfolio of furniture, electronics, and appliances. |

| Rent-A-Center | Flexible rental agreements for furniture, electronics, and appliances, targeting both residential and business customers. |

| Brook Furniture Rental Inc. | Wide selection of furniture rental services for home, office, and corporate clients, focusing on quick delivery. |

| The Everset | Curated furniture packages with a focus on style and comfort for both short-term and long-term rentals. |

Key Company Insights

Feather (8-12%)

It focuses on providing modern, sustainable furniture rental options, a strong digital presence, and a subscription model targeting urban millennials.

Aaron’s LLC (7-11%)

A dominant force in North America with both rent-to-own and rental services, a large physical store network that supports its rental offerings.

Rent-A-Center (7-10%)

A well-established player offering both long-term and short-term furniture rental options, known for its customer-centric service and wide reach.

Brook Furniture Rental Inc. (5-7%)

Known for catering to both residential and corporate customers, with a flexible inventory model, and being competitive in the corporate housing and home staging sectors.

The Everset (4-6%)

Offers curated furniture packages tailored to a design-conscious audience, focusing on quality and aesthetics in the rental space.

Other Key Players

The segmentation is into wood, metal, plastic, glass, and others.

The segmentation is into applications, including commercial and residential.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 13.2 billion in 2025.

The industry is predicted to reach a size of USD 29.5 billion by 2035.

Key companies include Feather, Aaron’s LLC, Rent-A-Center, Brook Furniture Rental Inc., The Everset, Fernished Inc., Furlenco, RentoMojo (Edunetwork Pvt. Ltd.), Luxe Modern Rentals, and Fashion Furniture Rental.

China, slated to grow at 8.5% CAGR during the forecast period, is poised for the fastest growth.

Wood furniture is being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Application , 2018 to 2033

Figure 1: Global Market Value (US$ million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Material, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ million) by Material, 2023 to 2033

Figure 17: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 25: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Material, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ million) by Material, 2023 to 2033

Figure 32: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 47: Western Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 48: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 55: Western Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ million) by Material, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ million) by Material, 2023 to 2033

Figure 92: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 93: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ million) by Material, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Furniture Polish Wipes Market Size and Share Forecast Outlook 2025 to 2035

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Furniture Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Furniture Polish Market Analysis by Product Type, Source, End Use, Sales Channel, and Region Through 2035

Furniture Packaging Market Trends & Industry Growth Forecast 2024-2034

Parental Control Software Market Report - Demand & Outlook 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

P2P Rental Apps Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Cat Furniture and Scratchers Market Analysis – Trends, Growth & Forecast 2025 to 2035

Pet Furniture Market Analysis - Growth & Trends 2025 to 2035

Market Leaders & Share in the Pet Furniture Industry

Breakdown for IBC Rental Business Market: Trends, Players, and Innovations

Car Rental Service Market Trends - Growth & Forecast 2024 to 2034

Boat Rental Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA