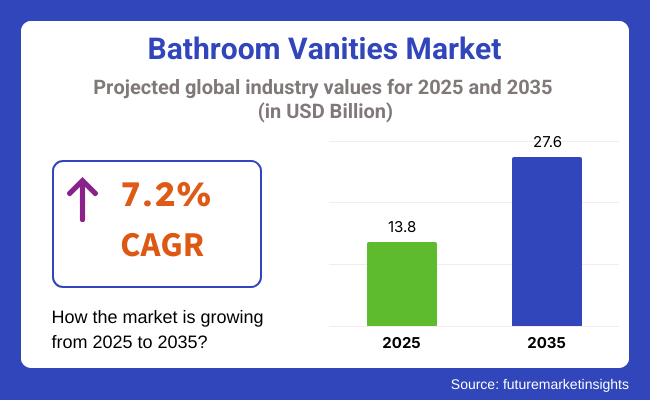

The bathroom vanities market size is expected to be USD 13.8 billion in 2025 and will register a 7.2% CAGR during the forecast period of 2025 to 2035. The global industry size is expected to grow to USD 27.6 billion by 2035. The key driving factor for this industry is the rapid urbanization with growing consumer fondness for well-designed and functional bathrooms.

Increased demand for bathroom remodeling and customizing, facilitated by advances in lifestyle and exposure to interior design trends, has greatly boosted the industry for bathroom vanities. Increased global disposable incomes and demands for new, space-efficient furniture have also fostered industry development.

Increased demand for vanity units incorporating technologies such as lighting, anti-fog mirrors and storage maximization; thus, manufacturers are investing money in design innovation as well as technology incorporation. High-end materials, green componentry and modularity of construction are also driving innovative designs. Both in the commercial as well as in residential segments, bathroom renovation has emerged as the epicenter of real estate appreciation, particularly in mature industries.

The move towards environmentally friendly purchasing behavior has also promoted the use of recyclable, water-resistant, and low-emission products, introducing an environmental aspect to product attractiveness. Advanced technology, such as smart mirrors and touchless, is enhancing the user experience.

Asia Pacific and Latin America's emerging economies are experiencing demand growth because of infrastructure growth and housing development schemes. These economies also reflect increased international awareness of home decor through online media, which in turn is fueling consumer demand for semi-luxury and luxury vanity products.

Through 2035, relentless innovation in design and functionality and exponential expansion in e-commerce platforms will have a significant impact on consumer buying behavior and industry coverage. In the face of heightened competition, differentiation through customization, sustainability, and digitalization will be the key to gaining industry share and driving long-term growth within this new paradigm.

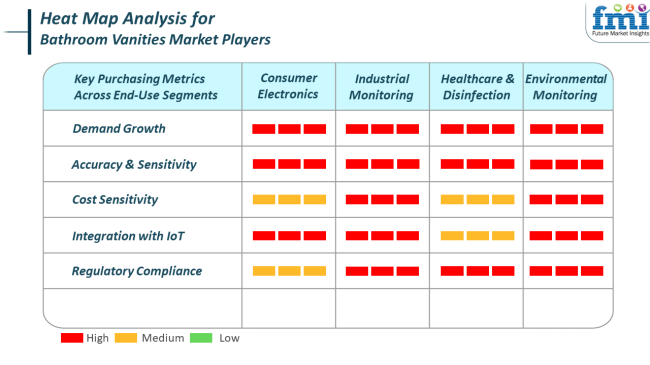

Although bathroom vanities are not usually linked with high-technology end-use applications, greater integration with home automation systems is in line with broad technology trends within industries. Consumer electronics are leading home interior design more and more, with in-lighting and smart mirrors increasingly being integrated into vanity units to enhance convenience and functionality. Such strong demand for technology-based furniture reflects a cross-industry trend towards digital utility.

For medical and industrial use, vanity installations are concerned with durability, sanitation, and compliance. Even more so in medical and disinfecting facilities, the materials chosen must be able to withstand rigorous sanitary standards, with automation being incorporated to assist with operation and maintenance efficiency. This creates parallels with industrial monitoring trends where precision and compliance are just as much of a top concern.

Environmental monitoring is tangentially related, specifically through the rising adoption of environmentally friendly materials for vanity manufacturing. Consumers demand product sustainability with approved lifecycle sustainability certificates, influencing buying decisions such as those used in environmental monitoring applications. In each segment, purchasing behavior continues to be more influenced by demands for responsible innovation.

The industry is confronted with numerous risks, which include supply chain disruption and price volatility of raw materials. Core materials like hardwoods, engineered composites, and metals are subject to geopolitical tensions, trade policy and environmental constraints. Such conditions trigger price volatility and influence production schedules, which strain manufacturers' and retailers' margins.

Shifting consumer choice is also dangerous. As there is increasing focus on sustainability and smart home control, companies that are not innovating or lagging behind will face the danger of obsolescence. Also, fast fashion concepts used in furnishing home can lead to product cycles shortening, causing risks of obsolescence in inventories and waste for industry players moving towards more static models of distribution and stock-of-goods selling.

Economic recessions and slowdowns in the real estate industry significantly impact demand, particularly that of luxury and upper-end classes. Bathroom vanity sales are usually linked with new residential development and repair activities; therefore, any decline in residential or commercial building could lead to vital harm to sales. Flexing such outside shocks with strong production foundations and flexible marketing strategies will be crucial in getting products moving.

The bathroom vanity industry underwent significant changes between 2020 and 2024 in response to a shift in consumer behavior and lifestyles. Growing concern for home renovations and interior décor prompted most homeowners to renovate bathrooms with special emphasis on newer, stylish vanities that balanced functionality and looks. Some of the most popular choices at the time were styles that incorporated storage, two sinks, and clean finishes.

Engineered wood and quartz gained popularity because they are durable and look clean. Technology features began to become a part of the industry, including built-in lighting, smart capabilities on mirrors, and touchless fixtures. Internet platforms also started influencing consumers, enabling them to make individual choices and providing convenience of delivery.

Between 2025 and 2035, the industry will be drawn towards higher-order innovations and sustainable technologies. Personalization will be the name of the game, with consumers seeking modular modules that convey personal taste and respond to individual spatial needs. Sustainability will influence materiality, with an emphasis on environmentally friendly, recycled, or reclaimed materials.

Technology will be further integrated, with smart mirrors, ambient lighting, and even voice-controlled or app-connected capabilities. The boundary between utility and luxury will continue to erode as bathroom spaces transform into wellness retreats, with vanities that are optimized for relaxation, efficiency, and personalization.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Functional and modern looks with built-in storage | Highly personalized, modular constructions with luxury touches |

| Resilient engineered materials and modern finishes | Sustainable, eco-friendly, and natural material uptake |

| Affordable smart features such as touchless faucets and LED mirrors | High-end tech such as voice control, app integration, and wellness lighting |

| More DIY upgrades and buying online | Need for personalized, experience-driven designs |

| Early interest in sustainable materials | Full integration of sustainability across design and sourcing |

| Home remodel trends and look-alike upgrades | Lifestyle personalization and wellness-focused living |

The industry is dominated by residential applications, accounting for an estimated 74% of global industry share in 2025, and ongoing dominance forecast through 2035.

Expansion is mostly spurred by home renovation growth, urban housing construction, and expanded interest in customized interior styles. Buyers are preferring double-sink setups and built-in storage in both new home builds and renovation work.

Demand in North America and Western Europe is concentrated in high-end wooden and stone vanities and in Asia-Pacific is for modular and wall-mounted units, which are their space-saving and functional values in small to mid-sized homes. Secondary demand comes from non-residential uses and accounts for about 26% of the industry.

These include hospitality, corporate offices, and public infrastructure projects. Hotel and resort chains are major purchasers, particularly in parts of the world such as the Middle East and Southeast Asia where tourist development is strong. Commercial builders of apartment complexes and office buildings value products with good durability and minimal maintenance, including metal framing and composite-stone faces.

Institutions such as universities and hospitals also induce volume purchasing of plain, standardized vanity units that conform to hygiene and safety requirements. Government investment in public restrooms and education infrastructure further boosts this segment's consistent growth.

Wood continues to be the leading material for bathroom vanities, with a projected 32% industry share in 2025.

It is commonly favored due to its design versatility and adaptability to a wide variety of design themes. Solid hardwoods are employed for high-end products, while more affordable, mass-market versions make use of engineered varieties like MDF and plywood. Natural wood finishes are preferred by customers in industrialized economies, particularly in master bathrooms for the home.

Meanwhile, environmentally conscious consumers are also increasingly choosing sustainably sourced or recycled wood materials, especially in North America and certain regions of Europe where green building is prevalent. Stone products account for around 23% of the industry, prized for their upscale appeal and superior durability. Marble and granite natural stones are favored in high-end residential and commercial applications, and quartz has become increasingly popular due to its non-porous properties and visual uniformity.

These products are typically chosen most frequently in high-income areas and in areas where long-term durability is more important. Engineered stone and cultured marble are making growing inroads in the mid-market, delivering similar aesthetics for less. Their use continues to expand in urban, high-density regions, as consumers there search for sophisticated finishes that also cater to long-term function.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 5.9% |

| France | 5.6% |

| Germany | 5.8% |

| Italy | 5.4% |

| South Korea | 5.7% |

| Japan | 5.3% |

| China | 7.1% |

| Australia-NZ | 6% |

The USA industry is projected to increase at 6.5% CAGR during the forecast period. Expansion in the USA is supported by an increasing trend toward interior decoration and home improvement, especially among urban shoppers. The culture of renovating home bathrooms with high-end and multifunctional vanities is shaping industry growth.

The demand for sleek designs that provide functionality, and beauty is defining product innovation in major brands. The increasing need for space-efficient and personalized solutions, particularly in urban areas, is also driving revenue growth further. Moreover, a rising number of residential building projects and renovation activities will also spur demand for new bathroom vanity installations.

The growing popularity of green materials and environmentally friendly consumer behavior is also fostering innovation in vanity products, including water-resistant finishes and modular storage. E-commerce channels remain a key driver of increased accessibility, providing a broad range of tailored design choices to end-users. In general, the USA industry is enjoying a combination of technological innovation and changing lifestyle trends that prioritize luxury and functionality in bathroom areas.

The UKindustry will grow at 5.9% CAGR over the study period. The industry is experiencing steady demand from residential remodeling and new housing segments. There is a strong focus on minimalist and space-saving designs, compelling manufacturers to bring forth compact vanity units appropriate for small bathrooms that are common in urban dwellings.

Growing concern for home looks has motivated homeowners to invest in modern and sleek vanity units providing space and storage in equal proportion. Growing environmental awareness is influencing UK consumer trends toward the use of sustainable finishes and materials. There is a manufacturer response in terms of eco-friendly products such as reclaimed wood, low-VOC paints, and water-conserving fixtures.

Established design styles such as Scandinavian and modern-industrial are affecting UK product design. In addition, online marketplace platforms are aiding product visibility, customization, and customer access, particularly for upscale products. Since buyers place importance on functionality without trading off aesthetic quality, the demand for cutting-edge and bespoke vanity options will help to support robust industry growth in the forecast period.

The France industry is likely to grow at 5.6% CAGR over the study period. The industry is driven by changing home design trends that increasingly involve European contemporary styles and upscale bathroom furnishings. Bathroom vanities are becoming popular not only as functional furniture but also as design focal points.

As urban dwellers demand improved organization and luxury in personal areas, demand for modular and ergonomic vanity designs continues to increase. Homeownership increases among younger generations, and government incentives for energy-efficient home renovations are indirectly affecting bathroom remodels.

French consumers prefer locally sourced, sustainable products, which has led to domestic manufacturers promoting product lines aligned with environmental concerns. Integrated lighting, intelligent mirrors, and creative storage are features becoming popular among middle and high-income consumer segments.

Also, the industry for professional installation services is growing alongside the sale of products, assisting buyers in embracing more personalized solutions. With homeowners and builders alike emphasizing durability and design consistency, France's industry is set for incremental but consistent progression.

The German industry is anticipated to expand at 5.8% CAGR throughout the study. The nation has a strong demand for quality-focused bathroom fittings, supported by a culture that emphasizes precision and efficiency in design. German consumers prefer bathroom vanities that blend technological aspects with minimalist designs, creating interest in wall-mounted units, built-in lighting, and concealed storage spaces.

Product functionality and quality continue to be the top priorities, with a growing trend toward customizable and ergonomic designs. The industry is boosted by Germany's robust manufacturing base, which lends itself to supporting quality control and innovation in bathroom fittings.

Sustainability in sourcing and energy efficiency are major buying drivers as customers look increasingly for sustainable and long-lasting alternatives. Both residential and commercial building activity, including hospitality upgrades, are fueling increased demand for new vanity installations.

Additionally, smart home integration and online retail trends are also improving industry accessibility and customer engagement. The German industry is anticipated to have a sustained growth path through a combination of pragmatism, sustainability, and contemporary design principles.

The Italian industry is anticipated to expand at 5.4% CAGR over the forecast period. The industry in Italy mirrors the country's long-standing emphasis on aesthetics and craftsmanship. Italian consumers are inclined towards vanities that highlight sophisticated materials, artistic designs, and sophisticated finishes, frequently opting for products that exhibit a combination of traditional craftsmanship and contemporary convenience.

Consequently, manufacturers are actively seeking marble textures, ceramic surfaces, and artisan-designed fixtures. The industry is witnessing growth in both the remodeling and new building sectors, especially in high-end residential developments in metropolitan areas.

Growing recognition of luxury home trends and spa-like interiors is driving demand for high-end vanity products. Urban home sizes are also spurring the shift to wall-mounted and slender units. Whereas luxury and artisanal goods rule the premium industry, mid-range vanities, with their blend of durability and looks, are also gaining traction. Whereas Italian families continue to spend money on updating interior decors at home, bathroom vanities are also becoming a primary concern for functionality and looks.

The South Korean industry is anticipated to grow at 5.7% CAGR throughout the study. South Korean consumers show a liking for intelligent and space-saving bathroom furniture, which is in response to the densely populated urban living situation in the country. The development of smart homes and smart devices is creating a growing demand for bathroom vanities with sensors such as lighting, in-built charging terminals, and anti-fog mirrors.

Modular compact designs are particularly favored, both for new dwelling constructions and apartment remodeling. Strong consumer sentiment towards aesthetics and cleanliness has driven manufacturers to launch products featuring antibacterial coating, easy-clean finishes, and waterproof materials.

The legacy of Korean modern design, which embodies simplicity and function, is driving innovation in materiality and spatial arrangement. Rising popularity for home improvement through do-it-yourself projects and the well-established infrastructure of e-commerce are also leading to broadening industry coverage. With a youthful, technology-aware population leading demand for fashionable yet practical products, the South Korean industry will continue to see steady growth during the forecast period.

The Japanese industry is anticipated to expand at 5.3% CAGR over the study period. The industry in the country is characterized by small, highly functional, and technologically advanced products. Urban homes are generally small in size, which necessitates demand for minimalist vanities that feature multifunctional storage, built-in lighting, and intelligent mirrors.

Clean lines, soft colors, and high durability are key features of consumer choice in Japan. Japan's older population is also affecting product design, with consideration of ergonomic designs, ease of access, and safety.

Finishes that include antibacterial properties and water-conserving materials are increasingly sought after, harmonizing with domestic standards for sanitation and sustainability. Moreover, redeveloping aging residential buildings coupled with robust retail infrastructure is propping up demand in urban areas.

Although classic style aesthetics remain culturally relevant, the incorporation of contemporary technology is facilitating a new wave of functional luxury bathroom furniture. The industry's consistent rate is an indicator of pragmatic requirements mixed with the element of innovation and cultural taste for accuracy in living areas.

The industry in China is anticipated to grow by 7.1% CAGR throughout the study. Urbanization and increasing disposable incomes are the major drivers for the thriving industry in China. There is an increased trend towards contemporary home interiors, with bathroom looks becoming a central theme of home design.

Customer demand is on the rise for bespoke and high-end vanities that provide both aesthetics and functionality with space. Mass residential projects and smart city initiatives are playing a major role in driving higher installations of high-end bathroom solutions.

Local manufacturers are quickly innovating to cater to the needs of a diverse consumer base, providing vanities with smart mirrors, LED lighting, and water-saving designs. Sustainability is also emerging as a key theme, with consumers expressing interest in green materials and production processes.

The e-commerce momentum contributes further to industry expansion through increased access to products, which includes customized solutions. China's industry is also remarkable for its scale, speed of innovation, and emerging middle-class purchasing power, including an aspirational lifestyle.

The Australia-New Zealand industry is forecast to grow at 6% CAGR over the study period. The region is witnessing increasing investment in residential infrastructure and lifestyle enhancement, which is driving demand for bathroom vanities. Consumers prefer modern and naturalistic designs, frequently opting for wooden textures, stone countertops, and minimalist lines. A new trend of eco-friendly buying is also being witnessed, with customers preferring sustainably sourced and low-impact materials.

In New Zealand and Australia, remodeling and renovation activity continues to be strong, especially in suburban developments and standalone houses. Manufacturers are meeting the demand with vanities that blend style, functionality, and longevity.

Small vanity models with storage space and intelligent integrations are becoming more sought after by city dwellers. Online shopping and in-store customization options are enhancing consumer satisfaction and access. As interior design becomes more of a priority for homeowners in the area, bathroom vanities are becoming a key feature that expresses taste and lifestyle.

The industry in North America is highly fragmented, with a mix of long-established brands and niche design-forward players competing across a spectrum of pricing, materials, and design aesthetics. Major companies like American Woodmark Corporation, Kohler Company, Avanity Corporation, Design Element Group, Inc., and Foremost Groups utilize brand legacy, supply chain control, and partnerships with major home improvement retailers to achieve strong industry positions.

American Woodmark Corporation is rather specific in its integration of cabinetry and vanity products through its link-up with big-box retailers such as Home Depot and Lowe's. That tie-up yields stock and semi-custom options. Kohler Company is also heading the most premium band in designer vanities integrated with impressive, smart bathroom fixtures and superior countertops. Avanity Corporation is established in the transitional and modern design category, particularly targeting boutique hotels and top-of-the-line residential renovations.

Design Element Group, Inc. is more value-driven by way of its contemporary ready-to-assemble vanities; foremost, it has continued strength in mid-tier resilience through productive, varied designs as well as long-term retail ties. The industry is seeing emerging custom options with water-repellant materials as well as innovations in storage integration.

The industry is now beginning to witness an influx of DTC brands and design studios coming into the space, increasing competition and pushing parent brands to hasten turnaround, increase flexibility for end-customization, and innovate materials. Consumer tastes are also changing more, with sustainability and modularity garnishing primary attention.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| American Woodmark Corporation | 16-20% |

| Kohler Company | 14-18% |

| Avanity Corporation | 10-13% |

| Design Element Group, Inc. | 9-12% |

| Foremost Groups | 8-11% |

| Other Key Players | 28-35% |

| Company Name | Offerings & Activities |

|---|---|

| American Woodmark Corporation | Offers semi-custom and stock vanities through large retail chains with quick delivery models. |

| Kohler Company | Premium, designer-grade bathroom vanities integrated with smart fixtures and luxury finishes. |

| Avanity Corporation | Focuses on modern and transitional vanities with a strong presence in hospitality and e-commerce. |

| Design Element Group, Inc. | RTA vanities with contemporary aesthetics, catering to budget-conscious and DIY customers. |

| Foremost Groups | Manufactures versatile vanity collections distributed through national retail partners. |

Key Company Insights

American Woodmark Corporation (16-20%)

Leading supplier of bath cabinetry and vanities; strong retail footprint and efficient mass customization capabilities.

Kohler Company (14-18%)

Premium innovator in integrated bathroom solutions; leverages design leadership and high-end retail exposure.

Avanity Corporation (10-13%)

A design-centric player with a broad portfolio of styles, preferred for modern remodels and hotel contracts.

Design Element Group, Inc. (9-12%)

Targets cost-effective remodeling projects; known for on-trend, affordable vanities sold online and in-store.

Foremost Groups (8-11%)

Focused on durable and practical vanities; key supplier to big-box retailers with national distribution strength.

By application, the industry is segmented into residential and non-residential.

By material, the industry is categorized into stone, ceramic, glass, wood, and metal.

By size, the industry is divided into 24 - 35 inch, 38 - 47 inch, and 48 - 60 inch.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry is slated to reach USD 13.8 billion in 2025.

The industry is predicted to reach a size of USD 27.6 billion by 2035.

Key companies include American Woodmark Corporation, Avanity Corporation, Bellaterra Home, LLC, Design Element Group, Inc., Design House (DHI Corp.), Empire Industries, Inc., Foremost Groups, Wyndham Collection, Kohler Company, Water Creation, Inc., Wilsonart LLC, Dupont Kitchen and Bath Fixtures, and Caesarstone.

China, slated to grow at 7.1% CAGR during the forecast period, is poised for fastest growth.

Residential applications are being widely used.

Figure 1: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Size, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Size, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 21: Global Market Attractiveness by Application, 2023 to 2033

Figure 22: Global Market Attractiveness by Material, 2023 to 2033

Figure 23: Global Market Attractiveness by Size, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Material, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Size, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Size, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 45: North America Market Attractiveness by Application, 2023 to 2033

Figure 46: North America Market Attractiveness by Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Size, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Size, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Size, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 74: Western Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 75: Western Europe Market Value (US$ million) by Size, 2023 to 2033

Figure 76: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 85: Western Europe Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 89: Western Europe Market Value (US$ million) Analysis by Size, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Size, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ million) by Size, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ million) Analysis by Size, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Size, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ million) by Application, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ million) by Material, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ million) by Size, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ million) Analysis by Size, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Size, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 146: East Asia Market Value (US$ million) by Material, 2023 to 2033

Figure 147: East Asia Market Value (US$ million) by Size, 2023 to 2033

Figure 148: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 157: East Asia Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 161: East Asia Market Value (US$ million) Analysis by Size, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Size, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ million) by Material, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ million) by Size, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ million) Analysis by Size, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Size, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Size, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Size, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Size, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 25: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Western Europe Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 31: Western Europe Market Value (US$ million) Forecast by Size, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ million) Forecast by Size, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ million) Forecast by Size, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 49: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 53: East Asia Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 55: East Asia Market Value (US$ million) Forecast by Size, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Size, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ million) Forecast by Size, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Size, 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA