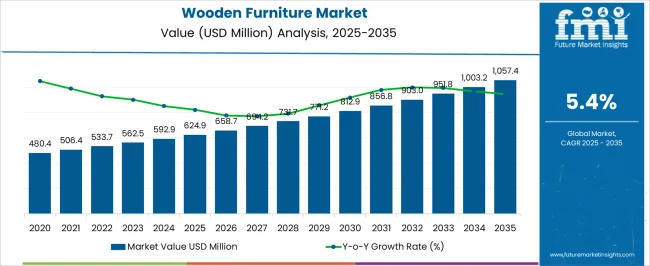

The Wooden Furniture Market is estimated to be valued at USD 624.9 million in 2025 and is projected to reach USD 1057.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The wooden furniture market is projected to grow from USD 624.9 million in 2025 to USD 812.9 million by 2030, generating an incremental gain of USD 188 million over the first five years, which represents 37.4% of the total incremental growth over the 10-year forecast period. This early-phase growth is driven by increasing consumer demand for eco-friendly, sustainable, and aesthetically pleasing wooden furniture, especially in the residential and commercial sectors.

The rise of online furniture sales, alongside the growing preference for customizable and locally sourced furniture, will further accelerate the market’s growth. The second half (2030–2035) will contribute USD 296.5 million, representing 62.6% of the total growth, driven by stronger momentum as wood furniture becomes more popular for both modern and traditional interior designs.

Annual increments will rise from USD 0.9 billion in the early years to USD 1.4 billion by 2035, reflecting faster growth driven by rising disposable incomes, urbanization, and the increasing shift towards sustainable building materials. Manufacturers focusing on product innovation, sustainability, and affordability are expected to capture the largest share of the USD 484.7 million opportunity.

| Metric | Value |

|---|---|

| Wooden Furniture Market Estimated Value in (2025 E) | USD 624.9 million |

| Wooden Furniture Market Forecast Value in (2035 F) | USD 1057.4 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The wooden furniture market is witnessing steady expansion, fueled by a rising emphasis on interior aesthetics, eco-conscious consumer behavior, and increasing investments in residential and commercial construction. As urbanization accelerates and disposable incomes rise, consumer preferences have shifted toward durable, customizable, and design-centric furniture solutions made from responsibly sourced wood.

The market has been influenced by the growing penetration of organized retail, online furniture platforms, and changing home renovation patterns, particularly in emerging economies. Advancements in joinery techniques, finishes, and wood treatment methods have improved the durability and appeal of wooden furniture across use cases.

The resurgence of natural materials in interior design and the influence of minimalist and Scandinavian aesthetics have further driven demand for wooden furniture in both traditional and contemporary styles Moving forward, sustainability initiatives and the integration of digital configurators and AR tools in retail channels are expected to enhance consumer engagement and fuel demand across key segments of the wooden furniture industry.

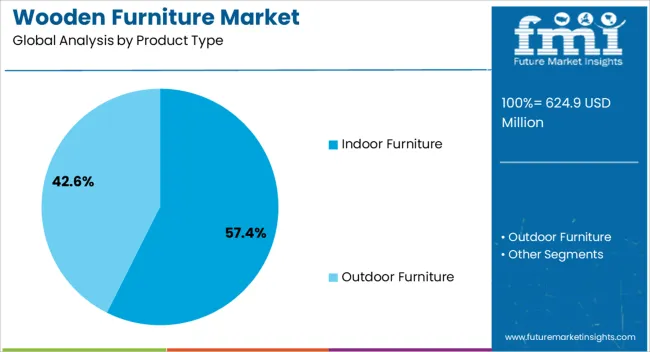

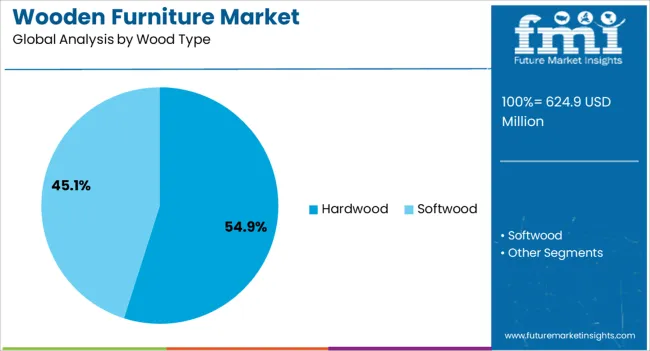

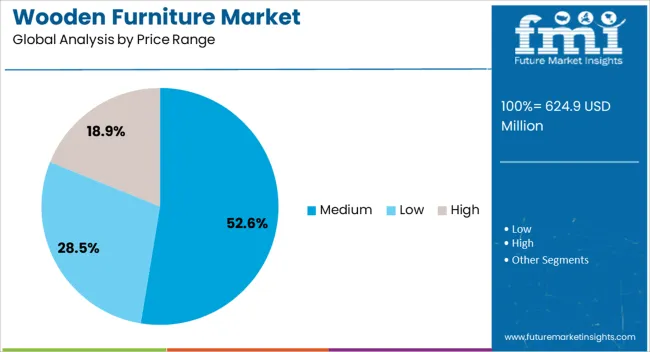

The wooden furniture market is segmented by product type, wood type, price range, application segment, distribution channel, and geographic regions. By product type, the wooden furniture market is divided into Indoor Furniture and Outdoor Furniture. In terms of wood type, the wooden furniture market is classified into Hardwood and Softwood. Based on price range, the wooden furniture market is segmented into Medium, Low, and High. By application segment, the wooden furniture market is segmented into Residential and Commercial. By distribution channel, the wooden furniture market is segmented into Offline and Online. Regionally, the wooden furniture industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Indoor furniture is projected to hold 57.4% of the total revenue share in the wooden furniture market in 2025, establishing it as the leading product type. This segment's growth is being influenced by increased consumer focus on home interiors, driven by hybrid work models, lifestyle changes, and the growing importance of personalized spaces. The segment has benefited from higher demand for wooden beds, wardrobes, dining tables, and study units, all of which are being designed with a blend of functionality and aesthetics.

Manufacturers have leveraged modularity, ergonomic considerations, and space-saving innovations to cater to evolving home layouts, particularly in urban regions with limited living space. Indoor wooden furniture also supports diverse interior themes, which have been enabled through a wide range of finishes and grain patterns.

The segment’s expansion has further been supported by omnichannel retail strategies and product visualization tools that allow customizatio.n Its continued relevance in daily living and the ability to align with shifting décor trends have made indoor furniture the dominant contributor to market revenue.

Hardwood is anticipated to contribute 54.9% of the overall revenue share in the wooden furniture market in 2025, positioning it as the most utilized wood type. The segment’s prominence is being driven by the durability, longevity, and aesthetic richness associated with hardwood varieties such as oak, teak, and walnut. These wood types offer superior resistance to wear and moisture, which has made them ideal for crafting long-lasting furniture items with intricate detailing.

The premium appeal of hardwood furniture has aligned with consumer expectations in both residential and luxury commercial spaces, where longevity and craftsmanship are prioritized. Growing consumer awareness about sustainable forestry practices has also increased the acceptance of certified hardwoods.

The segment's growth has been further reinforced by the rising adoption of heirloom-quality wooden pieces that reflect heritage craftsmanship As natural textures and grains remain in high demand among interior designers and homeowners alike, hardwood continues to be the material of choice for premium and mid-range furniture offerings globally.

The medium price range segment is expected to account for 52.6% of the revenue share in the wooden furniture market in 2025, making it the leading pricing category. The dominance of this segment is being driven by its balanced value proposition, which combines affordability with acceptable quality and design sophistication. Consumers in this category prioritize aesthetics, durability, and functionality while remaining budget-conscious, particularly in urban middle-income households.

The segment has seen rising demand through both offline retail and e-commerce channels, where a wide range of mid-priced wooden furniture is being offered with customization options and installment-based payment models. The presence of regional manufacturers and direct-to-consumer brands has expanded the availability of mid-priced products that replicate premium styles at accessible costs.

Additionally, the growing preference for modular and ready-to-assemble wooden furniture has supported volume sales within this price range. As consumers continue to seek reliable and stylish furniture within a controlled budget, the medium price segment is expected to maintain its leadership in the coming years.

The wooden furniture market is driven by the rising demand for premium products and customization in residential and commercial spaces. Opportunities are emerging in luxury and custom segments, particularly in growing economies. Trends in sustainable sourcing and modern design are reshaping the market, while challenges related to material costs and raw material scarcity remain. By 2025, navigating these obstacles and leveraging opportunities in emerging markets will be crucial for continued market expansion and innovation.

The growth of the wooden furniture market is primarily driven by the increasing demand for premium and customized furniture across residential and commercial spaces. As consumers seek sustainable, durable, and aesthetically appealing furniture, wooden pieces are increasingly being favored for their natural look and long-lasting qualities. The demand for wooden furniture is expected to continue rising, particularly in regions such as North America, Europe, and Asia-Pacific, where higher disposable incomes and interior design trends promote upscale furniture purchases through 2025.

Emerging markets, especially in Asia-Pacific and Latin America, present significant opportunities for the wooden furniture market. Rising incomes, urbanization, and increased disposable income are driving the demand for both functional and luxury wooden furniture in these regions. The growing middle class in countries like India and China is showing a preference for high-end furniture pieces that align with contemporary design trends. By 2025, these opportunities will drive substantial market growth, particularly in the luxury and custom furniture segments, where the demand for finely crafted wooden items is expected to rise significantly.

The wooden furniture market is increasingly shaped by trends toward sustainable wood sourcing and eco-friendly design. Consumers are becoming more aware of environmental impacts, leading to a preference for furniture made from responsibly sourced wood, such as FSC-certified materials. Additionally, modern design trends are emphasizing minimalist and functional wooden pieces, tailored for specific spaces. By 2025, these trends are expected to dominate, as manufacturers incorporate sustainable materials, appealing to eco-conscious consumers who value both form and function in their furniture choices.

The wooden furniture market faces significant challenges stemming from high material costs and the scarcity of high-quality raw materials. The cost of sourcing premium wood, especially hardwood, has increased due to supply chain disruptions and environmental regulations that limit overharvesting. These price hikes directly impact production costs and can limit affordability for consumers. Furthermore, the scarcity of high-quality wood in some regions can hinder the ability to meet demand. By 2025, these challenges will necessitate innovation in material sourcing, cost management, and efficient production techniques to ensure continued market growth.

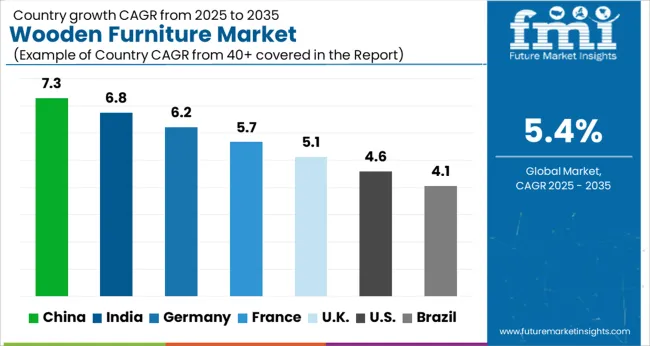

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global wooden furniture market is projected to grow at a 5.4% CAGR from 2025 to 2035. China leads with a growth rate of 7.3%, followed by India at 6.8%, and France at 5.7%. The United Kingdom records a growth rate of 5.1%, while the United States shows the slowest growth at 4.6%. These varying growth rates are driven by increasing demand for sustainable and stylish furniture, rising disposable incomes, urbanization, and growing investments in residential and commercial construction. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, expanding middle-class populations, and increasing demand for high-quality furniture, while more mature markets like the USA and the UK see steady growth driven by advancements in design, sustainability, and evolving consumer preferences. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wooden furniture market in China is growing rapidly, with a projected CAGR of 7.3%. China’s booming construction sector, coupled with rising disposable incomes and urbanization, is driving the demand for wooden furniture. The country’s growing middle class, increasing demand for homeownership, and the expanding hospitality industry continue to fuel market growth. Additionally, China’s shift towards sustainable and eco-friendly furniture solutions, combined with strong domestic production capabilities, contributes to the market’s expansion. The increasing preference for high-quality, custom-made furniture, particularly in urban areas, further accelerates demand for wooden furniture.

The wooden furniture market in India is projected to grow at a CAGR of 6.8%. India’s expanding real estate and construction sectors, combined with rising urbanization and increasing demand for stylish, high-quality furniture, are driving market growth. The country’s growing middle class, along with a rise in consumer spending on home décor and furniture, further accelerates the demand for wooden furniture. Additionally, India’s increasing preference for sustainable and environmentally friendly products, as well as government policies supporting green construction, continue to contribute to the growth of the wooden furniture market. The rise in the number of residential and commercial establishments further supports market demand.

The wooden furniture market in France is projected to grow at a CAGR of 5.7%. France’s increasing demand for high-quality, aesthetically pleasing, and sustainable furniture is driving steady market growth. The country’s growing interest in home décor, coupled with rising disposable incomes, continues to support the demand for wooden furniture in both residential and commercial sectors. France’s emphasis on sustainability and eco-friendly materials, along with a rising focus on reducing environmental impact in furniture manufacturing, accelerates the adoption of wooden furniture. The increasing number of renovation and remodeling projects further boosts the demand for stylish and durable furniture solutions.

The wooden furniture market in the United Kingdom is projected to grow at a CAGR of 5.1%. The UK’s demand for stylish and sustainable furniture solutions, driven by growing consumer preferences for high-quality, eco-friendly products, continues to support steady market growth. The country’s strong focus on sustainable manufacturing practices and the growing trend of interior design and home décor further fuel the adoption of wooden furniture. The UK’s growing residential construction market, coupled with increasing renovation and remodeling activities, continues to contribute to the demand for wooden furniture. Additionally, rising investments in the hospitality sector and commercial spaces further expand market opportunities.

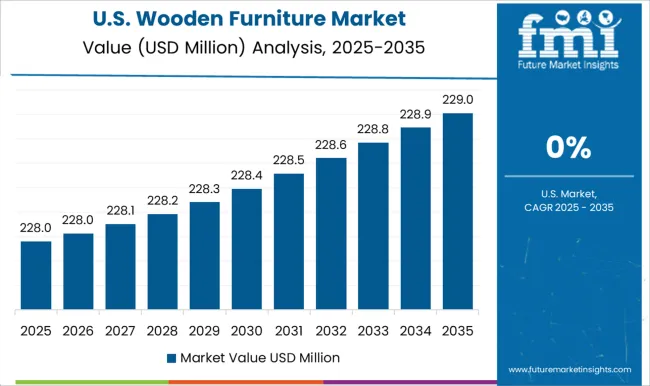

The wooden furniture market in the United States is expected to grow at a CAGR of 4.6%. The USA market remains steady, driven by increasing demand for high-quality, durable, and eco-friendly wooden furniture in residential and commercial applications. The country’s growing emphasis on sustainability, combined with consumer preferences for natural, non-toxic materials, continues to boost the adoption of wooden furniture. Additionally, the rise in home improvement projects, coupled with strong demand from the hospitality and retail sectors, supports market growth. The USA government’s focus on environmental regulations and green building practices further contributes to the demand for sustainable wooden furniture.

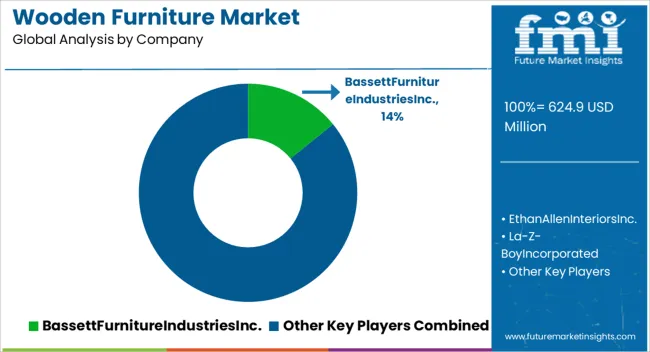

The wooden furniture market is dominated by Bassett Furniture Industries Inc., which leads with its high-quality, stylish wooden furniture solutions catering to both residential and commercial sectors. Bassett’s dominance is supported by its strong brand presence, innovative design, and commitment to providing durable, functional furniture made from sustainable wood materials. Key players such as Ethan Allen Interiors Inc., La-Z-Boy Incorporated, and Herman Miller, Inc. maintain significant market shares by offering a wide range of wooden furniture pieces that blend aesthetic appeal with practicality and comfort.

These companies focus on expanding product offerings, enhancing customization options, and incorporating sustainable materials to meet the evolving consumer demand for eco-friendly furniture solutions. Emerging players like Godrej & Boyce Manufacturing Company Limited, Natuzzi S.p.A., and Hooker Furniture Corporation are expanding their market presence by providing specialized wooden furniture solutions for niche applications such as luxury homes, office spaces, and eco-conscious interiors. Their strategies include enhancing product innovation, improving sustainability through responsible sourcing, and offering a diverse range of designs to cater to changing consumer preferences. Market growth is driven by increasing consumer demand for premium, high-quality furniture, rising disposable incomes, and the growing preference for sustainable, long-lasting home furnishings. Innovations in modular furniture systems, customizable designs, and sustainable production methods are expected to continue shaping competitive dynamics and fuel further growth in the global wooden furniture market.

| Item | Value |

|---|---|

| Quantitative Units | USD 624.9 Million |

| Product Type | Indoor Furniture and Outdoor Furniture |

| Wood Type | Hardwood and Softwood |

| Price Range | Medium, Low, and High |

| Application Segment | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BassettFurnitureIndustriesInc., EthanAllenInteriorsInc., La-Z-BoyIncorporated, NatuzziS.p.A., Godrej&BoyceManufacturingCompanyLimited, HookerFurnitureCorporation, HermanMiller,Inc., CasaInternationalLimited, Hülsta-WerkeHülsGmbH&Co.KG, and LauferGroupInternationalLtd |

| Additional Attributes | Dollar sales by wood type and application, demand dynamics across residential, commercial, and hospitality sectors, regional trends in wooden furniture adoption, innovation in sustainable sourcing and customization technologies, impact of regulatory standards on environmental compliance, and emerging use cases in smart home integration and modular furniture solutions. |

The global wooden furniture market is estimated to be valued at USD 624.9 million in 2025.

The market size for the wooden furniture market is projected to reach USD 1,057.4 million by 2035.

The wooden furniture market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in wooden furniture market are indoor furniture and outdoor furniture.

In terms of wood type, hardwood segment to command 54.9% share in the wooden furniture market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wooden Pallet Rental Service Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Furniture Polish Wipes Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Furniture Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Wooden Decking Market Size, Growth, and Forecast 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Furniture Polish Market Analysis by Product Type, Source, End Use, Sales Channel, and Region Through 2035

Wooden Barrels Market Growth - Demand & Forecast 2025 to 2035

Market Share Insights of Wooden Crate Providers

Furniture Packaging Market Trends & Industry Growth Forecast 2024-2034

Wooden Box Market Demand & Premium Packaging Trends 2024-2034

Wooden Pallets Market

Wooden Pallet Collars Market

Pet Furniture Market Analysis - Growth & Trends 2025 to 2035

Cat Furniture and Scratchers Market Analysis – Trends, Growth & Forecast 2025 to 2035

Market Leaders & Share in the Pet Furniture Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA