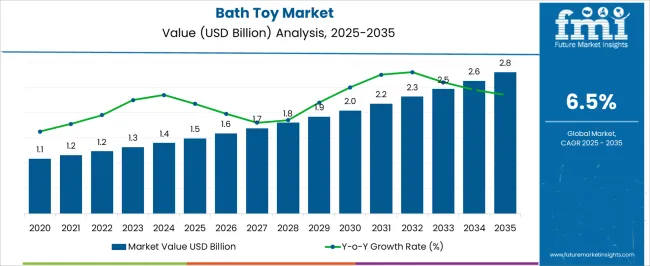

The bath toy market is projected at USD 1.4 billion in 2025 and anticipated to reach USD 2.8 billion by 2035, expanding at a CAGR of 6.5%. Breakpoint analysis indicates several key phases of acceleration, with early growth between 2025 and 2027 marked by rising consumer spending on safe, creative, and educational toys for toddlers. Mid-phase growth from 2028 to 2031 demonstrates stability in adoption rates, supported by product diversification into eco-friendly materials, interactive designs, and licensed cartoon or movie-themed characters.

Beyond 2032, expansion accelerates again as premium bath toys integrating sensory play, color-changing features, and multifunctional accessories gain popularity. Parents’ preferences for toys that combine hygiene, entertainment, and developmental learning create higher repeat purchases, strengthening revenue. Distribution through e-commerce and specialty baby product outlets widens reach, while collaborations with pediatric experts and endorsements from childcare brands provide credibility.

Dollar sales, share are also influenced by safety regulations, with compliance ensuring consumer trust across markets. Regional analysis suggests Asia-Pacific’s strong growth due to expanding middle-class households, while Europe and North America emphasize safety standards and branded collections. Breakpoints highlight that after periods of steady growth, surges are triggered by innovation, safety assurance, and targeted marketing campaigns, making the market highly dynamic with evolving consumer expectations.

| Metric | Value |

|---|---|

| Bath Toy Market Estimated Value in (2025 E) | USD 1.5 billion |

| Bath Toy Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The bath toy market is influenced by several interconnected parent markets, each contributing uniquely to overall demand and expansion. The infant and toddler toy segment holds the largest share at 40%, as bath toys are widely adopted for early-stage play, sensory stimulation, and engagement during hygiene routines, providing both entertainment and developmental benefits.

The educational toy segment contributes 25%, where bath toys are designed with learning features such as numbers, letters, and color recognition to support early childhood development. The personal care and baby hygiene products market accounts for 15%, with bath toys often bundled or co-purchased alongside soaps, shampoos, and skincare items, enhancing the overall bath-time experience. The water play and outdoor toy segment holds a 10% share, as many products cross over into pools and waterparks, supporting versatility and multi-use appeal. Finally, the licensed and character-based merchandise market represents 10%, driven by toys inspired by popular cartoons, movies, and gaming franchises that increase brand loyalty and repeat purchases.

Infant toys, educational toys, and personal care-linked segments account for 80% of global bath toy demand, indicating that developmental learning, hygiene integration, and character-driven designs remain the primary growth levers, while outdoor play and licensing support incremental opportunities.

The bath toy market is experiencing steady expansion driven by increasing awareness of early childhood development and the rising focus on safe and engaging playtime products for young children. The current market environment is shaped by growing parental preference for interactive and educational toys that promote sensory and motor skills during bath time.

Continuous innovations in material safety standards and non-toxic manufacturing processes are further supporting market growth. Increasing disposable incomes in emerging economies and the widespread availability of bath toys through both online and offline retail channels are enabling broader consumer reach.

The market outlook remains positive as manufacturers invest in product diversification and customization to meet evolving consumer expectations. Additionally, the trend towards eco-friendly and durable toys is opening new opportunities for sustained growth across various demographic segments.

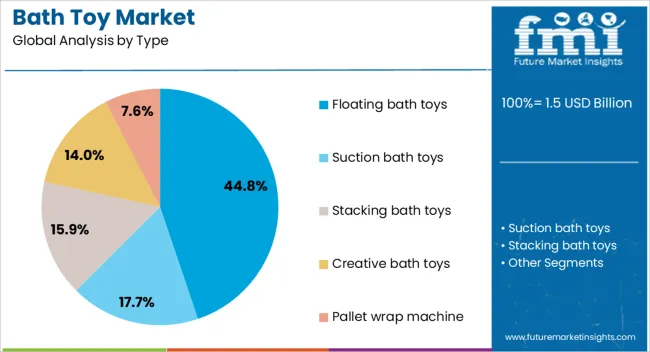

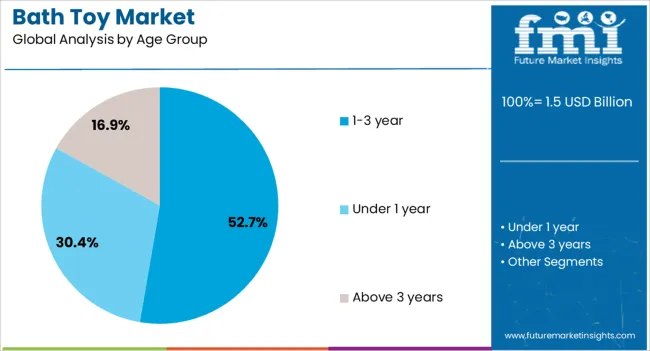

The bath toy market is segmented by type, age group, price range, distribution channel, and geographic regions. By type, bath toy market is divided into Floating bath toys, Suction bath toys, Stacking bath toys, Creative bath toys, and Pallet wrap machine. In terms of age group, the bath toy market is classified into 1-3 years, under 1 year, and above 3 years.

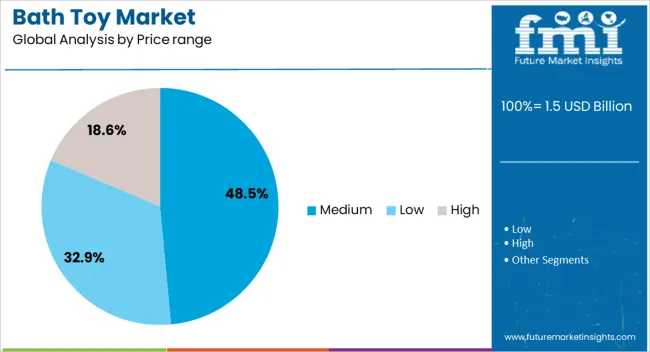

Based on price range, bath toy market is segmented into Medium, Low, and High. By distribution channel, bath toy market is segmented into Online and Offline. Regionally, the bath toy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Floating bath toys are projected to hold 44.8% of the Bath Toy market revenue share in 2025, making this the leading product type. The dominance of floating bath toys is attributed to their inherent suitability for water play, safety features, and ease of use by young children.

The ability of these toys to remain buoyant and visually engaging enhances their appeal during bath time, encouraging longer and more interactive play sessions. The versatility of floating toys to include various shapes and colors contributes to their sustained popularity.

Furthermore, the growing demand for products that combine entertainment with developmental benefits has reinforced the segment’s growth. Manufacturers have capitalized on these consumer preferences by incorporating bright designs and safe materials, which has accelerated adoption globally.

The 1-3 year age group segment is expected to capture 52.7% of the Bath Toy market revenue share in 2025, establishing it as the largest age-based segment. This significant share is linked to heightened parental focus on developmental milestones during early childhood and the preference for toys that support sensory exploration and motor skills in toddlers.

Bath toys designed for this age group are typically engineered with safety and ease of handling as priorities, which appeals to caregivers. Additionally, the rising number of young families and increased consumer spending on child-focused products have contributed to this segment’s growth.

The emphasis on educational play during routine activities such as bathing further reinforces the demand for age-appropriate bath toys targeted at this critical developmental stage.

The medium price range segment is projected to hold 48.5% of the Bath Toy market revenue share in 2025, marking it as the preferred pricing category among consumers. This preference is influenced by the balance of affordability and perceived quality offered in the medium price bracket, which aligns with consumer expectations for safe, durable, and engaging toys.

Buyers are increasingly seeking value-for-money products that meet safety standards while providing aesthetic and functional benefits. The availability of a wide variety of options within the medium price range, including innovative designs and trusted brand names, has further driven adoption.

Additionally, this segment benefits from widespread distribution across mass retail and e-commerce platforms, making it accessible to a broad consumer base and supporting its leading position in the market.

The bath toy market is evolving through educational integration, licensed merchandise, hygiene product bundling, and multi-use water play. Together, these dynamics highlight growth opportunities shaped by innovation in design, partnerships, and consumer-focused versatility.

The bath toy market is projected to gain traction as parents focus on products that combine entertainment with developmental benefits. Bath toys designed with educational features, including numbers, alphabets, and shapes, encourage cognitive growth while maintaining engagement during daily hygiene routines. Sensory stimulation through textures, colors, and sound-based designs has become a key preference for caregivers seeking functional play. Companies are emphasizing multi-purpose toys that balance learning and entertainment, allowing bath time to double as a developmental stage. Dollar sales, share highlight strong adoption in households with infants and toddlers, where safety, learning potential, and fun integration drive consumer decisions. Premium educational bath toys contribute heavily to overall demand.

A strong push from licensed and character-branded merchandise is redefining consumer choices in the bath toy space. Animated series, children’s films, and digital content inspire toy designs that increase brand loyalty and repeat purchases. Licensed bath toys provide familiarity for children, making bath routines enjoyable while driving higher price premiums. Collaborations between toy manufacturers and entertainment franchises expand the market footprint, as characters move from screen to bath time seamlessly. Retailers report strong demand for co-branded products in both offline stores and online platforms.

The co-purchase and bundling of bath toys with baby care products is a rising trend shaping market dynamics. Parents often select toys alongside shampoos, soaps, or skin-safe bathing accessories, creating a complementary demand stream. Manufacturers are capitalizing on this overlap by offering bundled packs and promotions that integrate toys into hygiene routines. Baby care brands are also collaborating with toy producers to expand product assortments and enhance consumer trust. This crossover ensures that bath toys become a part of the broader hygiene experience, increasing their necessity in daily parenting.

Versatility in product use is strengthening adoption, as many bath toys are now designed to function both indoors and outdoors. Toys compatible with pools, waterparks, and recreational play environments extend their usability beyond traditional bathrooms. Parents prefer products that provide long-term entertainment and adaptability, ensuring better return on spending. Floating toys, squirting figures, and interactive water-themed games dominate this segment, supported by consumer interest in multi-functional play options. This trend enhances product lifecycle and broadens retail opportunities across seasonal and leisure categories.

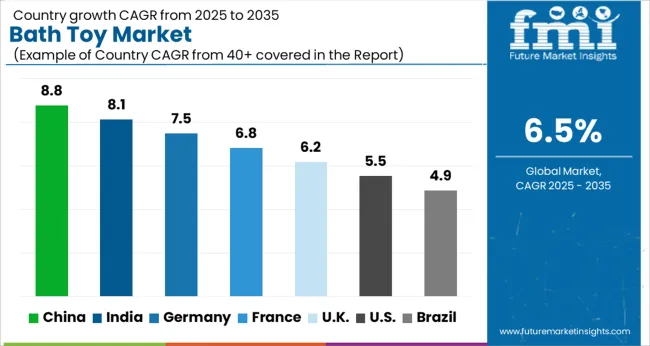

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| U.K. | 6.2% |

| U.S. | 5.5% |

| Brazil | 4.9% |

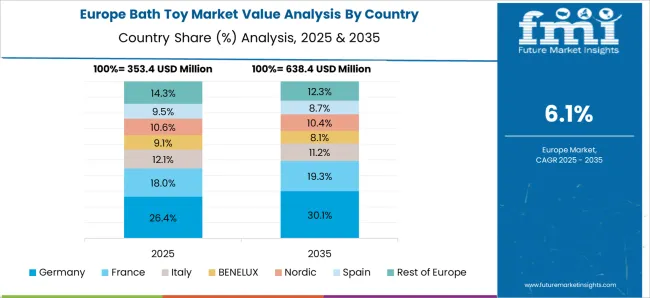

The global bath toy market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China leads at 8.8%, followed by India at 8.1%, Germany at 7.5%, the U.K. at 6.2%, and the U.S. at 5.5%. Growth is fueled by rising consumer focus on child development, early learning integration, and safety-certified play products. Asia, led by China and India, is seeing rapid adoption due to expanding middle-class spending, parental awareness of developmental toys, and widespread e-commerce distribution. Europe emphasizes premium, high-quality toys with strong safety compliance, while North America focuses on character-based, interactive, and educational toys that blend entertainment with cognitive benefits. Dollar sales, share indicate that premium learning-based toys and licensed merchandise dominate revenue streams, while multi-functional water play toys provide incremental growth across global markets. The analysis covers over 40+ countries, with the leading markets detailed above.

The bath toy market in China is projected to grow at a CAGR of 8.8% from 2025 to 2035, supported by rising parental focus on child development and the popularity of interactive play solutions. Rapid urban household growth and higher spending on premium, safe, and educational toys are fueling demand. Domestic manufacturers are innovating with water-safe, non-toxic materials and character-driven designs, while global players expand through e-commerce and retail partnerships. Licensed products inspired by cartoons and children’s media dominate sales, while multifunctional bath toys that combine learning and entertainment see increasing adoption. Dollar sales, share indicate premium educational products and branded toys lead revenue, while mid-tier and functional toys support mass adoption across broader consumer bases.

The bath toy market in India is expected to expand at a CAGR of 8.1% from 2025 to 2035, driven by increasing awareness of early childhood learning and rising spending on child-centric products. Middle-class households are prioritizing educational and interactive bath toys that enhance sensory skills and engagement. Domestic manufacturers focus on affordability and functionality, while international brands penetrate through modern retail and online channels with premium offerings. Licensed character-based toys are gaining strong traction, while eco-friendly and safety-certified products attract urban buyers. Dollar sales, share suggest branded and educational toys dominate high-value segments, whereas cost-effective, durable toys sustain widespread adoption in rural and semi-urban regions.

The bath toy market in Germany is projected to grow at a CAGR of 7.5% from 2025 to 2035, supported by strong consumer preference for safety, quality, and eco-friendly design. Parents favor toys made from BPA-free plastics, natural rubbers, and recycled materials, reflecting demand for child-safe and environmentally conscious products. Branded European manufacturers dominate with innovative designs, while imports expand choice through specialty retail and e-commerce. Educational bath toys that integrate counting, color recognition, and puzzle-based play are highly popular. Dollar sales, share indicate premium eco-conscious products dominate, while mid-range and functional bath toys continue to support mass-market penetration. Retail collaborations and online sales strengthen accessibility, driving consistent growth in family-centric households.

The bath toy market in the U.K. is expected to grow at a CAGR of 6.2% from 2025 to 2035, driven by increasing demand for developmental and character-based toys. Parents emphasize learning-based water toys that combine play with motor skills and creativity. Licensed products inspired by popular media franchises dominate premium sales, while eco-friendly bath toys made from safe, biodegradable materials gain visibility in retail outlets. Domestic and international brands compete through supermarkets, specialty stores, and digital platforms, ensuring accessibility across varied income groups. Dollar sales, share show premium branded toys dominate high-value segments, whereas affordable and functional toys maintain steady demand across wider households.

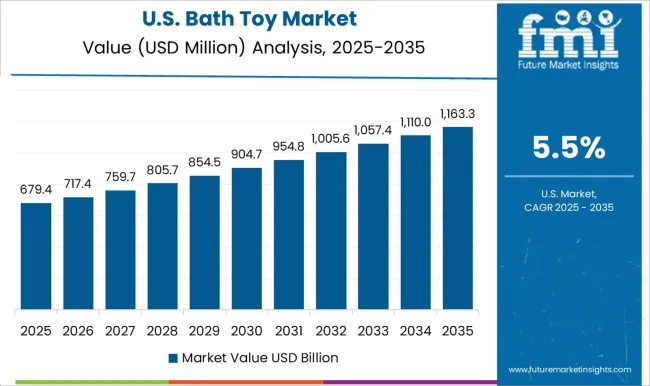

The bath toy market in the U.S. is projected to grow at a CAGR of 5.5% from 2025 to 2035, influenced by rising preference for interactive and character-driven toys. Parents seek multifunctional toys that encourage early learning, motor skills, and creativity during bath time. Licensed merchandise tied to popular children’s shows and movies dominates premium categories, while safety-certified, BPA-free, and eco-friendly toys appeal to health-conscious consumers. Retailers and e-commerce platforms enhance accessibility through bundled offerings, seasonal promotions, and brand-led campaigns. Dollar sales, share reveal premium licensed toys lead revenue, while mid-tier functional toys provide consistent adoption across mainstream households. Emerging trends highlight integration of smart bath toys with light and sound features for enhanced play.

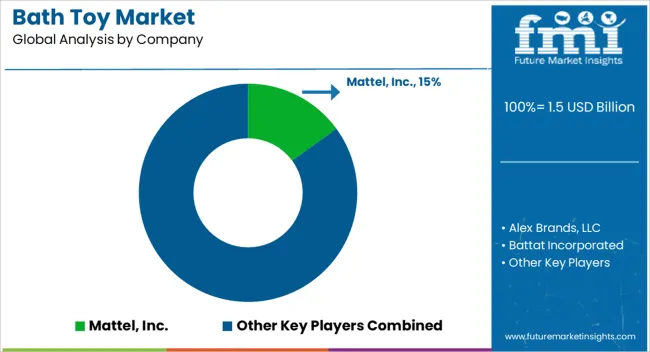

Competition in the bath toy market is defined by product safety, developmental value, and brand recognition. Mattel, Inc. and VTech Holdings Limited lead with diversified portfolios of interactive and character-based toys, emphasizing safety certifications, multifunctional features, and strong global retail presence. TOMY International, Inc. and Munchkin, Inc. compete by focusing on infant-safe designs, colorful playsets, and character-themed bath products that combine entertainment with developmental benefits. Green Toys, Inc. and Hape International AG differentiate through eco-friendly, non-toxic materials, offering BPA-free and recycled plastic toys that appeal to health-conscious parents. Regional and niche players such as Playgro Pty Ltd., Boon, Inc., and Skip Hop, Inc. leverage innovative designs and practical features, catering to parents seeking functionality alongside fun.

Infantino, LLC and Yookidoo Ltd. emphasize interactive, water-activated products with learning-focused designs, while Juratoys SAS and Luv n' Care, Ltd. build brand loyalty through premium collections and distribution via specialty stores. Alex Brands, LLC and Battat Incorporated strengthen their reach with affordable, durable bath toys positioned for mass-market appeal. Strategies across market players highlight safety compliance, parental trust, and continuous innovation in design and materials.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Type | Floating bath toys, Suction bath toys, Stacking bath toys, Creative bath toys, and Pallet wrap machine |

| Age Group | 1-3 year, Under 1 year, and Above 3 years |

| Price range | Medium, Low, and High |

| Distribution channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mattel, Inc., Alex Brands, LLC, Battat Incorporated, Boon, Inc., Green Toys, Inc., Hape International AG, Infantino, LLC, Juratoys SAS, Luv n' Care, Ltd., Munchkin, Inc., Playgro Pty Ltd., Skip Hop, Inc., TOMY International, Inc., VTech Holdings Limited, and Yookidoo Ltd. |

| Additional Attributes | Dollar sales, share across regions, growth drivers in infant and toddler categories, safety regulations, material innovations, retail vs. e-commerce performance, competitive positioning, and licensing opportunities. |

The global bath toy market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the bath toy market is projected to reach USD 2.8 billion by 2035.

The bath toy market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in bath toy market are floating bath toys, suction bath toys, stacking bath toys, creative bath toys and pallet wrap machine.

In terms of age group, 1-3 year segment to command 52.7% share in the bath toy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bathroom Furniture Market Size and Share Forecast Outlook 2025 to 2035

Bath Linen and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Remodeling Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bathroom Vanities Market Analysis - Growth, Trends and Forecast from 2025 to 2035

Bathtub Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Bath Rugs & Mats Market Growth - Trends & Industry Outlook 2025 to 2035

Bathroom Worktops Market Analysis - Trends & Forecast 2025 to 2035

Bath Bomb Market Growth – Size, Trends & Forecast 2024-2034

Pet Bathing Supplies Market Growth - Trends & Forecast to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Plastic Bathtub Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Medicated Bath Additive Market Size and Share Forecast Outlook 2025 to 2035

Preoperative Bathing Solution Market Analysis by End User into Intensive Care Unit, Surgical Wards and Medical Wards Through 2035.

Prefabricated Bathroom Pods Market Size and Share Forecast Outlook 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA