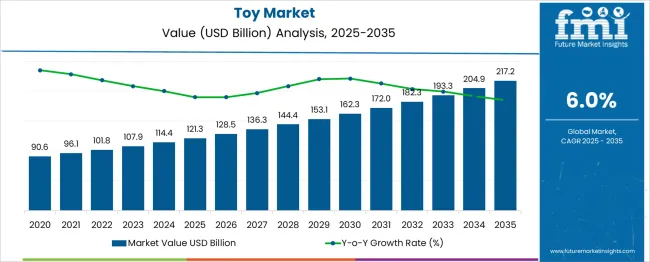

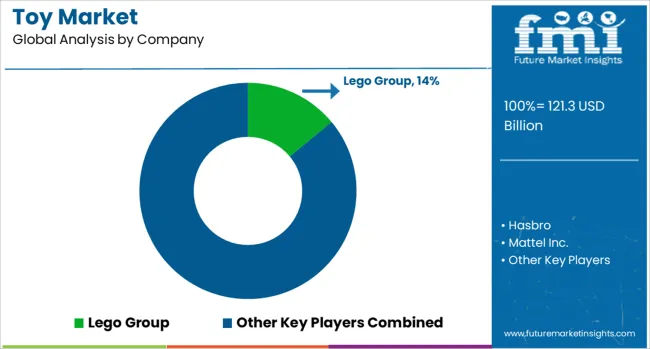

The Toy Market is estimated to be valued at USD 121.3 billion in 2025 and is projected to reach USD 217.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. From 2025 to 2030, the market grows steadily, reaching USD 162.3 billion. Annual increases show healthy momentum: USD 128.5 billion in 2026, USD 136.3 billion in 2027, USD 144.4 billion in 2028, and USD 153.1 billion in 2029.

This stable expansion favors companies that offer diverse, age-targeted product lines and maintain strong retail and e-commerce distribution. Brands investing in character licensing, thematic playsets, and interactive learning products are likely to gain market share as demand for engaging and educational toys grows. Smaller or traditional manufacturers may face share erosion if they fail to adapt to changing consumer preferences, safety standards, or digital integration. Supply chain agility and marketing strength will be key in retaining visibility and shelf space across global markets. From 2025 to 2030, the market will reward players who can balance creativity with cost control and reach. Seasonal responsiveness, packaging appeal, and cross-channel strategy will shape competitive advantage in a steadily expanding global toy industry.

| Metric | Value |

|---|---|

| Toy Market Estimated Value in (2025 E) | USD 121.3 billion |

| Toy Market Forecast Value in (2035 F) | USD 217.2 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The long-term value accumulation curve for the toy market reflects a steadily compounding growth pattern over the 2025–2035 period, supported by a consistent demand base and evolving product innovation cycles. Starting from a market size of USD 121.3 billion in 2025, the market grows to USD 217.2 billion by 2035, reflecting a robust and predictable CAGR of 6.0 %. The early phase of the curve (2025–2028) shows moderate annual increments, driven by sustained sales of traditional toys, educational products, and rising demand for licensed character-based items. During this phase, value accumulation is steady but not steep, as manufacturers optimize portfolios and expand into emerging markets. Between 2028 and 2032, the curve steepens noticeably.

This marks a mid-phase acceleration fueled by increased consumer spending, enhanced product personalization, and integration of smart features (e.g., toys with app connectivity, voice recognition, and learning feedback). The growth here is not only volume-driven but also value-enhanced through higher-margin segments. By the 2032–2035 period, the curve continues its upward momentum, with cumulative value rising sharply due to broader digital engagement, subscription-based toy services, and higher global participation in premium and STEM-focused toys. Overall, the curve represents a reliable long-term value accumulation trajectory, reflecting both durable demand and innovative evolution.

A significant shift has been observed in the way toys are being positioned, with emphasis being placed on learning, creativity, and cognitive skill enhancement. As families increasingly seek toys that combine entertainment with developmental value, manufacturers are aligning product strategies to meet these demands.

The future of the Toy market is expected to be shaped by product diversification, safe material usage, and tech-enabled experiences that engage children across different learning stages. Sustainability and customization trends are also influencing purchasing behavior, leading to rising investments in eco-friendly and inclusive product designs.

With growing disposable incomes, rising urbanization, and heightened awareness around early childhood education, the market is positioned for strong performance globally. The integration of value-added features into toys is likely to drive premiumization and sustain long-term industry growth..

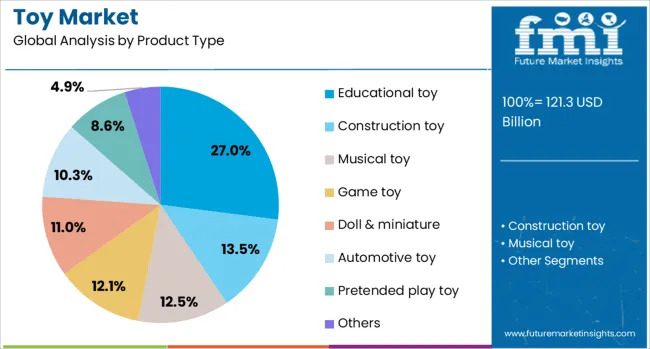

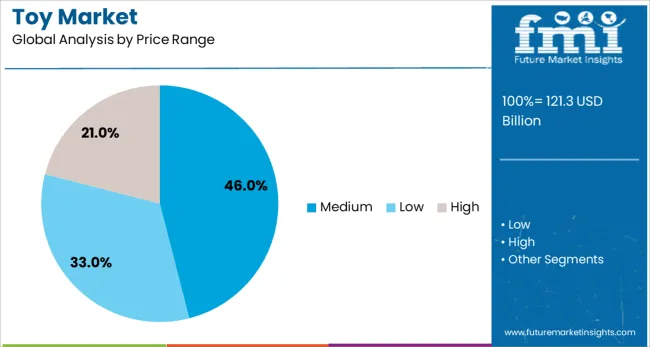

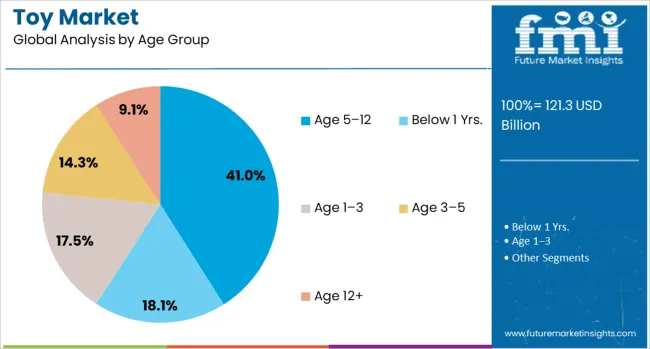

The toy market is segmented by product type, price range, age group, material, end use, distribution channel, and geographic regions. The toy market is divided into the following product types: Educational toy, Construction toy, Musical toy, Game toy, Doll & miniature, Automotive toy, Pretended play toy, and Others. The toy market is classified into Medium, Low, and High price ranges. The toy market is segmented into Age 5–12, Below 1 Yrs.., Age 1–3, Age 3–5, and Age 12+. The toy market is segmented by material into Plastic, Wooden, Metal, Fabric, and Biodegradable/Organic Materials. The toy market is segmented by end use into Individual and Commercial. The toy market is segmented by distribution channel into Offline and Online. Regionally, the toy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The educational toy subsegment within the product type category is projected to account for 27% of the Toy market revenue share in 2025, making it the leading product type. This growth has been attributed to the increasing demand for toys that promote cognitive development, problem-solving, and creativity in children. Parents and educators have shown a strong preference for products that support early learning goals and align with school readiness programs.

The segment has also benefited from the widespread availability of STEM-focused toys, which help build foundational skills in science, technology, engineering, and mathematics. Enhanced by rising awareness of developmental milestones and the role of purposeful play, educational toys have gained popularity in both urban and semi-urban households.

The growth of this subsegment has also been supported by product innovation, integration of interactive features, and endorsements by educational institutions. As parental priorities continue to shift towards meaningful engagement, educational toys are expected to remain at the forefront of the Toy market..

The medium price range segment is expected to hold 46% of the Toy market revenue share in 2025, emerging as the most preferred pricing tier. This segment has experienced growth due to its balance between affordability and quality, appealing to a broad range of consumers seeking durable yet reasonably priced toys. Parents have increasingly chosen products in this category that offer extended play value, educational benefits, and safe materials without incurring the cost of premium toys.

The availability of diverse toy options in this price band has supported strong penetration across middle-income households and gift-buying occasions. Manufacturers have focused on maximizing perceived value through multifunctional designs, colorful aesthetics, and licensing from popular media franchises.

Retailers and e-commerce platforms have further amplified this segment’s growth by offering bundled promotions and seasonal discounts. As economic conditions and consumer budgets remain a consideration in purchasing decisions, the medium price range is expected to continue its dominance across global markets..

The age 5 to 12 segment within the age group category is forecasted to capture 41% of the Toy market revenue share in 2025, making it the most significant age-based segment. This growth has been driven by the developmental needs and evolving interests of children within this age range, who demand more interactive, challenging, and skill-based play experiences. Toys targeted at this group have gained traction due to their alignment with academic learning, problem-solving, motor skills development, and social play.

The segment has benefited from school-related learning aids, themed building kits, board games, and role-play sets that cater to both educational and entertainment needs. Increasing screen exposure has also led to demand for offline, hands-on play that enhances imagination and group interaction.

Parents have shown preference for toys that keep children engaged meaningfully while supporting emotional and intellectual growth. With ongoing product innovation and a strong focus on developmental play, the age 5 to 12 group is expected to maintain its leadership in the Toy market..

The toy market is expanding globally due to rising consumer demand for educational, interactive, and collectible play experiences. Digital integration, such as app-enabled STEM toys and augmented reality kits, is driving innovation. Licensed products tied to media franchises and adult collector trends are fueling growth in both children’s and adult segments. Eco-conscious materials and sustainable manufacturing practices are gaining importance among buyers. E‑commerce platforms and social media marketing enhance access and visibility.

Regions undergoing industrial shifts and rising purchasing power, particularly North America, Europe, and the Asia-Pacific, remain key growth hubs. Market stability is supported by product diversification, evolving consumer preferences, and investment in technology-enabled play.

The integration of digital technologies with traditional toys is transforming the way consumers engage with play products. Emerging toys combine physical components with augmented reality, app interfaces, and interactive sensors to deliver immersive learning and entertainment. These hybrid products allow children to experiment with coding, robotics, and STEM learning while maintaining hands-on interaction. IoT connectivity and embedded artificial intelligence provide adaptive features and personalized content, enhancing both enjoyment and educational value. Parents increasingly value toys that encourage cognitive development alongside fun. The rise of tech-enabled play experiences supports recurring engagement and longer product life cycles. Manufacturers investing in hybrid design and software-enabled platforms differentiate themselves in a market evolving toward experiential and customizable play solutions. These tech-integrated toys offer new forms of storytelling, challenge-based learning, and content updates that align with digital expectations and educational goals

Licensed toy segments linked to popular franchises in movies, TV, and gaming continue to drive a substantial share of market demand. Collectible lines tied to entertainment properties attract both children and adult “kidult” buyers who seek memorabilia and display-worthy items. Social trends around nostalgia and emotional connection fuel interest among adult consumers, creating a sizeable collector economy outside traditional child segments. Blind-box collectible figures and limited-run plush toys gain visibility on social media, boosting brand presence and sales. These licensed and collectible products often generate recurring excitement around franchise releases or influencers. As adult consumers increasingly embrace toys as lifestyle purchases or stress-relief outlets, licensed collectibles represent a dynamic growth segment. These demand patterns prompt toy manufacturers to collaborate closely with entertainment licensors and cultivate community-driven fan loyalty through premium and exclusive releases.

There is strong growth in educational and STEM-focused toys as parents and educators seek tools that support early learning and skill development. Toys which encourage problem-solving, creativity, coding, and experimentation are increasingly prioritized in selection. These products often support tactile learning and incorporate science, math, and engineering concepts through engaging play. As remote and hybrid schooling persists, interactive learning aids extend into home environments. Subscription-based and modular STEM kits allow iterative learning and result in high engagement. Focused design on age-appropriate complexity, safety, and educational outcomes elevates acceptance in both household and institutional purchase settings. Manufacturers offering certified learning outcomes, high quality and repeatable usage benefit from strong institutional adoption in schools and educational programs globally, strengthening the base of the educational toy segment.

Changing consumer lifestyles are reshaping expectations and demand within the toy market. With dual-income households and busier schedules, parents increasingly value toys that are low maintenance, versatile, and encourage independent play without constant supervision. Compact, multifunctional toys that adapt to varied environments travel, home, daycare are gaining preference. Audio-guided storytelling toys, subscription toy kits, and “one-box” educational packs require minimal setup and support hands-off engagement. At the same time, busy families appreciate products that store easily and transition across age groups. Adult consumers seeking stress relief or leisure purchases favor tactile, minimalist designs requiring minimal assembly. Collectively, these lifestyle shifts prompt manufacturers to design toys that support flexible usage patterns, space-saving storage and reusable content. Brands aligning product design with modern household rhythms short assembly, modular formats, multi-use play gain traction in settings where time-strapped parents balance convenience, quality and engagement in toy choice decisions.

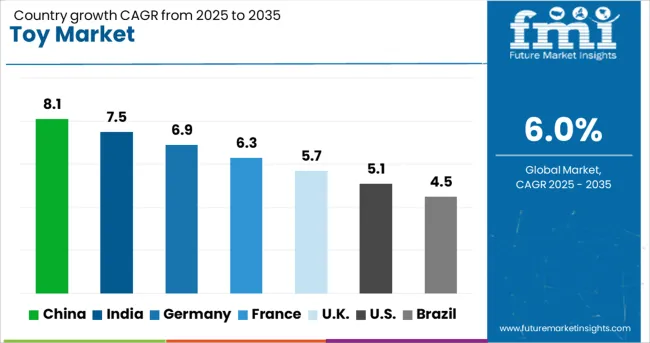

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The toy market is projected to expand at a CAGR of 6.0% through 2035, driven by innovation in educational toys, rising disposable income, and growing demand for character merchandise. China leads with an impressive growth rate of 8.1%, supported by a robust manufacturing ecosystem and strong export capabilities. India follows at 7.5%, buoyed by increasing localization, government support for indigenous toy production, and growing middle-class consumption. Germany, with a 6.9% growth rate, benefits from premium toy demand and adherence to strict quality standards. The United Kingdom, growing at 5.7%, shows steady growth through online retail expansion and evolving consumer preferences. The United States, expanding at 5.1%, continues to be a key market due to high per-child spending and strong innovation in interactive toys. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The toy market in China is expanding at a CAGR of 8.1%, fueled by rising disposable incomes, a booming middle class, and growing demand for premium educational toys. Domestic brands are leveraging e-commerce channels and influencer marketing to penetrate tier-2 and tier-3 cities. International toy manufacturers are increasingly localizing their offerings to align with cultural preferences and safety standards. Educational toys that promote STEM learning, language development, and creativity are gaining favor among parents, especially in urban regions. Additionally, toys based on popular domestic animation characters are capturing substantial market share. Government regulations ensure product safety, which strengthens consumer trust. Moreover, smart toys and augmented reality (AR)-enabled playsets are emerging segments, supported by advancements in local tech manufacturing.

India is witnessing a CAGR of 7.5% in the toy market, driven by growing awareness around cognitive development and a resurgence in demand for locally made toys. Initiatives like “Make in India” and restrictions on substandard imports are boosting domestic manufacturing. Middle-income families are spending more on developmental and skill-enhancing toys, especially in the preschool segment. Startups and traditional toy makers are introducing eco-friendly and culturally rooted products, often aligned with Indian mythology and heritage. Regional language packaging and voice-based learning tools are also making inroads. Online marketplaces have widened product reach, especially in semi-urban areas. Furthermore, toy libraries and rental platforms are promoting sustainable consumption models. Government support through toy clusters and innovation hubs is encouraging entrepreneurship in this space.

Germany is experiencing a CAGR of 6.9% in the toy market, supported by demand for sustainably produced, educational, and gender-neutral toys. Parents increasingly seek high-quality, durable toys with learning benefits and low environmental impact. German manufacturers are pioneers in wooden and eco-friendly toys, often certified with sustainability labels like FSC. Digital integration is carefully balanced with traditional play to avoid overexposure to screens. Educational toys promoting STEM, motor skills, and emotional intelligence are particularly popular. Germany’s retail environment supports specialty stores and boutique outlets that offer curated experiences. Toy companies also focus on age-appropriate labeling and rigorous quality assurance. The country’s emphasis on child development and safety regulations strengthens trust in domestic and European brands.

The toy market in the United Kingdom is growing at a CAGR of 5.7%, influenced by shifts in family dynamics, screen fatigue, and preferences for experiential play. British consumers are showing increased interest in toys that support outdoor activities, teamwork, and mental wellness. Educational kits focused on science experiments, coding, and robotics are gaining favor in both schools and homes. Retailers are adopting omnichannel strategies, combining e-commerce platforms with in-store demos and loyalty programs. Importantly, sustainability has become a key differentiator, with many UK toy companies exploring recyclable packaging and biodegradable materials. Licensing continues to be a major driver, with toys linked to film franchises and streaming content enjoying high turnover. Post-Brexit adjustments have led to changes in supply chains, impacting pricing and availability.

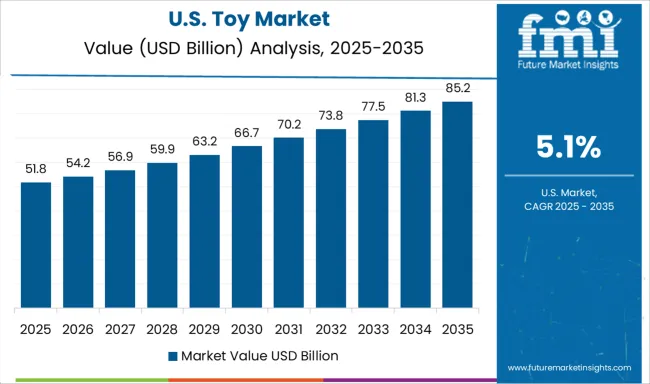

The toy market in the United States is expanding at a CAGR of 5.1%, with significant momentum coming from innovation in interactive and inclusive toys. American families are gravitating toward toys that promote inclusivity, diversity, and mental well-being. Tech-integrated toys featuring voice recognition, robotics, and app connectivity are in high demand, especially among tech-savvy parents. Educational and developmental toys for early learners remain strong performers. Major toy companies are also focusing on customizable and gender-neutral designs to match shifting societal preferences. Retail trends show growth in direct-to-consumer models, supported by influencer campaigns and subscription boxes. Regulatory compliance and product safety remain top priorities, especially with increased scrutiny around digital privacy in toys. Furthermore, nostalgia-driven reboots of classic toys are helping brands reach both children and adult collectors.

The global toy market continues to evolve rapidly, driven by innovation, brand licensing, digital integration, and shifting consumer preferences across age groups. From educational play to collectibles and tech-enabled toys, top players in the industry are balancing tradition with modern play patterns. Growth is further fueled by expanding online retail channels, franchise-based entertainment, and demand for sustainable and inclusive toys. Lego Group leads with its iconic construction toys and has successfully expanded into themed sets, digital gaming, and licensed collaborations (e.g., Star Wars, Harry Potter).

Hasbro and Mattel Inc. remain dominant through globally recognized brands like Transformers, Barbie, Hot Wheels, and Monopoly leveraging cross-platform content, film tie-ins, and digital apps. Bandai Namco Holdings Inc. excels in the Japanese and global markets with character-driven toys, anime collectibles, and strong synergy between physical products and media franchises like Dragon Ball and Gundam. Spin Master (creator of PAW Patrol) and MGA Entertainment (known for L.O.L. Surprise!) thrive in the collectible and surprise toy segment, frequently setting social media trends and driving rapid sell-through in mass retail. Playmobil and TOMY offer quality toys with educational and imaginative value, appealing to both younger children and parents. Meanwhile, Simba Dickie Group maintains a broad portfolio across categories and age groups, with strong distribution in Europe. As the market embraces interactive tech and nostalgia, suppliers that innovate while staying brand-authentic are poised for long-term growth.

As mentioned in LEGO’s official announcement on July 10, 2025, the company unveiled the LEGO Icons Transformers Soundwave set, featuring 1,505 pieces, a functioning cassette bay, and sound effects. The set launches August 1 for LEGO Insiders and August 4 publicly. As mentioned in Hasbro’s presentation at Toy Fair 2025, the company introduced Nano‑mals, interactive, sensory-focused electronic pets. Launching globally in Fall 2025 at $19.99, the toys feature lights, over 70 sounds, and textures, encouraging imaginative play and multi-unit interaction for children.

| Item | Value |

|---|---|

| Quantitative Units | USD 121.3 Billion |

| Product Type | Educational toy, Construction toy, Musical toy, Game toy, Doll & miniature, Automotive toy, Pretended play toy, and Others |

| Price Range | Medium, Low, and High |

| Age Group | Age 5–12, Below 1 Yrs., Age 1–3, Age 3–5, and Age 12+ |

| Material | Plastic, Wooden, Metal, Fabric, and Biodegradable/Organic Materials |

| End Use | Individual and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lego Group, Hasbro, Mattel Inc., Bandai Namco Holdings Inc., Spin Master, MGA Entertainment, Playmobil, TOMY, and Simba Dickie Group |

| Additional Attributes | Dollar sales by toy type including action figures, building sets, dolls, games and puzzles, plush toys, and connected smart toys; by application across retail stores, e-commerce platforms, specialty toy chains, and educational institutions in North America, Europe, and Asia-Pacific; demand driven by educational play, kidult collectibles, and seasonal gifting; innovation in AI-integrated toys, eco-friendly materials, and interactive digital features; costs influenced by licensing, raw material prices, electronic components, and global logistics. |

The global toy market is estimated to be valued at USD 121.3 billion in 2025.

The market size for the toy market is projected to reach USD 217.2 billion by 2035.

The toy market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in toy market are educational toy, construction toy, musical toy, game toy, doll & miniature, automotive toy, pretended play toy, others, _art and craft toys and _musical instruments.

In terms of price range, medium segment to command 46.0% share in the toy market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Toy Bag Market Analysis on Material Type, Bag Type, Category, Sales or Distribution Channel, and Region through 2025 to 2035

Toy Packaging Market Trends – Growth & Forecast 2024-2034

Pet Toys Market Analysis – Size, Share & Forecast 2025 to 2035

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Kids Toys Market Size and Share Forecast Outlook 2025 to 2035

Bath Toy Market Size and Share Forecast Outlook 2025 to 2035

Bird Toy Market Size and Share Forecast Outlook 2025 to 2035

IP Pop Toy Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Male Sex Toys Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Licensed Toy Market Size and Share Forecast Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Traditional Toys and Games Market Size and Share Forecast Outlook 2025 to 2035

Educational Toys Market Analysis and Overview by Category, End-use Sector, and Area through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA