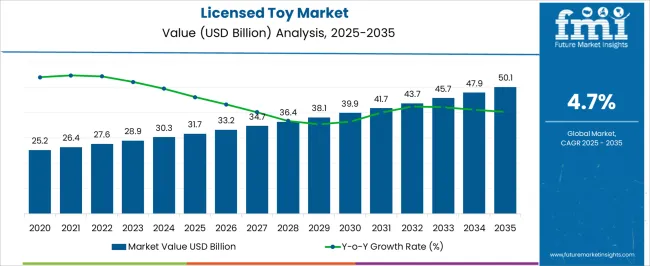

The licensed toy market is set to grow from USD 31.7 billion in 2025 to USD 50.1 billion by 2035, reflecting a CAGR of 4.7%. Compound absolute growth analysis provides insight into the incremental gains over time, illustrating how both volume expansion and price dynamics contribute to overall market development. From 2025 to 2027, the market advances from USD 31.7 billion to USD 34.7 billion, with intermediate values of USD 33.2 billion and 34.7 billion.

Growth during this early phase is driven by popular franchise launches, seasonal demand, and collaborations with leading media properties, which stimulate early adoption among children and collectors. Between 2028 and 2031, revenues rise from USD 36.4 billion to USD 41.7 billion, with intermediate gains at USD 38.1 billion and 39.9 billion. During this phase, compound absolute growth is bolstered by diversification of licensed products across educational, digital, and interactive toy segments. Expansion into emerging markets and strategic partnerships with global entertainment companies further accelerate incremental gains. From 2032 to 2035, the market reaches USD 50.1 billion, with intermediate milestones at USD 43.7 billion, 45.7 billion, and 47.9 billion.

| Metric | Value |

|---|---|

| Licensed Toy Market Estimated Value in (2025 E) | USD 31.7 billion |

| Licensed Toy Market Forecast Value in (2035 F) | USD 50.1 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The licensed toy market is strongly shaped by five interconnected parent markets, each contributing to overall demand and growth. The entertainment and media franchises market holds the largest share at 40%, driven by toys based on movies, TV shows, cartoons, and video games, which attract strong brand recognition and fan engagement. The retail and e-commerce distribution market contributes 25%, as supermarkets, specialty stores, and online platforms provide accessibility, visibility, and a broad consumer reach for licensed toys.

The consumer electronics and interactive toys market accounts for 15%, where digital toys and interactive products leverage popular licenses to enhance play value and engagement. The promotional and merchandising market holds a 10% share, driven by collaborations between brands, films, and franchises to create collectible toys and limited-edition products. Finally, the educational and learning toys market represents 10%, integrating licensed characters into educational kits, puzzles, and learning tools to attract children and improve learning outcomes. Entertainment, retail, and interactive toy segments account for 80% of overall demand, highlighting that media franchises, distribution networks, and interactive engagement remain the primary growth drivers, while promotional and educational applications provide complementary opportunities for market expansion globally.

The licensed toy market is witnessing steady growth, fueled by cross-media brand integration, rising disposable income among middle-class families, and growing affinity for collectible characters. Toy manufacturers are increasingly partnering with film studios, gaming franchises, and influencers to boost brand value and product differentiation.

Licensing strategies help brands capitalize on established fanbases while minimizing marketing costs. Additionally, evolving digital platforms such as streaming services and mobile games continue to extend the lifecycle and visibility of licensed characters.

As educational and imaginative play gain importance among parents, toys with strong narratives and familiar IPs are being favored over generic alternatives.

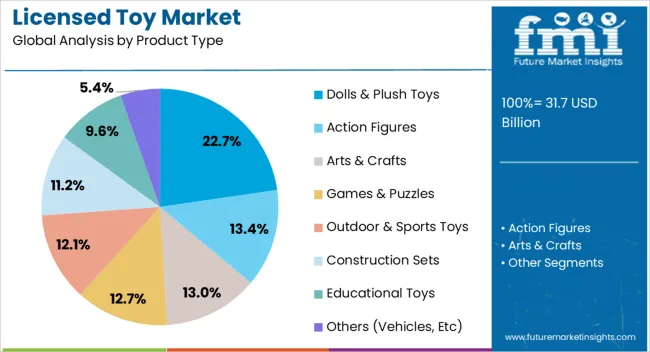

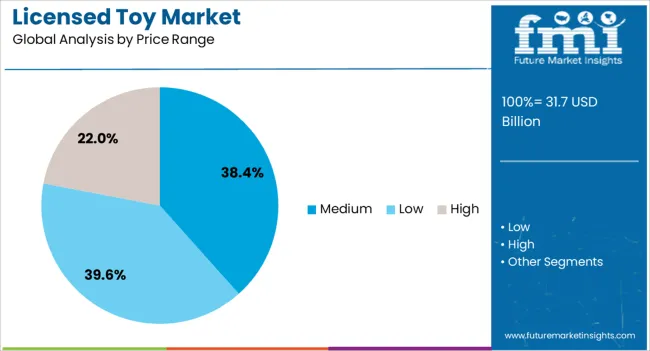

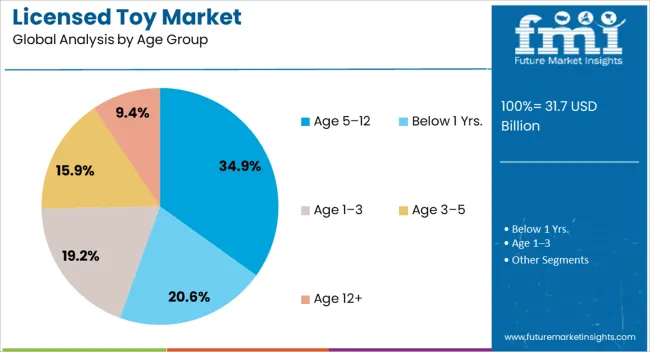

The licensed toy market is segmented by product type, price range, age group, end-use, distribution channel, and geographic regions. By product type, licensed toy market is divided into Dolls & Plush Toys, Action Figures, Arts & Crafts, Games & Puzzles, Outdoor & Sports Toys, Construction Sets, Educational Toys, and Others (Vehicles, Etc). In terms of price range, licensed toy market is classified into Medium, Low, and High. Based on age group, licensed toy market is segmented into Age 5–12, Below 1 Yrs., Age 1–3, Age 3–5, and Age 12+. By end-use, licensed toy market is segmented into Individual and Commercial. By distribution channel, licensed toy market is segmented into Offline. Regionally, the licensed toy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Dolls & plush toys are projected to lead with a 22.7% share in 2025, driven by their strong emotional appeal and character branding potential. These toys are often central to storytelling-based licensing, particularly from animated series and children's films.

Their tactile nature and giftability make them perennial favorites in both traditional retail and online marketplaces. Moreover, plush collectibles tied to limited editions and popular franchises help generate repeat purchases and fandom-based loyalty.

The segment continues to evolve with added interactivity, augmented reality tie-ins, and co-branding with apparel or accessories.

The medium price range is forecast to account for 38.4% of the licensed toy market by 2025, leading in revenue contribution. This segment balances affordability with perceived value, making it attractive for middle-income households.

It allows brands to integrate detailed design, interactive elements, and durable materials while remaining within reach for frequent gift purchases. Retailers are focusing on this segment with bundle packs, seasonal discounts, and character-specific promotions.

Additionally, medium-priced toys often serve as entry points for broader licensed merchandise ecosystems, such as themed apparel, school supplies, and digital content.

Toys targeting the age group of 5–12 years are expected to dominate with a 34.9% share in 2025. This age range exhibits the highest engagement with licensed content across TV, streaming platforms, mobile games, and comic books.

Children in this segment actively seek character-driven products that support role-play, collection, and creativity. Licensing deals focused on superheroes, princess franchises, fantasy universes, and gaming IPs are especially resonant within this group.

Moreover, educational toys with licensing tie-ins also see strong uptake due to school integration and parental encouragement. As brand influence peaks during these formative years, manufacturers are tailoring product lines, narratives, and accessory kits specifically for this demographic.

The licensed toy market is growing as manufacturers, retailers, and licensors prioritize brand recognition, consumer engagement, and differentiated play experiences. Demand is driven by popular entertainment franchises, movies, cartoons, video games, and celebrity-endorsed characters across action figures, dolls, construction sets, and interactive toys.

Challenges include high licensing fees, seasonal demand fluctuations, and regulatory compliance related to safety and materials. Opportunities exist in digital integration, collectible series, and co-branded merchandise. Trends highlight augmented reality, interactive play, customizable products, and cross-media marketing.

Consumers, especially children and collectors, increasingly prefer toys tied to well-known franchises, movies, TV shows, and digital content. Licensed toys offer familiarity, storytelling potential, and engagement through characters children recognize and love. Growth in media streaming, gaming, and social media exposure has strengthened brand-driven demand, influencing purchase decisions. Retailers prioritize toys with strong brand appeal that drive foot traffic and online sales. Interactive features such as motion sensors, lights, sounds, and app connectivity enhance play value. With increasing focus on personalized and immersive experiences, licensed toys are positioned as essential for brand-driven engagement and differentiated product portfolios in both mass-market and specialty retail channels.

Constraints include high licensing fees, contractual restrictions, and royalties, which impact profit margins. Production costs for high-quality materials, intricate designs, and interactive components can be significant. Supply chain limitations, including plastics, electronics, and packaging, may affect lead times and availability. Compliance with regional toy safety standards such as ASTM, EN71, and CPSIA adds regulatory complexity.

Seasonal demand peaks and inventory planning challenges further influence operational efficiency. Buyers increasingly rely on suppliers who provide consistent quality, certified safety compliance, and reliable delivery to meet retailer requirements and ensure timely launch of licensed product lines worldwide.

The market is trending toward customizable toys, digital interactivity, and technology-enabled play experiences. Augmented reality, app connectivity, and gamified features are increasingly integrated into licensed toys to enhance engagement and longevity. Co-branded and cross-media products leveraging movies, TV series, and video games are becoming a standard growth strategy. Retailers and e-commerce platforms are leveraging digital marketing and influencer campaigns to maximize reach. Collaboration between licensors, manufacturers, and technology providers ensures compliance, innovation, and operational efficiency. Suppliers providing high-quality, interactive, and brand-aligned toys are best positioned to capture long-term growth in the competitive licensed toy market.

Opportunities are strongest in interactive toys, augmented reality products, app-linked playsets, and collectible series that encourage repeat purchases. Collaboration with entertainment studios, gaming companies, and influencers expands the licensing portfolio. Cross-media campaigns and tie-ins with movies, shows, and digital content enhance brand visibility and sales potential.

Regional adoption in North America, Europe, and Asia-Pacific is driven by strong fan bases, digital engagement, and retail penetration. Suppliers offering innovative designs, interactive features, and comprehensive licensing support are well positioned to capitalize on the growing demand for immersive and collectible licensed toys across multiple consumer segments.

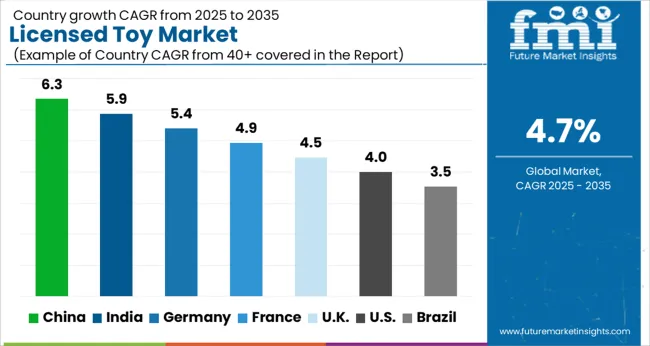

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

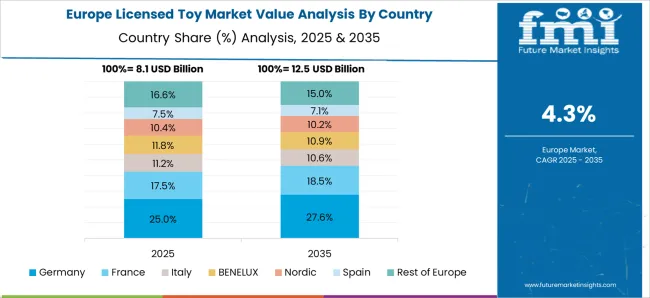

The global licensed toy market is projected to grow at a CAGR of 4.7% from 2025 to 2035. China leads expansion at 6.3%, followed by India (5.9%), Germany (8.1%), the UK (4.5%), and the USA (4.0%). Growth is driven by rising consumer spending on branded toys, collaborations with entertainment franchises, and increasing adoption of educational and collectible products. BRICS countries, particularly China and India, are witnessing rapid urban adoption and e-commerce penetration, while OECD nations such as Germany, the UK, and the USA focus on product quality, safety, and innovative designs to meet parental expectations. Seasonal campaigns and omnichannel distribution further enhance global growth. The analysis spans over 40+ countries, with the leading markets shown below

The licensed toy market in China is projected to grow at a CAGR of 6.3% from 2025 to 2035, driven by increasing consumer spending on children’s entertainment and the rise of e-commerce platforms. The market is fueled by the popularity of international and domestic characters across action figures, dolls, and collectible toys. Retailers are leveraging both physical stores and online marketplaces to enhance product availability and reach. Manufacturers focus on high-quality materials, safety compliance, and innovative designs to meet parental expectations. Brand collaborations with film studios, gaming franchises, and animated series further boost demand. Seasonal launches, gift-oriented packaging, and limited-edition releases create additional growth opportunities, while domestic producers expand production capacity and improve distribution networks.

The licensed toy market in India is expected to expand at a CAGR of 5.9% from 2025 to 2035, fueled by rising disposable income, a growing middle class, and increased awareness of branded toys. The demand is concentrated in urban centers, where parents invest in action figures, dolls, puzzles, and educational toys featuring popular film, television, and gaming characters. Domestic manufacturers are partnering with international licensors to produce affordable yet high-quality toys suitable for India’s diverse market. E-commerce platforms such as Amazon and Flipkart, along with organized retail chains, are widening distribution and facilitating product discovery. Seasonal promotions, festive sales, and gift-oriented campaigns further drive adoption. Companies are focusing on compliance with safety standards and material certifications to meet parental expectations.

The licensed toy market in France is projected to grow at a CAGR of 4.9% from 2025 to 2035, supported by demand for branded, high-quality, and collectible toys. French consumers show strong preference for licensed characters from international movies, animated series, and gaming franchises. Manufacturers emphasize safety, eco-design (material efficiency), and durability to comply with European Union toy safety regulations. Retail channels including specialty stores, hypermarkets, and online marketplaces enhance product visibility and reach. Seasonal launches during holidays and school breaks, along with limited-edition collectibles, boost consumer interest. Licensing agreements with major entertainment companies help expand product portfolios and marketing campaigns. Participation in toy fairs, trade shows, and collaboration with local artists and designers further increase brand engagement and market penetration.

The UK licensed toy market is expected to grow at a CAGR of 4.5% from 2025 to 2035, led by demand for branded action figures, dolls, and educational toys. Popular franchises, film releases, and animated series drive consumer preferences. Retailers focus on omnichannel strategies combining physical stores, e-commerce, and subscription boxes to reach families across urban and suburban regions. Manufacturers prioritize material safety, durability, and innovative designs to meet regulatory standards and parental expectations. Seasonal promotions, gift-oriented products, and licensing tie-ins with entertainment franchises enhance market appeal. Partnerships between domestic producers and global licensors expand product offerings and marketing campaigns. Schools, recreational programs, and hobby clubs are additional channels for awareness and adoption.

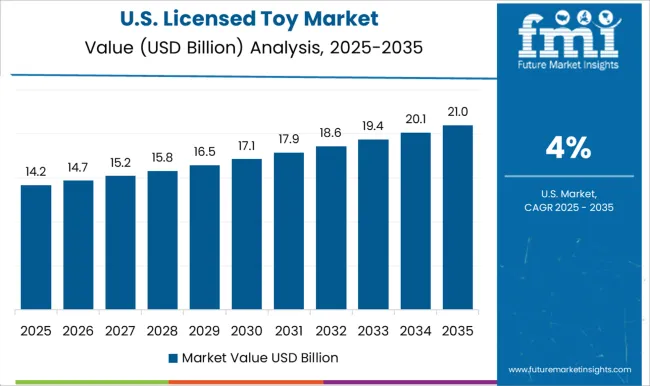

The USA market is projected to grow at a CAGR of 4.0% from 2025 to 2035, driven by strong demand for licensed toys tied to movies, TV shows, gaming franchises, and sports personalities. Retailers, including mass-market stores, specialty toy shops, and online platforms, are expanding access to branded products. Manufacturers focus on innovative designs, safety compliance, and high-quality materials to meet parental expectations. Seasonal promotions, holiday gift campaigns, and collectible editions increase consumer interest and repeat purchases. Collaborations with global licensors and entertainment studios facilitate product differentiation and marketing support. Educational toys featuring licensed characters are gaining traction in schools, recreational centers, and libraries. Online marketing campaigns and influencer endorsements are further enhancing brand visibility and driving purchase decisions among children and parents.

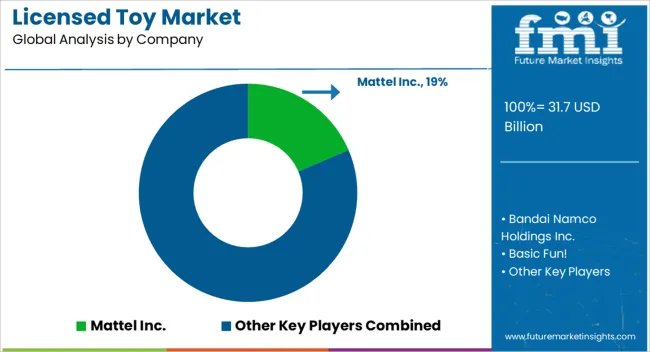

Competition in the licensed toy market is defined by brand partnerships, intellectual property rights, and innovation in play experiences. Mattel Inc. leads through globally recognized licenses such as Barbie, Hot Wheels, and Disney franchises, leveraging scale, distribution networks, and marketing reach. Bandai Namco Holdings Inc. competes with action figures, collectible toys, and gaming-linked merchandise, often tied to anime and video game properties. Fisher-Price, a Mattel division, focuses on early childhood learning toys with educational themes under licensed characters. Funko Inc. differentiates through pop culture collectibles, limited editions, and cross-licensed figurines. Hasbro Inc. dominates with multi-franchise products spanning board games, action figures, and role-play toys, emphasizing digital integration and media tie-ins.

JAKKS Pacific Inc., LEGO Group, and Mega Brands Inc. compete via construction and interactive playsets aligned with movie, superhero, and entertainment licenses. Melissa & Doug LLC and Playmobil offer creative, themed play sets, often targeting niche segments such as educational or imaginative play. Ravensburger AG, Spin Master Corp., Tomy Company Ltd., and VTech Holdings Ltd. focus on puzzles, electronic toys, and tech-enabled learning products, leveraging licensing agreements to enhance engagement and collectability. Strategies emphasize multi-channel distribution, seasonal product launches, and co-marketing with film, television, and gaming properties.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.7 Billion |

| Product Type | Dolls & Plush Toys, Action Figures, Arts & Crafts, Games & Puzzles, Outdoor & Sports Toys, Construction Sets, Educational Toys, and Others (Vehicles, Etc) |

| Price Range | Medium, Low, and High |

| Age Group | Age 5–12, Below 1 Yrs., Age 1–3, Age 3–5, and Age 12+ |

| End-Use | Individual and Commercial |

| Distribution Channel | Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mattel Inc., Bandai Namco Holdings Inc., Basic Fun!, Fisher-Price (Division of Mattel), Funko Inc., Hasbro Inc., JAKKS Pacific Inc., LEGO Group, Mega Brands Inc. (Owned by Mattel), Melissa & Doug LLC, Playmobil, Ravensburger AG, Spin Master Corp., Tomy Company Ltd., and VTech Holdings Ltd. |

| Additional Attributes | Dollar sales by product type (action figures, dolls, playsets, collectibles), target age group (infants, children, teens), and licensing type (entertainment, movie, gaming, TV). Demand is influenced by franchise popularity, seasonal promotions, and cross-media marketing. Regional trends indicate strong adoption in North America, Europe, and Asia-Pacific, driven by retail expansion, e-commerce penetration, and growing licensed entertainment content consumption. |

The global licensed toy market is estimated to be valued at USD 31.7 billion in 2025.

The market size for the licensed toy market is projected to reach USD 50.1 billion by 2035.

The licensed toy market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in licensed toy market are dolls & plush toys, action figures, arts & crafts, games & puzzles, outdoor & sports toys, construction sets, educational toys and others (vehicles, etc).

In terms of price range, medium segment to command 38.4% share in the licensed toy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Licensed Sports Merchandise Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Toy Market Size and Share Forecast Outlook 2025 to 2035

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Toy Bag Market Analysis on Material Type, Bag Type, Category, Sales or Distribution Channel, and Region through 2025 to 2035

Toy Packaging Market Trends – Growth & Forecast 2024-2034

Pet Toys Market Analysis – Size, Share & Forecast 2025 to 2035

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Kids Toys Market Size and Share Forecast Outlook 2025 to 2035

Bath Toy Market Size and Share Forecast Outlook 2025 to 2035

Bird Toy Market Size and Share Forecast Outlook 2025 to 2035

IP Pop Toy Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Male Sex Toys Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Traditional Toys and Games Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA