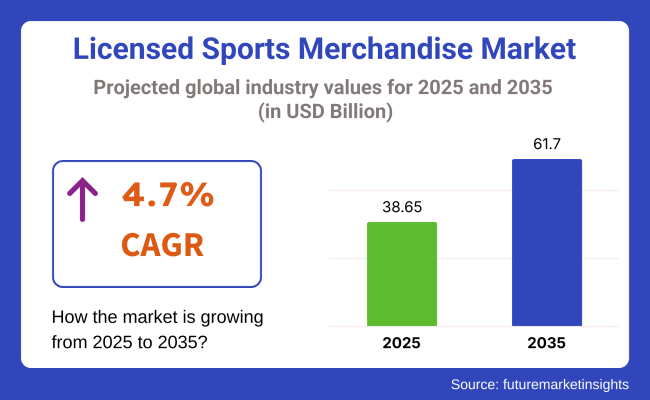

The licensed sports merchandise market is expected to grow from USD 38.65 billion in 2025 to USD 61.17 billion by 2035, expanding at a compound annual growth rate (CAGR) of 4.7% during the forecast period. The market’s growth is driven by increasing consumer demand for branded sports apparel, accessories, and memorabilia. As sports fandom continues to rise globally, licensed sports merchandise is becoming an essential part of fan culture, contributing to the market's expansion.

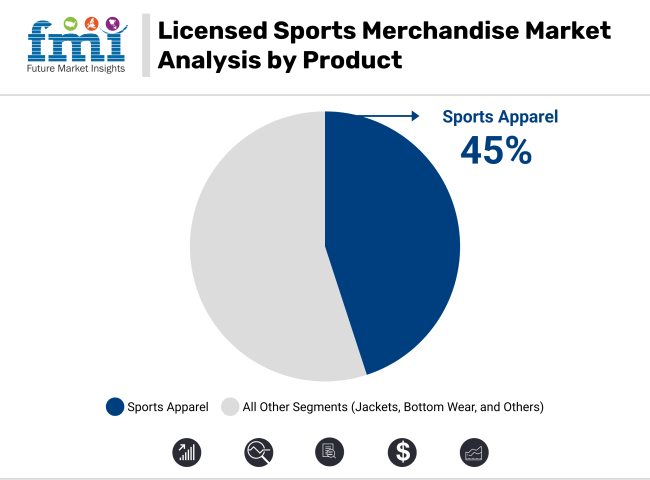

The sports apparel segment is expected to account for 45.0% of the market share in 2025, as fans increasingly seek high-quality, branded clothing to showcase their loyalty to teams and athletes. The growing popularity of sports jerseys, T-shirts, and other apparel, particularly with the rise of e-commerce platforms, has bolstered this segment.

Additionally, the market’s growth is being driven by the increasing trend of athleisure and sports-inspired fashion, with more consumers opting for comfortable and stylish clothing that reflects their support for various sports teams.

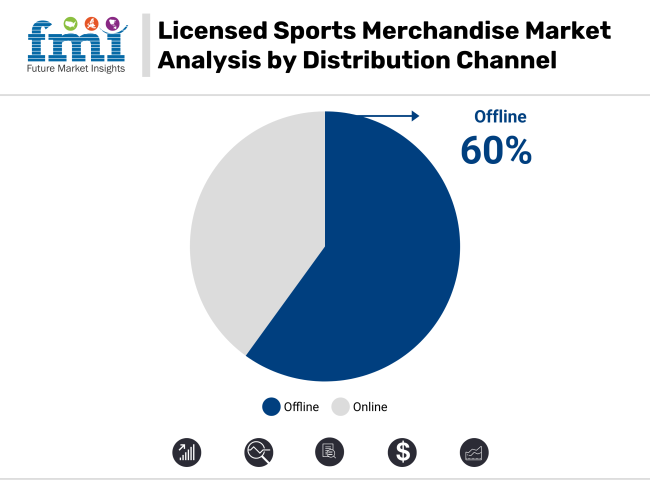

In terms of distribution, offline channels are expected to dominate, capturing 60.0% of the market share in 2025. Sports merchandise stores, team stadiums, and brick-and-mortar retail outlets remain the primary venues for purchasing licensed sports products.

However, e-commerce is rapidly gaining traction, with online platforms offering convenience, wider selections, and the ability to reach a global audience. As a result, a shift towards a hybrid model of online and offline distribution is anticipated, which will further fuel market growth.

On June 12, 2025, Fanatics Inc. announced a significant expansion of its global footprint by securing a 10-year licensing agreement with Italian football club Inter Milan. This partnership grants Fanatics exclusive rights to produce and distribute Inter Milan's official merchandise, including jerseys, apparel, and accessories, both online and in physical retail locations.

The deal aims to enhance fan engagement and accessibility to licensed sports products worldwide. Fanatics CEO Michael Rubin expressed enthusiasm about the collaboration, highlighting the opportunity to bring high-quality merchandise to Inter Milan's global fanbase.

This strategic move underscores Fanatics' commitment to broadening its international presence and solidifying its position as a leader in the licensed sports merchandise market. The licensed sports merchandise market is set to experience steady growth, driven by the ongoing enthusiasm for sports and the expansion of distribution channels worldwide.

The global licensed sports merchandise market is projected to experience steady growth from 2025 to 2035. Key segments driving this growth include sports apparel and offline distribution channels. These segments benefit from the increasing demand for officially licensed products, fueled by the popularity of sports and fan culture across various regions. Leading companies like Nike, Adidas, and Fanatics are expanding their product offerings to meet consumer preferences.

Sports apparel is expected to account for 45.0% of the licensed sports merchandise market share in 2025. This segment’s growth is driven by consumers’ growing preference for comfortable, stylish, and functional clothing both for sports and casual wear.

Athleisure, in particular, is experiencing a surge in popularity as more consumers adopt active lifestyles. Companies such as Nike, Adidas, and Under Armour are leading the market by offering high-performance, fashionable apparel that features team logos, player names, and other licensed elements.

The appeal of sports apparel goes beyond athletes; it has become a symbol of team loyalty and individual identity for fans. Moreover, collaborations between sports brands and high-fashion designers are expanding the appeal of sports apparel in the mainstream market, contributing to its continued dominance. Additionally, innovations in fabric technology, including moisture-wicking materials and sustainable fabrics, are expected to drive further market growth in this segment.

Offline distribution channels are projected to capture 60.0% of the market share in 2025. Despite the rise of e-commerce, brick-and-mortar stores continue to be the preferred shopping choice for licensed sports merchandise. This segment benefits from the tactile experience that consumers enjoy when purchasing products in-store, such as trying on apparel or seeing merchandise up close.

Furthermore, the immersive nature of sports retail stores, particularly those near stadiums or in high-traffic locations, offers an enhanced shopping experience for fans.

Sports merchandise retailers, including Fanatics and Lids, continue to invest in physical stores that cater to fans' enthusiasm for in-person shopping. The in-store experience is becoming more interactive, with augmented reality displays and exclusive product offerings available only through offline channels.

As live sports events draw large crowds, the demand for licensed sports merchandise at stadiums and physical stores is expected to remain strong. The offline segment’s growth is further supported by strategic partnerships between sports leagues and retailers to create localized experiences that connect with fans.

Challenges

High Initial Investment, Maintenance Costs, and Technical Expertise Requirements

Counterfeit sports products invasion directly impacts the licensed sports merchandise market, affecting the income of the official manufacturers. High royalty fees and strict licensing agreements add to the cost for retailers and restrict availability for small businesses.

In addition to, changing as customer preference digitally and because of the same NFT and virtual merchandise may replace apparel, accessories, and memorabilia, physical sports merchandise, demanding brands to adapt themselves to ever-changing customer behaviour.

Opportunities

Growth in E-Commerce Packaging, Food Safety Regulations, and Smart Sealing Technologies

The increasing interest in sports-themed apparel, collectibles, and memorabilia has a positive impact on market revenue despite facing several challenges. Licensed sports merchandise is becoming accessible globally due to the growing e-commerce platforms and direct-to-consumer (DTC) retailing Trends of personalization (e.g., custom jerseys, player-specific merchandise, limited-edition releases) are boosting consumer engagement.

Moreover, rising popularity of women’s sports, esports and international leagues are broadening the fan horizon while creating more avenues to generate revenue.

Strong fan engagement levels across the major leagues (NFL, NBA, MLB, and NHL) is driving growth in the licensed sports merchandise market in the USA Driven by the rise of online sports retail platforms, collaborations with streetwear brands and exclusive limited-edition releases.

Merchandise sales are boosted even more by the expansion of women’s sports leagues and international soccer fandom. Furthermore, licensed sports merchandise now turns into a new revenue stream such as with block chain-based authentication and NFT collectibles.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

Strong football culture, high demand for Premier League merchandise, and increasing sales of rugby and cricket apparel are driving steady growth of the UK market. The move towards sustainable sports merchandise such as eco-friendly jerseys and biodegradable packaging is influencing consumers. Also, we will pursue direct-to-consumer (DTC) sports brands and customized fan gear that'll shift the licensed sports products landscape.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

The sports merchandise market in Europe is powered by the dominance of football, significant sporting events such as the UEFA Champions League, and growth in esports licensing agreements. Germany, France and Spain are the top three countries for its official team merchandise sales, as well as Olympic and Formula 1-branded merchandise. The move towards sustainable, ethically made sportswear is providing new openings for eco-minded manufacturers and companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.7% |

Such rapid growth is propelled by the widespread popularity of baseball and football in Japan and the increasing impact of international sports leagues. And what we are seeing is the rise of anime-themed sports partnerships, jerseys incorporating technology for spectators, and the availability of collectible merchandise, which is increasingly appealing to the younger generations. Moreover, the growth of esports and online gaming-related merchandise is introducing new market opportunities for licensed brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

As the rise of esports, increased fandom around international sports leagues, prolific growth of K-League football merchandise sales and overall revenue-generating potential of the licensed sports industry continue to blossom, South Korea is becoming an increasingly important market for many global brands looking to capitalize on the licensed sports merchandise market.

Partnerships with K-pop stars and other big-ticket collaborations have helped drive demand for limited-edition sportswear and team merchandise globally. The country’s robust e-commerce channels and digital payment solutions also help online sports merchandise sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

Some of the factors that are contributing to the growth of this market include the increase in global fandom, the rise in partnerships between sports leagues and apparel brands, and the rise in AI-powered e-commerce & personalization. An increasing popularity for unique team merchandise, collectibles, and a new breed of digital merchandising products and services is also molding the industry.

Prominent players in the industry emphasize AI-driven product personalization, sustainable practices in sportswear, and Omni channel sales strategies. Key players include sports leagues, apparel manufacturers, and licensing companies creating premium, officially licensed merchandise across categories including apparel, accessories and collectibles.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 38.65 billion |

| Projected Market Size (2035) | USD 61.17 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Sports Apparel (T-Shirts and Tops, Collegiate Sports Apparel, Non-Collegiate Sports Apparel, Sweatshirts and Hoodies, Jackets, Bottom Wear, Others), Sports Footwear, Toys and Games |

| Distribution Channels Analyzed (Segment 2) | Online, Offline, Supermarkets & Hypermarkets, Specialty Stores |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Licensed Sports Merchandise Market | VF Corporation, Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Hanesbrands Inc., DICK’S Sporting Goods Inc., Sports Direct International plc, G-III Apparel Group, Ltd., Fanatics Inc. |

| Additional Attributes | dollar sales, CAGR trends, product type segmentation, distribution channel shifts, regional demand patterns, sports apparel vs footwear demand, competitor dollar sales & market share, online vs offline sales growth |

The overall market size for the licensed sports merchandise market was USD 38.65 billion in 2025.

The licensed sports merchandise market is expected to reach USD 61.17 billion in 2035.

The demand for licensed sports merchandise is expected to rise due to increasing global fan engagement, rising popularity of sports leagues, and expanding e-commerce platforms offering official team merchandise. The growing influence of social media and celebrity endorsements is further driving market growth. Additionally, advancements in fabric technology and sustainability initiatives in sports apparel are contributing to the increasing demand.

The top 5 countries driving the development of the licensed sports merchandise market are the USA, China, Germany, the UK, and Japan.

Sports Apparel and Sweatshirts & Hoodies are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Price, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Price, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Price, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Price, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Price, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Price, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Price, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Price, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Price, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Price, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Price, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Price, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Price, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Price, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Price, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Price, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Price, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Europe Market Attractiveness by Price, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Price, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Price, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Price, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Price, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Price, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product, 2023 to 2033

Figure 142: MEA Market Attractiveness by Price, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Licensed Toy Market Size and Share Forecast Outlook 2025 to 2035

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Turf Seed Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA