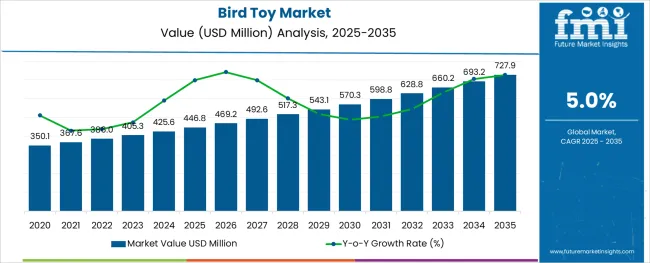

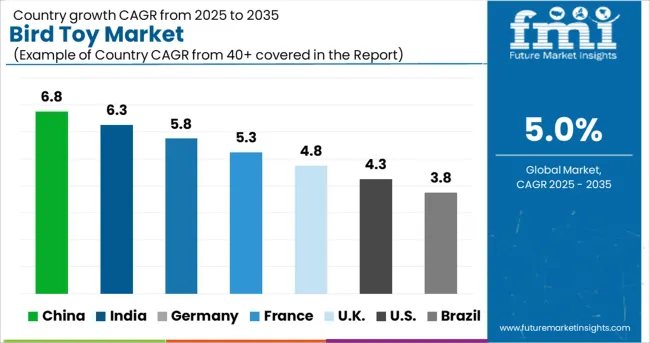

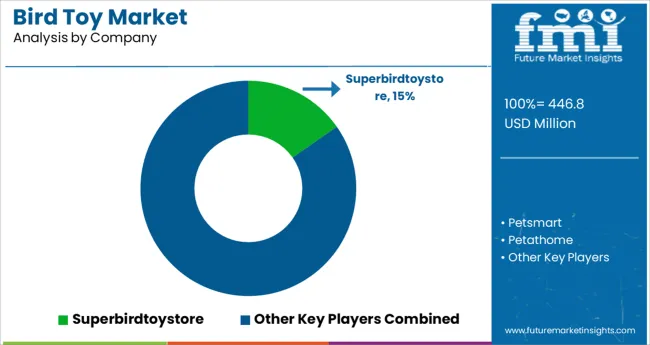

The Bird Toy Market is estimated to be valued at USD 446.8 million in 2025 and is projected to reach USD 727.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The bird toy market is undergoing notable expansion as pet ownership trends evolve and consumer awareness around avian mental stimulation and behavioral health increases. Rising demand for enrichment products that promote exercise, reduce anxiety, and support natural instincts has shifted industry focus toward diverse and interactive toy categories.

Manufacturers are introducing bird-safe materials, eco-friendly components, and species-specific designs to align with safety standards and pet wellness. Retailers are capitalizing on impulse buying and curated assortments, especially in physical formats where tactile evaluation plays a key role.

Meanwhile, social media and influencer-driven pet care education are amplifying consumer expectations for enrichment products that contribute to the emotional and physical wellbeing of companion birds. As pet humanization continues and disposable incomes rise across emerging markets, the bird toy category is expected to experience continued product diversification, with price-sensitive and premium segments developing in parallel.

The market is segmented by Product Type, Price Range, and Sales Channel and region. By Product Type, the market is divided into Foot Toys, Swings & Bungees, Snugglies, Perches & Perch Toys, Foraging Toys, Chewing toys, Noisemakers, Climbing toys, and Play gyms. In terms of Price Range, the market is classified into Low, Medium, and Premium. Based on Sales Channel, the market is segmented into Supermarkets/Hypermarkets, Pets Specialty Stores, Multi-Brand Stores, Pet care centers, Online Retailers, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Price Range, and Sales Channel and region. By Product Type, the market is divided into Foot Toys, Swings & Bungees, Snugglies, Perches & Perch Toys, Foraging Toys, Chewing toys, Noisemakers, Climbing toys, and Play gyms. In terms of Price Range, the market is classified into Low, Medium, and Premium. Based on Sales Channel, the market is segmented into Supermarkets/Hypermarkets, Pets Specialty Stores, Multi-Brand Stores, Pet care centers, Online Retailers, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

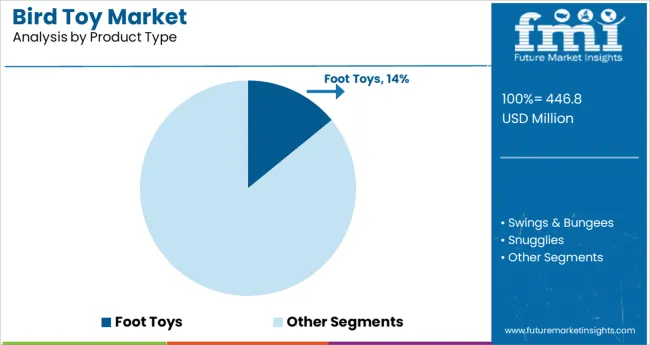

The foot toys subsegment is projected to capture 14.1% of the total revenue within the product type category in 2025, making it a prominent choice among toy types. This segment's growth has been driven by its compatibility with a wide range of bird species and its alignment with natural foraging and gripping behaviors.

Foot toys support beak conditioning and tactile engagement which are essential for avian mental stimulation and boredom prevention. The compact size and easy handling have made them ideal for cage interiors and travel settings, contributing to higher consumer preference.

Additionally, the availability of biodegradable materials and safe dyes in foot toy manufacturing has supported brand trust and repeat purchase behavior. As more bird owners recognize the need for a rotating variety of playthings to maintain pet engagement, foot toys are expected to sustain a stable position within the broader product mix.

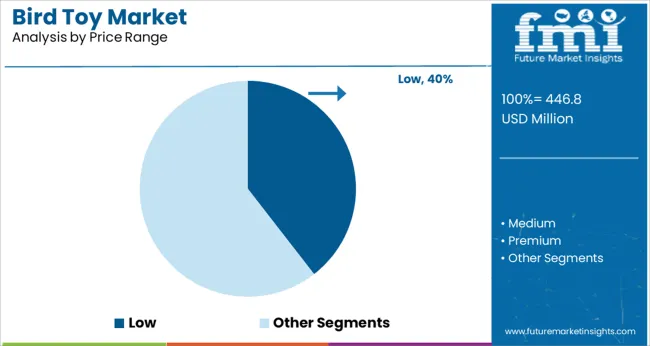

Within the pricing category, the low price range segment is expected to hold 39.5% of the market share in 2025, marking it as the most dominant pricing tier. This leadership is attributed to the widespread appeal of budget-friendly toys among first-time bird owners and value-conscious consumers. Low-cost options offer accessibility without compromising core functions such as stimulation, engagement, and chewing activity.

The recurring need for toy replacement due to wear and hygiene has made economical purchases more frequent. Retailers have responded with volume-based promotions and seasonal assortments that allow consumers to buy multiple units at affordable prices.

Furthermore, improvements in low-cost manufacturing processes and the use of recyclable materials have ensured profitability for brands without diluting consumer confidence. This pricing tier continues to support high volume turnover and entry-level product discovery across both online and offline retail environments.

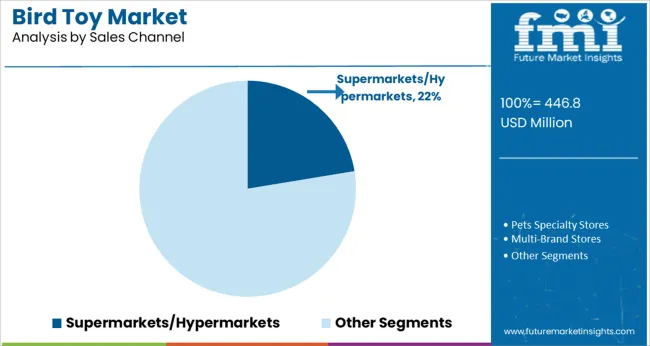

The supermarkets or hypermarkets segment is projected to account for 22.4% of total revenue in 2025 under the sales channel category, making it a key contributor to overall distribution. This channel’s prominence stems from its ability to deliver immediate product availability and visual merchandising, which supports impulse buying and product trial.

Physical retail settings offer an opportunity for consumers to assess toy texture, size, and packaging quality—factors that influence purchasing decisions for pet products. Supermarkets and hypermarkets have expanded their pet care aisles to include diverse avian categories, supported by branded displays and promotional tie-ins.

Additionally, these locations benefit from high footfall and routine shopping behavior, positioning bird toys within complementary categories such as pet food and accessories. The channel's emphasis on accessibility, affordability, and in-store experience continues to reinforce its relevance in the bird toy market.

Pet toy sales have increased dramatically in recent years. Pet parents now consider birds to be members of their family. This bird parenting craze has inspired pet parents to treat their birds with the same level of luxury as they would for their children or other family members. The growing affinity between people and their pets has prompted pet owners to spend more on luxurious accessories for birds.

Demand for eco-friendly toys and the increased proclivity of pet owners to purchase bird toys are driving the market. However, the worldwide pet toys and training market is restrained by a lack of awareness among buyers about how to use various goods for training. During the projected period, rising number of natural and eco-friendly toys manufacturers is expected to create opportunities for growth in the market.

Bird Owners are Preferring Exciting Wooden Toys for Training Birds

Owners of birds who live in mobile homes frequently require a trained bird. As a result of this, bird owners prefer toys for their birds that are both environmentally friendly and easy to use.

Cage birds can quickly get bored, and when this happens, they can begin to experience behavioural problems. They can become physically destructive by ripping off their fur, initiating screaming, biting, and/or repeating behaviours such as shaking their heads and experience high levels of discomfort. Rotating add-on toys can help pet owners avoid this problem as the birds can play with them and climb on them comfortably.

Toys encourage movement and give good wear to the beak and nails. Toys are used to hug, hang, explore and chew. Birds spend most of their time on their feet. They must move around and stay active to prevent obesity. The right toys can challenge these birds, encourage thinking, and help grow their intelligence by having them complete simple tasks.

High Demand for Chewing Toys for Birds Will Boost Sales

Brazil has the highest number of pet birds in the world. With approximately 191 million pet birds, Brazil is home to more than 1,000 to 2,000 known species of birds, so the types of birds kept as pets vary greatly.

Consumers in Brazil have different species of birds as pets and are preferring innovative bird toys. A four-legged (or footless) friend's company helps improve people's daily lives, physical health, and mental well-being.

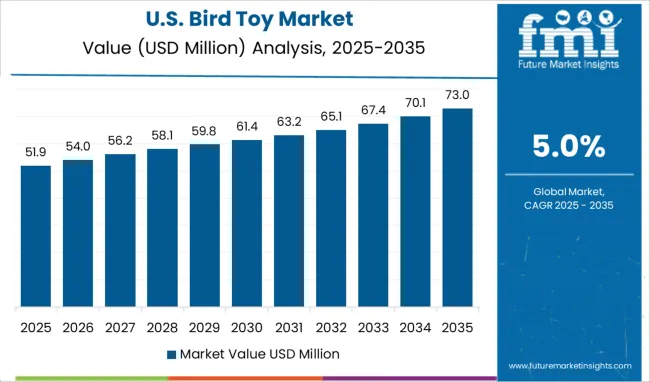

Rising Bird Ownership in the USA Will Fuel Demand for Swings and Bungees for Birds

The USA is expected to dominate the North America bird toys market over the forecast period amid high adoption of birds as pets in the country. Consumers in the USA are preferring eco-friendly and wooden bird toys to reduce waste and prevent harmful reactions caused by plastics. This is compelling manufacturers to launch innovative toys such as swings and bungees for birds, which will continue pushing sales in the market over the forecast period.

Swings are the Most Favorite Toy of Birds

Swings and bungees are the most popular toys among bird owners since birds enjoy swinging and it keeps them entertained for a longer period of time. Although birds are known to enjoy swings, this does not indicate that they will all be anxious to begin swinging. Every bird has its personality. Swings are popular among birds because they like the movement and flow of air via their feathers and wings. Swings provide both fun and a natural setting for parrots to enjoy.

Online chains are expanding across the globe

In terms of sales channel, demand in the online segment is slated to surge at a considerable pace over the forecast period. Online channels are the most preferred by bird owners because it is the most convenient and easy method of purchasing bird toys. There are many bird toy retailers and companies that are selling customized toys online, which is expected to boost sales in this segment.

Th global bird toys market is highly consolidated with a large number of players operating in the market. Amid surging demand for eco-friendly toys, manufacturers are striving to launch bird toys made from sustainable materials. They are also investing in research and development to incorporate innovative designs and materials that are comfortable to various species of birds. For instance:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 446.8 million |

| Projected Market Valuation (2035) | USD 727.9 million |

| Value-based CAGR (2025 to 2035) | 5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & MEA |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Germany, the UK., France, Spain, Italy, Russia, Benelux, South Africa, Northern Africa GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand. |

| Key Segments Covered | Product Type, Price Range, Sales Channel, and Region. |

| Key Companies Profiled | Superbirdtoystore; Petsmart; Petathome; Petvalu; Makeyourownpettoys; Petland; Petmate; Bradley Caldwell; A&E cage company; My safe bird store; Playful parrot |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global bird toy market is estimated to be valued at USD 446.8 million in 2025.

It is projected to reach USD 727.9 million by 2035.

The market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types are foot toys, swings & bungees, snugglies, perches & perch toys, foraging toys, chewing toys, noisemakers, climbing toys and play gyms.

low segment is expected to dominate with a 39.5% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bird Cages & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bird Detection System Market Size and Share Forecast Outlook 2025 to 2035

Bird Carriers Market Size and Share Forecast Outlook 2025 to 2035

Bird Food Market Analysis - Size, Share, and Forecast 2025 to 2035

Bird Feeding & Water Suppliers Market Trends – Growth & Forecast 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

USA Bird Food Market Insights - Trends & Demand 2025 to 2035

Wild Birds Products Market Growth – Size, Trends & Forecast 2025 to 2035

Migratory Birds Tourism Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Multifunctional Laser Bird Repeller Market Size and Share Forecast Outlook 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Toy Market Size and Share Forecast Outlook 2025 to 2035

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Toy Bag Market Analysis on Material Type, Bag Type, Category, Sales or Distribution Channel, and Region through 2025 to 2035

Toy Packaging Market Trends – Growth & Forecast 2024-2034

Pet Toys Market Analysis – Size, Share & Forecast 2025 to 2035

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Kids Toys Market Size and Share Forecast Outlook 2025 to 2035

Bath Toy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA