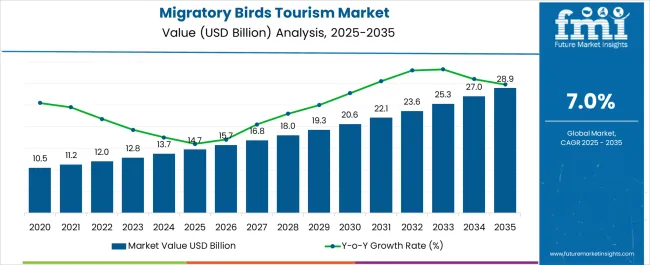

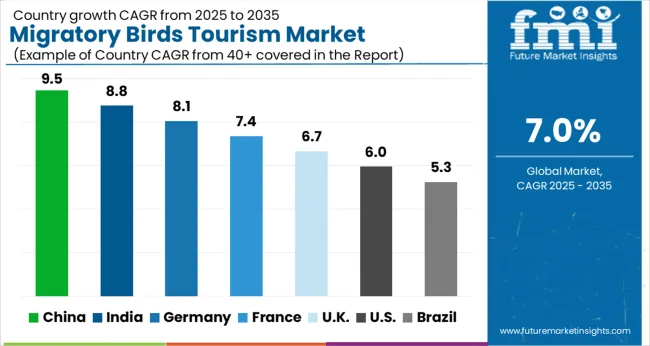

The Migratory Birds Tourism Market is estimated to be valued at USD 14.7 billion in 2025 and is projected to reach USD 28.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Migratory Birds Tourism Market Estimated Value in (2025 E) | USD 14.7 billion |

| Migratory Birds Tourism Market Forecast Value in (2035 F) | USD 28.9 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The migratory birds tourism market is witnessing steady growth, supported by increasing ecological awareness, rising interest in biodiversity-based travel, and infrastructure development near bird habitats. Seasonal birding events, conservation-driven travel programs, and heritage-linked eco-tourism circuits have contributed to increased global and domestic tourist movement in key flyway zones.

National parks and wetland authorities have enhanced visitor infrastructure, enabling higher tourist footfall without disturbing migratory patterns. Governments and NGOs are collaboratively promoting bird tourism through citizen science initiatives, digital guides, and festival-linked itineraries.

The emergence of photography-led wildlife tours and the promotion of avifaunal hotspots in digital media have further elevated awareness. Looking ahead, investment in interpretation centers, mobile-friendly booking systems, and community-led conservation models is expected to shape the next wave of growth in this market.

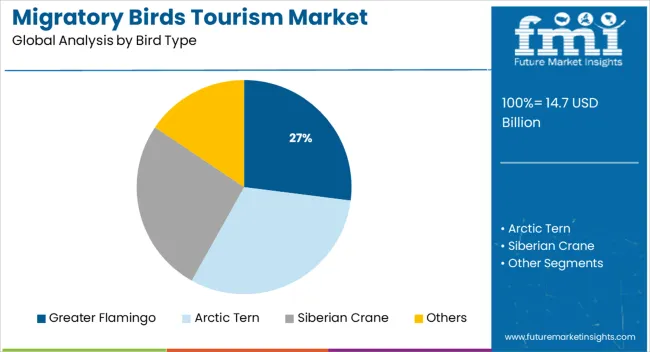

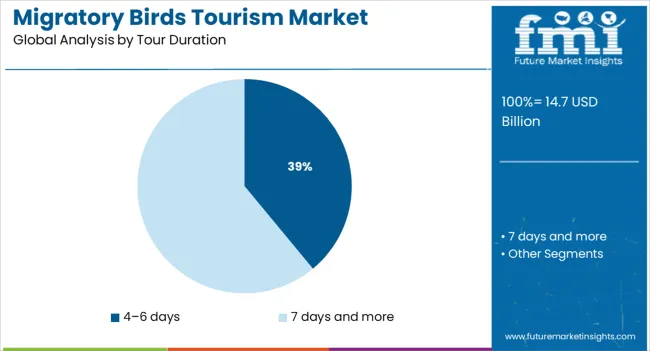

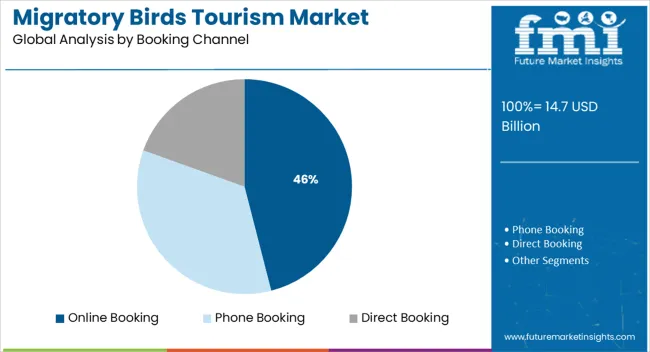

The market is segmented by Bird Type, Tour Duration, Booking Channel, and Tourist Type and region. By Bird Type, the market is divided into Greater Flamingo, Arctic Tern, Siberian Crane, and Others. In terms of Tour Duration, the market is classified into 4–6 days and 7 days and more. Based on Booking Channel, the market is segmented into Online Booking, Phone Booking, and Direct Booking. By Tourist Type, the market is divided into Domestic and International. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Greater Flamingo-based tourism is projected to hold 27.0% of the overall market revenue in 2025, making it the leading bird type segment. This dominance is being driven by the species’ iconic visibility, social behavior, and presence in high-footfall wetlands across major migratory corridors.

The aesthetic appeal and distinct pink coloration of the Greater Flamingo have increased its attractiveness to photographers, eco-tourists, and family travelers alike. Their predictable migratory patterns and congregation in accessible, protected habitats have enabled tourism operators to plan guided itineraries with high sighting reliability.

In addition, awareness campaigns, local bird festivals, and responsible tourism programs have further enhanced demand. With wetland infrastructure and interpretation services improving, Greater Flamingo-based circuits are expected to retain their appeal among both seasoned birders and casual nature enthusiasts.

Tour durations spanning 4–6 days are anticipated to contribute 39.0% of the total market revenue in 2025, making this the leading duration category. This segment's strength is linked to the alignment of such packages with peak sighting periods and logistical feasibility for regional travel.

A balance between accessibility, affordability, and quality of experience has led tour operators to structure birding tours within this window, especially around weekend getaways and holiday seasons. These tours allow for multi-location birdwatching without causing traveler fatigue, while also supporting local hospitality and transport ecosystems.

Furthermore, government ecotourism policies and seasonal birdwatching calendars are often curated around 4–6 day formats, increasing consistency in demand. As tour planners prioritize shorter, high-engagement travel formats post-pandemic, this duration range is expected to remain the most preferred.

Online booking is expected to account for 46.0% of the revenue share in 2025, positioning it as the dominant booking channel in the migratory birds tourism market. This trend is being supported by the digital transformation of travel planning, increased adoption of mobile apps, and integration of virtual birding tools with booking interfaces.

Bird tourism operators are leveraging real-time availability, e-ticketing for sanctuary entries, and influencer-driven itinerary promotions to boost online visibility and conversion. Additionally, online platforms enable last-minute bookings and dynamic itinerary customization—both critical for migratory bird watching where weather and timing play crucial roles.

Social media communities and travel forums have also played a pivotal role in building trust and awareness for online booking options. With digital payments, live location tracking, and user-generated ratings becoming mainstream, online channels are expected to continue as the preferred booking method for birding experiences.

Bird migration is the structured seasonal movement of migratory birds. These migrations have routes that trace generally from north to south. The primary motive behind this migration is the hunt for food and breeding.

Despite the significant risk of predators, many bird species migrate in order to avoid the extreme cold and severe winters in extreme latitudes. Three million worldwide birding tours are taken each year, according to the BirdLife International Organization, making it a rising international interest.

New destinations are getting added to the migration routes of the birds as these regions have developed the ecology and the migratory birds find it suitable for their accommodation.

According to the USA Fish and Wildlife Service, 40% of bird enthusiasts are eager to travel to track down new bird species. This gives an idea that people are getting more and more interested in bird watching which will have a great and positive impact on the growth of Migratory Birds tourism in coming years.

One of the most environmentally sustainable forms of nature-based travel is birdwatching, which is also a very lively leisure activity. More and more individuals seem to become engaged in birdwatching, including professionals and amateurs from numerous countries.

A great increase is seen in the number of bird watchers globally which has boosted the migratory bird tourism market to a great extent. Once any individual is attracted by the essence of bird watching, there is no looking back. Bird watchers are always interested in exploring new and different kinds of species. Hence, these enthusiasts are willing to go a long way to satisfy their desires which fuels Migratory Birds Tourism.

Photography is a profession that needs interesting subjects and scenic venues along with skills. Most wildlife photography consists of regional wildlife that is available in a given region. This makes it difficult to make the pictures look unique each time. As a result, photographers tend to visit the destinations and routes of migratory birds.

This helps the photographers provide a spectrum of birds that are not found and seen easily. This increases the number of travelers looking for bird-watching tours, especially the tours which comprise migratory birds due to their fascination and hence provides an extra range to the Migratory Birds Tourism market.

The annual World Migrating Bird Day (WMBD) campaign raises awareness of the need of protecting migratory birds and their habitats. It has a global reach and is a powerful instrument for increasing public awareness of the dangers migrating birds face, the value of their habitats, and the need for international collaboration to protect them.

To commemorate WMBD, individuals from all over the world conduct public events such as bird festivals, educational initiatives, exhibitions, and birding outings. All of these activities can be carried out at any time of the year due to the fact that different countries and regions experience migration peaks at various times, with the main days for international celebrations falling on the second Saturdays of May and October.

The declining bird population and their limited habitat are two major obstacles in migratory bird tourism. For a variety of reasons, including sport, recreation, and food, people have engaged in wildlife hunting, which has had catastrophic effects on the ecological balance.

While some nations have enacted laws that forbid or closely regulate hunting, others have not. Illegal acts undermine society, natural resources, and ultimately our entire survival in addition to decimating the avian population.

While hunters help preserve natural ecosystems when they hunt responsibly, they also see how illicit killings damage their image. In some countries, it is still socially acceptable to engage in criminal activity. This may drastically reduce the number of migratory birds, which makes it harder for enthusiasts to enjoy their majesty and elegance.

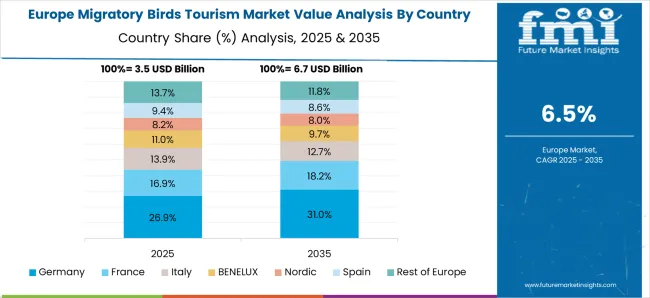

Europe is the largest market for Bird watching

Around the world, about 3 million international trips are taken for bird watching each year. Migratory Birds tourism is a market growing at an accelerated pace, with the largest share coming from Europe. At least 20% of European tourists are attracted by wildlife tourism and are also interested in bird watching.

Bird watching is a pastime that is famous among most Europeans. Birdwatching tours for occasional birdwatchers are 37% of all European tour operators offer. Even though the birdwatching market is spreading, most European tour operators categorize birdwatching tourism as a subsection of wildlife tourism.

Most tour operators do not provide tours specifically for birdwatching, but regard birdwatching as a special activity. European tour operators that offer birdwatching activities usually participate in wildlife tourism and ecotourism tours.

China is taking efforts to protect its environment

Local governments adhere to the incorporation of environmental protection, cultural heritage, and premium-grade development for the betterment of cultural tourism projects across the Yellow River.

The city's Yellow River Delta National Wildlife Refuge has turned out to be an essential stopover site in the winter for migratory birds in recent years due to the local government's non-stop efforts to rehabilitate the ecological environment.

The number of bird species inhabiting the wetlands has increased from 187 species in 1992 to 371 species in 2025, with a total bird population of about 3 to 4 million, attracting many tourists. I am fascinated. Dongying is now the world's largest breeding ground for a rare migratory bird, the oriental white stork.

Migratory Birds tourism is growing in India

India is a huge center for migratory birds, with a staggeringly vast and varied landscape and weather conditions that keep migratory birds there for months. A large number of different migratory birds stay on its territory. Winter is the perfect time for migratory birds to migrate from cold to warm climates.

Many birds come to India in winter. Birds visit India from Europe and Africa. There are also local immigrants who move from the north to the south of the country. And then there are the highland migrants, who move from the high mountainous areas to the lower plains across India.

Various touring companies have also started offering packaged tours that follow the trail of these migratory birds due to the increasing interest of travelers in bird watching making India the upcoming tourist destination for migratory birds tourism.

Online Booking is More Preferred by Tourists

The online booking channel is favored by most tourists as the use of the internet has grown tremendously in recent times. This gives the traveler convenience of booking specific tours along with the additional information required. Also, migratory routes are often away from human settlements and pre-booking makes it easy for tourists to plan their journey which is done online mode.

The popularity of Ornithology Tourism among middle-aged People Will Remain High

The average age of the traveler is 50 years. While 35-55 years is the age group having the most number of tourists. The number of migratory bird tourists will remain high among middle-aged people and seniors as they have time and capacity to spend bird watching.

Older bird watchers remain the primary target group, but the market is slowly changing. More and more millennials are interested in bird-watching tourism. This is partly due to the growing awareness of sustainability issues, especially in relation to the importance of biodiversity across generations.

Birders are unaware of the migratory routes

As most of the population isn’t aware of the migratory routes and destinations of the birds, they tend to opt for packaged tours which provide them with every facility needed to visit an unknown and new destination like accommodation, food, and others.

Leading players in the market are coming up with new strategies to improve the migratory bird tourism sector. There has also been a rise in the number of tour providers which provide tours that are specifically designed for bird watching. The providers are taking constant efforts to increase their reach in every part of the world.

For instance:

Bird Quest Tours has arranged numerous private guided birding tours and extensions for individuals, couples, small groups of friends, clubs, and societies, and even for other bird tour operators. If travelers are unable to go on standard tours, they can choose these tailor-made options.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & Middle East and Africa(MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Colombia Germany, United Kingdom, France, Italy, Russia, South Africa, Turkey, United Arab Emirates(UAE), Egypt, Jordan China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Philippines, Cambodia, Vietnam Australia & New Zealand. |

| Key Segments Covered | Bird Type, tour duration, Booking channel, tourist type, tour type, and Region. |

| Key Companies Profiled |

India Bird Watching; Junglelore Pvt Ltd; Yatra.com; Travel Tour World; National Geographic Partners; Shikhar Travels; Ranthambore natoinal park.com; Toehold Travel; Himalaya Birding; Nature trip |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global migratory birds tourism market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the migratory birds tourism market is projected to reach USD 28.9 billion by 2035.

The migratory birds tourism market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in migratory birds tourism market are greater flamingo, arctic tern, siberian crane, _great white pelican and others.

In terms of tour duration, 4–6 days segment to command 39.0% share in the migratory birds tourism market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wild Birds Products Market Growth – Size, Trends & Forecast 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Agritourism Market Size and Share Forecast Outlook 2025 to 2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Analyzing War Tourism Market Share & Industry Leaders

War Tourism Market Insights - Size, Trends & Forecast 2025 to 2035

Dark Tourism Market Forecast and Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA