The kids toys market is projected to be valued at USD 146.4 billion in 2025 and is expected to reach USD 227.4 billion by 2035, advancing at a CAGR of 4.5% during the forecast period. Growth is being influenced by rising demand for interactive and educational toys, expanding digital integration in play experiences, and increasing consumer spending on premium toy categories. Manufacturers are focusing on eco-friendly materials, licensed character products, and smart toys with augmented and virtual reality features to capture evolving preferences. E-commerce platforms and omnichannel distribution strategies are playing a pivotal role in widening market access. Emerging economies in Asia are driving sales momentum, while developed regions continue to sustain steady demand through brand-driven and innovation-focused offerings.

Quick Stats for Kids Toys Market

| Metric | Value |

|---|---|

| Kids Toys Market Estimated Value in (2025 E) | USD 146.4 billion |

| Kids Toys Market Forecast Value in (2035 F) | USD 227.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Kids Toys market is experiencing consistent growth, driven by evolving consumer preferences, rising disposable incomes, and an increasing focus on early childhood development. The current landscape reflects a strong shift towards interactive and educational toys, with manufacturers continuously innovating to align with changing parental expectations and developmental needs. Regulatory improvements in toy safety and the expansion of organized retail channels have contributed to broader market penetration.

Demand for themed and character-based toys remains steady, supported by global media franchises and expanding e-commerce platforms that offer a wider selection to consumers. As awareness around cognitive and motor skill development grows among parents, the demand for age-appropriate, safe, and skill-enhancing toys is expected to rise.

The market is also benefiting from increased urbanization and the influence of digital media in shaping product appeal among children. Innovation in sustainable materials and tech-integrated play will likely define the next phase of growth in this evolving consumer segment.

The kids' toys market is segmented by product type, material, age group, category, price range, gender, distribution channel, and geographic regions. By product type, the kids' toys market is divided into Dolls and Stuffed Toys, Action Figures and Playsets, Building and Construction Toys, Educational Toys, Board Games and Puzzles, Outdoor Sports Toys, Electronic Toys, and Others (Play and Dress-up Toys). In terms of material, the kids' toys market is classified into Plastic, Wood, Fabric, Metal, and Others.

Based on the age group of the kids, the toys market is segmented into Preschool (4-6 years), Infants (0-2 years), Toddlers (2-4 years), Early School Age (6-8 years), and Middle Childhood (8-10 years). The kids' toys market is segmented into Conventional and Smart. The price range of the kids' toys market is segmented into Mid, Low, and High. By gender, the kids' toys market is segmented into Boys and Girls. The distribution channel of the kids' toys market is segmented into Offline and Online. Regionally, the kids' toys industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Dolls and Stuffed Toys segment is projected to account for 22.7% of the overall Kids Toys market revenue in 2025, making it a prominent product category. This strong market position is being attributed to the emotional connection these toys foster among children and their timeless appeal across generations.

Demand has been reinforced by character-based merchandising linked to animated content and children's entertainment, which continues to influence purchase decisions. The segment's growth is also being supported by increased gifting occasions and cultural practices where soft toys are considered comforting and safe.

Manufacturers have focused on enhancing the sensory appeal of these toys through soft textures, vibrant colors, and storytelling elements, which has contributed to stronger engagement. As parents and caregivers prioritize emotionally supportive and imaginative play experiences, the Dolls and Stuffed Toys segment is expected to maintain its relevance and strong market contribution in the years ahead.

The Plastic segment is expected to contribute 63.1% of the total revenue within the Kids' Toys market in 2025, marking it as the leading material category. This dominance is being driven by plastic’s versatility, cost-efficiency, and durability in toy manufacturing. The material allows for a wide variety of shapes, textures, and colors, which has enabled manufacturers to create engaging and interactive toy designs at scale.

Its lightweight nature and compatibility with mass production technologies have further supported high-volume distribution. Safety regulations have also led to improvements in non-toxic plastic formulations, making them more acceptable to both consumers and regulators.

As innovation in design complexity and functional integration becomes more prevalent in the toy industry, plastic continues to serve as a reliable and scalable material choice. The sustained demand for colorful, durable, and affordable toys has further reinforced plastic’s leading position in the market.

The Preschool age group segment is anticipated to capture 26.8% of the Kids' Toys market revenue in 2025, making it a key target demographic. Growth in this segment is being driven by the heightened focus on cognitive development, hand-eye coordination, and early learning during this critical developmental stage.

Parents are increasingly selecting toys that offer educational value, motor skill enhancement, and safe engagement for children in the 4 to 6-year age range. Manufacturers have responded by creating age-specific products that combine play with developmental objectives, such as puzzles, interactive learning kits, and role-play sets.

The growing popularity of preschool-focused content and characters has also influenced buying behavior, with toys that reflect familiar on-screen themes enjoying strong demand. As the importance of structured play during early childhood becomes more recognized, the Preschool segment is expected to remain a vital contributor to market growth.

The kids toys market is driven by rising disposable incomes, the growing demand for educational toys, and the influence of licensing and characters from popular media. E-commerce is rapidly becoming a dominant sales channel, fueling market growth across various regions.

The kids toys market continues to thrive, driven by rising disposable incomes globally. As middle-class populations grow, especially in emerging markets, parents have greater purchasing power, enabling them to invest in higher-quality, premium toys for their children. This economic shift has led to an increase in demand for educational and interactive toys that offer developmental benefits. In addition, as consumer confidence improves, families are more likely to spend on non-essential items like toys, leading to growth in sectors such as board games, dolls, and action figures. The ability to afford a wide variety of toys supports robust market expansion.

The increasing demand for educational toys is shaping the growth of the Kids Toys Market. Parents are increasingly prioritizing products that not only entertain but also promote cognitive, social, and emotional development. Categories like STEM (Science, Technology, Engineering, and Mathematics) toys, puzzles, and creative construction sets are gaining popularity, particularly among parents focused on enhancing their children’s learning experiences. The rise of educational toys is complemented by strong marketing strategies, emphasizing the developmental advantages of these toys. Furthermore, educational toys’ ability to combine play with learning makes them a long-term favorite, helping to foster sustained market growth.

Licensing agreements and characters from popular TV shows, movies, and digital platforms significantly influence the Kids Toys Market. The rise of multimedia franchises, particularly those with strong fan followings such as Marvel, Disney, and animated series, has driven demand for toys based on characters from these franchises. These licensed toys are particularly popular in action figures, dolls, and plush toys. The strong emotional connection children form with these characters leads to increased sales, as toys become a tangible connection to beloved media. This trend is likely to continue, with toy manufacturers expanding licensing agreements to tap into new consumer segments.

The Kids Toys Market has seen a shift toward e-commerce, with online sales growing at a rapid pace. E-commerce platforms provide convenience, broader product selection, and competitive pricing, attracting consumers to shop for toys online. The rise in online shopping is particularly strong in developing markets where traditional brick-and-mortar retail infrastructure may be less accessible. Online retailers and toy manufacturers are increasingly focusing on enhancing their digital presence, providing interactive shopping experiences and personalized product recommendations to engage customers. This digital shift is expected to continue fueling market growth, allowing manufacturers to reach a wider audience.

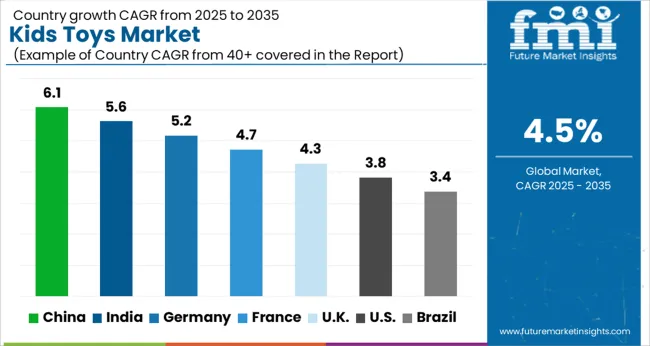

The kids toys market is projected to grow globally at a CAGR of 4.5% from 2025 to 2035, driven by factors such as increasing disposable income, growing e-commerce platforms, and the rising demand for educational and interactive toys. China leads with a CAGR of 6.1%, fueled by the growing middle-class population, increasing investments in the toy manufacturing sector, and a shift toward high-quality, educational toys. India follows at 5.6%, supported by the expansion of retail and e-commerce channels and rising consumer spending on toys. France records a CAGR of 4.7%, boosted by the demand for eco-friendly and educational toys. The United Kingdom grows at 4.3%, driven by the rise of sustainable toy trends and online retail. The United States posts 3.8%, reflecting stable demand in the mature market with growing interest in innovative and STEM-based toys. This analysis highlights the key growth drivers in these regions, providing insights into strategic investments, market penetration, and consumer preferences that will shape the future of the global Kids Toys Market.

China is projected to register a CAGR of 6.1% during 2025–2035, up from an estimated 5.5% in 2020–2024, highlighting accelerated growth driven by rising disposable incomes and increasing demand for educational and interactive toys. The increase in growth rate is supported by an expanding middle class, growing demand for high-tech toys, and the shift toward e-commerce platforms that improve accessibility. The country's robust manufacturing sector and dominance in global toy exports further contribute to this upward trend. The demand for premium educational toys and interactive experiences will continue to fuel this growth.

India is forecasted to achieve a CAGR of 5.6% during 2025–2035, up from around 5.0% in 2020–2024. This growth is driven by an expanding population, rising disposable income, and the shift in parental preferences toward educational toys. The adoption of online retail platforms has made toys more accessible, particularly in smaller cities and rural areas. The growing influence of social media and licensing deals with popular characters are expected to further drive demand for toys. The "Make in India" initiative has also reduced dependency on imports, lowering costs and improving market accessibility.

France is expected to grow at a CAGR of 4.7% from 2025 to 2035, an increase from 4.2% during 2020–2024. This rise in demand is driven by consumers’ growing preference for high-quality, sustainable, and educational toys. French parents increasingly seek products that offer cognitive, social, and emotional benefits. The demand for STEM toys, puzzles, and activity-based learning products is on the rise. E-commerce growth in France is contributing to broader access to toys, and government regulations promoting sustainable products are influencing toy manufacturers to innovate in eco-friendly categories.

The UK is forecasted to post a CAGR of 4.3% during 2025–2035, up from 3.6% during 2020–2024. This acceleration reflects rising demand for educational toys, particularly in STEM and development-focused categories. The market is benefiting from growing consumer interest in eco-friendly products and sustainable materials. Online retail platforms are gaining share, offering wider access to toys, and contributing to sales growth. Furthermore, the UK's commitment to sustainability regulations is encouraging toy manufacturers to develop greener options. The expansion of adventure-based and character-driven toys continues to drive sales.

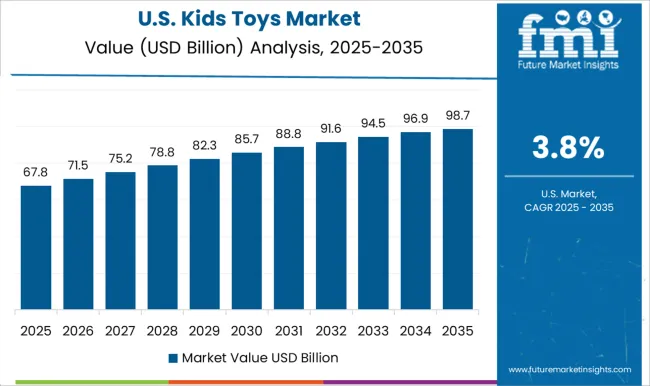

The USA kids toys market is expected to grow at a CAGR of 3.8% during 2025–2035, up from 3.2% during 2020–2024. The growth in this market is supported by a stable birth rate, high disposable incomes, and increasing demand for premium and educational toys. The rise in digital and interactive toys, such as smart toys and toys with app integration, is also driving market expansion. The increasing popularity of subscription boxes and toy rentals further contributes to growth. Moreover, the strong retail presence and established distribution networks ensure consistent product availability across the country.

The kids toys market features a combination of global toy manufacturing giants and specialized product developers, including companies such as The LEGO Group, Bandai Namco Holdings Inc., Hasbro, Inc., Mattel, Inc., MGA Entertainment, Inc., and VTech Holdings Limited. These players dominate the market by offering a wide range of innovative, interactive, and educational toys for various age groups. The LEGO Group leads the market with its extensive portfolio of construction toys and games, emphasizing creativity and developmental skills. Mattel and Hasbro, known for iconic brands such as Barbie, Hot Wheels, and Monopoly, continue to capture the attention of children worldwide through media tie-ins and licensing deals. Bandai Namco Holdings, Playmobil, and MGA Entertainment maintain strong positions through popular franchises like Power Rangers, Playmobil figures, and LOL Surprise! Toys. VTech, LeapFrog, and other educational toy brands target the growing demand for interactive learning products. Ravensburger and Spin Master lead with puzzles, games, and toys focused on entertainment and educational experiences. Competitive strategies include licensing popular media franchises, investing in R&D for STEM-focused toys, and strengthening digital engagement through app integration. These companies continue to diversify their portfolios and enhance distribution channels, driving steady growth in the global toy industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 146.4 Billion |

| Product Type | Dolls and Stuffed Toys, Action Figures and Playsets, Building and Construction Toys, Educational Toys, Board Games and Puzzles, Outdoor Sports Toys, Electronic Toys, and Others (Play and Dress-up Toys) |

| Material | Plastic, Wood, Fabric, Metal, and Others |

| Age Group | Preschool (4-6 years), Infants (0-2 years), Toddlers (2-4 years), Early School Age (6-8 years), and Middle Childhood (8-10 years) |

| Category | Conventional and Smart |

| Price Range | Mid, Low, and High |

| Gender | Boys and Girls |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The LEGO Group, Bandai Namco Holdings Inc., Crayola LLC, Hasbro, Inc., Jakks Pacific, Inc., LeapFrog Enterprises, Inc., Mattel, Inc., Melissa & Doug, LLC, MGA Entertainment, Inc., Playmobil, Ravensburger AG, Spin Master Ltd., Tomy Company, Ltd., VTech Holdings Limited, and Winning Moves Games Ltd. |

| Additional Attributes | Dollar sales, market share by category (educational, interactive, action figures), consumer preferences, pricing strategies, and distribution channels. |

The global kids toys market is estimated to be valued at USD 146.4 billion in 2025.

The market size for the kids toys market is projected to reach USD 227.4 billion by 2035.

The kids toys market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in kids toys market are dolls and stuffed toys, action figures and playsets, building and construction toys, educational toys, board games and puzzles, outdoor sports toys, electronic toys and others (play and dress-up toys).

In terms of material, plastic segment to command 63.1% share in the kids toys market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kids Splint Market Size and Share Forecast Outlook 2025 to 2035

Kids Sports Equipment and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kids Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Brain Health Supplements Market Size and Share Forecast Outlook 2025 to 2035

Kids Sports Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

Kids Musical Instrument Market Size and Share Forecast Outlook 2025 to 2035

Kids Storage Furniture Market by Type, Material, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Kids Recreational Services Market by Activity Type, Service Type, and Region - Forecast to 2025 to 2035

Kids Watch Market

Kids’ Eyewear Market Report – Trends & Forecast 2024-2034

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Industrial RO Skids Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mesh Nebulizer for Kids Market Size and Share Forecast Outlook 2025 to 2035

Coolant Filtration Skids Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Pet Toys Market Analysis – Size, Share & Forecast 2025 to 2035

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA