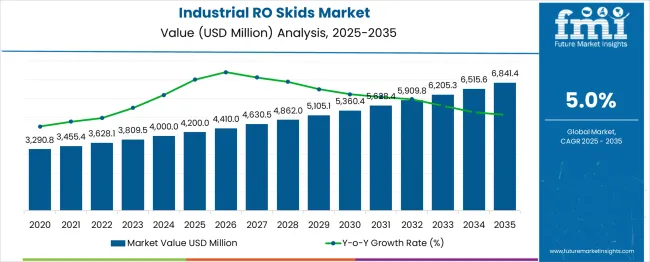

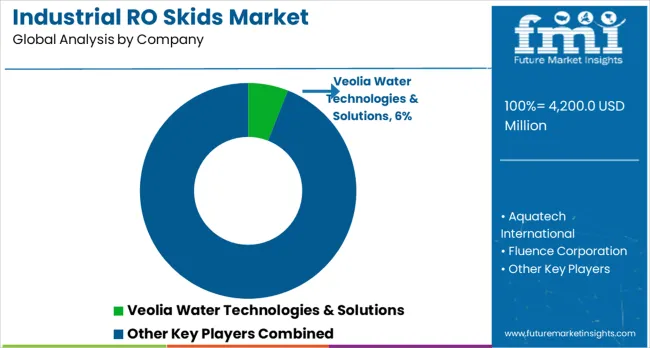

The global industrial RO skids market is projected to grow from USD 4,200.0 million in 2025 to approximately USD 6,841.3 million by 2035, recording an absolute increase of USD 2,641.3 million over the forecast period. This translates into a total growth of 62.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.0% between 2025 and 2035. The overall market size is expected to grow by nearly 1.63X during the same period, supported by the rising demand for water treatment solutions and increasing industrial water purification requirements across diverse manufacturing sectors.

Between 2025 and 2030, the industrial RO skids market is projected to expand from USD 4,200.0 million to USD 5,360.4 million, resulting in a value increase of USD 1,160.4 million, which represents 43.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for clean water in industrial processes, increasing regulatory requirements for water treatment, and growing awareness among manufacturers about the importance of sustainable water management. Service providers and manufacturers are expanding their production capabilities to address the growing complexity of modern industrial water treatment systems.

From 2030 to 2035, the market is forecast to grow from USD 5,360.4 million to USD 6,841.3 million, adding another USD 1,480.9 million, which constitutes 56.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of modular containerized solutions, integration of advanced membrane technologies, and development of standardized treatment protocols across different industrial applications. The growing adoption of water recycling and reuse systems will drive demand for more sophisticated RO skid solutions and specialized technical expertise.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4,200.0 million |

| Forecast Value in (2035F) | USD 6,841.3 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

Between 2020 and 2025, the industrial RO skids market experienced steady expansion, driven by increasing industrial water treatment requirements and growing awareness of water scarcity issues. The market developed as manufacturing facilities recognized the need for specialized equipment to meet stringent water quality standards. Environmental regulations and sustainability initiatives began emphasizing proper water treatment procedures to maintain compliance and reduce environmental impact.

Market expansion is being supported by the rapid increase in industrial water treatment requirements worldwide and the corresponding need for efficient, reliable reverse osmosis solutions. Modern industrial facilities rely on high-quality treated water for various processes including manufacturing, cooling, and cleaning applications. Even minor variations in water quality can significantly impact production efficiency and product quality standards.

The growing complexity of water treatment regulations and increasing environmental compliance requirements are driving demand for professional RO skid solutions from certified manufacturers with appropriate technology and expertise. Regulatory agencies are increasingly requiring comprehensive water treatment documentation to maintain operational permits and ensure environmental compliance. Industry standards and manufacturer specifications are establishing standardized treatment procedures that require specialized equipment and trained operators.

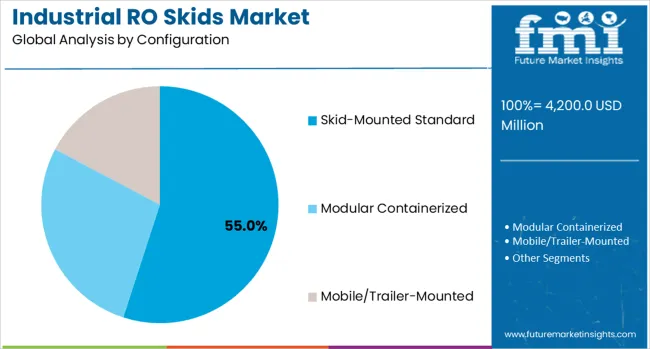

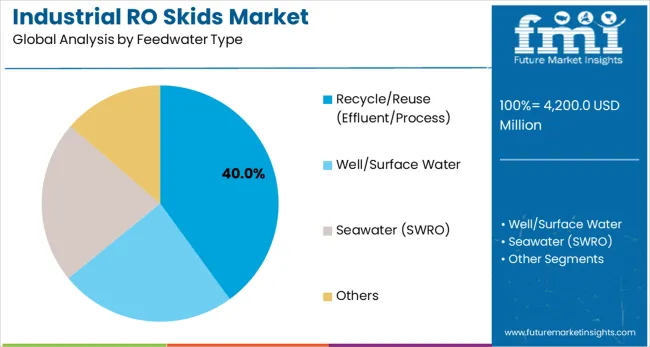

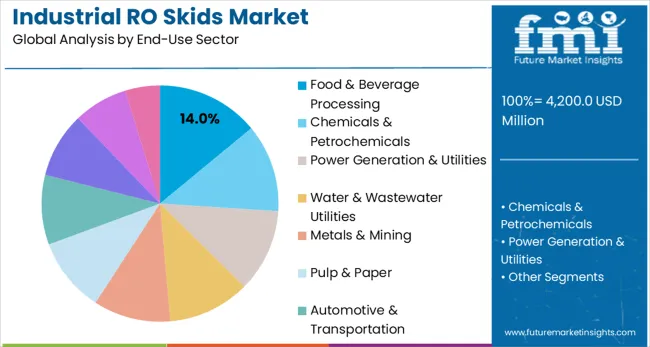

The market is segmented by capacity, configuration, feedwater type, end-use sector, and region. By capacity, the market is divided into ≤50 m³/h, 51-200 m³/h, and >200 m³/h segments. Based on configuration, the market is categorized into skid-mounted standard, modular containerized, and mobile/trailer-mounted systems. In terms of feedwater type, the market is segmented into well/surface water, recycle/reuse (effluent/process), seawater (SWRO), and others. By end-use sector, the market spans food & beverage processing, chemicals & petrochemicals, power generation & utilities, water & wastewater utilities, metals & mining, pulp & paper, automotive & transportation, electronics & semiconductors, oil & gas, and construction & building services. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The 51-200 m³/h capacity segment is projected to account for 46% of the industrial RO skids market in 2025, underscoring its role as the most widely adopted capacity range. Medium-capacity RO systems are ideally suited for manufacturing facilities, chemical processing plants, and utilities that require dependable water treatment without the high operating costs of large-scale units. These systems provide a balance between efficiency, flexibility, and affordability, making them attractive to industries with varied but substantial water demands.

Their modularity allows for scalable deployment, accommodating growth or changes in process requirements. The segment benefits from well-established manufacturing practices, broad supplier availability, and standardization of components, which simplifies both procurement and maintenance. As industries face increasing pressure to optimize resource efficiency while maintaining compliance with water quality standards, the 51-200 m³/h range will continue to serve as the backbone of industrial RO skid adoption.

Skid-mounted standard configurations are expected to represent 55% of industrial RO skid demand in 2025, highlighting their leadership in industrial water treatment. These systems are pre-engineered and factory-tested, ensuring reliability and reducing commissioning times once deployed on-site. Standard skid systems are particularly valued for their cost-effectiveness, as economies of scale lower both production and procurement costs. Their compact, integrated design simplifies installation and provides consistent performance for a wide variety of industrial applications, including boiler feedwater treatment, process water preparation, and utility operations.

With industries increasingly prioritizing fast deployment and minimal downtime, skid-mounted standard systems offer significant operational advantages over custom-built units. Suppliers also continue to innovate within this category, offering advanced automation, remote monitoring, and energy-efficient membranes as standard features. This combination of reliability, affordability, and convenience ensures that skid-mounted standard configurations maintain their dominant market position.

The recycle/reuse feedwater segment is projected to contribute 40% of the industrial RO skids market in 2025, reflecting the growing importance of water conservation in industrial operations. These systems treat wastewater streams, process effluents, and secondary sources to enable reuse, reducing dependence on freshwater intake and lowering discharge costs. Adoption is strongly driven by tightening environmental regulations, sustainability commitments, and the financial benefits of minimizing water sourcing expenses.

Industrial sectors such as textiles, power generation, and petrochemicals increasingly prioritize circular water strategies, where RO skids play a critical role in maintaining consistent quality for reuse applications. Advances in membrane technology, fouling resistance, and energy recovery devices have further improved the cost-effectiveness of recycle/reuse solutions. As water scarcity intensifies globally, industries are investing in these systems not only for compliance but also as a strategic approach to operational resilience.

The food and beverage processing sector is estimated to hold 14% of the industrial RO skids market in 2025, making it the largest single end-use segment despite its relatively modest percentage share. This industry requires consistent supplies of high-quality treated water for manufacturing, cleaning, sanitation, and ingredient processing. Stringent hygiene standards and regulatory frameworks demand RO systems that can reliably remove contaminants while ensuring compliance with international food safety guidelines.

The segment benefits from the growing global demand for packaged foods, beverages, and dairy products, which amplifies investment in advanced water treatment systems. RO skids are particularly valued for their ability to deliver purified water at scale while maintaining flexibility across multiple production lines. With consumer and regulatory expectations rising, food and beverage processors remain steady drivers of demand for reliable, compliant, and efficient RO skid systems.

The industrial RO skids market is advancing steadily due to increasing water treatment requirements and growing recognition of water scarcity issues. However, the market faces challenges including high capital costs, need for regular membrane replacement and maintenance, and varying water quality requirements across different industrial applications. Technological innovation and standardization efforts continue to influence system performance and market development patterns.

The growing deployment of modular containerized and mobile RO systems is enabling flexible water treatment capabilities at remote locations, temporary sites, and facilities with varying capacity requirements. Mobile units equipped with trailer-mounted systems provide rapid deployment and operational flexibility for emergency situations and temporary applications. These solutions are particularly valuable for construction projects, mining operations, and disaster response scenarios that require immediate water treatment capabilities.

Modern RO skid manufacturers are incorporating advanced membrane technologies and automated control systems that improve treatment efficiency and reduce operational complexity. Integration of smart sensors, remote monitoring capabilities, and predictive maintenance systems enables optimized system performance and reduced downtime. Advanced membrane materials also support treatment of challenging water sources including high-salinity and contaminated feedwater streams.

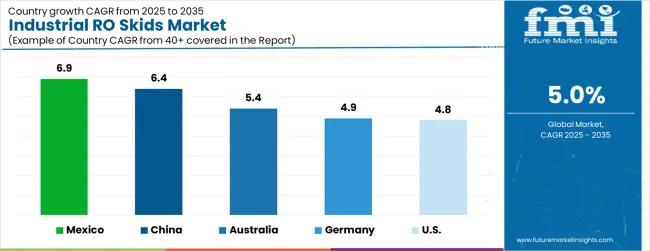

| Country | CAGR |

|---|---|

| Mexico | 6.9% |

| China | 6.4% |

| Australia | 5.4% |

| Germany | 4.95 |

| USA | 4.8% |

The industrial RO skids market is growing rapidly, with Mexico leading at a 6.9% CAGR through 2035, driven by expanding manufacturing sector, water scarcity concerns, and increasing industrial water treatment regulations. China follows at 6.4%, supported by massive industrial growth, environmental compliance requirements, and government initiatives for water conservation. Australia grows steadily at 5.4%, addressing water scarcity challenges and expanding mining operations. Germany records 4.9%, emphasizing advanced manufacturing and environmental sustainability. The USA shows steady growth at 4.8%, focusing on infrastructure modernization and regulatory compliance. Overall, Mexico and China emerge as the leading drivers of global industrial RO skids market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from Industrial RO Skids in Mexico is projected to exhibit the highest growth rate with a CAGR of 6.9% through 2035, driven by rapid industrial development and increasing water treatment requirements in manufacturing sectors. The country's expanding automotive, electronics, and chemical industries are creating significant demand for high-quality treated water. Major manufacturing facilities are implementing comprehensive water treatment systems to support production operations and meet environmental compliance requirements.

Revenue from Industrial RO Skids in China is expanding at a CAGR of 6.4%, supported by massive industrial growth and increasing environmental compliance requirements. The country's manufacturing sector modernization and water scarcity concerns are driving demand for efficient water treatment solutions. Industrial facilities across electronics, chemicals, and textiles sectors are implementing advanced RO systems to meet production requirements and regulatory standards.

Revenue from Industrial RO Skids in Australia is growing at a CAGR of 5.4%, driven by expanding mining operations and increasing water treatment requirements in remote locations. The country's mining sector and water scarcity challenges are creating demand for mobile and containerized RO systems. Industrial facilities are implementing advanced water treatment solutions to address challenging water sources and environmental constraints.

Demand for Industrial RO Skids in Germany is projected to grow at a CAGR of 4.9%, supported by the country's emphasis on advanced manufacturing and environmental sustainability. German industrial facilities are implementing sophisticated water treatment systems that meet stringent environmental standards and support high-precision manufacturing processes. The market is characterized by focus on technological innovation, energy efficiency, and compliance with comprehensive environmental regulations.

Demand for Industrial RO Skids in the USA is expanding at a CAGR of 4.8%, driven by infrastructure modernization and increasing regulatory requirements for water treatment. Industrial facilities across diverse sectors are upgrading water treatment systems to meet environmental standards and improve operational efficiency. The market benefits from established manufacturing infrastructure and comprehensive regulatory framework supporting water quality compliance.

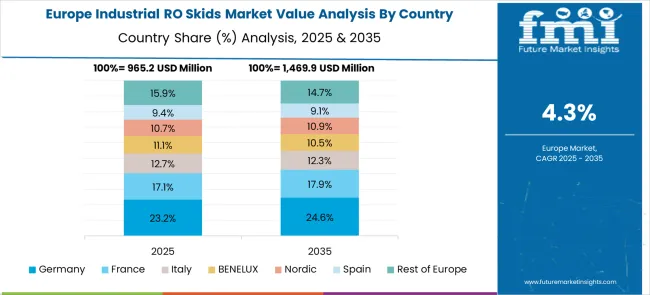

The European industrial RO skids market demonstrates sophisticated development across major economies with Germany leading through its advanced manufacturing capabilities and strong industrial water treatment sector, supported by companies like Veolia Water Technologies & Solutions and Pentair pioneering innovative membrane technologies for diverse industrial applications. The UK and France show significant growth in food processing and chemical industries, where stringent water quality standards drive demand for advanced RO systems. German companies leverage their engineering expertise to develop comprehensive treatment solutions, while international players like Aquatech International and Xylem (Evoqua) establish strong European presence.

Italy and Spain exhibit expanding adoption in automotive and power generation sectors, driven by environmental regulations and sustainable manufacturing initiatives. Nordic countries emphasize energy-efficient solutions and environmental compliance, while Eastern European markets show growing interest in upgrading industrial water infrastructure. The market benefits from strict EU environmental regulations, Industry 4.0 adoption, and the region's leadership in precision manufacturing, positioning Europe as a key innovation center for next-generation industrial RO skid solutions across multiple water treatment applications.

The industrial RO skids market is defined by competition among specialized equipment manufacturers, water treatment companies, and engineering firms. Companies are investing in advanced membrane technologies, modular system designs, automation capabilities, and comprehensive service support to deliver efficient, reliable, and cost-effective water treatment solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

ABRA/Driven Brands operates globally, providing comprehensive Industrial RO Skids with focus on reliability, efficiency, and technical support. Aquatech International, USA-based, offers advanced water treatment solutions with emphasis on custom engineering and process optimization. Fluence Corporation, operating globally, provides modular and containerized RO systems for diverse industrial applications. H2O Innovation, Canada, delivers innovative water treatment technologies with focus on sustainability and operational efficiency.

IDE Technologies, Israel, emphasizes advanced desalination and water treatment solutions with proven track record in challenging applications. Kovalus Separation (ex-Koch Membrane), USA, offers comprehensive membrane technologies and system integration capabilities. Kurita America, Japan/USA, provides sophisticated water treatment solutions with emphasis on chemical and industrial applications. Pentair, USA, delivers comprehensive water treatment systems with focus on reliability and service support.

Toray Membrane, Japan, offers advanced membrane technologies and system solutions for industrial water treatment applications. Veolia Water Technologies & Solutions, France/Global, provides comprehensive water treatment services and technology solutions worldwide. Xylem (Evoqua), USA, delivers advanced water treatment systems with focus on automation and digital integration capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4,200.0 million |

| Capacity Segments | ≤50 m³/h, 51-200 m³/h, >200 m³/h |

| Configuration | Skid-Mounted Standard, Modular Containerized, Mobile/Trailer-Mounted |

| Feedwater Type | Well/Surface Water, Recycle/Reuse, Seawater, Others |

| End-Use Sectors | Food & Beverage, Chemicals, Power Generation, Water Utilities, Mining, Pulp & Paper, Automotive, Electronics, Oil & Gas, Construction |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, China, Japan, South Korea, India, Australia, Brazil and 40+ countries |

| Key Companies Profiled | Aquatech International, Fluence Corporation, H2O Innovation, IDE Technologies, Kovalus Separation, Kurita America, Pentair, Toray Membrane, Veolia Water Technologies, and Xylem (Evoqua) |

| Additional Attributes | Dollar sales by membrane type and skid capacity, regional demand trends, competitive landscape, buyer preferences for modular versus custom-engineered units, integration with smart water management platforms, innovations in energy recovery, advanced pretreatment, and sustainable membrane materials |

The global industrial ro skids market is estimated to be valued at USD 4,200.0 million in 2025.

The market size for the industrial ro skids market is projected to reach USD 6,841.4 million by 2035.

The industrial ro skids market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in industrial ro skids market are 51–200, ≤50 and >200.

In terms of end-use sector, food & beverage processing segment to command 14.0% share in the industrial ro skids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA