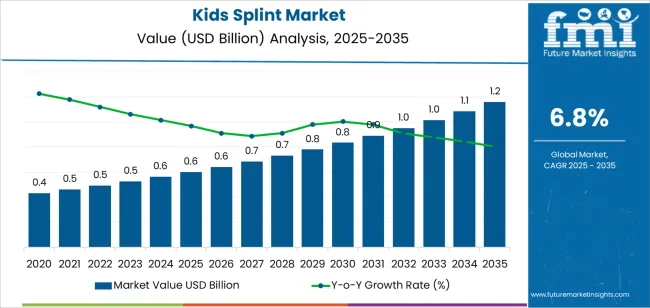

The global kids splint market is anticipated to grow from USD 0.6 billion in 2025 to approximately USD 1.2 billion by 2035, recording an absolute increase of USD 0.6 billion over the forecast period. This translates into a total growth of 93.1%, with the market forecast to expand at a CAGR of 6.8% between 2025 and 2035. The market size is expected to grow by nearly 1.9 times during the same period, supported by increasing prevalence of pediatric orthopedic conditions requiring immobilization and support, growing awareness of early intervention benefits in musculoskeletal development, and rising adoption of specialized pediatric orthotic devices across clinical and home care settings.

The market expansion reflects fundamental shifts in pediatric orthopedic care focusing customized treatment approaches and age-appropriate device specifications. Healthcare providers are investing in comprehensive pediatric rehabilitation infrastructure that supports both acute injury management and chronic condition treatment protocols. Kids splints represent specialized medical devices requiring precise fitting considerations, growth accommodation features, and child-friendly designs that promote treatment compliance. Manufacturing standards are evolving to address diverse developmental stages ranging from toddlers to adolescents, driving demand for splints that combine clinical effectiveness with comfort and adjustability across extended treatment periods.

Technological advancement in splint design is enabling lightweight materials and enhanced breathability while maintaining structural rigidity and immobilization effectiveness requirements. The integration of adjustable fastening systems and modular components addresses growth-related sizing changes and individual anatomical variations. Regional variations in pediatric healthcare access and orthopedic treatment protocols create differentiated growth trajectories, with developed markets focusing on advanced materials and custom fabrication while emerging markets emphasize affordable standardized options and capacity expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.6 billion |

| Market Forecast Value (2035) | USD 1.2 billion |

| Forecast CAGR (2025-2035) | 6.8% |

| PEDIATRIC HEALTHCARE ADVANCEMENT | CLINICAL TREATMENT REQUIREMENTS | TECHNOLOGY & DESIGN STANDARDS |

|---|---|---|

| Pediatric Orthopedic Awareness Growth Continuing expansion of early intervention programs across established and emerging healthcare markets driving demand for specialized pediatric immobilization solutions. | Comprehensive Treatment Protocols Modern pediatric orthopedic standards requiring age-appropriate splinting devices across diverse injury types and developmental conditions. | Medical Device Safety Standards Regulatory requirements establishing performance benchmarks favoring certified hypoallergenic pediatric orthotic components. |

| Sports Injury Prevention Focus Growing participation in youth sports activities and organized athletics creating steady demand for protective splinting and injury management capabilities. | Growth Accommodation Demands Pediatric treatment protocols requiring adjustable devices offering extended usability across developmental growth periods and anatomical changes. | Child-Friendly Design Requirements Quality standards requiring comfortable materials and appealing aesthetics supporting treatment compliance among pediatric patient populations. |

| Early Intervention Recognition Expansion of developmental disorder screening and congenital condition management requiring specialized orthotic support for neurological and musculoskeletal applications. | Immobilization Effectiveness Standards Clinical applications demanding proper joint stabilization and alignment maintenance while accommodating pediatric activity levels and compliance challenges. | Material Biocompatibility Certification Safety standards requiring non-toxic materials and validated dermatological profiles supporting prolonged skin contact in pediatric applications. |

| Category | Segments Covered |

|---|---|

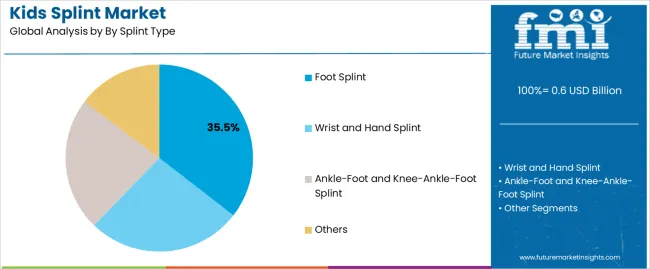

| By Splint Type | Foot Splint, Wrist and Hand Splint, Ankle-Foot and Knee-Ankle-Foot Splint, Others |

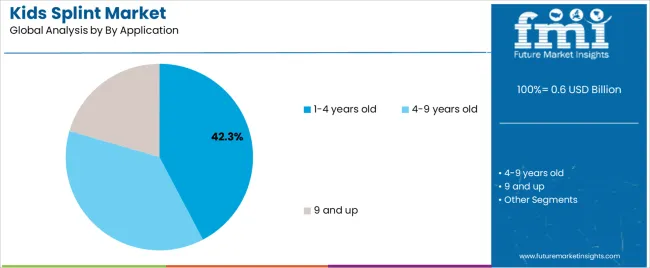

| By Application | 1-4 years old, 4-9 years old, 9 and up |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Foot Splint |

|

| Wrist and Hand Splint |

|

| Ankle-Foot and Knee-Ankle-Foot Splint |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| 1-4 years old |

|

| 4-9 years old |

|

| 9 and up |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Pediatric Healthcare Infrastructure Investment Continuing expansion of specialized pediatric orthopedic services across established and emerging healthcare systems driving demand for age-appropriate immobilization devices. | Cost Sensitivity Pressures Family budget constraints and insurance coverage limitations affecting premium device adoption and frequent replacement due to growth-related sizing needs. | Lightweight Material Innovation Integration of advanced thermoplastics and composite materials enabling improved comfort and reduced device weight while maintaining immobilization effectiveness. |

| Congenital Condition Prevalence Increasing recognition of early splinting intervention importance in managing clubfoot, developmental dysplasia, and neuromuscular conditions affecting pediatric mobility. | Compliance Challenges Patient cooperation difficulties and caregiver burden concerns affecting treatment adherence and therapeutic outcome achievement in pediatric populations. | Customization Technology Advancement Enhanced 3D scanning capabilities, digital modeling systems, and additive manufacturing enabling personalized device fabrication compared to standardized options. |

| Sports Participation Growth Growing focus on youth athletics and organized sports programs creating steady demand for protective equipment and injury management solutions. | Sizing Complexity Rapid pediatric growth requiring frequent device adjustments and replacements affecting cost-effectiveness and caregiver satisfaction with orthotic solutions. | Aesthetic Design Development Development of colorful patterns, character themes, and appealing visual designs improving patient acceptance and treatment compliance while maintaining clinical functionality. |

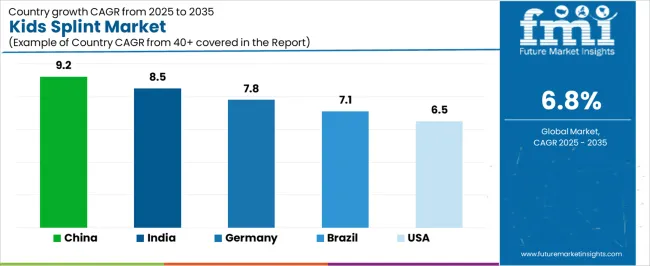

| Country | CAGR (2025-2035) |

|---|---|

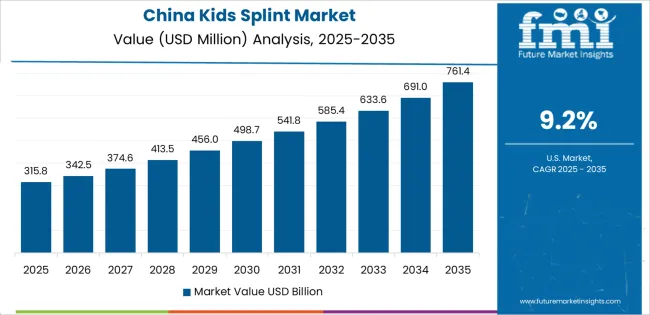

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

China is projected to exhibit strong growth with substantial market value by 2035, driven by expanding pediatric orthopedic infrastructure and comprehensive early intervention program development creating opportunities for medical device suppliers across children's hospitals, rehabilitation centers, and specialized treatment institutions. The country's growing middle class healthcare spending and increasing awareness of developmental disorder management are creating significant demand for both standardized and custom-fabricated pediatric splinting solutions. Major orthopedic device manufacturers and healthcare facility operators are establishing comprehensive local production capabilities to support large-scale deployment operations and meet growing demand for affordable yet effective pediatric orthotic devices.

India is expanding substantially by 2035, supported by extensive pediatric healthcare infrastructure development and comprehensive government health program implementation creating steady demand for affordable orthotic solutions across diverse population segments and regional healthcare categories. The country's large pediatric population and growing awareness of orthopedic treatment benefits are driving demand for splint solutions that provide clinical effectiveness while supporting cost-conscious procurement requirements. Medical device distributors and healthcare facility operators are investing in local manufacturing partnerships to support growing deployment operations and product localization initiatives.

Germany is projected to reach substantial value by 2035, supported by the country's leadership in pediatric orthopedic care and advanced medical device technologies requiring sophisticated splinting systems for specialized treatment applications and custom fabrication requirements. German healthcare facilities are implementing high-quality orthotic devices that support precise anatomical fitting, growth accommodation, and comprehensive therapeutic protocols. The market is characterized by focus on clinical outcomes, material innovation, and compliance with stringent medical device and child safety standards.

The United States is growing to reach substantial value by 2035, driven by comprehensive pediatric orthopedic service networks and increasing sports medicine focus creating opportunities for device suppliers serving both acute care facilities and outpatient rehabilitation providers. The country's extensive insurance coverage for pediatric orthotic devices and expanding early intervention service availability are creating demand for splint solutions that support diverse treatment protocols while maintaining clinical performance standards. Medical device manufacturers and orthotic fabrication facilities are developing specialized product lines to support age-specific requirements and clinical outcome optimization.

Brazil is projected to reach meaningful value by 2035, driven by public healthcare system capacity expansion and pediatric specialty service development supporting children's hospital growth and comprehensive orthopedic treatment applications. The country's expanding middle class and growing private healthcare sector participation are creating demand for cost-effective splint solutions that support clinical effectiveness and accessibility standards. Medical device distributors and healthcare facility operators are maintaining comprehensive supply capabilities to support diverse pediatric treatment requirements.

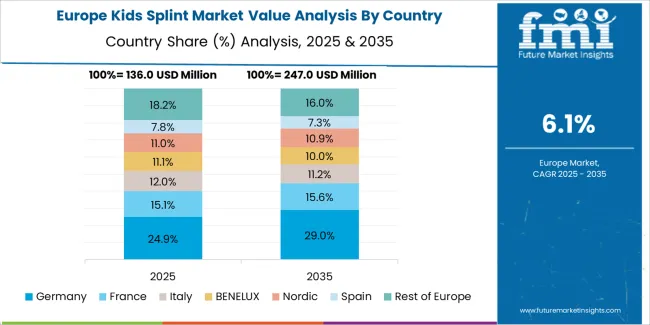

The kids splint market in Europe is projected to grow from USD 213.1 million in 2025 to USD 395.3 million by 2035, registering a CAGR of 6.4% over the forecast period. Germany is expected to maintain its leadership position with a 29.7% market share in 2025, declining slightly to 28.9% by 2035, supported by its advanced pediatric orthopedic infrastructure and comprehensive child healthcare coverage systems.

France follows with a 20.4% share in 2025, projected to reach 21.1% by 2035, driven by comprehensive pediatric specialty hospital networks and integrated early intervention service programs. The United Kingdom holds a 17.6% share in 2025, expected to decrease to 16.9% by 2035 due to NHS budget optimization initiatives affecting elective orthotic device procurement. Italy commands a 14.8% share, while Spain accounts for 10.9% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 6.6% to 8.3% by 2035, attributed to increasing pediatric orthopedic service adoption in Nordic healthcare systems and emerging Eastern European children's hospitals implementing specialized treatment programs.

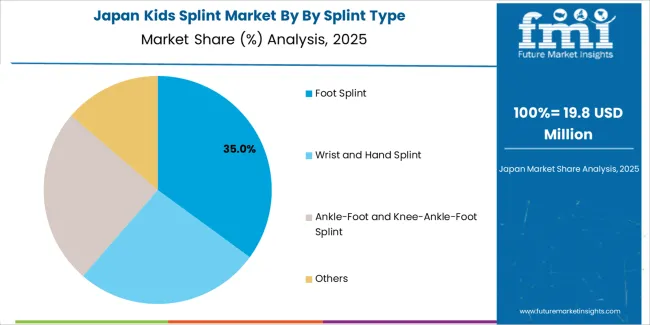

Japanese kids splint operations reflect the country's meticulous approach to pediatric healthcare and comprehensive child safety regulations. Major orthopedic device manufacturers including Kawamura Gishi, Nakamura Brace, and specialized pediatric orthotic providers maintain rigorous product development processes focusing growth accommodation features, hypoallergenic materials, and detailed fitting protocols that exceed international pediatric device standards. This creates substantial barriers for international suppliers but ensures exceptional quality supporting optimal therapeutic outcomes.

The Japanese market demonstrates unique design preferences, with significant focus on compact profiles and aesthetic considerations that minimize visual impact while maintaining clinical effectiveness. Healthcare providers require specific adjustment mechanisms and fastening systems that accommodate Japanese children's anthropometric characteristics and cultural preferences regarding medical device appearance.

Regulatory oversight through the Ministry of Health, Labour and Welfare emphasizes comprehensive safety validation for pediatric medical devices, with particular attention to material biocompatibility and long-term skin contact considerations. The classification system requires extensive pediatric-specific testing data and post-market surveillance protocols, creating advantages for suppliers with established pediatric device expertise and comprehensive quality documentation systems.

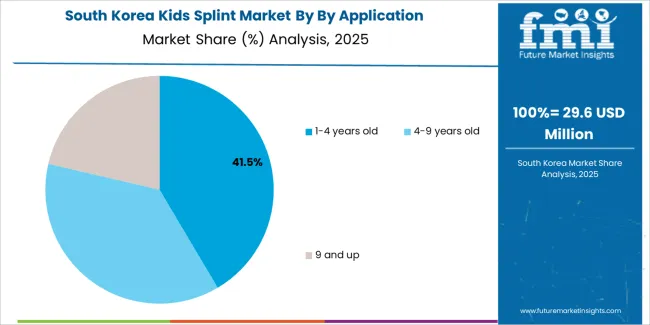

South Korean kids splint operations reflect the country's advanced pediatric healthcare capabilities and growing focus on early intervention services. Major children's hospitals including Seoul National University Children's Hospital, Severance Children's Hospital, and Asan Medical Center drive sophisticated treatment protocols that influence device specifications and clinical outcome expectations.

The Korean market demonstrates particular strength in integrating splinting devices with comprehensive rehabilitation programs and developmental monitoring protocols. Healthcare facilities emphasize evidence-based treatment approaches and measurable outcome improvement, creating demand for splint solutions that support standardized therapeutic goals while accommodating individual patient variations.

Regulatory frameworks through the Ministry of Food and Drug Safety incorporate specific pediatric device requirements addressing safety, effectiveness, and growth accommodation capabilities. These standards align with international pediatric medical device regulations while incorporating Korean-specific testing protocols and documentation requirements that support market quality expectations.

Profit pools are consolidating around specialized pediatric orthotic expertise and clinical outcome validation, with value migrating from commodity splint manufacturing to engineered solutions offering age-specific sizing systems, growth accommodation features, and compliance-enhancing designs. Several competitive archetypes dominate market positioning: established orthopedic device manufacturers leveraging comprehensive product portfolios and clinical relationships; specialized pediatric orthotic fabricators focusing on custom solutions and therapeutic expertise; regional distributors providing fitting services and follow-up support; and emerging suppliers targeting specific age segments through innovative materials and appealing aesthetics.

Switching costs remain moderate due to clinical protocol flexibility and caregiver preferences, though therapeutic relationship continuity and fitting expertise create practitioner loyalty toward established suppliers. Technology transitions toward digital scanning and 3D printing create periodic windows for competitive repositioning, particularly among providers offering rapid customization capabilities. Clinical evidence demonstrating superior outcomes and patient compliance differentiate premium suppliers, especially during treatment protocol development and specialty program establishment.

Market consolidation continues as larger medical device companies acquire specialized pediatric orthotic manufacturers to expand product portfolios and capture growing segments. Direct-to-consumer channels are emerging for standardized products, while custom fabrication and complex cases remain practitioner-driven. Strategic priorities center on establishing relationships with children's hospital networks and pediatric orthopedic specialists through validated clinical outcomes and comprehensive fitting support services. Product line diversification across age segments and condition-specific applications addresses varying therapeutic requirements and reimbursement frameworks. Future positioning requires balancing standardization efficiency with customization capabilities and maintaining regulatory compliance across multiple jurisdictions while adapting to evolving pediatric treatment philosophies and material science advancements.

| Items | Values |

|---|---|

| Quantitative Units | USD 0.6 million |

| Product | Foot Splint, Wrist and Hand Splint, Ankle-Foot and Knee-Ankle-Foot Splint, Others |

| Application | 1-4 years old, 4-9 years old, 9 and up |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, Japan, United Kingdom, and other 40+ countries |

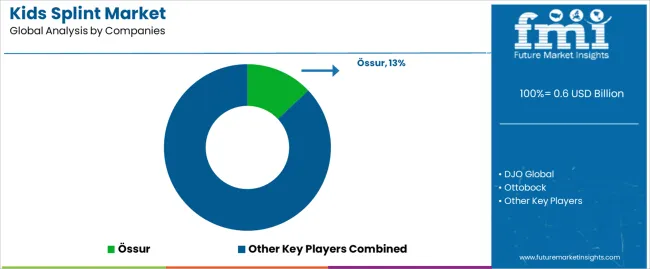

| Key Companies Profiled | Össur, DJO Global, Ottobock, Thuasne, Becker Orthopedic, Breg, Orliman, Fillauer LLC, Trulife, Invent Medical, ORTHO-TEAM AG, Surestep, Crispin Orthotic |

| Additional Attributes | Dollar sales by splint type/application, regional demand (NA, EU, APAC), competitive landscape, age-specific device adoption, growth accommodation innovations, and child-friendly design advancements driving treatment compliance, therapeutic effectiveness, and pediatric orthopedic care quality |

The global kids splint market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the kids splint market is projected to reach USD 1.2 billion by 2035.

The kids splint market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in kids splint market are foot splint, wrist and hand splint, ankle-foot and knee-ankle-foot splint and others.

In terms of by application, 1-4 years old segment to command 42.3% share in the kids splint market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kids Toys Market Size and Share Forecast Outlook 2025 to 2035

Kids Sports Equipment and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kids Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Brain Health Supplements Market Size and Share Forecast Outlook 2025 to 2035

Kids Sports Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

Kids Musical Instrument Market Size and Share Forecast Outlook 2025 to 2035

Kids Storage Furniture Market by Type, Material, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Kids Recreational Services Market by Activity Type, Service Type, and Region - Forecast to 2025 to 2035

Kids Watch Market

Kids’ Eyewear Market Report – Trends & Forecast 2024-2034

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Industrial RO Skids Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mesh Nebulizer for Kids Market Size and Share Forecast Outlook 2025 to 2035

Coolant Filtration Skids Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA