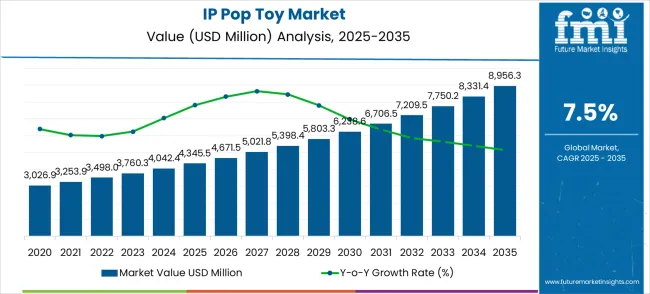

The IP pop toy market is set to grow from USD 4,345.5 million in 2025 to USD 8,956.3 million by 2035, with a CAGR of 7.5%. The market follows a steady growth trajectory, but key inflection points highlight significant shifts in demand and consumer trends. The first inflection point occurs between 2025 and 2027, when the market rises from USD 4,345.5 million to USD 4,671.5 million. This initial surge is driven by the increasing popularity of IP-based toys and licensed characters, attracting a larger consumer base, particularly among children and collectors. The infusion of new characters and innovative designs during this period accelerates demand and sets the foundation for future growth.

The next inflection point comes around 2028, when the market jumps from USD 5,021.8 million to USD 5,398.4 million. This significant shift is fueled by the continued expansion of IP-driven toy collections and collaborations between toy manufacturers and popular media franchises. Increased focus on interactive and collectible toy experiences pushes the market to new heights. The market accelerates further between 2030 and 2032, reaching USD 6,706.5 million, as consumer preferences evolve toward innovative, tech-infused toys that blend entertainment and education. By 2035, the market reaches its peak of USD 8,956.3 million, driven by a mature fanbase, advanced technology integration, and the continued rise of pop culture-driven products that cater to a global, diverse audience.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4,345.5 million |

| Forecast Value in (2035F) | USD 8,956.3 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The IP Pop Toy market holds specific shares within its parent markets. In the toy market, it represents approximately 8-10%, driven by strong demand for character-based toys, especially those tied to popular franchises. Within the collectibles market, IP Pop Toys account for about 12-15%, as limited edition toys and rare characters attract a dedicated following of adult collectors. In the entertainment merchandise market, the market share for IP Pop Toys is around 5-7%, with licensing agreements contributing to the development of toys based on movies, TV shows, and gaming franchises. In the pop culture market, IP Pop Toys hold a significant share of around 10-12%, due to the high demand for culturally iconic figures and characters. Finally, in the online retail market, these toys account for about 15-18%, as e-commerce platforms play a key role in distributing these products to a global audience, particularly with exclusive, limited-edition releases.

Market expansion is being supported by the increasing global demand for entertainment merchandise and the corresponding need for collectible products that can provide emotional connection and community engagement while maintaining design excellence across various pop culture and entertainment franchise applications. Modern consumers are increasingly focused on implementing lifestyle choices that can express personal identity, create social connections, and provide meaningful experiences through high-quality collectible products. IP pop toys' proven ability to deliver superior design quality, enhanced collectible value, and versatile cultural compatibility make them essential products for contemporary entertainment consumption and lifestyle expression solutions.

The growing focus on social media culture and community building is driving demand for IP pop toys that can support content creation, enable social sharing experiences, and provide reliable collectible value with distinctive design appeal and limited availability. Entertainment merchandise processors' preference for products that combine cultural relevance with quality craftsmanship and collectible potential is creating opportunities for innovative IP pop toy implementations. The rising influence of anime culture and gaming communities is also contributing to increased adoption of pop toys that can provide authentic fan experiences without compromising design quality or collectible integrity.

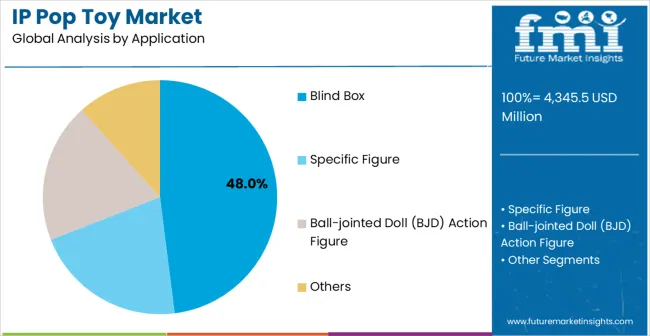

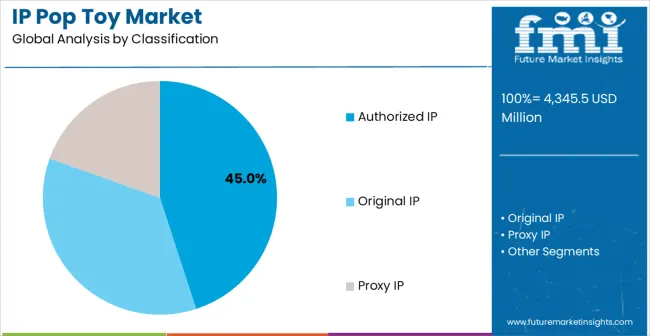

The market is segmented by classification, application, and region. By classification, the market is divided into authorized IP, original IP, proxy IP, and others. Based on application, the market is categorized into blind box, specific figure, ball-jointed doll (BJD), action figure, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

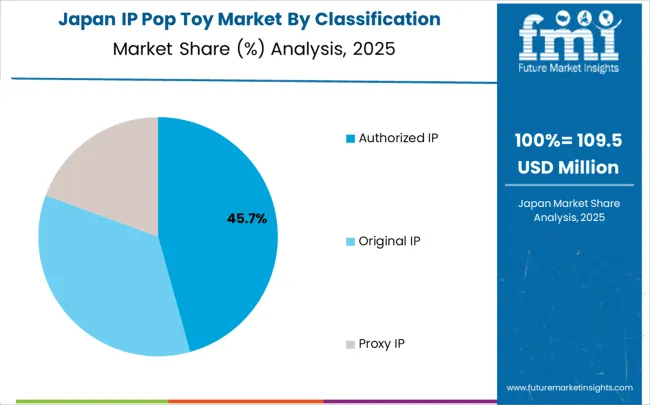

The authorized IP segment is projected to account for 48.0% of the IP pop toy market in 2025, reaffirming its position as the leading classification category. Collectors and entertainment fans increasingly utilize authorized IP pop toys for their superior authenticity, proven brand recognition, and convenience in franchise-based collecting across anime series, gaming properties, and entertainment brand merchandise. Authorized IP technology's established licensing capabilities and consistent quality output directly address the consumer requirements for reliable collectible value and authentic fan experiences in official entertainment merchandise.

This classification segment forms the foundation of modern collectible toy operations, as it represents the category with the greatest brand authenticity and established market demand across multiple entertainment franchises and pop culture properties. Manufacturer investments in enhanced authorized IP licensing technologies and quality control systems continue to strengthen adoption among collectors and fans. With consumers prioritizing authentic experiences and proven collectible value, authorized IP pop toys align with both emotional connection objectives and investment considerations, making them the central component of comprehensive entertainment merchandise strategies.

Blind box applications are projected to represent 45.0% of IP pop toy demand in 2025, underscoring their critical role as the primary application format for surprise-based collectible experiences in toy retail and collector community environments. Collectors prefer blind box formats for their exceptional surprise elements, superior collectible excitement, and ability to create collecting communities while maintaining product discovery experiences and trading opportunities. Positioned as essential formats for modern collectible toy consumption, blind boxes offer both entertainment advantages and social benefits.

The segment is supported by continuous growth in collectible toy culture and the growing availability of specialized packaging technologies that enable premium surprise experiences with enhanced collectible presentation and community engagement requirements. Toy manufacturers are investing in blind box systems to support high-volume distribution and consumer engagement for next-generation collectible experiences. As collectible culture becomes more social and discovery-driven, blind boxes will continue to dominate the application market while supporting advanced collecting utilization and community building strategies.

The IP pop toy market is advancing steadily due to increasing demand for entertainment merchandise and growing adoption of collectible culture that provides enhanced fan experiences and superior community engagement across diverse pop culture and lifestyle applications. The market faces challenges, including intellectual property licensing complexity, market saturation concerns, and the need for continuous design innovation investments. Innovation in digital integration and green manufacturing continues to influence product development and market expansion patterns.

The growing adoption of original IP creation and proxy IP development is enabling toy manufacturers to produce premium IP pop toys with superior design creativity, enhanced manufacturing quality, and advanced collectible features. Advanced design systems provide improved product differentiation while allowing more efficient production and consistent output across various character designs and collectible formats. Manufacturers are increasingly recognizing the competitive advantages of advanced design capabilities for brand differentiation and premium market positioning in demanding collector segments.

Modern IP pop toy producers are incorporating digital authentication and interactive technologies to enhance collectible experiences, provide ownership verification, and ensure authentic collector engagement through blockchain integration and augmented reality features. These technologies improve collectible authenticity while enabling new applications, including digital trading and virtual display systems. Advanced digital integration also allows manufacturers to support premium positioning and collector satisfaction beyond traditional physical toy capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

| USA | 7.1% |

| UK | 6.4% |

| Japan | 5.6% |

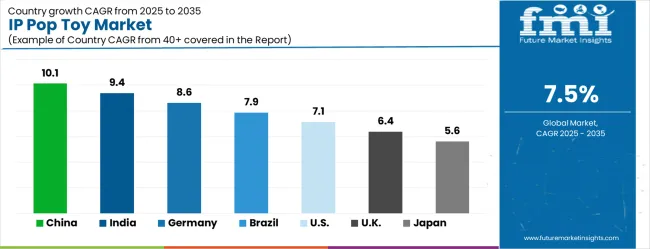

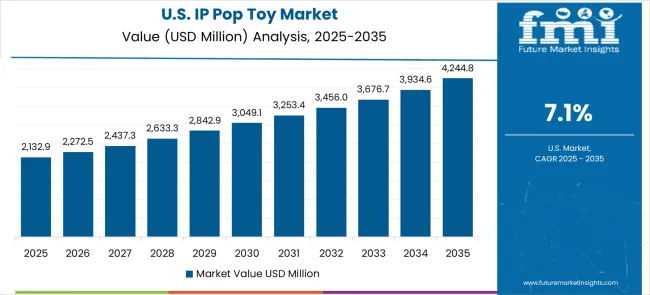

The IP pop toy market is experiencing strong growth globally, with China leading at a 10.1% CAGR through 2035, driven by the expanding entertainment industry, growing pop culture consumption, and significant investment in character-based merchandise development. India follows at 9.4%, supported by large-scale youth demographic expansion, emerging collectible culture, and growing domestic demand for entertainment products. Germany shows growth at 8.6%, emphasizing collectible market innovation and premium toy development. Brazil records 7.9%, focusing on entertainment culture expansion and collectible retail modernization. The USA demonstrates 7.1% growth, prioritizing entertainment merchandise technologies and high-quality collectible solutions. The UK exhibits 6.4% growth, emphasizing pop culture capabilities and quality collectible adoption. Japan shows 5.6% growth, supported by character culture excellence and advanced toy design innovation.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from IP pop toys in China is projected to exhibit exceptional growth with a CAGR of 10.1% through 2035, driven by expanding entertainment industry infrastructure and rapidly growing pop culture consumption supported by government cultural industry development initiatives. The country's abundant entertainment content production capacity and increasing investment in character merchandise technology are creating substantial demand for collectible entertainment products. Major entertainment companies and toy manufacturers are establishing comprehensive IP pop toy capabilities to serve both domestic and international markets.

The IP pop toys market in India is forecasted to grow at a CAGR of 9.4%, supported by the country's growing youth population, emerging collectible culture, and increasing domestic demand for entertainment products and character-based merchandise. The country's developing entertainment supply chain and growing pop culture industry are driving demand for sophisticated collectible capabilities. International toy brands and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for IP pop toy products.

The sale of IP pop toys in Germany is growing at a CAGR of 8.6%, supported by the country's advanced toy industry, strong focus on design innovation, and robust demand for high-quality collectible products among discerning consumers. The nation's mature collectible market and high adoption of premium entertainment merchandise are driving sophisticated product capabilities throughout the retail chain. Leading manufacturers and design studios are investing extensively in premium collectible development and advanced manufacturing methods to serve both domestic and export markets.

Demand for IP pop toys in Brazil is set to grow at a CAGR of 7.9%, driven by expanding entertainment culture infrastructure, increasing collectible retail modernization patterns, and growing investment in character merchandise technology development. The country's developing entertainment resources and modernization of retail facilities are supporting demand for advanced collectible technologies across major market regions. Entertainment retailers and toy companies are establishing comprehensive capabilities to serve both domestic consumer centers and emerging collectible markets.

Revenue from IP pop toys in the USA is expected to expand at a CAGR of 7.1%, supported by the country's advanced entertainment industry, focus on high-quality merchandise supply, and strong demand for sophisticated collectible solutions among entertainment-focused consumers. The USA's established toy manufacturing sector and entertainment expertise are supporting investment in advanced collectible capabilities throughout major retail centers. Industry leaders are establishing comprehensive quality management systems to serve both domestic and export markets with premium entertainment merchandise.

Demand for IP pop toys in the UK is growing at a CAGR of 6.4%, driven by the country's entertainment industry, focus on quality collectible adoption, and strong demand for high-performance entertainment products among established consumers. The UK's mature entertainment sector and focus on collector excellence are supporting investment in advanced collectible capabilities throughout major retail centers. Entertainment companies are establishing comprehensive collectible systems to serve both domestic and international markets with quality entertainment merchandise.

The IP pop toys market in Japan is expanding at a CAGR of 5.6%, supported by the country's focus on character culture excellence, advanced toy design applications, and strong preference for high-quality collectible solutions. Japan's sophisticated character industry and focus on design precision are driving demand for advanced collectible technologies including premium character figures and high-performance manufacturing methods. Leading manufacturers are investing in specialized capabilities to serve character merchandise production, entertainment retail, and precision collectible applications with premium toy offerings.

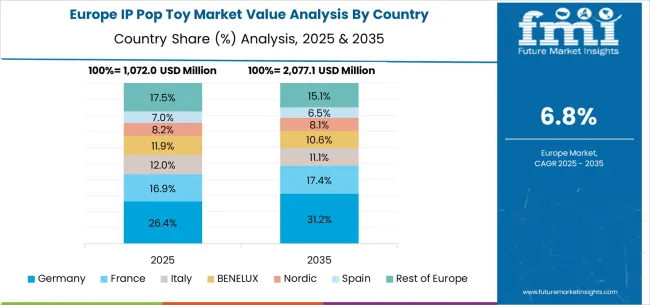

The IP pop toy market in Europe is projected to grow from USD 956.2 million in 2025 to USD 1,971.4 million by 2035, registering a CAGR of 7.5% over the forecast period. Germany is expected to maintain its leadership position with a 22.0% market share in 2025, declining slightly to 21.5% by 2035, supported by its strong toy industry, advanced collectible retail facilities, and comprehensive entertainment merchandise supply network serving major European markets.

France follows with an 18.5% share in 2025, projected to reach 18.8% by 2035, driven by robust demand for IP pop toys in entertainment retail, collectible specialty stores, and character merchandise applications, combined with established pop culture traditions incorporating premium collectible products. The United Kingdom holds a 16.0% share in 2025, expected to decrease to 15.7% by 2035, supported by strong entertainment sector demand but facing challenges from competitive pressures and retail market restructuring. Italy commands a 14.5% share in 2025, projected to reach 14.7% by 2035, while Spain accounts for 12.0% in 2025, expected to reach 12.2% by 2035. The Netherlands maintains a 4.5% share in 2025, growing to 4.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 12.5% to 12.4% by 2035, attributed to increasing adoption of collectible entertainment products in Nordic countries and growing character merchandise activities across Eastern European markets implementing entertainment retail modernization programs.

The IP pop toy market is characterized by competition among established toy manufacturers, specialized collectible producers, and integrated entertainment merchandise companies. Companies are investing in character licensing research, design innovation optimization, manufacturing quality development, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective IP pop toy solutions. Innovation in design technologies, collectible experiences, and premium manufacturing is central to strengthening market position and competitive advantage.

Bandai leads the market with a strong market share, offering comprehensive entertainment merchandise solutions with a focus on anime and gaming applications and advanced character licensing systems. Sideshow Collectible provides specialized collectible capabilities with an focus on premium figure production and collector engagement. KOTOBUKIYA delivers innovative character merchandise with a focus on anime franchises and product quality. Kaiyodo specializes in figure manufacturing and advanced collectible solutions for Japanese markets. Kidrobot focuses on designer toy technology and integrated collectible operations. Funko offers specialized pop culture products with focus on broad licensing applications and collector accessibility.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4,345.5 million |

| Classification | Authorized IP, Original IP, Proxy IP, Others |

| Application | Blind Box, Specific Figure, Ball-jointed Doll (BJD), Action Figure, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Bandai, Sideshow Collectible, KOTOBUKIYA, Kaiyado, Kidrobot, and Funko |

| Additional Attributes | Dollar sales by classification and application category, regional demand trends, competitive landscape, technological advancements in design systems, licensing innovation, manufacturing development, and collectible optimization |

Region:

The global IP pop toy market is estimated to be valued at USD 4,345.5 million in 2025.

The market size for the IP pop toy market is projected to reach USD 8,956.3 million by 2035.

The IP pop toy market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in IP pop toy market are authorized ip, original IP and proxy ip.

In terms of application, blind box segment to command 48.0% share in the IP pop toy market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lipoprotein Metabolism Disorders Treatment Market

Apolipoprotein Test Market

Abetalipoproteinemia Management Market Size and Share Forecast Outlook 2025 to 2035

Sugar-Free Lollipops Market Growth - Consumer Trends 2025 to 2035

IP TCG Market Size and Share Forecast Outlook 2025 to 2035

IPM Motors Market Size and Share Forecast Outlook 2025 to 2035

Pop-up Pourer Market Size and Share Forecast Outlook 2025 to 2035

Population Health Management Platforms Market Size and Share Forecast Outlook 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Toy Market Size and Share Forecast Outlook 2025 to 2035

Pop-up Hotels Market Size and Share Forecast Outlook 2025 to 2035

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

IP PBX Market Analysis - Size, Share, and Forecast 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Popcorn Making Cart Market Growth - Demand & Forecast 2025 to 2035

IP Camera Market Trends – Growth, Demand & Forecast 2025 to 2035

IP-MPLS VPN Services Market Insights – Trends & Forecast 2025 to 2035

Toy Bag Market Analysis on Material Type, Bag Type, Category, Sales or Distribution Channel, and Region through 2025 to 2035

Popcorn Market Trends – Growth, Demand & Flavored Innovations

Toy Packaging Market Trends – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA