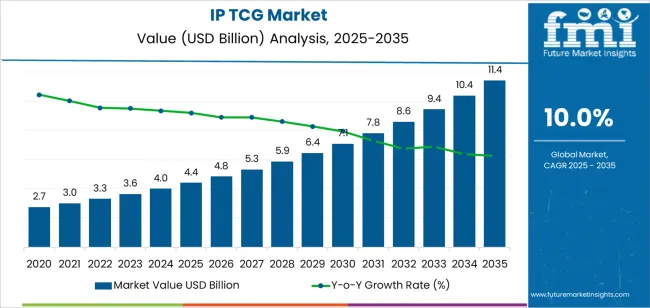

The global IP TCG market is projected to reach USD 11.4 billion by 2035, recording an absolute increase of USD 7.0 billion over the forecast period. The market is valued at USD 4.4 billion in 2025 and is set to rise at a CAGR of 10.0% during the assessment period. The overall market size is expected to grow by nearly 2.6X during the same period, supported by increasing demand for collectible gaming products in entertainment and retail sectors, driving adoption of licensed trading card systems and expanding investments in brand development facilities and distribution infrastructure globally. The market expansion reflects growing requirements for intellectual property-based entertainment in gaming applications, where IP trading card games deliver superior player engagement and collectibility compared to conventional card game formats. Gaming facilities across hobby shops, retail chains, and online marketplaces are implementing IP TCG product lines to achieve higher customer retention and faster inventory turnover cycles. The integration of these specialized gaming products with multimedia franchises enables retailers to generate revenue streams 45-65% higher compared to traditional card game approaches while maintaining player community requirements.

The market demonstrates strong momentum across developed and emerging entertainment economies, where gaming industries are transitioning from conventional card games to licensed intellectual property systems that offer superior brand recognition characteristics. IP TCG technology addresses critical gaming challenges including player engagement maintenance in competitive gaming applications, collectibility value creation in secondary markets, and brand loyalty consistency across extended product releases. The entertainment sector's shift toward cross-media franchises and complex character universes creates sustained demand for trading card games capable of representing diverse intellectual properties, multiple card rarities, and evolving gameplay mechanics with minimal barrier to entry and consistent quality output. Retail gaming operators are adopting IP TCGs for merchandise programs where brand recognition directly impacts sales performance and customer loyalty requirements. The technology's ability to generate recurring purchases with excellent community building reduces customer acquisition costs and accelerates retail workflows.

Entertainment retailers and gaming specialty stores are investing in IP TCG product systems to enhance competitive positioning through improved customer engagement metrics and expanded franchise monetization capabilities. The integration of advanced artwork technologies and optimized gameplay designs enables these products to achieve player retention rates 30-50% higher than conventional systems while maintaining collectibility characteristics. However, initial licensing cost requirements for intellectual property rights and distribution complexity barriers for optimal market coverage may pose challenges to market expansion in cost-sensitive retail segments and regions with limited access to organized play infrastructure.

Between 2025 and 2030, the IP TCG market is projected to expand from USD 4.4 billion to USD 7.1 billion, resulting in a value increase of USD 2.7 billion, which represents 38.3% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for collectible gaming products in retail and entertainment sectors, product innovation in card design technology and gameplay mechanics, as well as expanding integration with digital platforms and tournament infrastructure. Companies are establishing competitive positions through investment in exclusive license acquisitions, premium card production technologies, and strategic market expansion across hobby retail channels, mass market distribution, and online marketplace applications.

From 2030 to 2035, the market is forecast to grow from USD 7.1 billion to USD 11.4 billion, adding another USD 4.3 billion, which constitutes 61.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized gaming systems, including advanced holographic card technologies and multi-franchise crossover products tailored for specific player demographics and collectibility requirements, strategic collaborations between intellectual property holders and card game publishers, and an enhanced focus on competitive play optimization and community engagement enhancement. The growing emphasis on player retention and franchise monetization will drive demand for advanced, high-quality IP TCG solutions across diverse entertainment and gaming applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.4 billion |

| Market Forecast Value (2035) | USD 11.4 billion |

| Forecast CAGR (2025-2035) | 10.0% |

The IP TCG market grows by enabling retailers and publishers to achieve superior player engagement and revenue generation while building sustainable gaming communities in collectible entertainment operations. Gaming retailers face mounting pressure to improve product differentiation and customer loyalty, with IP TCG systems typically providing 45-65% revenue premium over generic card games, making these licensed products essential for competitive retail operations. The entertainment and gaming industries' need for recognizable intellectual property creates demand for trading card game solutions that can leverage established franchises, engage diverse player demographics, and ensure consistent product demand across multiple release cycles and tournament seasons.

Organized play initiatives promoting competitive gaming infrastructure and community building drive adoption in hobby shops, retail chains, and online platforms, where brand recognition has a direct impact on sales velocity and customer retention. The global shift toward multimedia entertainment consumption and cross-platform engagement accelerates IP TCG demand as retailers seek gaming products that capitalize on franchise popularity and maximize consumer spending. However, limited awareness of competitive play formats and higher product costs compared to generic card games may limit adoption rates among casual gaming retailers and regions with developing organized play infrastructure and limited distributor support.

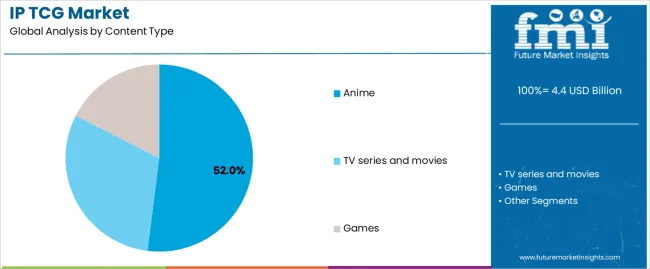

The market is segmented by content type, application, and region. By content type, the market is divided into anime, TV series and movies, and games. Based on application, the market is categorized into adult and juvenile. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

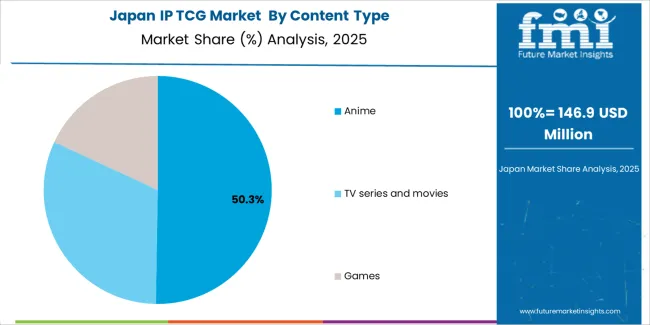

The anime segment represents the dominant force in the IP TCG market, capturing approximately 52% of total market share in 2025. This advanced category encompasses popular series adaptations, character-focused releases, and specialized expansions optimized for dedicated fan communities, delivering strong brand recognition and superior collectibility in trading card operations. The anime segment's market leadership stems from its passionate fan base architecture, extensive character roster availability, and compatibility with existing gaming communities across hobby shops, retail locations, and tournament venues.

The TV series and movies segment maintains a substantial 29.0% market share, serving players who engage with live-action franchises through blockbuster film adaptations, streaming series tie-ins, and specialized entertainment properties that combine cinematic appeal with gameplay mechanics. The games segment represents 19.0% market share through video game adaptations, mobile game crossovers, and interactive entertainment properties that leverage existing player communities.

Key advantages driving the anime segment include:

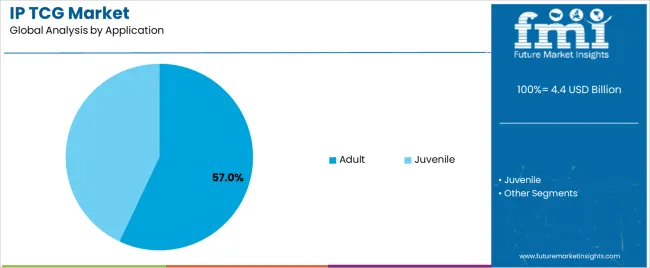

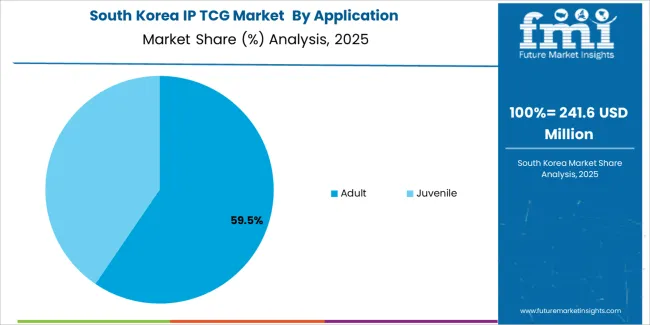

Adult applications dominate the IP TCG market with approximately 57% market share in 2025, reflecting the extensive adoption of collectible card gaming across mature player demographics, competitive tournament participants, and serious collector communities. The adult segment's market leadership is reinforced by widespread participation in tournament play (23.0%), high-value collecting activities (19.0%), and organized competitive gaming (15.0%), which provide essential engagement advantages and spending consistency in premium gaming markets.

The juvenile segment represents 43.0% market share through specialized applications including entry-level gaming products (18.0%), educational entertainment formats (14.0%), and age-appropriate gameplay mechanics (11.0%) that introduce younger players to trading card gaming while building long-term engagement patterns.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to entertainment consumption and gaming engagement. First, anime and entertainment franchise expansion creates increasing requirements for merchandise products, with global anime industry revenue exceeding USD 25 billion annually in major markets worldwide, requiring compelling IP TCG systems for franchise monetization, fan engagement, and brand extension across trading card formats. Second, competitive gaming growth and tournament infrastructure development drive adoption of organized play products, with IP TCGs generating player participation rates 40-55% higher while building sustainable gaming communities through regular tournament events and competitive rankings used extensively in hobby retail and organized play venues. Third, digital entertainment integration and cross-platform engagement accelerate deployment across retail channels, with IP TCGs connecting seamlessly with mobile games, streaming content, and social media platforms enabling multi-touchpoint fan engagement in entertainment ecosystems.

Market restraints include licensing cost barriers affecting smaller publishers and independent game developers, particularly where intellectual property acquisition requires substantial upfront investment and where product margins constrain adoption of premium franchise licenses. Distribution complexity requirements for multi-tier retail coverage pose market entry challenges for new publishers lacking established distributor relationships, as IP TCG success depends heavily on hobby shop presence, mass market penetration, and online marketplace availability that vary significantly across regional markets and retail formats. Limited availability of organized play infrastructure in emerging markets creates additional barriers, as competitive gaming requires tournament venues, judge programs, and community coordination to achieve target engagement levels.

Key trends indicate accelerated adoption in Asian entertainment markets, particularly China and India, where anime consumption and gaming participation rates are expanding rapidly through digital streaming platforms and mobile entertainment adoption driving franchise awareness. Technology advancement trends toward augmented reality card features with digital connectivity, premium holographic finishes for enhanced collectibility, and blockchain authentication systems enabling verified rarity tracking are driving next-generation product development. However, the market thesis could face disruption if fully digital card games achieve breakthrough capabilities in replicating physical collectibility experiences, potentially reducing demand for physical trading card products in specific player segments.

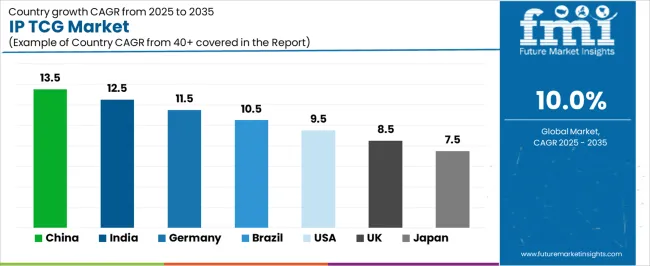

| Country | CAGR (2025 to 2035) |

|---|---|

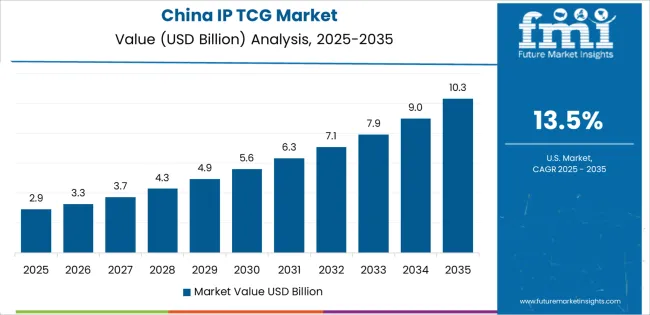

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| Brazil | 10.5% |

| USA | 9.5% |

| UK | 8.5% |

| Japan | 7.5% |

The IP TCG market is gaining momentum worldwide, with China taking the lead thanks to aggressive anime consumption growth and digital entertainment expansion. Close behind, India benefits from growing gaming culture development and youth demographic engagement, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding retail gaming networks and entertainment franchise awareness strengthen its role in South American gaming markets. The USA demonstrates robust growth through established tournament infrastructure and competitive gaming investment, signaling continued adoption in organized play applications. Meanwhile, Japan stands out for its mature gaming culture and franchise development expertise, while UK and Germany continue to record consistent progress driven by hobby retail expansion and competitive gaming communities. Together, China and India anchor the global expansion story, while established markets build stability and product innovation into the market's growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

China demonstrates the strongest growth potential in the IP TCG Market with a CAGR of 13.5% through 2035. The country's leadership position stems from comprehensive anime consumption expansion, intensive digital entertainment platform development, and aggressive youth market engagement targets driving adoption of licensed trading card gaming products. Growth is concentrated in major metropolitan regions, including Beijing, Shanghai, Guangzhou, and Chengdu, where hobby retailers, entertainment stores, and online marketplaces are implementing IP TCG product systems for revenue enhancement and customer engagement improvement. Distribution channels through specialty gaming stores, mass market retailers, and e-commerce platforms expand deployment across anime fan communities, competitive gaming venues, and collectible product markets. The country's cultural industry development policies provide support for entertainment product adoption, including regulatory frameworks for imported content and domestic franchise development initiatives.

Key market factors:

In major metropolitan areas, including Delhi, Mumbai, Bangalore, and Hyderabad, the adoption of IP TCG products is accelerating across hobby gaming stores, entertainment retailers, and online gaming platforms, driven by digital entertainment consumption growth and increasing youth engagement with gaming culture. The market demonstrates strong growth momentum with a CAGR of 12.5% through 2035, linked to comprehensive anime streaming adoption and increasing investment in organized play infrastructure capabilities. Indian retailers are implementing IP TCG product lines and tournament programs to improve customer engagement while meeting growing entertainment demand in gaming communities serving youth demographics and collector markets. The country's entertainment industry development creates sustained demand for franchise-based gaming products, while increasing emphasis on competitive gaming drives adoption of tournament-ready card game systems that enhance player participation.

Germany's advanced gaming retail sector demonstrates sophisticated implementation of IP TCG product systems, with documented case studies showing 35-45% revenue growth in hobby gaming operations through franchise product strategies. The country's retail infrastructure in major gaming markets, including Bavaria, North Rhine-Westphalia, Baden-Württemberg, and Berlin, showcases integration of trading card products with organized play networks, leveraging expertise in competitive gaming and collector communities. German retailers emphasize product quality and community engagement, creating demand for premium IP TCG solutions that support revenue commitments and customer loyalty requirements. The market maintains strong growth through focus on competitive play development and community building, with a CAGR of 11.5% through 2035.

Key development areas:

The Brazilian market leads in Latin American IP TCG adoption based on expanding gaming retail operations and growing entertainment franchise awareness in major urban centers. The country shows solid potential with a CAGR of 10.5% through 2035, driven by youth market investment and increasing domestic demand for collectible gaming products across anime fandom, competitive gaming, and entertainment merchandise sectors. Brazilian retailers are adopting IP TCG product lines for engagement with growing gaming communities, particularly in anime-based products attracting passionate fan demographics and in competitive formats where tournament play drives product demand. Technology deployment channels through gaming stores, entertainment retailers, and online platforms expand coverage across urban gaming markets and youth-focused retail locations.

Leading market segments:

USA market leads in advanced IP TCG applications based on integration with sophisticated tournament infrastructure and comprehensive organized play platforms for competitive gaming excellence. The country shows solid potential with a CAGR of 9.5% through 2035, driven by established gaming culture and increasing adoption of franchise-based entertainment across hobby retail, mass market channels, and competitive gaming venues. American retailers are implementing IP TCG product systems for diverse player demographics, particularly in competitive tournament formats demanding sophisticated gameplay and in collector markets where premium products drive high-value transactions. Technology deployment channels through specialty retailers, big-box stores, and online marketplaces expand coverage across diverse gaming communities.

Leading market segments:

The UK market demonstrates consistent implementation focused on hobby gaming retail and competitive tournament operations, with documented integration of IP TCG products achieving 30-40% customer engagement improvements in gaming store operations. The country maintains steady growth momentum with a CAGR of 8.5% through 2035, driven by gaming culture presence and entertainment franchise engagement across organized play venues and collector communities. Major gaming markets, including London, Birmingham, Manchester, and Glasgow, showcase deployment of franchise products that integrate with existing tournament infrastructure and support engagement requirements in competitive gaming environments.

Key market characteristics:

IP TCG market in Japan demonstrates sophisticated implementation focused on franchise development and competitive gaming operations, with documented integration of trading card products achieving sustained market leadership through innovative gameplay mechanics and premium collectibility features. The country maintains steady growth momentum with a CAGR of 7.5% through 2035, driven by gaming culture maturity and emphasis on product quality principles aligned with entertainment industry standards. Major gaming markets, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced deployment of franchise products that integrate seamlessly with organized play infrastructure and comprehensive collector networks.

Key market characteristics:

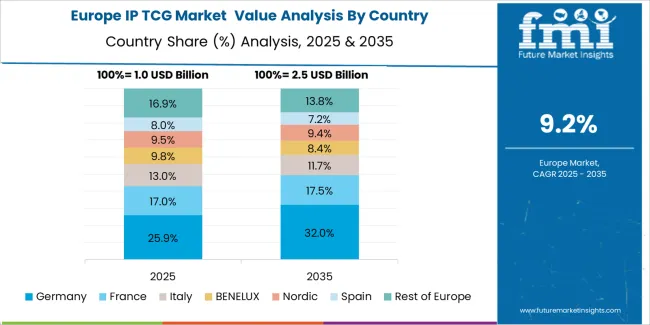

The IP TCG market in Europe is projected to grow from USD 1,270.5 million in 2025 to USD 3,289.6 million by 2035, registering a CAGR of 10.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, declining slightly to 27.8% by 2035, supported by its extensive gaming retail infrastructure and major organized play communities, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg gaming regions.

France follows with a 19.6% share in 2025, projected to reach 20.1% by 2035, driven by comprehensive gaming retail expansion and competitive tournament programs in major metropolitan areas. The United Kingdom holds a 17.2% share in 2025, expected to reach 17.5% by 2035 through hobby gaming operations and organized play development. Italy commands a 13.7% share in both 2025 and 2035, backed by growing gaming communities and entertainment retail operations. Spain accounts for 10.3% in 2025, rising to 10.6% by 2035 on youth market engagement and gaming retail expansion. The Rest of Europe region is anticipated to hold 10.8% in 2025, expanding to 11.5% by 2035, attributed to increasing IP TCG adoption in Nordic countries and emerging Central & Eastern European gaming markets.

The Japanese IP TCG market demonstrates a mature and innovation-focused landscape, characterized by sophisticated integration of anime-based trading card systems with existing competitive gaming infrastructure across hobby shops, entertainment retailers, and tournament venues. Japan's emphasis on product quality and franchise authenticity drives demand for trading card games that support engagement commitments and collectibility standards in competitive gaming environments. The market benefits from strong partnerships between intellectual property holders and game publishers including major entertainment companies, creating comprehensive product ecosystems that prioritize gameplay innovation and community engagement programs. Gaming centers in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced competitive gaming implementations where IP TCG products achieve exceptional player retention through optimized tournament formats and comprehensive collector support systems.

The South Korean IP TCG market is characterized by growing international publisher presence, with companies maintaining significant positions through comprehensive distribution support and competitive gaming infrastructure for hobby retail operations and tournament venue applications. The market demonstrates increasing emphasis on digital integration and community engagement, as Korean retailers increasingly demand franchise products that connect with mobile gaming platforms and sophisticated social media ecosystems deployed across youth demographics. Regional gaming distributors are gaining market share through strategic partnerships with international publishers, offering specialized services including organized play programs and community-building initiatives for competitive gaming and collector engagement operations. The competitive landscape shows increasing collaboration between multinational publishers and Korean entertainment distribution specialists, creating hybrid distribution models that combine international franchise expertise with local market knowledge and community engagement capabilities.

The IP TCG market features approximately 15-20 meaningful players with moderate fragmentation, where the top three companies control roughly 48-52% of global market share through established intellectual property portfolios and comprehensive distribution networks. Competition centers on franchise strength, gameplay innovation, and organized play support rather than price competition alone. Pokemon leads with approximately 22.0% market share through its comprehensive franchise integration and global brand recognition.

Market leaders include Pokemon, Konami, and Wizards of the Coast, which maintain competitive advantages through powerful intellectual property licensing, global distribution infrastructure, and deep expertise in competitive gaming development across multiple entertainment sectors, creating brand loyalty advantages with hobby retailers and organized play communities. These companies leverage research and development capabilities in gameplay mechanics optimization and ongoing tournament support relationships to defend market positions while expanding into emerging gaming markets and new franchise properties.

Challengers encompass Bandai and Bushiroad, which compete through specialized franchise offerings and strong regional presence in key gaming markets. Product specialists, including Kayou, Tomy Company, and regional publishers, focus on specific intellectual properties or geographic markets, offering differentiated capabilities in localized content, competitive pricing structures, and niche franchise development.

Regional players and emerging publishers create competitive pressure through licensed property acquisitions and responsive community engagement, particularly in high-growth markets including China and India, where franchise awareness provides advantages in market penetration and player community building. Market dynamics favor companies that combine recognized intellectual properties with comprehensive organized play offerings that address the complete gaming lifecycle from product launch through competitive tournament infrastructure and community support.

IP trading card games represent advanced entertainment products that enable publishers to achieve 45-65% revenue premiums compared to generic card games, delivering superior player engagement and brand loyalty with established franchise recognition and competitive gameplay mechanics in demanding retail gaming applications. With the market projected to grow from USD 4,381.0 million in 2025 to USD 11,355.4 million by 2035 at a 10.0% CAGR, these licensed gaming products offer compelling advantages - franchise leverage, community building, and revenue generation - making them essential for adult applications (57.0% market share), juvenile markets (43.0% share), and retailers seeking alternatives to generic card games that lack brand recognition and sustainable player communities. Scaling market adoption and product deployment requires coordinated action across intellectual property licensing, retail infrastructure development, game publishers, organized play networks, and entertainment industry investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 billion |

| Content Type | Anime, TV series and movies, Games |

| Application | Adult, Juvenile |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Pokemon, Kayou, Konami, Wizards of the Coast, Tomy Company, Bandai, Bushiroad |

| Additional Attributes | Dollar sales by content type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with game publishers and distribution networks, retail facility requirements and specifications, integration with organized play infrastructure and tournament systems, innovations in card production technology and gameplay mechanics, and development of specialized franchise products with enhanced collectibility and competitive gaming capabilities. |

The global ip tcg market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the ip tcg market is projected to reach USD 11.4 billion by 2035.

The ip tcg market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in ip tcg market are anime , tv series and movies and games.

In terms of application, adult segment to command 57.0% share in the ip tcg market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IPM Motors Market Size and Share Forecast Outlook 2025 to 2035

IP Pop Toy Market Size and Share Forecast Outlook 2025 to 2035

IP PBX Market Analysis - Size, Share, and Forecast 2025 to 2035

IP Camera Market Trends – Growth, Demand & Forecast 2025 to 2035

IP-MPLS VPN Services Market Insights – Trends & Forecast 2025 to 2035

IP Centrex Platforms Market

IP Multimedia Subsystem Market Report – Forecast 2016-2026

RIP Software Market Size and Share Forecast Outlook 2025 to 2035

Bipolar Electrodialysis Membrane Market Size and Share Forecast Outlook 2025 to 2035

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

Sip Feeds Market Forecast and Outlook 2025 to 2035

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Wiper Blade Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Tipper Body Equipment Market Size and Share Forecast Outlook 2025 to 2035

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA