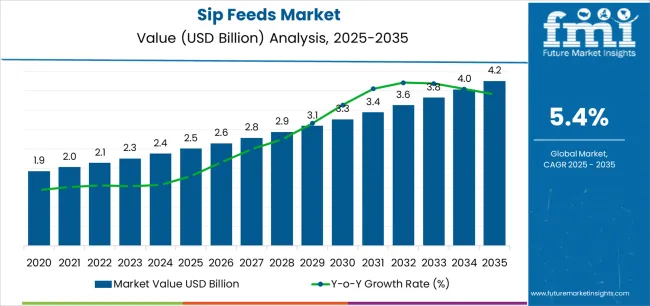

The Sip Feeds Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The Sip Feeds market is experiencing steady growth driven by the rising demand for specialized nutritional solutions tailored to individual health needs. The future outlook for this market is shaped by increasing awareness about disease-specific nutrition, the growing aging population, and the emphasis on preventive healthcare. The demand for high-quality, easily digestible, and nutritionally balanced sip feeds is being fueled by healthcare providers, caregivers, and patients seeking effective dietary management options.

Rising prevalence of chronic conditions, malnutrition, and post-surgery recovery requirements further support the market expansion. Investments in research and development have LED to formulation innovations that enhance nutrient absorption and patient compliance.

Additionally, healthcare institutions and commercial caregivers are increasingly adopting sip feeds as part of routine dietary management programs, reflecting a shift toward evidence-based nutritional care The convergence of aging demographics, chronic disease management, and personalized nutrition is anticipated to drive sustained growth in the Sip Feeds market across both developed and emerging regions.

| Metric | Value |

|---|---|

| Sip Feeds Market Estimated Value in (2025 E) | USD 2.5 billion |

| Sip Feeds Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

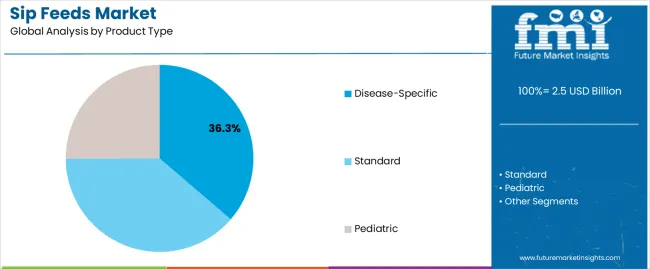

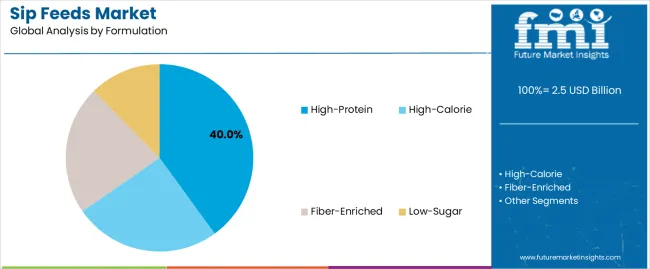

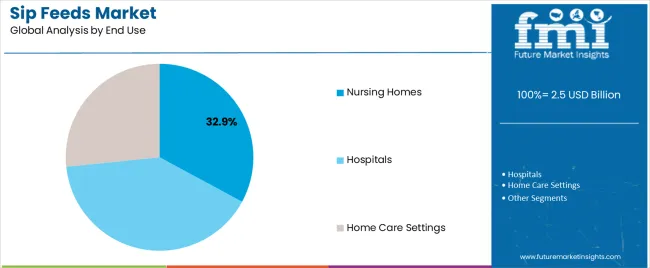

The market is segmented by Product Type, Formulation, End Use, and Distribution Channel and region. By Product Type, the market is divided into Disease-Specific, Standard, and Pediatric. In terms of Formulation, the market is classified into High-Protein, High-Calorie, Fiber-Enriched, and Low-Sugar. Based on End Use, the market is segmented into Nursing Homes, Hospitals, and Home Care Settings. By Distribution Channel, the market is divided into Hospital Pharmacies, Retail Pharmacies, Health & Wellness Stores, and Online Retail. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The disease-specific product type segment is projected to hold 36.3% of the Sip Feeds market revenue share in 2025, making it the leading product type. This growth has been driven by the increasing prevalence of chronic diseases and the demand for tailored nutritional solutions that support disease management and recovery.

Nutritional formulations in this segment are designed to meet specific medical needs, ensuring precise nutrient delivery that aids in patient health outcomes. The adoption of disease-specific sip feeds is further reinforced by healthcare providers and caregivers who prioritize effective dietary interventions as part of treatment plans.

Additionally, ongoing innovation in nutrient composition and flavor profiles has improved patient compliance, making sip feeds more acceptable and easier to integrate into daily routines The segment’s expansion is supported by the rising awareness of nutritional therapy as an essential component of clinical care and preventive health management.

The high-protein formulation segment is expected to capture 40.0% of the Sip Feeds market revenue share in 2025, establishing it as the leading formulation type. Growth in this segment has been influenced by the increasing recognition of protein as a critical nutrient for muscle maintenance, recovery, and overall health, especially among elderly populations and patients with chronic illnesses.

High-protein sip feeds provide targeted nutrition that supports tissue repair, immune function, and energy levels. The segment has also benefited from the development of palatable and easily digestible formulations that improve patient adherence.

Rising awareness among healthcare professionals and caregivers about the benefits of protein-enriched diets is further driving adoption Moreover, demand from institutional settings such as hospitals and long-term care facilities has reinforced the prominence of this segment, as high-protein sip feeds are integral to patient care programs and recovery protocols.

The nursing homes end-use segment is anticipated to account for 32.9% of the Sip Feeds market revenue in 2025, making it the leading end-use category. This growth is driven by the increasing aging population and the need for specialized nutritional support within long-term care settings.

Nursing homes prioritize easily administrable, nutritionally complete sip feeds to manage malnutrition, chronic conditions, and age-related dietary deficiencies. The adoption of sip feeds in these facilities is reinforced by their ability to provide consistent nutrient intake and improve overall patient outcomes.

Additionally, the growing emphasis on preventive healthcare and clinical nutrition protocols in nursing homes has accelerated the demand for high-quality, tailored sip feeds The segment’s growth is further supported by institutional policies focusing on resident health, recovery, and wellbeing, positioning nursing homes as a key driver of market revenue in the Sip Feeds industry.

Increasing demand for personalized nutrition around the world

Personalized nutrition has become a significant trend in the sip feeds market. Businesses are making products based on age groups; they can be tailored to medical profiles or dietary preferences. By doing this, it becomes easier for individuals to take care of their specific nutritional requirements about what they eat through consuming better foods.

Thanks to technological advances like genetic testing plus AI-driven healthcare assessments among others means that we now have more accurate details leading us into personalized dieting strategies. Personalized sip feeds fall under niche markets but they are influential when it comes to maintaining continuous lifestyle-related ailments and promoting one's well-being.

Rise of plant-based sip feeds in the landscape

The emergence of plant-based diets has influenced the sip feeds market resulting in many more products being made from plant-based sources. These drinks cater specifically to consumer looking for vegan or vegetarian alternatives as well as those who cannot consume animal proteins due to lactose intolerance or allergies.

As such plant-based drinks also fit into consumers’ demand for eco-friendly products which are ethical while simultaneously meeting their health aspects thus perceiving them as healthier compared to animal protein-dependent drinks which cannot be recycled. There is a wide range of plant sources that companies can utilize when producing sip feeds including soya, peas, almonds and many more to make such products taste good while providing all the necessary nutrients.

Rising integration of functional ingredients in sip feeds

A trend gaining popularity in functional ingredients is being infused into sip feeds. For example, there are some components like probiotics, prebiotics, omega-3 fatty acids and antioxidants which have additional health benefits apart from their basic nutritional value. In other words, functional drinks are designed to serve particular purposes such as enhancing gut health or immunity and improving brain function.

This issue is driven by an increased knowledge among consumers about how nutrition helps to prevent diseases before they occur therefore promoting physical well-being. Functional ingredients are therefore very crucial because they provide a company differentiator and at the same time meet new trends in the health-conscious consumer market space.

Global Sip Feeds sales increased at a CAGR of 4.4% from 2020 to 2025. For the next ten years (2025 to 2035), projections are that expenditure on Sip Feeds will rise at 5.7% forecast CAGR.

Over the past few decades, there has been remarkable growth in the global sip feeds market as knowledge of good nutrition as a disease management strategy rose considerably. In the past, this market grew by increasing chronic illness rates, an ageing population and advancements in medical nutrition. Companies have taken note of this and developed specialized products for different health conditions like diabetes, cancer and malnutrition.

Additionally, market expansion is attributed to innovation in formulations and flavours that make sip feeds more enjoyable for a wide variety of people. The market has also experienced increased demand recently with more emphasis being put on preventive medicine and care for long-term diseases. Hence, sip feeds gained more significance during the COVID-19 pandemic due to people's concern about their wellbeing.

Moreover, it is worth mentioning that companies continue to make strides in product development and manufacturing using various technologies which therefore help them create better nutritional solutions. Therefore, looking forward, the future outlook of the global sip feed market appears bright as it is set to rise further because of some key factors. This is largely driven by the ageing world population since old people need special nutrition to manage age-related problems that come with time.

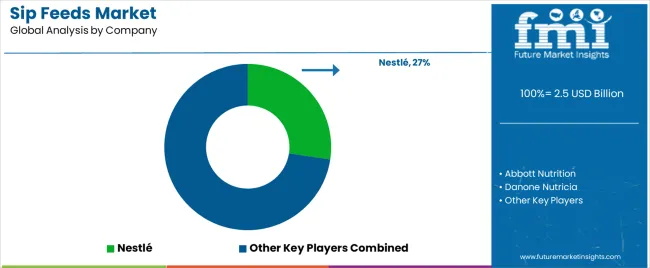

The sip feeds market is highly concentrated, with a few MNCs controlling much of the market. Nestlé Health Science, Abbott Nutrition and Danone Nutricia are some of the players in this industry that have extensive resources, research capacities and international distribution networks to maintain their presence. Additionally, MNCs engage in mergers and acquisitions as part of their strategies to grow their product lines and geographic coverage.

In a consolidated market, smaller firms face higher barriers to entry due to major companies holding significant market share. The concentration enables top players to dictate trends, pricing and innovation within the market. For instance, Nestle Health Science acquiring Vital Proteins or Abbott Nutrition launching Ensure Max Protein demonstrates how these companies use their monopolistic power for expansion.

Nevertheless, other domestic competitors operate at regional levels across different world markets apart from those regions dominated by multinational corporations (MNCs). These businesses often specialize in niche segments or alter their products according to regional tastes and regulations. Some examples include Fresenius Kabi, which has a strong presence in Europe; meanwhile, Hormel Health Labs focuses on North America.

However, fragmented markets consisting of many small-to-medium enterprises (SMEs) lead to a low degree of concentration among competitors while consolidation remains a defining feature of the sip feeds industry. In such an environment where competition is stiff, creativity and strategic alliances become vital for them to be able to thrive and continue competing with the already established big fishes of the industry.

The following table shows the estimated growth rates of the top three markets. India and China are set to exhibit high Sip Feeds consumption, recording CAGRs of 11.5% and 10.1%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 5.1% |

| Brazil | 6.3% |

| UK | 4.6% |

| China | 6.5% |

| India | 7.2% |

USA to maintain its position as the top country in the world sip feeds market due to some reasons; it has a strong healthcare set-up and a high prevalence of chronic diseases demanding special nutritional products among others. Besides, there exists an aged population in America that requires special nutrition directed at aging-related health challenges which further boosts the market.

The presence of major players in the market and continuous product development innovation are other factors contributing to the dominance of the USA in sales of sip feeds. This makes sure of steady growth as well as leadership in this very competitive market environment. The industry for Sip Feeds in the United States is projected to exhibit a CAGR of 5.1% during the assessment period and revenue from the sales of Sip Feeds in the country is expected to reach USD 389.8 Million with a market share of 33.1%.

The sip feeds market is booming, driven by China's fast ageing population. As the elderly numbers increase, so too does the demand for nutritional products that are tailored to their age-related health demands. For dealing with age-related disorders such as malnutrition, frailty and chronic diseases, sip feeds offer a suitable and efficient method. These trends are also being supported by the Chinese government with an emphasis on healthcare improvement as well as increased awareness about nutrition in old-age care.

This trend has seen significant growth in China's sip feeds industry driven by its ageing population requirements. These trends are leading to a projected value of USD 4.2.0 Million by 2035 with Sip Feeds demand calculated to rise at a value CAGR of 6.5% during the forecast period (2025 to 2035) with a value share of 16.4%.

Indian market provides a great opportunity for firms operating in the sip feed industry. There is growing knowledge of the importance of nutrition in managing various health conditions due to its large and diverse population base. In order to grow their market presence, companies have heightened their focus on India capitalizing on an expanding healthcare infrastructure and growing disposable incomes within the country.

Such moves include partnerships with local healthcare providers, and region-specific product marketing campaigns custom-made for that area among others all of which contribute to a growing market share of this sector. The goal of these companies is to achieve tremendous success in sales of sip feeds by addressing the specific nutritional needs of Indian people. These factors are responsible for the robust projected forecast CAGR of 7.2% from 2025 to 2035, with the country achieving a global value share of 8.6% in 2035 with a value of USD 355.0 million.

| Segment | Disease-specific |

|---|---|

| Main segment | Product Type |

| Value Share (2025) | 36.3% |

Sip feeds specifically designed for different diseases meet individual nutrient requirements associated with various illnesses like diabetes mellitus, cancer and gastrointestinal diseases among others. They provide important nutrients used in managing or treating those diseases including proteins minerals vitamins among other components that may be present at higher levels there in than other typical food substances targeted towards healthy beings only.

Increased prevalence rates of chronic ailment cases significantly contribute to their dominance alongside escalating recognition regarding the essence related to more focused feeding practices during medical interventions meant for patients suffering from such conditions.

They can also be given by physicians considering some critical factors so as not only to improve patient outcomes but also to make lives better. With a dominating share of 36.3%, this segment has an estimated value of USD 1,498.5 Million in 2035 and is projected to grow at a forecast CAGR of 6.4%.

| Segment | Nursing Homes |

|---|---|

| Main segment | End Use |

| Value Share (2025) | 32.9% |

Sip feeds customers who buy directly from nursing homes tend to purchase more because these institutions look after residents with high dietary needs. Nutritional care for older people in nursing homes often involves managing malnourished, frail, as well patients with chronic ailments commonly found among this age group.

Malnutrition, frailty and chronic diseases that are associated with elderly persons are hence managed by sip feeds through providing the necessary nutrients to such individuals which maintain good health and also their general welfare. Nutrient products can be regularly given to patients within a nursing home environment due to the controlled nature of such facilities making them an important part of the diet for many residents.

This market therefore has significant demand from these entities thereby promoting the growth of the sip feeds market. This growth has propelled its value to USD 1,358.2 Million in 2035 with a market share of 32.9% and further projections suggest its growth at a CAGR of 6.7%.

The global sip feeds market is characterized by intense competition among major participants who continuously come up with new ideas to strengthen their position in the industry. Companies across the globe have been involved in mergers and acquisitions mainly aimed at expanding their product portfolios as well as reaching more customers.

They have acquired small specialized firms such as Nestlé Health Science and Abbott Nutrition to enhance their product offerings while strengthening their presence in the market.

Developing and launching products is not uncommon since most companies come up with improved formulas or brands focusing on certain conditions like diabetes mellitus, malnutrition or old age effects. These measures improve taste perception while simplifying the consumption process and providing extra nutritional value targeting a wide range of consumers.

To sustain growth, companies are also focusing on strategic partnerships and collaborations with healthcare providers and institutions. This approach helps in increasing product visibility and credibility. Also, investments in research and development are crucial as they enable companies to stay ahead with innovative solutions meeting changing customer preferences and regulatory requirements.

As per product type, the industry has been categorized into Standard, Disease-specific, and Pediatric.

As per Formulation, the industry has been categorized into High-protein, High-calorie, Fiber-enriched, and Low-sugar.

As per End Use, the industry has been categorized into Hospitals, Home Care Settings, and Nursing Homes.

As per Distribution Channel, the industry has been categorized into Hospital Pharmacies, Retail Pharmacies, Health & wellness Stores, and Online Retail.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

The global sip feeds market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the sip feeds market is projected to reach USD 4.2 billion by 2035.

The sip feeds market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in sip feeds market are disease-specific, standard and pediatric.

In terms of formulation, high-protein segment to command 40.0% share in the sip feeds market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sippy Cups Market Analysis – Size, Growth & Trends to 2033

Anti Siphon Valves Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Session Initiation Protocol (SIP) Trunk Market

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Compound Horse Feedstuff Market Analysis by Feed Type, Horse Activity, and Ingredient Composition Through 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA