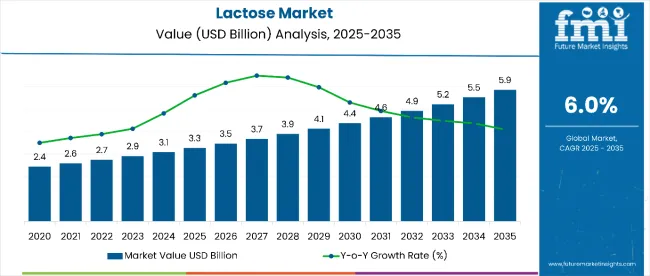

The Lactose Market is estimated to be worth USD 3.27 billion in 2025 and is projected to reach a value of USD 5.86 billion by 2035, expanding at a CAGR of 6% over the assessment period of 2025 to 2035.

The growth rate for the global lactose market is going to go up for the next period, fueled by the many different sectors that will make use of this all-around item. A number of essential factors are one of the main elements that add to the positive market outlook. One of the main factors is the constantly increasing demand for lactose-containing dairy products. The consumption of dairy products has been on the rise due to the large global population, especially in developing areas.

Since it is a naturally occurring element in milk, lactose is a key ingredient in many dairy products, such as fluid milk, cheese, yogurt, and ice cream. The shift in consumer preferences toward natural and less processed dairy products is a big factor that has contributed to the increase in lactose, as the manufacturers are trying to catch up with the new consumer choices.

The market's growth is not only based on the dairy sector, but another factor involved is the increase in prebiotics derived from lactose. The alertness of gut health is known and the prebiotics being supportive of a healthy microbiome have boosted the inclusion of prebiotics derived from lactose in food, beverage, and supplement products. Lactose is not just a prebiotic. It is a disaccharide that can be divided into two monosaccharides, which are glucose and galactose.

Both of these sugars can be fermented by the helpful bacteria in the intestines, thus promoting gut health as a whole. The rise of gut health awareness among consumers is expected to maintain the increasing trend of the use of lactose prebiotic products.

Lactose also has a significant role in the expansion of the market within the pharmaceutical and nutraceutical sector applications. Lactose is an essential excipient in the drug formulation process because of its properties, such as compressibility, flowability, and compatibility with active ingredients.

Also, the growing need for natural, lactose-based supplements and nutraceuticals has led to the broadening of lactose use in different health and wellness products. Technological advancements in the processing and purification of lactose have played a part in this, as well.

The extraction, purification, and modification techniques have been developed, making it possible to create specialized, high-quality lactose products that meet the demands of various industries. These changes have not only resulted in the consistent and reliable supply of lactose but also created new paths for product distinction and value-added applications.

Moreover, the dairy industry is also promoting sustainability and the efficient use of lactose by-products which are adding strength to the entire lactose market.

The dairy companies are committed to waste reduction and increasing their by-product value through the extraction and utilization of lactose, which has made it significantly essential. This trend supports environmental sustainability in the dairy industry and, at the same time, provides a reliable and cost-effective source of lactose for many different applications.

Lactose demand is foreseen to increase even more in the future as the world population continues to grow and the consumer consumption of products based on nature, function, and health brings focus on it. The lactose market holds innovative pathways and sustainable lactose applications that will make it grow in the foreseeable future.

Lactose usage per person continues to rise in several dairy-focused economies. The Netherlands and Ireland report consistent demand in infant nutrition and pharmaceutical formulations. South Korea is seeing more lactose-based formulations in adult functional beverages. In contrast, India and Vietnam show lower intake levels, though their export-grade whey is increasingly used for processed ingredient production.

Modern retailers have started labeling lactose ingredients in meal kits for improved clarity. In the USA, warehouse clubs report more volumes of lactose isolate in functional mixes. Malaysian foodservice uses lactose in sauces and ready meals, while Japan increases lactose inclusion in restaurant-grade seasonings.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.6% (2024 to 2034) |

| H2 2024 | 6.2% (2024 to 2034) |

| H1 2025 | 5.8% (2025 to 2035) |

| H2 2025 | 6.3% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 5.6% in the first half (H1) of 2024 and then slightly faster at 6.2% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 5.8% in the first half of 2025 and continue to grow at 6.3% in the second half. The industry saw a decline of 30 basis points in the first half (H1 2025) and an increase of 58 basis points in the second half (H2 2025).

Lactose-Containing Functional Foods' Popularity

The rise of lactose-containing functional foods is a direct response to the increasing consumer demand for nutritious and functional food products. Lactose, being a special ingredient, is nowadays prevalently found in superfood bars, protein powders, and fortified dairy items.

By utilizing lactose's unique characteristics like enhancing the texture, improving the absorption of nutrients, and adding a natural source of carbohydrates, manufacturers are inventing multifunctional food formulas.

This is part of the trend that is being marketed particularly well to health-conscious consumers who are looking for products with added benefits against a normal nutritional profile. Lactose's adaptability is additionally responsible for it being included in various functional food types, like sports and weight management, which, in turn, attracts more customers to it.

The Functionality of Lactose in Infant Formulas

Lactose is a necessity in infant formula, which is the closest option to human milk in terms of the nutrients. Companies are targeting infant formulas with the optimum lactose levels to give infants proper growth, development, and gut health. Given its potential to both derive energy and support the development of beneficial gut bacteria, lactose is a key nutrient in infant health.

With the parents gaining more knowledge on the significance of lactose for their babies' nutrition, increasing the amount of rich lactose in the formula seems to be a logical outcome. Moreover, the presence of lactose in infant formula primarily encourages the baby's digestive system to develop by enhancing the absorption of vital nutrients.

Lactose's Function as an Excipient in Pharmaceutical Products

Lactose's functional ingredient range also extends to the medical area, where it is widely regarded as an excipient in various drug formulations. Lactose is an ideal candidate for tablet and capsule manufacturing because of its high compressibility, flowability, and easy processability.

Moreover, due to its inert nature and compatibility with the active pharmaceutical ingredients, lactose is an important component in the creation of both safe and effective drug products.

The pharmaceutical industry's would-be exclusive supplier of high-quality and reliable lactose sources continues to drive up the demand for multifunctional food ingredients. Besides, the role of lactose in the bioavailability enhancement and stability improvement of some drug formulations further manifests its worth in the pharmaceutical sector.

Improving Gut Health with Lactose-Derived Prebiotics

As people are starting to grasp the importance of having a healthy gut and, therefore, maintaining gut health, there has been a rise in the exploration of lactose-derived prebiotics. Lactose can be broken down into monosaccharides glucose and galactose, which are then fermented by the beneficial gut bacteria, promoting a healthy microbiome.

Manufacturers have already studied the promising potential of lactose-derived prebiotics in a variety of food, beverage, and supplement products that focus on gut health and overall wellness besides addressing consumer preferences.

The prebiotic properties of lactose have also been reported to be related to better immune function and lower risk of some gastrointestinal disorders, which has made them even more popular in the health and wellness market.

Increasing Lactose Intolerance Affects the Sales

Lactose intolerance, a condition where individuals lack the enzyme lactase to digest lactose properly, is being reported more and more in every country worldwide. This change has markedly affected the lactose product sales as the groups most at risk, namely the lactose intolerants, tactically limit or exclude milk and products containing lactose.

Manufacturers are meeting this challenge by developing lactose-free or low-lactose options that accommodate the needs of the expanding limited-lactose population and help them to defend their market share. The rising concern and diagnosis of lactose intolerance also brought broader demands in different food and beverage categories for products that are lactose-free or contain less lactose.

The Natural Sweetener Options Gaining More Attention with the Growth of the Sales

There is a noticeable shift in consumers' consciousness concerning the adverse health effects that artificial sweeteners and added sugars have. The consumers have begun to search for options that do not contain added sugars or artificial sources by replacing them with the more natural sources like lactose which is now seen as a more wholesome and less processed substitute. Manufacturers are making the most of this phenomenon by emphasizing the sweetness of lactose and the positive effects that are supposedly coming with it.

Manufacturers in the gluten-free, clean label, and minimally processed food sectors expect the demand for lactose-rich products to go up since consumers are the ones who are increasingly in demand of those products. Lactose's dominating status among other sweeteners is also fostered by the impression that it is capable of providing a steadier and more gradual energy release, thus being a desired component for conscious consumers.

The comprehensive analysis on global lactose sales from the year 2020 to 2024 has revealed the market's past achievements and the core reasons for what has happened in it explain all the identifier trends and this historical data provides the foundation for market trajectory understanding and the factors those affected sales and supply.

The sales forecasts for 2025 to 2035 which are the main ones to look at tell us what demand will be and that it will grow. These predictions include the variations in consumer demand, regulatory changes, technical progress, and the widening applications of lactose in multiple disciplines, like food and beverage, pharmaceuticals, and nutraceuticals.

The long-term demand predictions form the basis of the possible strategies, and consideration of the historical sales analysis allows one to benefit from the global lactose market that is on the rise. Glide over the establishment of mutual partnerships and cooperation to get a far better grasp of your product's worth and, thus, the market.

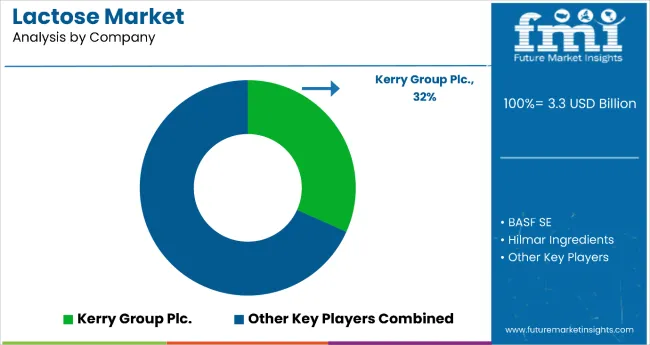

The global lactose market is characterized by moderate market concentration, as multinational corporations and specialized regional manufacturers form the biggest part. This landscape of competitiveness is the breeding ground of innovation, strategic partnerships, mergers, and acquisitions as companies vigorously pursue their goals of becoming stronger and fulfilling the market needs.

The lactose market at the top includes the large dairy conglomerates and ingredient suppliers who are the main actors in the global lactose space. This industry, which includes the likes of Glanbia Nutritionals, Fonterra Co-operative Group, and Lactalis Ingredients, is gaining the benefits of their vast production capabilities, world-spanning distribution networks, and power in brand recognition.

These players are behind the heavy spending on research and development that aims at enhancing their lactose products' functionality and purity, particularly the lactose monohydrate, which has been heavily used in the food, beverage, pharmaceutical, and nutraceutical sectors all along.

Besides the leading players, the market holds a significant portion of specialized regional manufacturers and small-scale producers. These types of companies are generally dedicated to niche applications or meet the special needs of local markets, thus the regional players are key in diversifying the market and providing customers with a wider range of lactose-based solutions. They are often agile and have a deep understanding of regional preferences, which are key assets that help them stand out.

The competitive environment is also shaped by the constant mergers and acquisitions in the industry. The giants are on a mission to develop their product lines, move into new markets, and firmly root themselves globally by means of the strategic and specialized acquisition of smaller companies. These activities would not only consolidate the market but would also drive innovation, leading to the development of more advanced lactose products on offer.

Besides mergers and acquisitions, the establishment of strategic partnerships has become a common play among the market players. By collaborating with complementary players, they aggregate the benefits of each, consolidating their markets and improving customer service.

Usually, these partnerships are typified by joint R&D ventures, co-manufacturing scenarios, or through the importation of specialized technologies, which illustrates the dynamic competitive nature in the lactose market.

Moderate market concentration, the focus on innovation, and the strategic partnerships highlight the dynamic and competitive environment that has been created. The relatively competitive environment promotes the innovation of new application areas, operational efficiencies, and the improvement of existing products, all of which are beneficial to the ultimate consumers across a variety of sectors.

With an increasing global demand for lactose products, the market will remain competitive, where the leading players, along with specialized regional manufacturers, will vie for a larger share of this lucrative and booming industry.

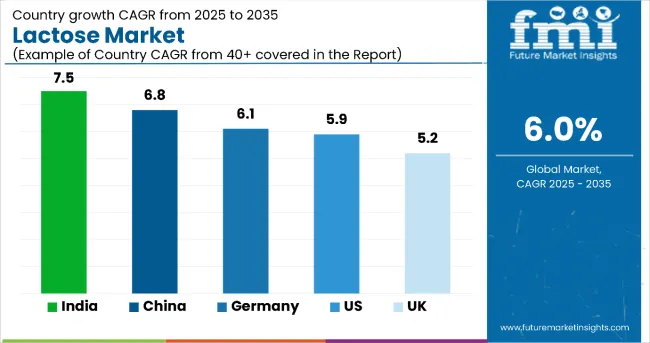

The following table shows the estimated growth rates of the top three countries. USA, China and India are set to exhibit high consumption, and CAGRs of 5.9%, 6.8% and 7.5% respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 5.9% |

| China | 6.8% |

| India | 7.5% |

In the United States lactose, it is the health-conscious and fitness-oriented people who are driving the new trends in lactose-containing sports nutrition and performance products. Lactose, in addition to being a carbohydrate, is the best way to gain energy and recover muscles.

Thanks to this, manufacturers are developing new protein powders, protein shakes, and energy drinks specifically designed for sportspeople. This trend is also the result of consumers' greater inclination towards clean-label and natural ingredients in sports supplements.

The thriving market for infant formula in China is an important source of dairy lactose in that country. The Chinese state, by its recent policy measures, encourages higher birth rates and better infant nutrition through lactose-rich infant formula; that is, the issue of increased demand for such products has arisen.

Companies, both domestic and international, are in a race to produce pregnant milk products that contain lactose, which are increasingly popular among Chinese consumers who now know that lactose is essential for infants to thrive.

The enormous dairy industry in India is a major source of lactose as a waste product and is thus a promising area for the valorisation and proper use of lactose.

Dairy companies in India are searching for modern methods to extract, purify, and add lactose to different food, drinks, and medicine products. By realizing this project, they will not only bolster the dairy sector's bottom line much more but also enhance the sustainability by reducing waste and diversifying income streams.

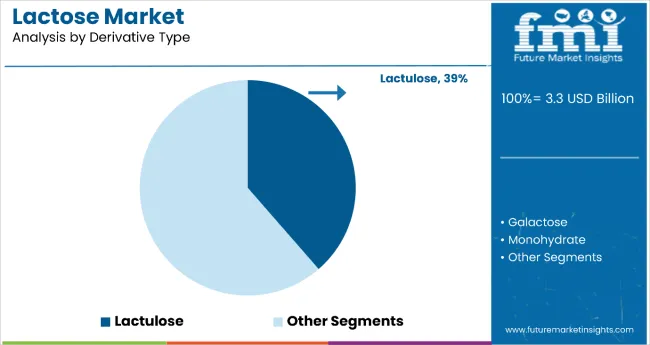

Lactulose holds the dominant position with 38.6% of the market share in the derivative type category within the lactose market. This leadership is driven by lactulose's widespread applications across multiple industries, particularly its use as a sweetener in the food and beverage industry and as a laxative in pharmaceutical applications.

Lactulose's prebiotic properties make it valuable for promoting beneficial gut bacteria, supporting its growing adoption in functional foods and dietary supplements focused on digestive health.

The segment's dominance is reinforced by lactulose's increasing utilization in pharmaceutical formulations where it serves as an effective treatment for constipation and hepatic encephalopathy.

Its gentle action and safety profile make it suitable for various patient populations, including elderly and pediatric patients. As awareness of gut health and prebiotics continues to grow, and with the expanding pharmaceutical applications requiring effective and safe therapeutic options, the lactulose segment is expected to maintain its market leadership through continued research and development in both pharmaceutical and nutraceutical applications.

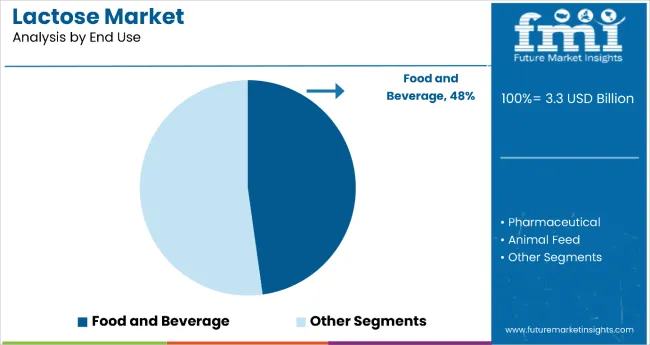

Food and beverages hold the dominant position with 47.8% of the market share in the end use category within the lactose market. This leadership is driven by lactose's essential role in dairy product standardization and its widespread use across various food applications including yogurt, milk, cheese, butter, and confectionery products.

The food industry relies heavily on lactose as a functional ingredient that enhances texture, provides mild sweetness, and serves as a bulking agent in processed foods, bakery products, and dairy-based formulations.

The segment's dominance is reinforced by the growing consumption of dairy products globally and the increasing demand for functional foods that incorporate lactose for its nutritional and processing benefits. Lactose serves as an excellent carrier for flavors and seasonings, making it valuable in dry seasoning blends and instant food mixes. Its role in infant nutrition, particularly in baby formula manufacturing, further strengthens its position in the food and beverage sector.

As consumer preferences continue to favor natural ingredients and clean-label products, the food and beverage segment is positioned to maintain its market leadership through continued innovation in dairy-based products and functional food applications.

The actual market situation of the lactose market is different, with players of different sizes like huge global dairy corporations and small ingredient producers. The companies find themselves in a field where there are regular developments, such as newly created products, mergers and acquisitions, and strategic partnerships that work to improve their position in the market.

The first-choice companies are directing their budgets to research and development activities in order to increase the functional ability of lactose products in addition to lactose monohydrate, which will suit the interests of food, beverage, pharmaceutical, and nutraceutical industries.

Mergers and acquisitions are the strategies often implemented, as companies pursue the promotion of their products, access to new technologies, and the increase of their global footprint. Besides, the establishment of mutual partnerships gives players the opportunity to come together, gain various skills, networks, and insights into the market, thus, broadening competition in the lactose business further.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.27 billion |

| Projected Market Size (2035) | USD 5.86 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Form | Powder, Granule |

| By End Use | Food and Beverage, Pharmaceutical, Animal Feed, Others |

| By Derivative Type | Monohydrate, Galactose, Lactulose, Tagatose, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | BASF SE, Davisco Foods International Inc., Armor Pharma, Hilmar Ingredients, Hoogwegt Group B.V., Kerry Group Plc., India Limited, Merck & Co. KgAa, Milei GmbH, Ba'emek Advanced Technologies Ltd., Others |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

Powder, Granule

Food and Beverage, Pharmaceutical, Animal Feed, Others

Lactose Monohydrate, Galactose, Lactulose, Tagatose, Others

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

FMI projects the demand for sphere to expand at rapid value CAGR of 6% over the forecast period 2025 to 2035

The sector is dominated by Asia pacific, and this trend is projected to continue for the assessment period.

Some of key players includes Glanbia Nutritionals Fonterra Co-operative Group Lactalis Ingredients Arla Foods Ingredients Kerry Group Davisco Foods International Leprino Foods Agropur Ingredients Hilmar Ingredients Lactose India Limited and few Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: MEA Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: MEA Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Derivative Type, 2018 to 2033

Table 48: MEA Market Volume (Tons) Forecast by Derivative Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Form, 2023 to 2033

Figure 22: Global Market Attractiveness by End Use, 2023 to 2033

Figure 23: Global Market Attractiveness by Derivative Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Form, 2023 to 2033

Figure 46: North America Market Attractiveness by End Use, 2023 to 2033

Figure 47: North America Market Attractiveness by Derivative Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Derivative Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 93: Europe Market Attractiveness by Form, 2023 to 2033

Figure 94: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 95: Europe Market Attractiveness by Derivative Type, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Derivative Type, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Derivative Type, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 130: MEA Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 134: MEA Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Derivative Type, 2018 to 2033

Figure 138: MEA Market Volume (Tons) Analysis by Derivative Type, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Derivative Type, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Derivative Type, 2023 to 2033

Figure 141: MEA Market Attractiveness by Form, 2023 to 2033

Figure 142: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 143: MEA Market Attractiveness by Derivative Type, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lactose-Free Butter Market Size and Share Forecast Outlook 2025 to 2035

Lactose Assay Kit Market Size and Share Forecast Outlook 2025 to 2035

Lactose-Free Probiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lactose-free Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Lactose and Derivative Business

Lactose Free Dairy Product Market Outlook – Share, Growth & Forecast 2025 to 2035

Competitive Breakdown of Lactose Providers

Lactose-free Cheese Market Growth - Consumer Trends & Industry Analysis 2025 to 2035

Lactose-Free Probiotic Yogurt Market Trends - Product Type & Sales Insights

Lactose-free Infant Formula Market

Lactose-free Sour Cream Market

Galactose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A2 Lactose-Free Milk Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

UK Lactose Market Report – Demand, Trends & Outlook 2025-2035

USA Lactose Market Insights – Growth & Demand 2025-2035

Low-Lactose Dairy Foods Market

ASEAN Lactose Market Insights – Size, Share & Growth 2025-2035

Europe Lactose Market Trends – Size, Share & Forecast 2025-2035

Refined Lactose Market Size and Share Forecast Outlook 2025 to 2035

Reduced Lactose Whey Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA