The USA Lactose market is projected to reach a value of USD 452.5 Million in 2025, growing at a CAGR of 7.1% over the next decade to an estimated value of USD 900.8 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 452.5 Million |

| Projected USA Value (2035) | USD 900.8 Million |

| Value-based CAGR (2025 to 2035) | 7.1% |

The rise of the market comes from the increased necessity of lactose in food, pharmaceuticals, and specialty nutrition applications. In addition to its capabilities of functioning as a pharmaceutical filler, a food product sweetener, and a livestock feed energy source, lactose is valuable in various industries.

The increasing realization of lactose's advantages in infant formula, bakery, confectionery, and dairy product applications is becoming a market driving force. Another factor is the more frequent inclusion of lactose-derived sweeteners like lactulose and tagatose in the basket of choices.

Lactose stands as a primary basic ingredient in the food and beverage sector for dairy products along with sports nutrition and dietary supplements. Pharmaceutical companies now use more lactose to develop tablets that improve drug stability and bioavailability.

As seen elsewhere, lactose inclusion in livestock feeds is for the double purpose of improving feed digestibility and enhancing livestock nutrition which consequently aids in the total market growth.

The science of lactose refining is changing with the improvement of technologies and as well the rise of clean-label and functional food fads. High purity lactose products are gaining prominence as a result of the increasing consumer demand and it is anticipated that the introduction of organic and lactose-free products will pave the roadmap for the emergence of new market opportunities.

Lactose demand has been on the rise in recent months, as the major application sectors, especially the pharmaceutical and specialty food formulations, have been the driving forces behind this.

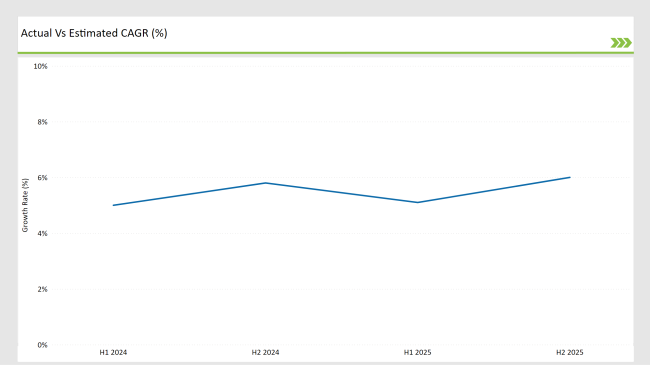

H1 signifies period from January to June, H2 Signifies period from July to December

Technological improvements in lactose purification and the arrival of the likes of tagatose and lactulose as specialty lactose derivatives are the factors backing the expansion of this sector. The increased emphasis on the production of lactose-free dairy products has also resulted in more research into lactose hydrolysis processes.

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | Kerry Group: Expanded its lactose monohydrate production facility to meet rising demand from the pharmaceutical sector. |

| March 24 | FrieslandCampina: Launched a new lactose ingredient optimized for infant formula applications. |

| May 24 | Arla Foods Ingredients: Introduced a lactose-based low-calorie sweetener targeting diabetic-friendly food products. |

| July 24 | Hilmar Cheese Company: Developed a high-purity lactose granule product designed for clean-label food formulations. |

| September 24 | Agropur: Partnered with animal feed manufacturers to enhance lactose utilization in livestock nutrition programs. |

Lactose-Based Sweeteners' Expansion in Health and Wellness Products

More and more people are looking for sweeteners that are low in calories as well as functional, which is why lactose-based derivatives are being produced on the rise.

These sweeteners have a special role in a person's weight control, diabetes, and foods with a low glycemic index; on the other hand, they also find a place in products like diabetic-friendly foods, weight management drinks, and functional beverages tagged with these sweeteners. Although this trend is noteworthy, it raises questions about the sustainability of such sweetener sources, because the market continues to expand rapidly.

Food manufacturers are more and more adding lactose-based sweeteners to sports nutrition, dietary supplements, and baby formula to meet nutritional demands while retaining desirable taste and texture. With the regulatory approvals backing their use in health-focused products, lactose derivatives first are bound to register the largest market expansion in the next years.

Lactose's Increased Use in Pharmaceuticals and Nutraceuticals

Pharmaceutical-grade lactose has a strong development trend as an important component in tablet formulations. Its great compressibility, flowability, and solubility make it a favorite filler in oral solid dosage forms. Lactose monohydrate in particular is a widely used chemical in drug formulations as it brings stability and uniformity in tablet production.

Apart from the pharmaceutical sector, the nutraceutical industry is utilizing the binding properties of lactose in probiotic supplements and functional foods that are fortified. As the target population starts to display a knack for products that are personalized in their nutrition and gut-health-enhancing supplements, lactose's prominence in nutraceutical formulations will be expected to go further.

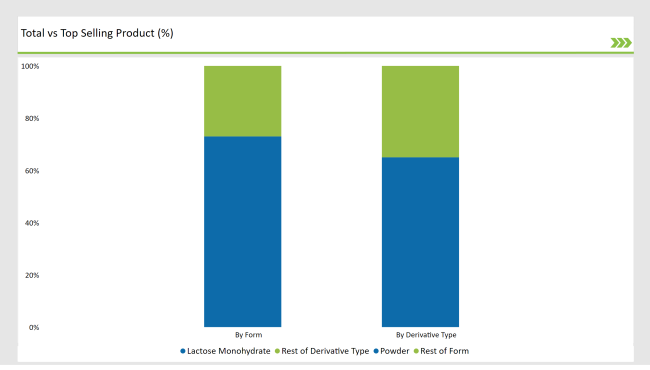

% share of Individual categories by Form and Derivative Type in 2025

Powder Form Leads the Market

Powdered lactose is the leading product in the market because of its 73% share in 2025; this is due to its extensive application within the food processing, pharmaceutical, and infant nutrition industries. Finely distributed and highly soluble, lactose powder is a key ingredient in the formulations of bakery, dairy, and beverage products.

The powder's simple handling and complementary nature with several ingredients have favored it as the first form in industrial practices. Furthermore, the use of novel spray-drying technologies is instrumental in the production of a higher quality and more stable powdered lactose, reinforcing its and the market's position.

Lactose Monohydrate Is the Biggest Market Holder

Lactose monohydrate is combining with a 65% market share in 2025, primarily due to its large-scale application in pharmaceutical formulations and infant nutrition. Lactose monohydrate is used as a stabilizing agent and bulking agent in tableting production as well as in the delivery of drugs with respected shelf stability.

There is an increasing demand for high-quality lactose monohydrate among medical and dietary applications. On top of that, lactose monohydrate has become more and more popular in the sports nutrition industry where it helps with energizing and recovery benefits.

Note: above chart is indicative in nature

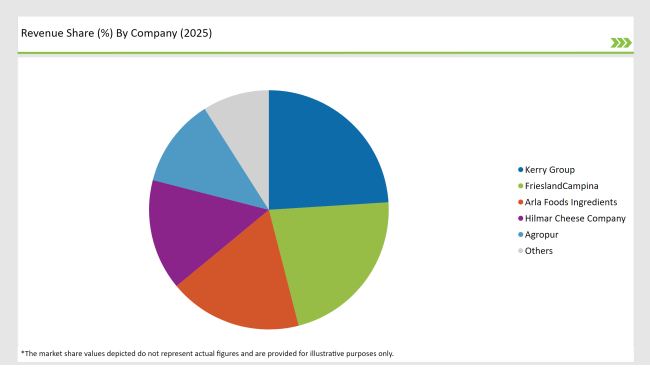

The USA lactose market is highly competitive and the focus for key players will be in line with enhancing the production capacities, optimizing the supply chain, and investing in R&D. Large manufacturers Kerry Group, Friesland, Campina, Arla Foods Ingredients, Hilmar Cheese Company, and Agropur dominate the market by the deployment of latest technologies in lactose refining and strategic partnerships.

Higher requirements for pharmaceutical-grade lactose and specialty dietary uses boost investment in purification methods. The market's diversity has expanded through company-developed lactose-free alternatives catering to individuals who suffer from lactose intolerance. The lactose market expands through organic and clean-label products as manufacturers launch sustainable manufacturing solutions for minimal processing needs.

Demand remains mainly for food and beverages, particularly for dairy, confectionery, and infant nutrition applications. Pharma-grade lactose, however, is increasingly adopted due to excellent compressibility and good solubility in drug formulation. The application expansion in the nutraceutical segment, mainly in functional food and probiotic products, continues to support this growth.

By form, the market includes powder and granules.

By derivative type, the market is segmented into lactose monohydrate, galactose, lactulose, tagatose, and other lactose derivatives

By end use, the industry is divided into food and beverage, pharmaceutical, animal feed, and other industrial applications.

The market is expanding due to rising demand for lactose in food, pharmaceuticals, and animal nutrition, along with increased use in functional sweeteners.

Powdered lactose leads with 73% of the market share, widely used in food processing and pharmaceutical applications

Lactose-based sweeteners such as tagatose and lactulose are gaining popularity as low-calorie sugar alternatives in diabetic-friendly and functional foods.

Lactose monohydrate accounts for 65% of the derivative market, serving as a critical excipient in pharmaceuticals and infant nutrition.

Top manufacturers include Kerry Group, FrieslandCampina, Arla Foods Ingredients, Hilmar Cheese Company, and Agropur.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA