The global lactose market has a diversified competitive structure with 58% controlled by large multinational corporations. Leaders FrieslandCampina, Fonterra, and Lactalis dominate because of vertically integrated supply chains, advanced processing technologies, and global reach.

These companies supply lactose for dairy, pharmaceuticals, infant nutrition, and functional foods and enjoy economies of scale and established brand trust. Regional players, led by Arla Foods and Saputo, with 24%, use their significant local supply chain advantages and exceedingly high market penetration in places like Europe, North America, and Latin America. They focus on region-specific formulation and regulatory compliances, so they are also highly competitive within their territory.

The emerging/niche players in the market like Milei GmbH, Agropur, and Prolactal, have captured 18%, and their market focus is toward high-purity lactose applications for pharmaceutical and other specialized usages. Such companies differentiate themselves through their quality control, customization, and collaboration with larger firms to meet growing demand in infant formulas and medical formulations.

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (FrieslandCampina, Fonterra, Lactalis, Arla Foods, Saputo) | 58% |

| Regional Leaders (Glanbia, DMK Deutsches Milchkontor, Kerry Group, Meggle, Hilmar Cheese Company) | 24% |

| Startups & Niche Brands (Milei GmbH, Agropur, Prolactal, Armor Proteines, ALPAVIT) | 18% |

The market is moderately consolidated, with multinational corporations holding a clear majority and regional and niche players holding their own within niche applications.

Lactose can be found both in Powder and Liquid forms. Powder is at 70% market share. This form of lactose is so versatile because of its ease to manage, store, and incorporate into any formulation. The fine, free-flowing nature of the powdered form allows for seamless integration into a wide range of products, from food and beverages to pharmaceuticals and animal feed.

The Granule segment constitutes the other 30% share of the market because, in some application areas, there will be a need for a coarser granular form of lactose. The granular form, depending on the type of manufacturing process, can provide specific functional properties, like improved flowability and controlled release. This powder form dominates the market because it is easy to use and accommodates a broad range of products, while also allowing the tailoring of the particle size for specific needs within a variety of industries.

Lactose is consumed in various end-use industries around the world. The Food and Beverage industry dominates the market by capturing 45% of the total market share. Lactose is used as a functional ingredient in most food and beverage products, dairy items, baked goods, and confectionery.

The Pharmaceutical segment accounts for 20% of the market because lactose is considered an excipient commonly used in the manufacture of tablets, capsules, and other pharmaceutical formulations. The Animal Feed segment also accounts for a large share of the market because lactose is a valuable nutrient for animal diets, especially in the dairy and livestock industries.

The remaining portion of the market is categorized as "Others," which may include specialized or niche applications of lactose, such as in the cosmetics and personal care industries, or in the production of certain chemicals and industrial products.

Expansion, technological advancements, and changing consumer preferences are the defining factors of the 2024 lactose market. The major players have established their bases by investing in specialized lactose derivatives, sustainability initiatives, and high growth sectors such as pharmaceuticals and functional nutrition. Market leaders have increased their production capacities and streamlined their distribution channels to keep pace with surging demand in emerging markets.

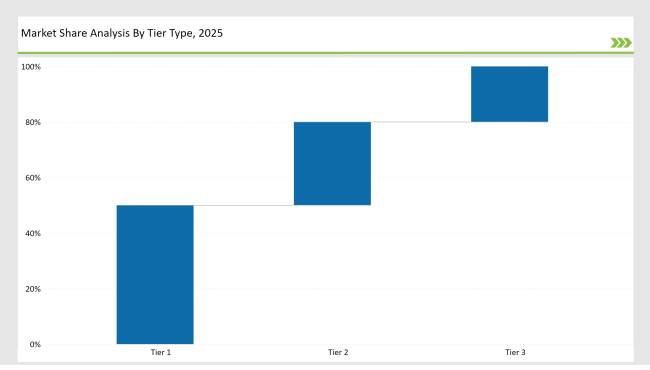

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | FrieslandCampina, Fonterra, Lactalis |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Glanbia, Arla Foods, DMK Deutsches Milchkontor |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Regional players, startups |

| Brand | Key Focus |

|---|---|

| FrieslandCampina | Strengthened production of high-purity lactose for pharma applications. |

| Fonterra | Developed lactose-based functional food ingredients. |

| Lactalis | Invested in digital lactose traceability systems. |

| Arla Foods | Focused on lactose innovations for sustainable dairy. |

| Saputo | Launched lactose solutions targeting plant-based dairy alternatives. |

| Kerry Group | Expanded lactose-based probiotic segment. |

| Hilmar Cheese Co. | Increased automation in lactose processing. |

| Meggle | Introduced lactose-enriched protein formulations. |

| Agropur | Developed high-purity lactose for infant nutrition. |

| DMK Deutsches Milchkontor | Strengthened partnerships in European lactose markets. |

Demand in the pharmaceutical industry for high-purity lactose is expected to rise over the next decade as a filler and stabilizer in tablet formulation. It is also driven by demand in the functional food space, led by increasing awareness of gut health and digestive wellness, for prebiotics and lactose-derived ingredients.

The research and development will go into creating lactose-based nutritional solutions which support gut microbiota, facilitate digestion, and fortify the immune systems. Innovations in lactose extraction, nanofiltration, and enzymatic processing shall improve efficiency levels with the attendant purity levels.

As the sports nutrition industry continues to grow, lactose will be used more in energy-boosting supplements and protein formulations. The infant formula manufacturers will also increase their use of lactose as more people prefer breast milk substitutes that are easier to digest. Formulations of lactose to meet these markets can lead to continued revenue growth. Lactose is still the most widely used ingredient in dairy processing, but lactose intolerance is increasing around the world.

This would involve transporting the lactose across long distances, which would increase costs and a carbon footprint. Regional lactose processing hubs closer to key consumer markets would reduce coordination expenses and result in a more resilient supply chain.

Investments in automation and AI-driven inventory management also assist in improving efficiency and minimizing operational disruptions. There is increased consolidation in the lactose industry, as major players acquire smaller firms to increase their market presence.

FrieslandCampina, Fonterra, and Lactalis lead the global lactose market, accounting for a combined 35% of total production. These companies dominate due to their extensive dairy processing capabilities and strong supply chain networks.

Investing in carbon-neutral processing plants, water-efficient extraction techniques, and biodegradable packaging will enhance sustainability. FrieslandCampina and Arla Foods are pioneers in green lactose production, reducing their carbon footprint while maintaining high-quality standards.

Lactose is widely used as a filler, stabilizer, and binder in tablet formulations due to its compressibility and flow properties. Companies like Kerry Group and Hilmar Cheese Company are investing in ultra-pure lactose to meet stringent pharmaceutical-grade requirements.

The increasing demand for lactose-free dairy alternatives could reduce lactose consumption in traditional dairy sectors. However, enzyme-treated lactose derivatives and high-purity lactose for functional foods and pharmaceuticals will help sustain market growth.

Emerging technologies like membrane filtration, enzymatic hydrolysis, and AI-driven process optimization are improving lactose purity and efficiency. Companies integrating these innovations can achieve higher yield rates and better cost management.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lactose-Free Butter Market Size and Share Forecast Outlook 2025 to 2035

Lactose Market Report – Size, Growth & Forecast 2025 to 2035

Lactose Assay Kit Market Size and Share Forecast Outlook 2025 to 2035

Lactose-Free Probiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lactose-free Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Lactose and Derivative Business

Lactose Free Dairy Product Market Outlook – Share, Growth & Forecast 2025 to 2035

Lactose-free Cheese Market Growth - Consumer Trends & Industry Analysis 2025 to 2035

Lactose-Free Probiotic Yogurt Market Trends - Product Type & Sales Insights

Lactose-free Sour Cream Market

Lactose-free Infant Formula Market

Galactose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A2 Lactose-Free Milk Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

UK Lactose Market Report – Demand, Trends & Outlook 2025-2035

USA Lactose Market Insights – Growth & Demand 2025-2035

Low-Lactose Dairy Foods Market

ASEAN Lactose Market Insights – Size, Share & Growth 2025-2035

Europe Lactose Market Trends – Size, Share & Forecast 2025-2035

Refined Lactose Market Size and Share Forecast Outlook 2025 to 2035

Reduced Lactose Whey Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA