The Australian Lactose market is estimated to be worth USD 17.4 million by 2025 and is projected to reach a value of USD 53.9 million by 2035, growing at a CAGR of 11.9% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Australia Industry Size (2025) | USD 17.4 million |

| Projected Australia Value (2035) | USD 53.9 million |

| Value-based CAGR (2025 to 2035) | 11.9% |

The Lactose market in Australia is the production, distribution, and consumption of plant-based or synthetic cream substitutes, mainly used in beverages like coffee and tea and in cooking and baking.

The creamers are formulated with plant-based ingredients like coconut milk, almond milk, oat milk, or soy protein and contain extra flavors and stabilizers for the feel and taste of dairy cream. Being lactose-free, non- dairy creamers are appropriate for those suffering from lactose intolerance but increasingly have been aimed at vegans, vegetarians, and consumers looking for a healthier or allergy-free option.

The growth and demand in the Australian market arise from consumers looking for alternatives for plant-based, health-conscious, and sustainable food products. Furthermore, rising dairy allergy awareness, moral issues over treatment of animals and environmental issues pertaining to dairy farming is increasing the need for Lactose. Apart from this, an increasingly premium-oriented food and beverages market with high coffee culture demand are also fueling the need in Australia.

Innovations in flavor, functional ingredients, and packaging also add benefit to the market, thus catering to a larger demographic beyond dietary limitations. In other words, the Lactose have turned out to be a developing as well as changing segment of the food industry in Australia.

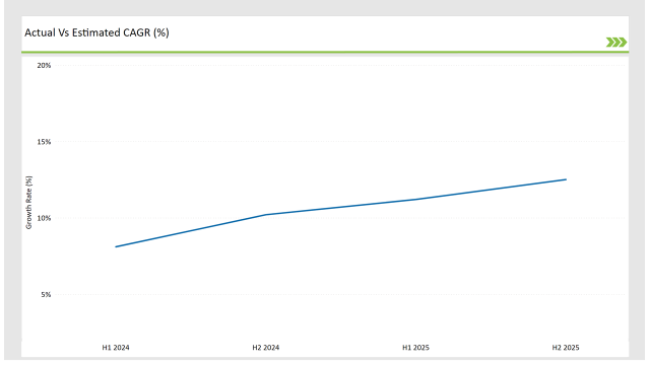

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Lactose market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Lactose sector is predicted to grow at a CAGR of 11.2% during the first half of 2025, increasing to 12.5% in the second half of the same year.

In 2024, the growth rate is anticipated to slightly decrease to 8.1% in H1 but is expected to rise to 10.2% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

The above figures reflect the fluid and evolving landscape of the Australian lactose market, determined by regulatory shifts, changes in consumer preferences, and product innovations.

The half-yearly report can be highly valuable for the companies that look forward to implementing strategies in harmony with the trends predicted for the future while confronting the challenges faced by the market. This break-down is vital in the navigating of the complexity of the lactose market to ensure companies take advantage of the emerging opportunities and stay ahead in a competitive environment.

| Date | Development/M&A Activity & Details |

|---|---|

| September 2024 | It is an interest shown in acquiring Beston Global Food Company's cheese and lactoferrin production business in Jervois, South Australia by Japan's Megmilk Snow Brand Co., which will lead to significant development in the dairy sector of the country if that acquisition gets past regulatory approvals. |

| March 2023 | The Betta Milk and Meander Valley Dairy brands were acquired by Bega Cheese Limited from TasFoods Limited and Van Diemen's Land Dairy Pty Ltd. This purchase by Bega Cheese will enable it to expand its regional presence in Tasmania through an increased variety of dairy products along with improved efficiency in its operations. |

Surge in Lactose-Free Dairy Products

Demand for lactose-free dairy products has significantly changed in Australia, and this is majorly attributed to the rise of lactose intolerance. With a growing number of Australians switching to lactose-free milk, cheese, and yogurts, the trend has made dairy manufacturers innovate to accommodate the dietary needs of consumers. Even though health concerns fuel the trend, there has been increasing awareness of the connection between lactose consumption and gastrointestinal discomfort.

Expansion of lactose-free products also presents new market opportunities for dairy processors, especially within the international markets. Furthermore, this helps the Australian market as more companies now rush for introducing lactose-free versions as a result, creating competition amongst themselves and improving the choice amongst the consumers thus leading to even further innovation.

The Role of Lactose in Pharmaceutical Applications

In pharmaceutical industries, even though the most common use is in association with dairy products, lactose serves a very vital role. Because of its characteristics as a binder, stabilizer, and bulking agent, it is significantly used as an excipient in tablet formulations in Australia.

It is becoming very popular since the Australian pharmaceutical industry is rising high, and demand for oral solid dosage forms is on the rise. Lactose is a critical ingredient in the preparation of drugs, vitamins, and supplements. Personalized medicine and an aging population that needs constant medication will increase the consumption of lactose for these applications.

Personalized medicine and an aging population that needs constant medication will increase the consumption of lactose for these applications. As the pharmaceutical sector continues to seek more dependable suppliers, demand for high-quality lactose products will continue on its upward path.

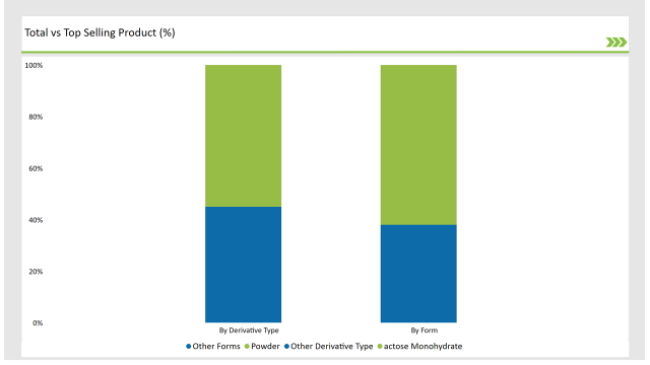

% share of Individual categories by Derivative Type and Form in 2025

Dry Form Lactose Dominates Australia’s Lactose Market: The Convenience and Versatility Factor

The dry form of the lactose market is slowly becoming a dominant force in Australia, mainly because of its convenience and ease of storing it. The versatile use of the dry form of lactose makes it possible for a wide range of applications.

The distinct advantages that dry lactose as a powder offers to both industrial manufacturers and consumers merge with the changing needs of the market and create this dominance in the Australian lactose market. Dry form lactose is an extremely popular compound in the vast majority of industries. These include diary, pharmaceutical, and food processes. Therefore, food and beverage companies prefer dry lactose due to its stability and long shelf life and ease of handling.

Its property of being added to powder mix, protein bars, and health supplements makes it ideal for manufacturers developing functional foods or diet products. With Australian consumers increasingly demanding on-the-go solutions for food and snacks, dry form lactose acts as a cornerstone ingredient driving the growth of functional protein-enriched snacks.

Amino Acids: The Driving Force behind Australia's Lactose Market Growth

Amino acids are the fastest-growing segment in the Australian lactose market and the most emerging leading force based on increasing demand for high-performance and special dietary products. In multiple applications, particularly health supplements, sports nutrition, and functional foods, amino acids play an important role because they are critical building blocks of protein. The emerging trend about amino acids has made this the largest segment in Australia's lactose market.

Increased consumer interest in health and fitness, as well as the growth of protein-based diets, has increased demand for amino acids in Australia. It is observed that there has been a growing demand for products based on amino acids in the Australian market, which can be characterized in terms of a culture of an active lifestyle with an increasing interest in fitness.

Note: The above chart is indicative in nature

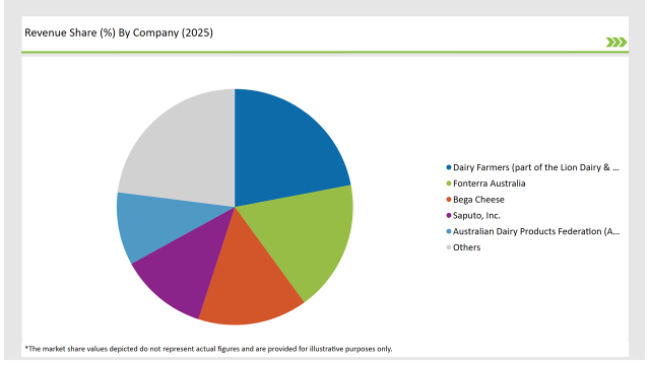

Tier 1 players are large market share and better distribution network holding firms. Among the leading producers and suppliers of dairy products, these firms represent an excellent presence not only in Australia but also in other global markets. The leaders have emerged by virtue of wide-range offerings in lactose, including lactose powders, granules, and pharmaceutical-grade lactose.

Tier 2 companies are more focused or regional presences. Most of them target specific segments or niches within the lactose sector. They may also tailor product development more specifically to meet specific needs, such as lactose-free formulation or lactose for a specific industrial application.

Tier 3 players in the Australian lactose market are small-scale producers, startups, or emerging companies that have a relatively small market share. These companies are usually small and in their development stage.

They may concentrate on developing new products based on lactose or focus on filling market gaps in underserved areas. They might not have the capacity or resources to compete with the larger players, but these companies are always at the front of new product trends and innovations.

The industry includes various form of lactose such as powder, and liquid.

The industry includes various end-use applications such as food and beverage, pharmaceutical, animal feed, and others.

The industry includes various derivative type Lactose monohydrate, galactose, lactulose, tagatose, and others.

By 2025, the Australian Lactose market is expected to grow at a CAGR of 11.9%.

By 2035, the sales value of the Australian Lactose industry is expected to reach USD 53.9 million.

Key factors propelling the Australian Lactose market include Increase in pharmaceutical applications of lactose, lactose's role in infant formula and nutritional products, and rising health consciousness and functional foods.

Prominent players in Australia Lactose manufacturing include Fonterra Australia Murray Goulburn (now part of Saputo Inc.), Lactalis Australia, Bega Cheese, Australian Dairy Products Federation (ADPF), Parmalat Australia, Warrnambool Cheese and Butter Factory, Norco Co-operative Dairy Farmers (part of the Lion Dairy & Drinks), and Manildra Group among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA