The ASEAN Lactose market is set to grow from an estimated USD 91.9 million in 2025 to USD 236.2 million by 2035, with a compound annual growth rate (CAGR) of 9.9% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 91.9 million |

| Projected ASEAN Value (2035F) | USD 236.2 million |

| Value-based CAGR (2025 to 2035) | 9.9% |

The ASEAN Lactose market is on its way to tremendous growth owing to the increased health-consciousness of consumers, more so than the expectant mothers. The demand for lactose additives, especially prenatal vitamins is rising exponentially as people start to realize the benefits of maternal health and nutrition.

Given the expansion of this market, it is expected to reach USD 236.2 million in 2035 from USD 91.9 million in 2025, a growth rate of 9.9% compound annual growth rate (CAGR). This is due to factors like maintaining a healthy lifestyle being a new cultural mindset, the expansion of the digital market, and the increased sales of lactose products.

The ASEAN Lactose market is quite a mixed bag that includes various products like capsules, tablets, and natural sweeteners all representing different consumer preferences. As a result of the surge in e-commerce platforms, it has become much easier for customers to get these products, thus providing them with more convenience and options.

While the market transforms, the manufacturers are focusing on innovative and unique products to meet the high standards of quality lactose-based products that customers are looking for. As a result of the above factors, this sector has become a great place to invest in the ASEAN Lactose market, with the rise of consumer-oriented changes and their awareness of maternal health evolution as the main drivers.

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Lactose market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Lactose market, the sector is predicted to grow at a CAGR of 6.5% during the first half of 2024, with an increase to 7.7% in the second half of the same year.

In 2024, the growth rate is expected to decrease slightly to 8.5% in H1 but is expected to rise to 9.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Launch of a new line of chickpea-based snacks by a leading food manufacturer targeting health-conscious consumers. |

| 2024 | The partnership between a pulse supplier and a major food brand to develop lentil-based ready-to-eat meals. |

| 2024 | Introduction of a new range of organic yellow pea flour by a prominent food company catering to the growing demand for gluten-free alternatives. |

| 2024 | Expansion of a pulse processing facility in Malaysia to increase production capacity and meet rising demand for pulse-based products. |

Growing Demand for Natural Sweeteners

The market for lactose natural sweeteners is rising because of the eager health seekers in people's behavior. The more people realize that their health is at risk through the consumption of artificial sweeteners and the use of additives, the more they want to have products that do not contain only sweeteners and additives but also other natural ingredients.

This trend is among pregnant women who are more and more interested in prenatal vitamins and dietary supplements that are made of no artificial constituents. Natural substances, like monk fruit and stevia, are the trending diets where people can consume them and due to the health benefits and low-calorie levels, this is more viable than sugar itself.

Response to this movement is the manufacturers who started to change the format of the products to be sold with these sweeteners. They are the ones who would promote them these days, especially in the gummy segment where there is a significant shift to the use of natural products since taste is the most important factor for consumer acceptance.

Rise of E-Commerce and Online Retail

E-commerce sites are the primary avenue for sourcing a variety of prenatal vitamins for consumers, as they can compare, and read reviews before making a purchase. Besides, the online shopping site has made it possible for pregnant women to shop for the nutritional support they want anywhere they can access the internet. Furthermore, internet shops many times include product information that is more user-friendly, like ingredient lists, and the advantages of vitamins, plus consumers can easily select the best supplements for their personal needs.

The rise of e-commerce has caused some disruption in the milk protein sector in recent years as there has been an influx of companies that are trying to establish a dominating online presence and broaden their scope of operations.

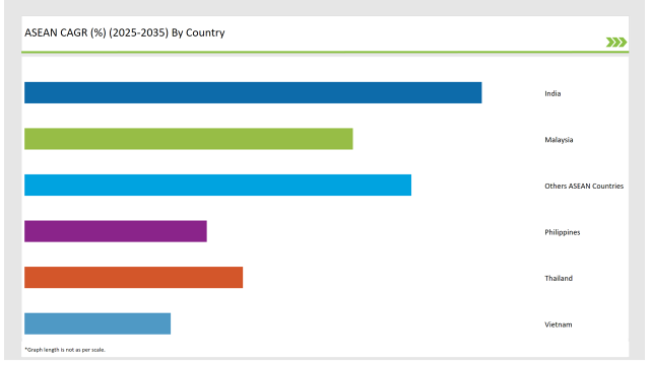

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India's lactose market is growing swiftly, with the major factor being people's growing interest in women's health and nutrition. The Indian government has formed many campaigns to bring about a change through knowledge transfer to women on the need for adequate nutrition during pregnancy. These initiatives have had a tremendous positive impact on women's health by making them more aware of the right nutrients they should have for their bodies and babies to be healthy and strong.

The rapid expansion of the e-commerce sector in India has played another vital role in achieving this aim, as women are now able to procure prenatal vitamins not only in cities but also in remote areas. Accessibility has been the most crucial factor in the development of the lactose-based supplements market, as it has removed barriers such as product unavailability and lack of convenience.

Moreover, the trend of women preferring organic and natural prenatal vitamins has also emerged; it is mainly because a considerable number of women are in quest for products that are in line with their health values and healthy living.

The lactose market in Thailand also marks its progress which is driven by the focus given on the nutritional support of pregnant women. The government of Thailand has realized that pregnant women's health is crucial and so, the strategies that have been put in place are aimed at proper nutrition during pregnancy.

These efforts have resulted in a widening of the knowledge base on the effects of prenatal vitamins, thus marking lactobacillus-based products as new kids on the block" in the dairy industry. The e-commerce and online retail channels boom has been the main driver, making it convenient for customers to obtain the products, especially prenatal vitamins, easily from the Internet.

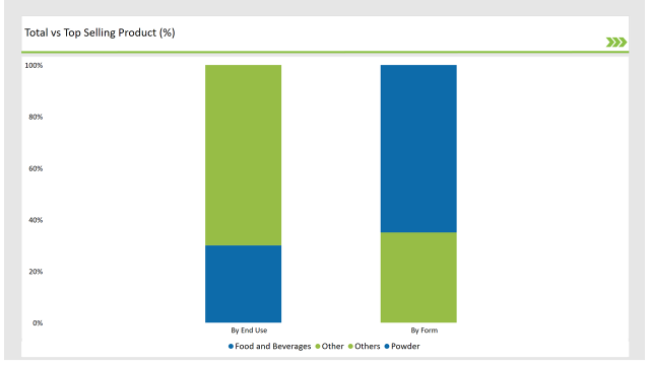

Powder remains the most popular form of dietary supplement.

The lactose market will be mainly ruled by the powder sector evidently with a large share of 65% in 2025. This lactose type is popular due to its technical versatility and ease of handling, which is why it is a ubiquitous choice for both manufacturers and end-users. The powdered form of lactose, you will find, is mostly seen in dietary supplements, baby food, and functional foods because of its unique feature to mix with other ingredients.

A significant benefit of powdered lactose is that it is solid and tends to last longer compared to liquid forms. This feature is particularly concerned by manufacturers requiring products that can tolerate unfavorable storage conditions without sacrificing quality. With this in mind, powdered lactose can find its application in a wide range of formulations which in turn gives product development more options.

Food and drink is an important and prominent segment of the lactose market.

Food and drink is an important and prominent segment of the lactose market, holding a 30% market share in the year 2025. This segment contains plenty of products such as dairy products, baked items, and nutritional drinks that use lactose as a principal item. The rising consumer interest in the foods and beverages that provide health benefits is the main reason behind the growth of this segment.

Besides, lactose is used in the processing of food and drinks apart from being a sweetener to get the natural flavor for the drink, getting a pleasant texture, and providing nutritional value.

As people are becoming more aware of their health, there is a new tendency to seek out products that are made with natural ingredients instead of artificial ones and that have functional benefits. Hence, this has resulted in lactose being utilized in a range of products including protein powders, meal replacements, and fortified beverages.

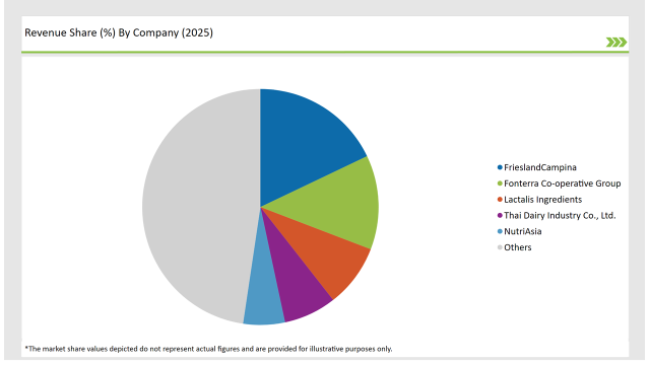

2025 Market Share of ASEAN Lactose Manufacturers

Note: The above chart is indicative

The lactose market in ASEAN is a very competitive area with many players who are fighting for a part of the market. The main manufacturers are the popular established brands, the new emerging companies, and the private label products, which all provide different lactose-based supplements according to the taste of consumers. The competition in the market is diversely affected by product quality, price, distribution channel, and marketing strategies.

As per Form Type, the industry has been categorized into Powders and Granules

As End Use, the industry has been categorized into Food and Beverage, Pharmaceutical, Animal Feed, and Others

As a Derivative Type, the industry has been categorized into Lactose Monohydrate, Galactose, Lactulose, Tagatose, and Others.

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Lactose market is projected to grow at a CAGR of 9.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 236.2 million.

India are key Country with high consumption rates in the ASEAN Lactose market.

Leading manufacturers include FrieslandCampina, Fonterra Co-operative Group, Lactalis Ingredients, Thai Dairy Industry Co., Ltd., and NutriAsiaare the key players in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA