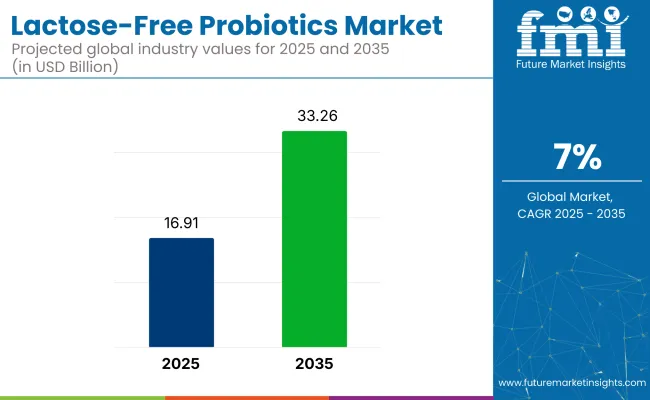

The global lactose-free probiotics market is projected to expand from USD 16.91 billion in 2025 to USD 33.26 billion by 2035, registering a CAGR of 7% during the forecast period. Growth is being driven by rising consumer awareness regarding digestive health and the increasing prevalence of lactose intolerance globally.

| Attribute | Value |

|---|---|

| Industry Size (2025) | USD 16.91 billion |

| Industry size (2035) | USD 33.26 billion |

| Forecast CAGR (2025 to 2035) | 7% |

The demand for lactose-free probiotic products is being accelerated by the growing number of lactose-sensitive consumers seeking dairy alternatives that support gut health. The introduction of a wide range of lactose-free probiotic foods and supplements is further enhancing industry reach.

The industry holds varying shares within its parent markets. In the broader probiotics market, approximately 10-15% is accounted for by lactose-free probiotics, driven by the increasing demand for products catering to lactose-intolerant consumers. Within the functional foods industry, around 5-8% of the overall segment is represented by lactose-free probiotic products, as more consumers opt for foods with added health benefits.

In the lactose-free products industry, about 7-10% is made up by lactose-free probiotics, reflecting the growing preference for dairy-free and lactose-free health solutions. In the dairy alternatives industry, around 12-18% is contributed by lactose-free probiotics, as plant-based options like dairy-free yogurt and beverages gain popularity. Lastly, in the dietary supplements industry, about 3-5% is accounted for by lactose-free probiotics, focusing on gut health and digestive support.

The strategic importance of product diversification has been highlighted by industry leaders. “We are excited to drive continued expansion with more convenient pack formats and lactose-free options at leading retailers,” stated Jesse Merrill, Chief Executive Officer and Co-Founder of Good Culture.

This statement underscores the emphasis on broadening product portfolios to meet evolving consumer preferences. Leading players are investing in research and development, forging strategic collaborations, and expanding the business to reach to capitalize on growth opportunities. Consumer trends toward natural, organic, and sustainable products are also influencing innovation in the lactose-free cultures sector.

Strong investments are being made due to rising demand for dairy-free functional foods, yogurt formats, Lactobacillus strains, supermarket distribution, and digestive health-focused applications.

Yogurt is expected to lead the market in 2025, capturing 20% of the total share.

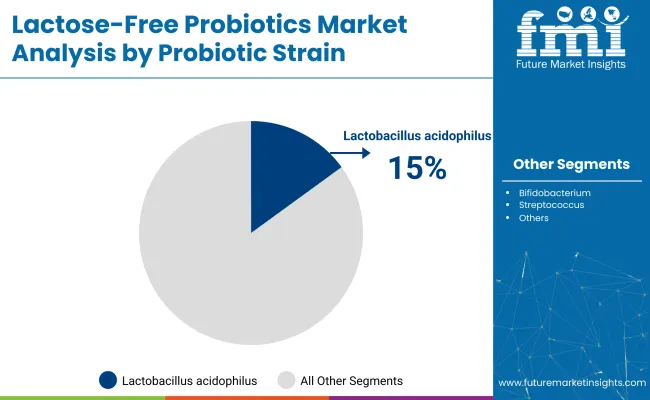

Lactobacillus acidophilus is expected to account for around 15% of lactose-free probiotic food products in 2025

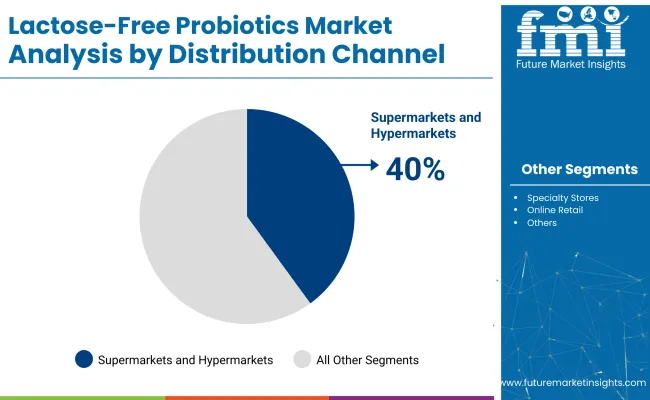

Supermarkets and hypermarkets are projected to account for 40% of the share in 2025.

The digestive health segment is expected to account for 45% of the share in applications by 2025

The lactose-free probiotics industry is being driven by rising lactose intolerance awareness and demand for digestive health products. However, challenges such as formulation complexities and consumer skepticism are limiting rapid industry growth.

Increasing Lactose Intolerance Awareness and Digestive Health Demand

Global awareness of lactose intolerance is driving the demand for dairy-free probiotics. Digestive health solutions that avoid the discomfort of lactose are increasingly sought. Probiotics formulated without lactose are preferred by those with dietary restrictions and sensitivities. The focus on gut health and immune support is further fueling industry growth. Dairy-free probiotics are being integrated into functional foods, dietary supplements, and beverages.

Challenges in Formulation and Consumer Doubts

Despite rising demand, challenges such as formulation complexities and consumer doubts are limiting industry growth. The viability and stability of probiotics are affected by the removal of lactose, and advanced technology is required for effective delivery. Doubts about the efficacy of dairy-free probiotics are slowing adoption, while misinformation and lack of awareness are contributing to hesitant behavior.

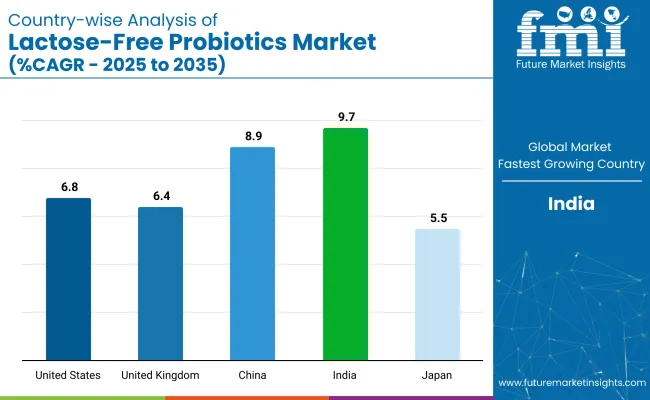

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

| United Kingdom | 6.4% |

| China | 8.9% |

| India | 9.7% |

| Japan | 5.5% |

The lactose-free probiotics market is growing globally at a 7% CAGR, with diverse growth rates across key regions. India (BRICS) leads the industry with the highest growth rate of 9.7%, driven by increasing awareness of lactose intolerance and a rising demand for digestive health products. China (BRICS) follows closely at 8.9%, reflecting a growing focus on gut health and probiotic consumption among the urban middle class.

Developed industries such as the United States (OECD) and the United Kingdom (OECD) show stable growth at 6.8% and 6.4%, respectively, due to the established demand for health supplements. Japan (OECD), at 5.5%, exhibits the slowest growth, likely due to industry saturation. Emerging economies like India and China represent the highest growth opportunities, driven by expanding health-conscious populations and increasing lactose intolerance awareness.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

Demand in India is expected to grow at a 9.7% CAGR through 2035. Growth is driven by rising consumer awareness, increased disposable income, and demand for lactose-free dairy alternatives. Lactose-free portfolios are being expanded by companies like Amul, Parle Agro, and Nestlé India. Interest in health-conscious lifestyles is promoting demand.

Industry reach is being enhanced by government campaigns and improved labeling. Accessibility is being expanded through e-commerce platforms, while diverse consumer needs are being met by ongoing innovation in formulations and packaging. The rapid expansion in industry is supported by a focus on wellness and dietary health.

The USA industry is expected to grow at a CAGR of 6.1% from 2025 to 2035. A well-established healthcare infrastructure and increasing consumer demand for lactose-free products are driving the industry. Lactose-free dairy alternatives are being innovated by key players such as Danone, Dairy Farmers of America, and Blue Diamond Growers.

Lactose-free offerings are being expanded in retail and foodservice sectors, and growth is being supported by consumer preference for plant-based foods. Adoption is being accelerated by government healthcare initiatives and awareness campaigns.

The sales of lactose-free probiotics in the UK are projected to grow at a steady CAGR of 6.4% through 2035.The demand is driven by increasing consumer awareness and growing demand for lactose-free products. Lactose-free portfolios are being expanded by leading brands like Arla Foods, Müller UK, and The Collective Dairy.

Product visibility across physical and online channels is being improved by retailers. Awareness of lactose intolerance and alternative dairy options is being raised by government health initiatives. Innovation in taste and nutritional content is attracting a wider consumer base, and customer reach is being enhanced by e-commerce platforms.

The sales of lactose-free probiotics in China is projected to grow at a CAGR of 8.9% through 2035. Growth is fueled by dietary shifts, rising health awareness, and increasing consumer demand for lactose-free products. Significant investments are being made by dairy companies like Yili Group, Mengniu Dairy, and Beingmate in lactose-free product development.

Nutritional awareness and education are being supported by government programs. Product accessibility is being increased by the expansion of retail chains and e-commerce platforms. Demand for lactose-free dairy and plant-based alternatives is being driven by rising lifestyle diseases. Product offerings are being innovated to propel industry expansion.

Sales of lactose-free probiotics in China are projected to grow at a 5.5% CAGR through 2035.Growth is influenced by an aging population with increased digestive sensitivities and rising dietary awareness. Lactose-free and low-lactose dairy options are being developed by companies like Meiji Holdings, Morinaga Milk Industry, and Snow Brand Milk Products.

Nutritional education focused on digestive health is being encouraged by government initiatives. The demand for functional foods and digestive health supplements is supporting industrial growth. Product availability is being expanded through supermarkets and online retailers, and consumer acceptance is being enhanced by ongoing product innovation and promotion.

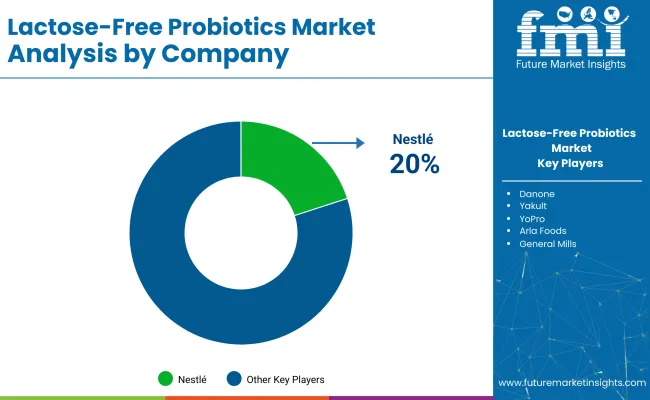

Leading companies such as Danone, Nestlé, Yakult, and General Mills, which maintain dominance through extensive R&D, global distribution, and diverse product portfolios. For example, lactose-free probiotic yogurts are offered by Danone under the Activia and Actimel brands. Rising firms like Valio Ltd., Arla Foods, and Stonyfield Farm are focusing on regional and specialized segments.

Emerging companies such as YoPro and Ehrmann AGare targeting specific industries with competitive pricing. High entry barriers are driven by advanced manufacturing requirements, strict food safety regulations, and substantial capital investment. The industry exhibits moderate consolidation, influenced by ongoing mergers and acquisitions.

Recent Industry Developments in the Lactose-Free Probiotics Market

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 16.91 billion |

| Projected Industry Size (2035) | USD 33.26 billion |

| CAGR (2025 to 2035) | 7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for values and Volume in units |

| Product Types Analyzed | Dairy-based; Plant-based; Fruit-based; Probiotic supplements |

| Probiotic Strains Analyzed | Lactobacillus; Bifidobacterium; Streptococcus; Bacillus; Saccharomyces; Others |

| Distribution Channels Analyzed | Supermarkets & hypermarkets; Specialty stores; Pharmacies & drugstores; Online retail; Others |

| Applications Analyzed | Digestive health, Immune support, Weight management, Women’s health, Pediatric health, Others |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | USA; Canada; Germany; U.K.; France; Spain; Italy; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; U.A.E. |

| Key Players | Danone; Nestlé; Yakult; General Mills; Valio Ltd.; Arla Foods; Stonyfield Farm; YoPro; Ehrmann AG |

| Additional Attributes | Dollar sales by product type (Dairy-based vs Plant-based vs Fruit-based vs Supplements); Dollar sales by form (Yogurt, Kefir, Cheese, Ice cream, Capsules, Tablets, Powders, Liquids); Trends in sugar reduction and clean-label adoption; Strain-specific formulation innovations; Growth of functional beverage and nutraceutical applications; Regional consumption patterns and per-capita intake. |

The industry is segmented into dairy-based probiotics (including yogurt, kefir, cheese, ice cream, and others), plant-based probiotics (soy-based, almond-based, coconut-based, oat-based, and others), fruit-based probiotics (juices, smoothies, and others), and probiotic supplements (capsules, tablets, powders, liquids, and others).

The industry includes Lactobacillus (L. acidophilus, L. rhamnosus, L. plantarum, and others), Bifidobacterium (B. bifidum, B. longum, B. lactis, and others), Streptococcus (S. thermophilus and others), Bacillus (B. coagulans, B. subtilis, and others), Saccharomyces (S. boulardii and others), and other strains.

The industry is segmented into supermarkets & hypermarkets, specialty stores, pharmacies & drugstores, online retail, and others.

The industry covers digestive health, immune support, weight management, women’s health, pediatric health, and others.

The industry covers North America, Europe, Asia Pacific, Latin America, the Middle East and Africa.

The industry is expected to reach USD 33.26 billion by 2035.

The industry size is projected to be USD 16.91 billion in 2025.

The industry is expected to grow at a CAGR of 7% from 2025 to 2035.

Yogurt is expected to dominate the industry with a 20% share in 2025.

Digestive health is projected to account for 45% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotics After Antibiotic Recovery Market Analysis by Ingredient and Sales Channel Through 2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Probiotics Market Analysis by Dipotassium Phosphate Anhydrous, Dipotassium Hydrogen Phosphate Trihydrate, Dipotassium Phosphate Used in Coffee Mate, Potassium Phosphate dibasic and Dipotassium Hydrogen Phosphate Through 2035

Custom Probiotics Market Size and Share Forecast Outlook 2025 to 2035

Multistrain Probiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Single-strain Probiotics Market

D-Lactate Free Probiotics Market Size and Share Forecast Outlook 2025 to 2035

Demand for Multistrain Probiotics in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA