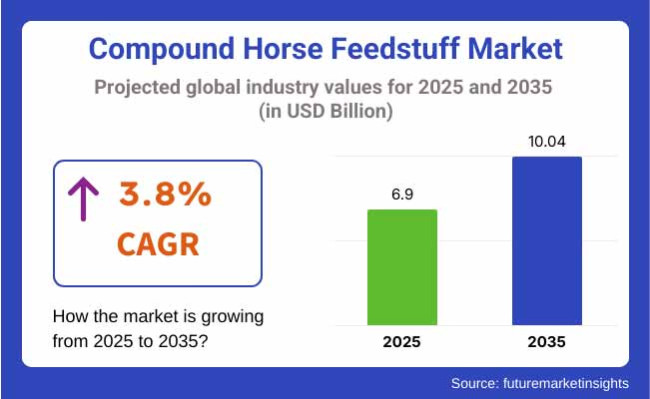

The global compound horse feedstuff market reached USD 6.9 billion in 2025. The growth is expected to be at a CAGR of 3.8% over the forecast period (2025 to 2035), ultimately reaching a sales value of USD 10.04 billion by the end of 2035.

There is steady growth mainly because there is more demand for nutritionally balanced horse feed formulas with specific functions. Compound horse feedstuff, which is a mix of grains, proteins, vitamins, and minerals, would be beneficial for guiding horses to be in good health, exercise better, and increase the overall quality of life for the animal.

The growth is also significantly backed by the increased participation in horse racing, equestrian sports, and leisure horse riding. Trainers and horse owners favor the use of high-quality feeds made with the specific objective of helping muscle development, digestion, and endurance. Also, industry trends are being shaped by the requirement for tailored feed alternatives that are distributed according to the specific type of horses, age, and activity level.

The trend towards the consumption of all-natural and organic horse feed is one of the contributory factors for growth. Companies are producing compound feedstuff devoid of artificial additives, genetically modified ingredients, and chemical preservatives based on customer demand for clean-label equine nutrition. Moreover, the coming of specialty feeds like low-starch, high-fiber, and probiotic-enhanced formulations has set the stage for driving product innovation.

Feed processing technology such as pelleting, extrusion, and micronization is drastically improving horses' nutrient absorption and digestibility. The addition of omega-3 fatty acids, essential amino acids, and herbal supplements in compound horse feed are the other contributors to its functional benefits. Not only that, the digitalization in equine nutrition management, such as smart feeding systems and performance-tracking apps, acts as an influencing factor in purchasing decisions.

Some challenges include changes in the cost of raw materials, the imposition of strict rules on feed formulation, and issues with contamination. Furthermore, competition from traditional forage-based diets and homemade feed mixtures might affect the use of commercial compound feed solutions.

The growing preventive equine health care and the demand for performance-enhancing nutrition mean that new growth paths are emerging. Also, the delivery of specialized horse feed to customers worldwide is aided by online channels and direct-to-consumer marketing strategies. There will be continued growth as the industry keeps on changing.

The industry is driven by increasing awareness of equine performance and nutrition. Professional stables and racing industries emphasize high-energy, high-protein feed to guarantee endurance and muscle development.

Leisure horse owners, on the other hand, opt for affordable and balanced nutrition feed that promotes overall well-being. Breeding operations emphasize feeds fortified with key vitamins, minerals, and amino acids to ensure foal growth and lactating mare requirements.

There is an increasingly high demand for GMO-free and organic feedstuffs, especially amongst higher-end horse societies and horse breeders. Second, value-added feed is taking off, where specially formulated diets may be chosen based on age, level of exercise, and wellness state.

Sustainability becomes increasingly important, with companies launching environmentally friendly packaging and sustainably sourced ingredients. The trend towards pelleted and extruded feeds guarantees improved digestibility and nutrient uptake, rendering them popular choices among different buyer groups.

Between 2020 and 2024, there was a huge transformation as scientific research widened the field of knowledge about the nutritional needs of the horse. Horse owners also broke away from traditional feeding practices with a focus on nutrient availability, amino acid balance, and gastrointestinal health.

This shift introduced the development of science-designed solutions to specific problems such as metabolic efficacy, joint welfare, and performance recovery. Clean labeling pressure intensified, with increased movement towards non-GMO, preservative-free, and natural-derived ingredients. Additionally, gut health became an issue, prompting the use of fiber-enriched, probiotic-enhanced feeds to maximize gastrointestinal function.

During the 2025 to 2035 timeframe, horse nutrition will reach greater sophistication based on AI-enhanced analytics providing individualized feeding plans developed uniquely for each horse. The pressure on research surrounding the gut microbiome will bring with it deeply tailored versions crafted for optimal digestive absorption of nutrients.

Hypoallergenic and limited-ingredient diets will have higher demand as feed sensitivities are increasingly identified. Sustainability will also be a concern, with the development of eco-friendly sourcing, novel protein sources, and circular economy packaging.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Scientific Formulation Sophistication - More emphasis on amino acid profiles, bioavailability of nutrients, and interactions among ingredients. | AI-Driven Precision Feeding - AI-designed feeds that are customized to the specific needs of individual horses based on current health and performance data. |

| Performance-Based Customization - Custom feeds for recreation, breeding, and performance horses. | Microbiome-Optimized Nutrition - Introduction of the new science of gut health to functional probiotic and prebiotic-enriched feeds for personalized digestive wellness. |

| Clean Label & Natural Trends - Consumers are embracing non-GMO, preservative-free, and less processed content. | Sustainable & Regenerative Sourcing - Plant-based alternative protein, ingredient supply management, and circular economy packaging. |

| Digestive Health Focus - Low-starch, high-fiber consumption in anticipation of preventing digestive discomfort. | Accuracy Nutrient Absorption - Genetically bioengineered diets designed to optimize cellular nutrient absorption. |

| Life Stage-Dieting - Foal, mature equine, and geriatric-life stage dieting. | Adaptive Feeding Protocols - Artificial Intelligence-based, disease-specific protocols that dynamically change feeds according to metabolic variation and real-time wellness indicators. |

The industry is expanding due to growing equestrian activities and the increased number of horse owners. On the other hand, the variable costs of raw materials, especially grains and protein sources, present financial threats. Fluctuations in agricultural commodities due to weather change, disruption of supply chains, and political tension might affect production costs and profit margins.

In addition, horse health issues related to feeding them with the right nutrition elements also have an impact on our business. Wrong feed forms cause problems like stomach upset and horse metabolic disorders. Hence, companies are to concentrate on scientifically formulated mixed feeds that have an adequate nutrient profile and product development that is actually driven by research in order to achieve the targeted horse's well-being and performance.

Market efficiencies are also impacted due to supply chain disturbances like transportation delays and ingredient shortages. The reliance on certain suppliers to procure some key materials only exacerbates the risk of logistical pressures. Strengthening connections with suppliers, undertaking raw material procurement in local markets, and managing the storage of inventory levels to be strategic can be the major solutions to these issues.

The sustainability issue of feed production and sourcing, on the other hand, tarnishes a company's name. The feed crops' carbon emissions as well as the environmental impacts and water usage have all triggered questions.

Firms must ensure that they are fully involved in the adoption of sustainable farming models, lookup alternative protein sources, and initiate eco-friendly packaging campaigns in order to meet the industry sustainability goals and customers' demands.

| Countries | CAGR |

|---|---|

| USA | 4.1% |

| UK | 3.0% |

| France | 2.7% |

| Germany | 3.3% |

| Italy | 2.9% |

| South Korea | 4.5% |

| Japan | 2.8% |

| China | 5.6% |

| Australia | 5.2% |

| New Zealand | 4.0% |

The advancement of scientific nutrition and data-crafted performance improvement defines the USA compound horse feedstuff industry. Manufacturers still invest in research-formulated feeding regimens for competitive horse pursuits like racing, dressage, and eventing. Businesses use computer programs to deliver personalized feeding programs with up-to-date monitoring of horse welfare and performance.

Strong consumer interest in equine health and sustainability has led consumers to look for organic, non-GMO ingredient demand, and manufacturers have reformulated product portfolios accordingly. Strong infrastructure underlying equestrian recreation and competition provides a platform for steady growth, fueled by premium feed consumption and process technology for ingredients.

The compound horse feedstuff market shows a combination of tradition and sophisticated nutritional knowledge in the UK. Regulated foods and quality parameters provide best-of-class product availability, with added interest in gut health and fiber-rich content-based formulas. The interest in recreational riding has also created augmented demand, with herbal and probiotic-enriched products backed by natural food choices and a rising marketplace for similar products.

In the wake of climatic change and the triggered brand transition in grazing, producers have set eyes on making feed solutions to counteract seasonal gaps. The UK market is also dominated by veterinary guidance, and hence, research-based products are one of the brands' success factors.

The industry in France is a significant driver of compound feedstuff demand, and competitive show jumping and racing drive demand. Strong agricultural regulations in the country promote locally sourced ingredients, traceability, and green production.

Producers invest in protein-formulated feed for endurance activities as they are keen on high-performance feed. Manufacturers are moving towards functional additives, e.g., omega-3-enhanced feed enhancing joint health. Equine breeding schemes also drive growth as young horses demand special nutritional control. France's traditional horse culture, combined with firm regulatory dominance, drives constant growth.

Germany is characterized by tough animal welfare legislation and robust consumer expectations of feed production transparency. Producers focus on local raw material availability to keep up with sustainability trends, and regulatory compliance is a key hurdle.

Veterinarians and professional trainers lead feed selection, the latter influencing demand for scientifically formulated mixes that propel performance and recuperation. Care for horse digestive health has mounted, resulting in fiber-based and probiotic-supplemented feeds.

Italy is supported by a strongly organized equestrian tourist market and an increasing focus on performance dietetics. The Mediterranean climate prevalent in the country supports feed formulation, with an emphasis on water-enabling ingredients and trace minerals. Producers are incorporating traditional botanical ingredients like olive leaf and chamomile into feed mixtures to enhance digestive and immune wellness.

The growth of equine rehabilitation facilities has also stimulated demand for rehabilitation-targeted specialty nutrition. With Italian breeders placing a focus on quality rather than quantity, feed manufacturers customize their products to aid foals' development and growth, improving growth opportunities.

The South Korean industry has expanded greatly from government efforts encouraging horse racing, leisure horse riding, and horse riding therapy. The compound feedstuffs are supported by consumers' higher willingness to pay for the best quality of nutrition for competition and companion animals.

As local production of feedstuffs is limited, high-quality imports have an impact on the market, leading to demand for sophisticated products with elevated levels of amino acids and electrolytes. Growing interest in horse-assisted therapy has also influenced feed decision-making, prioritizing balanced diets to ensure temperament stability. South Korea's investments in horse breeding and horse training facility infrastructure ensure a healthy growth trajectory.

Japan is reputed to be disciplined in its method toward horse sports and equine care with a focus on high-accuracy dieting. The nation's interest in targeted feeding programs has driven the demand for professional-formulated compound feedstuffs designed for dual-purpose use of equine ranging from racetrack to therapy riding.

The limited presence of grassland in Japan has placed immense importance on supplementing feed, thereby enhancing the rate of penetration of fortified concentrate to a great extent. Incorporating seafood-derived products like seaweed-based additives became popular due to mineral content. Since the country values long equine life, products for aging horses are more in demand.

The horse feedstuff industry in China is expanding rapidly due to rising participation in horse sports and government-sponsored breeding schemes. Increasing disposable incomes among horse owners have encouraged demand for high-quality, performance feeds.

Foreign feed companies are keepers busy working with local suppliers to meet regulation requirements while continuing to provide quality. There is also a demand for high-energy foods, especially in sports such as polo and endurance racing. China's investment in its equestrian sector by constructing infrastructure also underpins the continued expansion of specialized equestrian feed products for various climatic zones.

Australian market expansion is driven by its robust domestic grain production and wealthy equestrian tradition. The diverse climate of the country requires region-specific formulation of feed, bridging nutritional deficiencies due to adverse weather conditions. Manufacturers have developed heat-stable vitamin stabilizers and moisture-stable packaging to preserve feed quality.

Increased demand for protein-enriched feeds for developing muscles and endurance, fuelled by the growing popularity of horse sports such as show jumping and racing, has spurred the industry. Australia's commitment to sustainable agriculture has also caused more organic and non-GMO ingredients to be used, leading to further market growth.

New Zealand's horse heritage and emphasis on nutritional naturality sustain its market. Horse husbandry through grass-feeding in the country shapes feed compounding, with farmers emphasizing supplementation rather than full meal substitution.

Demand for probiotic and organic-rich feed formulations has grown, reflecting consumer interest in overall equine health. Tight biosecurity controls in New Zealand steer local ingredient sourcing to nearby suppliers and environmentally responsible methods. Growth in endurance and eventing has fueled demand for performance feed, and this has propelled stable growth over the forecast period.

| Segment | Value Share (2025) |

|---|---|

| Pellets | 48% |

There are different segments in the compound horse feedstuff industry, such as pellets and crumbles/cubes. Pellets will contribute the largest share, estimated at 48.5% in 2025, and crumbles/cubes at 32.7%.

Horse owners often favor pellets because they are nutritionally balanced, easy to store, and digestible. A benefit of using pelleted feed in horses is that it gives them consistent nutrition in each mouthful and stops picky eating habits. Pellets are also less messy and have a longer shelf life, so they may prove less susceptible to spoilage than traditional grain-based feeds.

Knowledge of these differences has led some key leaders, such as Purina Mills and Cavalor, to develop specialized pelleted formulas to meet horses' specific needs. Others target performance horses for optimal energy and muscle support.

In contrast, others focus on senior horses or horses with metabolic diseases in the present, such as Equine Metabolic Syndrome (EMS) or Cushing's disease. In addition, the rising usage of fortified and medicated pellets, especially for equine health management, is also propelling the segment's growth.

Cubes/crumbles (32.7% industry share) have higher usage where exact high-fiber diets and slow-chewing feed options are required for horses. These are especially good for older horses or those with dental problems, as they are easier to chew and digest than whole grains or large pelleted feeds. Fiber-rich crumbles and cubes made by brands such as Triple Crown or Nutrena are great for endurance horses, seniors, or horses on the mend.

| Segment | Value Share (2025) |

|---|---|

| Cereal-based (By Ingredient Composition) | 52.1% |

Based on the composition of the ingredients used, the compound horse feedstuff market can be divided into organic cereals, which will have the largest share of 52.1% in 2025, and supplements, which will have a share of around 25.4%.

Horses mostly obtain sugar, energy, and fiber from organic cereals. Added grains can include oats, barley, and corn, as they are highly digestible and provide nutrients that are found naturally at a due proportion in the horse itself.

Foodstuff such as oats is a particularly palatable feedstuff that is softer and easier for a horse to chew. It is often included as a staple foodstuff in many equine feed formulations. Barley and corn are higher-survival-calorie crops that help with digestion/are processed.

This segment has witnessed substantial growth due to the increasing consumer inclination towards organic, non-GMO, and chemical-free feed. In response, companies like Purina Mills and Hygain have developed organic feed formulations emphasizing a more natural, preservative-free diet.

The demand for higher quality and purity in feed has never been higher, and horse owners are not afraid to ask for pesticide-free and organic options, as well as ethically sourced grains and other ingredients.

These products can be separated into the leading segment of the horse supplements with a 25.4% share, responsible for optimal horse health and performance as well as injury recovery. These contain various nutrients, including vitamins, minerals, amino acids, and probiotics, which target a range of equine health issues, including joint support, digestive health, immune function, and muscle development.

Specific brands, such as Kentucky Equine Research and Triple Crown, focus specifically on producing nutrition balancers and fortified additives targeted toward senior, performance, and special-needs horses.

Probiotics and prebiotics are often included in diets to promote a healthy microbial balance in the horse's gut, helping to prevent colic and other digestive conditions. Joint-supporting supplements, omega-3 fatty acids, and other ingredients that promise to help maintain mobility and create a less inflamed environment for an aging horse are also popular among owners.

The compound horse feedstuff market is a fusion of scientific development, performance-driven formulations, and region-based feeding practices. Industry leaders such as Purina, Cargill (Nutrena), ADM, and Triple Crown Feed, with a firm footing in research and development, maintain their competitive edge through synergetic supply chains and premium ingredient sourcing. These firms are into precision nutrition, gut health optimization, and condition-specific formulations for performance horses, breeding stock, and recreational horses.

With consumer awareness growing regarding feed efficiency, metabolic health, and the balance of gut microbiome, the industry is witnessing demands for low-starch, high-fiber, and fortified feed blends. Specialized equine nutrition brands differentiate themselves with targeted formulations, customized supplementation, and scientifically based performance claims that earn the loyalty of veterinarians, trainers, and competitive riders alike.

Besides strategic acquisitions, where the big agricultural corporations grow their equine feed portfolios through brand acquisitions and formulation enhancements, independent manufacturers remain in strong positions by promoting direct relationships with customers, agile innovation, and regionally adapted formulations.

Distribution dynamics formulate additional competition, with retail channels focused on brand building, consumer education, and value marketing, while professional channels emphasize clinical validation, performance data, and recommendations from authorities.

With rising demand for functional nutrition, sustainable sourcing, and specialty blends, the companies that can reciprocate scientific validation of those industries with high transparency in their premium ingredients and truly tailored feeding solutions will lead this changing industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Purina Animal Nutrition | 18-22% |

| Cargill | 15-19% |

| ADM | 12-16% |

| Triple Crown Feed | 8-12% |

| Martin Mills | 6-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Purina Animal Nutrition | Provides high-performance feeds designed for equine athletes, with gut health support as well as innovative amino acid formulations. |

| Cargill | Emphasizes research-driven equine nutrition, creating high-energy and specialty feeds for endurance and racing horses. |

| ADM | Manufactures premium equine feeds with a focus on fiber-based and controlled starch diets to avoid metabolic problems. |

| Triple Crown Feed | Excels in forage-based and beet pulp formulations, catering to digestion and energy efficiency requirements. |

| Martin Mills | Offers affordable, nutritionally complete equine feeds formulated for regional adaptation and wide industry acceptance. |

Key Company Insights

Purina Animal Nutrition (18-22%)

Key leader Purina offers proprietary feeds like the Ultium Competition feed, which was formulated to help horses build endurance and recover faster from exercise. The company's innovations don't stop there with gut-balancing supplements and tailor-made nutrition regimens.

Cargill (15-19%)

Cargill's Nutrena line remains a solid second, with science-formulated horse feeds like SafeChoice and ProForce focused on controlled starches and digestive care advantages.

ADM (12-16%)

ADM offers a line of high-fiber, low-glycemic feeds, meeting the increasing requirement for metabolically safe horse nutrition. The company blends biotin and yeast culture to enhance hoof health and digestion.

Triple Crown Feed (8-12%)

Triple Crown specializes in superior forage-based products, such as beet pulp mixtures, which maximize energy utilization while minimizing colic risk. Its emphasis on slow-digesting carbohydrates has solidified its position among competitive equestrian segments.

Martin Mills (6-10%)

Martin Mills is competitive in regional sales with value-for-money, nutritionally balanced horse feeds. The company competes based on localized feed adaptation and a strong retail network.

Other Key Players (30-40% Combined)

The segmentation is into Pellets, Crumbles/Cubes, and Powder/Mash.

The segmentation is into organic cereals, supplements, cakes/meals, and other products.

The segmentation is into Performance, Senior/Old, Professional, Mare & Foal, and Others.

The segmentation is into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The industry is expected to reach USD 6.9 billion in 2025.

The market is projected to grow to USD 10.04 billion by 2035.

The market is expected to grow at a CAGR of 3.8% from 2025 to 2035.

The Cereal-Based segment is among the most widely used in the market.

Key companies include Purina Animal Nutrition, Cargill, ADM, Triple Crown Feed, Martin Mills, Nutrena, Blue Seal Feeds, Tribute Equine Nutrition, and Buckeye Nutrition.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Ingredient, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Ingredient, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Ingredient, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Ingredient, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Ingredient, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Ingredient, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Ingredient, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Ingredient, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Ingredient, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Ingredient, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Ingredient, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Ingredient, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Ingredient, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Ingredient, 2018 to 2033

Table 57: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East & Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 60: Middle East & Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 61: Middle East & Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 62: Middle East & Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 63: Middle East & Africa Market Value (US$ Million) Forecast by Ingredient, 2018 to 2033

Table 64: Middle East & Africa Market Volume (MT) Forecast by Ingredient, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Ingredient, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Ingredient, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Ingredient, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Form, 2023 to 2033

Figure 22: Global Market Attractiveness by Ingredient, 2023 to 2033

Figure 23: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Ingredient, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Ingredient, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Ingredient, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Form, 2023 to 2033

Figure 46: North America Market Attractiveness by Ingredient, 2023 to 2033

Figure 47: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Ingredient, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Ingredient, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Ingredient, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Ingredient, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Ingredient, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Ingredient, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Ingredient, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 93: Europe Market Attractiveness by Form, 2023 to 2033

Figure 94: Europe Market Attractiveness by Ingredient, 2023 to 2033

Figure 95: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Ingredient, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Ingredient, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Ingredient, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Ingredient, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Ingredient, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Ingredient, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Ingredient, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Ingredient, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Ingredient, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Ingredient, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Ingredient, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Ingredient, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East & Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 170: Middle East & Africa Market Value (US$ Million) by Ingredient, 2023 to 2033

Figure 171: Middle East & Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 172: Middle East & Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East & Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 178: Middle East & Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 179: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 180: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 181: Middle East & Africa Market Value (US$ Million) Analysis by Ingredient, 2018 to 2033

Figure 182: Middle East & Africa Market Volume (MT) Analysis by Ingredient, 2018 to 2033

Figure 183: Middle East & Africa Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 184: Middle East & Africa Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 185: Middle East & Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 186: Middle East & Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 187: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 188: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness by Form, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness by Ingredient, 2023 to 2033

Figure 191: Middle East & Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compounds Market Size and Share Forecast Outlook 2025 to 2035

Compound Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Semiconductor Materials Market Growth - Trends & Forecast 2025 to 2035

Compound Feed Market Analysis by Ingredients, Form, Livestock and Region through 2035

Compounded Topical Drugs Market Analysis – Size, Share & Forecast 2024-2034

Compound Semiconductor Market Analysis – Growth & Forecast 2024-2034

Compounding Systems Market

Compounded Bioidentical Hormone Therapy Market

Wire Compounds and Cable Compounds Market Growth - Trends & Forecast 2025 to 2035

Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Lemon Compound Market Size and Share Forecast Outlook 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Orange Compound Market Size and Share Forecast Outlook 2025 to 2035

Lithium Compound Market Size and Share Forecast Outlook 2025 to 2035

Potting Compound Market Size and Share Forecast Outlook 2025 to 2035

Plastic Compounding Market Size, Growth, and Forecast 2025 to 2035

Purging Compounds Market

Platinum Compounds Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Global Bulk-Drug Compounding Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA