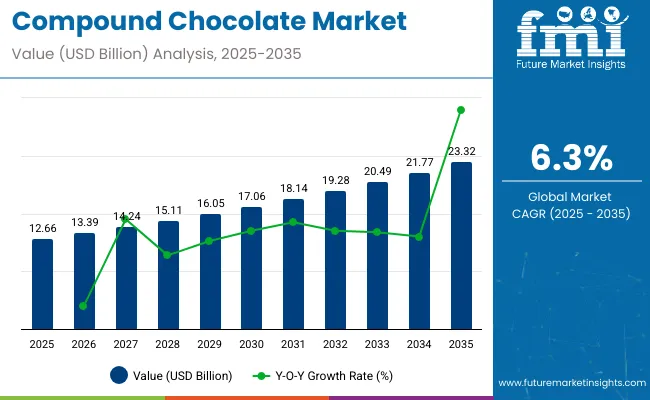

The global compound chocolate market is projected to grow from USD 12.66 billion in 2025 to USD 23.32 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% during the forecast period. This steady growth is fueled by rising demand for affordable and versatile chocolate alternatives, expanding confectionery and bakery sectors, and increasing consumer preference for innovative chocolate products worldwide.

Compound chocolate is a cost-effective alternative to traditional chocolate, made by replacing cocoa butter with vegetable fats such as palm oil. This substitution reduces production costs and provides benefits like improved melting properties and ease of handling during manufacturing, which are driving its adoption in various food products including candies, biscuits, ice creams, and beverages.

The growing popularity of confectionery and snack products across emerging economies, particularly in Asia-Pacific and Latin America, is creating significant opportunities for compound chocolate manufacturers. Urbanization, rising disposable incomes, and shifting consumer lifestyles are encouraging the consumption of sweet and indulgent foods, further boosting market demand.

Additionally, health-conscious innovations such as sugar-free, organic, and flavored compound chocolates are gaining traction among consumers seeking healthier indulgence options without compromising taste. Manufacturers are investing in product development to cater to these evolving preferences.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 12.66 Billion |

| Projected Global Industry Value (2035F) | USD 23.32 Billion |

| Value-based CAGR (2025 to 2035) | 6.3% |

Europe and North America remain important markets due to their well-established confectionery industries and consumer acceptance of diverse chocolate formats. However, the Asia-Pacific region is expected to witness the fastest growth, driven by expanding middle-class populations and increasing penetration of western-style confectionery products.

In a 2024 industry interview, Barry Glazier, Senior Chocolate Fellow at Mars Inc., remarked, “Great chocolate comes down to selecting the finest ingredients and combining them at just the right ratio. With Galaxy, we're able to make a silky‑smooth chocolate that has a richness of flavour by using a special cooking process that brings out the underlying caramel essence along with the welcoming comfort of cooked milk.

”His insight highlights how ingredient quality and process optimization drive sensory excellence in both compound and traditional chocolate development. With continuous product innovation, expanding food applications, and growing consumer demand, the compound chocolate market is poised for sustained growth through 2035.

While some markets are well-established with a strong preference for premium and artisanal chocolates, others are experiencing rapid growth driven by changing lifestyles, urbanization, and rising disposable incomes. In mature regions like Europe and North America, consumers seek high-quality, ethically sourced, and health-conscious chocolate options, with seasonal gifting contributing significantly to sales. Meanwhile, in the Asia Pacific region, chocolate is gaining traction as an everyday indulgence, supported by increasing retail access and cultural acceptance.

Per capita consumption of compound chocolate varies widely across regions, influenced by industrial use, consumer preferences, and affordability. Unlike traditional couverture chocolate, compound chocolate is primarily used in mass-market products due to its lower cost and ease of handling. It is popular in regions where confectionery and bakery industries are expanding rapidly. While not commonly consumed directly, compound chocolate makes up a significant portion of the chocolate used in snacks, coated products, and baked goods.

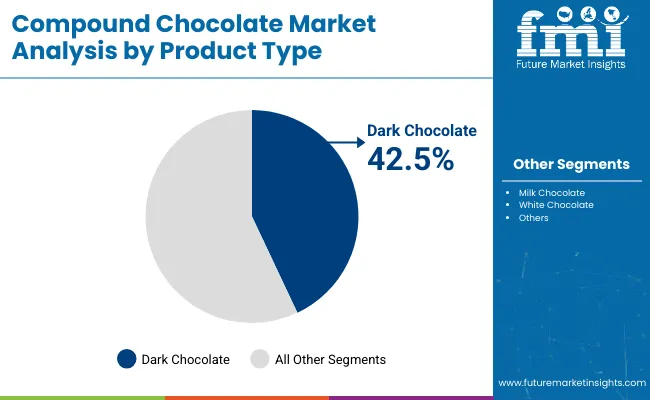

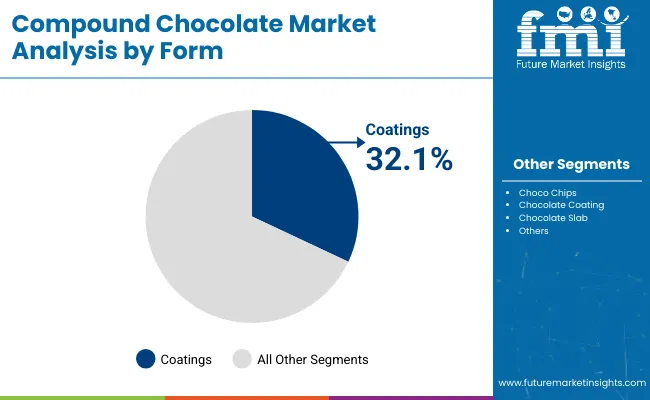

Dark compound chocolate leads with a 42.5% market share in 2025, driven by its antioxidant benefits and sensory appeal. Coatings dominate the form segment at 32.1%, favored for versatility, ease of use, and broad application across confectionery and frozen desserts.

The dark compound chocolate segment is projected to capture 42.5% of the Compound Chocolate Market by 2025. Consumers are increasingly drawn to dark chocolate for its rich aesthetic appeal, complex flavor profile, and health benefits-particularly its high antioxidant content and potential to regulate blood pressure.

Dark compound chocolate offers textural advantages and pairs well with diverse ingredients, enhancing premium confectionery products. Its growing popularity is fueled by health-conscious consumers seeking indulgence with functional benefits. Manufacturers invest in improving cocoa content and flavor consistency to meet evolving preferences.

Regions like North America and Europe, with established dark chocolate consumption patterns, drive segment growth, while emerging markets show rising adoption due to increased awareness of health benefits. Dark compound chocolate remains a key growth driver within the broader compound chocolate category.

Coatings hold a 32.1% share in the compound chocolate market by 2025, dominating due to their adaptability and ease of use. Unlike couverture chocolate, compound coatings do not require tempering, making them suitable for a wide temperature range and varied production processes.

The ability to incorporate diverse fats allows compound coatings to achieve multiple textures, from crisp to creamy, fitting applications in baked goods, ice cream sticks, and confectionery enrobing. The lack of ingredient restrictions enables flavor innovation, expanding product development opportunities.

This versatility supports broad adoption by manufacturers seeking cost-effective, reliable coatings without compromising taste or appearance. As convenience and product variety remain priorities, compound chocolate coatings will continue to lead form segments in the market.

Both Europe and North America are seeing significant increases in demand for fine-tuning cocoa. Gourmet chocolates use premium and ultra-high-end beans. Particularly in nations like the US, UK, China, India, Netherlands, Germany and Switzerland regular premium chocolates are made with regular low-fine beans. Health trends and the demand for more upscale goods are the main drivers of this development. The market is expanding overall thanks to the premium cocoa markets sustainability and single-origin certification.

Manufacturers are responding to the growing demand by launching premium and single-origin chocolate lines. Additionally, they are bolstering regional economies. These tactics are assisting brands in increasing their profit margins and developing a more favorable reputation. Nestle for example incorporated the single-origin specific variety Arriba cocoa beans into its new chocolate molding and packing line in Ecuador enabling the company to produce value-added chocolates for both domestic and export markets.

Plant-based and vegan diets are becoming more and more popular which is another important factor. Compound chocolate made with non-dairy ingredients is in greater demand as consumers grow more health conscious. Manufacturers are being encouraged by this change to develop and broaden their product offerings in order to serve this growing market niche. Ideally positioned to take advantage of this demand is compound chocolate which can be produced without dairy products while still having a taste and texture similar to traditional chocolate.

In order to appeal to ethical and health-conscious consumers manufacturers are putting more effort into creating vegan-friendly recipes which could increase the market potential for compound chocolate in both developed and emerging nations.

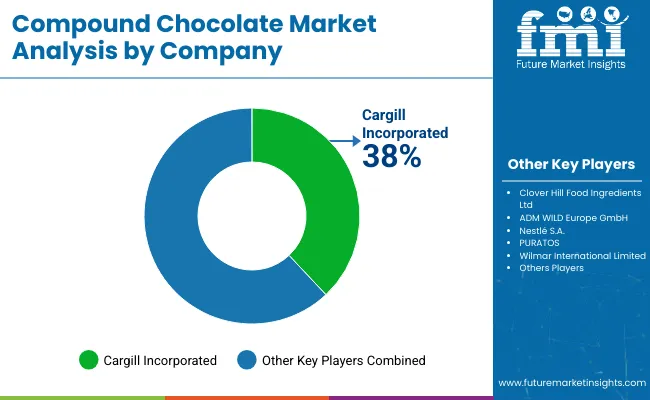

Tier 1 companies includes industry leaders acquiring a 30% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 10%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies includes mostly of small-scale businesses serving niche economies and operating at the local presence having a market share of 60%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

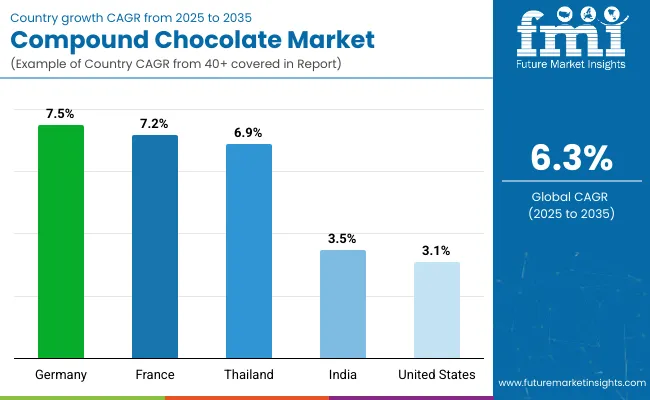

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, France and Thailand come under the exhibit of high consumption, recording CAGRs of 3.1%, 7.2% and 6.9%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 3.1% |

| France | 7.2% |

| Thailand | 6.9% |

It is anticipated that USA’s demand for compound chocolate will rise in tandem with the growing demand for high-end chocolate and confections. Sugar-free organic and dark chocolate consumption is still being driven by a growing interest in leading healthier lives. Compound chocolate is the perfect option for food manufacturers in a variety of industries including bakery confectionery ice cream and frozen desserts due to its advantageous price when compared to pure cocoa-based chocolates and its capacity to solidify without tempering.

A significant portion of the USA compound chocolate market is made up of milk chocolate which is still in high demand along with other varieties. For the sourcing and use of cocoa butter equivalents or substitutes in confections businesses are developing sustainable solutions.

The demand for chocolate products is greatly increased by the large number of foreign visitors to Thailand. The market for compound chocolate is growing as a result of tourists frequently buying chocolates as presents or for their own consumption. Thai chocolates are a popular souvenir because of their distinctive flavors and eye-catching packaging. In Thailand compound chocolate is heavily promoted by the extensive network of duty-free stores and retail outlets.

These retailers are primarily found in Bangkok Phuket and Pattaya. Compound chocolate is more visible and easily accessible thanks to these retail spaces strategic placement in malls airports and other busy tourist destinations. Due to its strategic placement tourists will frequently come into contact with these goods which boosts sales and solidifies Thailand’s standing as a major market for producers of compound chocolate.

In the market for compound chocolate France is anticipated to hold the largest market share accounting for more than 24% of demand sales. Compound chocolate sales in France are expected to present a huge opportunity over the next ten years. To meet the rising demand for these food items European chocolate producers either process cocoa beans or purchase semi-finished goods from processors.

There are many different companies fighting for market share in the dynamic and competitive compound chocolate market. By implementing strategic plans like partnerships mergers acquisitions and political backing these players are attempting to establish their dominance. To cater to the large population in various regions the companies are concentrating on developing their product line.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 12.66 billion |

| Projected Market Size (2035) | USD 23.32 billion |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and metric tons for volume |

| Product Types Analyzed (Segment 1) | Dark Chocolate, Milk Chocolate, White Chocolate |

| Forms Analyzed (Segment 2) | Choco Chips, Chocolate Coating, Chocolate Slab |

| Applications Analyzed (Segment 3) | Bakery and Confectionery, Ice Cream and Frozen Desserts, Chocolate Beverages, Snacks, Sauces and Spreads |

| Regions Covered | North America; Europe; Middle East & Africa; ASEAN; South Asia; Asia; New Zealand; Australia |

| Countries Covered | United States, Canada, Mexico, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, New Zealand, UAE, South Africa |

| Key Players Influencing the Market | Clover Hill Food Ingredients Ltd, ADM WILD Europe GmbH, Cargill Incorporated, Nestlé S.A., PURATOS, Wilmar International Limited, INFORUM Group, Barry Callebaut, Bühler AG, Blommer Chocolate Company |

| Additional Attributes | Dollar sales, share by product type, form, application, region, consumer trends, growth drivers, competitive landscape, innovations in fats & coatings, regulatory shifts, pricing trends, new markets, key buyer segments, and supply chain dynamics. |

By product type, industry has been categorized into Dark Chocolate, Milk Chocolate and White Chocolate

By form industry has been categorized into Choco Chips, Chocolate Coating and Chocolate Slab

By function type industry has been categorized into Bakery and Confectionery, Ice Cream and Frozen Desserts, Chocolate Beverages, Snacks and Sauces and Spreads

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 6.3% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 23.32 Billion.

Growing demand of veganism is increasing demand for Compound Chocolate.

Europe is expected to dominate the global consumption.

Some of the key players in manufacturing include Clover Hill Food Ingredients Ltd, INFORUM Group, Buhler AG and more.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 6: Global Market Volume (MT) Forecast by Form, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 8: Global Market Volume (MT) Forecast by Application, 2017 to 2032

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 12: North America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 14: North America Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 16: North America Market Volume (MT) Forecast by Form, 2017 to 2032

Table 17: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 18: North America Market Volume (MT) Forecast by Application, 2017 to 2032

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 22: Latin America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 26: Latin America Market Volume (MT) Forecast by Form, 2017 to 2032

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 28: Latin America Market Volume (MT) Forecast by Application, 2017 to 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: Europe Market Volume (MT) Forecast by Country, 2017 to 2032

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 34: Europe Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 35: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 36: Europe Market Volume (MT) Forecast by Form, 2017 to 2032

Table 37: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 38: Europe Market Volume (MT) Forecast by Application, 2017 to 2032

Table 39: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 40: Europe Market Volume (MT) Forecast by Distribution Channel, 2017 to 2032

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: East Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 43: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 44: East Asia Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 45: East Asia Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 46: East Asia Market Volume (MT) Forecast by Form, 2017 to 2032

Table 47: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 48: East Asia Market Volume (MT) Forecast by Application, 2017 to 2032

Table 49: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 50: East Asia Market Volume (MT) Forecast by Distribution Channel, 2017 to 2032

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 52: South Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 53: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 54: South Asia Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 55: South Asia Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 56: South Asia Market Volume (MT) Forecast by Form, 2017 to 2032

Table 57: South Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 58: South Asia Market Volume (MT) Forecast by Application, 2017 to 2032

Table 59: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 60: South Asia Market Volume (MT) Forecast by Distribution Channel, 2017 to 2032

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 62: Oceania Market Volume (MT) Forecast by Country, 2017 to 2032

Table 63: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 64: Oceania Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 65: Oceania Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 66: Oceania Market Volume (MT) Forecast by Form, 2017 to 2032

Table 67: Oceania Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 68: Oceania Market Volume (MT) Forecast by Application, 2017 to 2032

Table 69: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 70: Oceania Market Volume (MT) Forecast by Distribution Channel, 2017 to 2032

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 72: MEA Market Volume (MT) Forecast by Country, 2017 to 2032

Table 73: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 74: MEA Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 75: MEA Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 76: MEA Market Volume (MT) Forecast by Form, 2017 to 2032

Table 77: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 78: MEA Market Volume (MT) Forecast by Application, 2017 to 2032

Table 79: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 80: MEA Market Volume (MT) Forecast by Distribution Channel, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Form, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 5: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 7: Global Market Volume (MT) Analysis by Region, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 15: Global Market Volume (MT) Analysis by Form, 2017 to 2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 19: Global Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2017 to 2032

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 26: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 27: Global Market Attractiveness by Form, 2022 to 2032

Figure 28: Global Market Attractiveness by Application, 2022 to 2032

Figure 29: Global Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 30: Global Market Attractiveness by Region, 2022 to 2032

Figure 31: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 32: North America Market Value (US$ Million) by Form, 2022 to 2032

Figure 33: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 35: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 37: North America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 45: North America Market Volume (MT) Analysis by Form, 2017 to 2032

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 49: North America Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2017 to 2032

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 56: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 57: North America Market Attractiveness by Form, 2022 to 2032

Figure 58: North America Market Attractiveness by Application, 2022 to 2032

Figure 59: North America Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 60: North America Market Attractiveness by Country, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 62: Latin America Market Value (US$ Million) by Form, 2022 to 2032

Figure 63: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 75: Latin America Market Volume (MT) Analysis by Form, 2017 to 2032

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 79: Latin America Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2017 to 2032

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 86: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 87: Latin America Market Attractiveness by Form, 2022 to 2032

Figure 88: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 90: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 91: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 92: Europe Market Value (US$ Million) by Form, 2022 to 2032

Figure 93: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 94: Europe Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 95: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 97: Europe Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 101: Europe Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 104: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 105: Europe Market Volume (MT) Analysis by Form, 2017 to 2032

Figure 106: Europe Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 108: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 109: Europe Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 113: Europe Market Volume (MT) Analysis by Distribution Channel, 2017 to 2032

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 116: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 117: Europe Market Attractiveness by Form, 2022 to 2032

Figure 118: Europe Market Attractiveness by Application, 2022 to 2032

Figure 119: Europe Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 120: Europe Market Attractiveness by Country, 2022 to 2032

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 122: East Asia Market Value (US$ Million) by Form, 2022 to 2032

Figure 123: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 124: East Asia Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 125: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 130: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 131: East Asia Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 134: East Asia Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 135: East Asia Market Volume (MT) Analysis by Form, 2017 to 2032

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 138: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 139: East Asia Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 142: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 143: East Asia Market Volume (MT) Analysis by Distribution Channel, 2017 to 2032

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 146: East Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 147: East Asia Market Attractiveness by Form, 2022 to 2032

Figure 148: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 149: East Asia Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 150: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 151: South Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 152: South Asia Market Value (US$ Million) by Form, 2022 to 2032

Figure 153: South Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 154: South Asia Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 155: South Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 160: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 161: South Asia Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 164: South Asia Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 165: South Asia Market Volume (MT) Analysis by Form, 2017 to 2032

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 168: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 169: South Asia Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 170: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 172: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 173: South Asia Market Volume (MT) Analysis by Distribution Channel, 2017 to 2032

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 176: South Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 177: South Asia Market Attractiveness by Form, 2022 to 2032

Figure 178: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 179: South Asia Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 180: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 181: Oceania Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 182: Oceania Market Value (US$ Million) by Form, 2022 to 2032

Figure 183: Oceania Market Value (US$ Million) by Application, 2022 to 2032

Figure 184: Oceania Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 185: Oceania Market Value (US$ Million) by Country, 2022 to 2032

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 190: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 191: Oceania Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 194: Oceania Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 195: Oceania Market Volume (MT) Analysis by Form, 2017 to 2032

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 198: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 199: Oceania Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 202: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 203: Oceania Market Volume (MT) Analysis by Distribution Channel, 2017 to 2032

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 206: Oceania Market Attractiveness by Product Type, 2022 to 2032

Figure 207: Oceania Market Attractiveness by Form, 2022 to 2032

Figure 208: Oceania Market Attractiveness by Application, 2022 to 2032

Figure 209: Oceania Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 210: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 211: MEA Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 212: MEA Market Value (US$ Million) by Form, 2022 to 2032

Figure 213: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 214: MEA Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 215: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 217: MEA Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 220: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 221: MEA Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 222: MEA Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 224: MEA Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 225: MEA Market Volume (MT) Analysis by Form, 2017 to 2032

Figure 226: MEA Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 228: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 229: MEA Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 230: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 232: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 233: MEA Market Volume (MT) Analysis by Distribution Channel, 2017 to 2032

Figure 234: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 236: MEA Market Attractiveness by Product Type, 2022 to 2032

Figure 237: MEA Market Attractiveness by Form, 2022 to 2032

Figure 238: MEA Market Attractiveness by Application, 2022 to 2032

Figure 239: MEA Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 240: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Compounds Market Size and Share Forecast Outlook 2025 to 2035

Compound Semiconductor Materials Market Growth - Trends & Forecast 2025 to 2035

Compound Horse Feedstuff Market Analysis by Feed Type, Horse Activity, and Ingredient Composition Through 2035

Compound Feed Market Analysis by Ingredients, Form, Livestock and Region through 2035

Compounded Topical Drugs Market Analysis – Size, Share & Forecast 2024-2034

Compound Semiconductor Market Analysis – Growth & Forecast 2024-2034

Compounding Systems Market

Compounded Bioidentical Hormone Therapy Market

Wire Compounds and Cable Compounds Market Growth - Trends & Forecast 2025 to 2035

Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Lemon Compound Market Size and Share Forecast Outlook 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Orange Compound Market Size and Share Forecast Outlook 2025 to 2035

Potting Compound Market Size and Share Forecast Outlook 2025 to 2035

Plastic Compounding Market Size, Growth, and Forecast 2025 to 2035

Lithium Compound Market Growth – Trends & Forecast 2024-2034

Purging Compounds Market

Platinum Compounds Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA