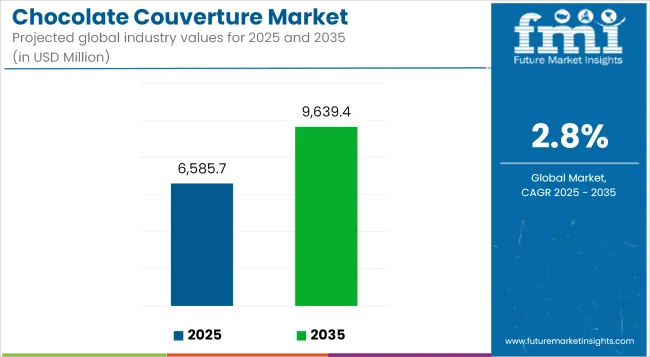

The chocolate couverture market is anticipated to reach USD 9.64 billion by 2035, rising from USD 6.59 billion in 2025, with growth unfolding at a CAGR of 2.8% over the decade. This steady momentum is underpinned by the expanding footprint of premium chocolate across both professional kitchens and home baking segments. Couverture’s high cocoa butter content and exceptional workability continue to make it the gold standard for chefs and chocolatiers seeking refined texture and gloss in molded, dipped, and coated applications.

Demand has been further bolstered by product innovation within premium chocolate formats, where couverture remains a foundational ingredient across both industrial and craft chocolate production.

Market momentum is being shaped by the growing premiumization trend in desserts and snacks, especially within gourmet bakeries and confectioners. Demand for high fluidity chocolate with higher cocoa butter content has been prioritized for coating and enrobing functions. However, growth is being modestly restrained by raw material price volatility, especially for cocoa liquor and butter, alongside increasing scrutiny over sustainable sourcing.

The market is also witnessing clear segmentation across product types-dark, milk, and white couverture-with dark chocolate seeing the highest traction owing to perceived health benefits and lower sugar content. Manufacturers are re-engineering their formulations to accommodate clean-label, organic, and single-origin preferences to secure differentiation in saturated retail and B2B channels.

| Attributes | Description |

|---|---|

| Estimated Global Chocolate Couverture Industry Size (2025E) | USD 6585.7 million |

| Projected Global Chocolate Couverture Industry Value (2035F) | USD 9639.4 million |

| Value-based CAGR (2025 to 2035) | 2.8% |

Over the coming decade, expansion is expected to concentrate within emerging artisan chocolatiers, premium foodservice chains, and plant-based applications. By 2025, dark chocolate couverture is estimated to comprise over 42% of total revenues, a share that will likely remain dominant through 2035 due to its compatibility with diverse culinary applications.

Couverture blocks, commanding 39.7% market share in 2025, are projected to retain their edge due to their process versatility in melting, tempering, and remolding. The outlook favors stable growth, underpinned by functional innovation and demand from patisserie, hospitality, and specialty food manufacturers across North America and Europe.

Foodservice applications are projected to hold 28.9% of the chocolate couverture market share in 2025, driven by sustained expansion in artisan bakeries, dessert cafés, and hotel patisserie chains. This segment plays a strategic role in bridging the industrial and artisanal divide, offering chefs and culinary specialists a premium medium to develop gourmet experiences.

From plated desserts to filled bonbons and drizzled pastries, couverture’s superior viscosity and cocoa butter content offer critical functional value. Regulatory efforts like the EU’s Cocoa and Chocolate Products Directive 2000/36/EC define couverture requirements precisely, fostering trust and compliance within European professional kitchens.

Operators such as Fauchon Paris and Conditorei Coppenrath & Wiese (Germany) have expanded usage of origin-specific couverture to align with luxury dessert trends. This segment is further evolving with demand for vegan and allergen-free offerings, prompting partnerships with suppliers like Valrhona and Republica del Cacao for specialty couverture lines.

As premium dining rebounds post-COVID, particularly in tourism-linked regions, growth will be anchored in high-margin plated formats and culinary-led storytelling. Strategic sourcing, origin traceability, and chef collaborations will shape purchasing decisions through 2035. As a result, foodservice operators will remain a disproportionately influential customer base despite relatively moderate volume uptake.

Retail channels are expected to capture 22.1% of global chocolate couverture revenues in 2025, gradually increasing with rising do-it-yourself (DIY) culinary culture and premium in-home consumption. Within this segment, private labels are gaining market share through focused SKU development in couverture blocks, callets, and small-batch discs for baking and dessert decoration.

Retail giants like Carrefour, Aldi Süd, and E.Leclerc have introduced premium couverture lines featuring UTZ/Rainforest Alliance-certified cocoa, targeting ethically conscious bakers and consumers. These offerings now compete directly with heritage brands like Callebaut or Lindt under consumer-grade couverture SKUs.

Regulatory alignment with labeling norms, such as the USA FDA’s Standard of Identity for Chocolate (21 CFR §163), has empowered new entrants to market couverture-based SKUs as functional and high-end. Clean-label reformulation, sustainable cocoa sourcing, and single-origin positioning are becoming standard features across packaging to differentiate within mature grocery environments.

Notably, baking influencers and recipe content from platforms like Tastemade and Bon Appétit have also driven interest in home use of professional-grade couverture. Between 2025 and 2035, continued value growth will come from hybrid packs targeting occasion-based baking, kids’ confectionery workshops, and home gourmet gifting kits.

Rise of Health-Conscious Indulgence: The Demand for Wellness-Focused Chocolate

The increasing demand for more active alternatives, in the way that sugar-free, natural, and dark chocolates, is forceful stock exchange for couverture chocolate, that is frequently used in high-end bakery that caters to well-being-alert consumers.

Scharffen Berger is famous for allure rich, dark chocolate that focuses on transfering premium, antioxidant-rich alternatives. Their Scharffen Berger 70% Cacao dark dark is a perfect example, dream up accompanying excellent cocoa to entice fitness-conscious purchasers pursuing a more healthful indulgence.

With a obligation to sustainability and excellent factors, Scharffen Berger ensures that allure produce align accompanying the increasing wellbeing trend in the burnished color manufacturing.

Valrhona is legendary for its finest dark sugary food, like the Valrhona 70% Araguani dark sugary food. Known for its rich dark content and slightest sugar, this burnished color is a favorite with buyers looking for more healthful luxury.

Valrhona's obligation to premium ingredients and righteous sourcing, containing its direct participations accompanying dark farmers, create it a favorite choice for those pursuing both indulgence and sustainability in their dark.

Sustainability and Ethical Sourcing

Consumers are increasingly choosing brands that offer sustainably sourced, fair-profession, and fairly caused couverture chocolate, providing to display progress.Barry Callebaut AG: Barry Callebaut is a manager in the chocolate manufacturing, popular for allure strong obligation to sustainability.

Through allure Forever Chocolate program, the party aims to make tenable dark the standard. This program addresses key issues like clear-cutting, child labor, and want in dark cultivation communities. Barry Callebaut focuses on righteous sourcing, active straightforwardly with ranchers by way of drives like Cocoa Horizons, which helps increase farmers' living environments and boosts the kind of cocoa result.

Lindt & Sprünglindt has captured important steps toward sustainability with their Lindt & Sprüngli Farming Program. This push supports the unending sustainability of burnished color farming by guaranteeing producers command a price of fairly, utilizing tenable cultivation practices, and advancing social and material trustworthiness.

Lindt again works accompanying confirmation programs like Fairtrade and UTZ Certified, guaranteeing that their cocoa is garnered in an righteous and mature style.

Single-Origin and Bean-to-Bar Products

The current toward distinct-inception and bean-to-bar chocolates persists to evolve, accompanying couverture burnished color makers putting on premium, identifiable burnished color beginnings that offer singular flavors and characteristics.

Von Geusau is actually popular for allure grain-to-bar chocolates. However, they usually offer production like Von Geusau 75% Dark Chocolate (Single Origin) and additional alternatives.They undertake using sole-inception dark, culled straightforwardly from farms, to ensure the obvious flavors of the beans are emphasize. Their assurance to feature and traceability create them a premium choice for dark suitors.

ICAM is a famous brand that trains in sole-origin couverture burnished color, cautiously selecting burnished color beans from particular domains to create different flavor descriptions. By sourcing high-quality burnished color from domains like Venezuela, Ecuador, and Peru, ICAM brings out the singular traits of each inception.

Their crop are highly popular by connoisseurs and chefs for their premium value and regular flavor, making ruling class a standard choice in the professional chocolate-making manufacturing.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 2.8% |

| H2(2024 to 2034) | 3.4% |

| H1(2025 to 2035) | 3.4% |

| H2(2025 to 2035) | 4.0% |

The Chocolate Couverture market is expected to grow steadily with notable half-yearly compound annual growth rates (CAGR). From 2025 to 2035, H1 shows a growth rate of 2.8%, while H2 is slightly higher at 3.1%. Moving to the 2025 to 2035 period, H1 is projected to grow at 3.4%, indicating a positive trend. In H2 growth for the same period is slightly higher at 4.0%.

The chocolate couverture market is governed by a join of global officers, local players, and concentration brands, each donating to the industry's overall development. Tier 1 associations, holding about 30% of the share, include Barry Callebaut AG, Lindt & Sprüngli, Valrhona, and Max Felchlin AG. These brands are widely acknowledged for their big production, thorough allocation networks, and strong closeness in two together B2B and B2C segments.

Barry Callebaut, exemplification, equipment couverture chocolate to big cuisine manufacturers, while Lindt and Valrhona focus on premium burnished color merchandise favored by phyllo chefs and chocolatiers general. Their dominance is compelled by powerful supply chains, innovation in sugary food formulations, and a traditional global honor.

Tier 2 performers, accounting for 50% of the market, involve brands like ICAM, Guittard, Cocoa Processing Company Ltd. (Golden Tree), and Chocolats Marionnettes. These companies generally pamper regional industry, contribution prime couverture chocolate accompanying apparent flavor profiles.

Many intervening-judge players devote effort to something tenable sourcing and organic dark result, making them standard between ethical shoppers. Tier 3 brands, to a degree Scharffen Berger, Struben, and Von Geusau, represent the remaining 20% of the market, specializing in artisanal and limited-array couverture chocolates.

These brands stress creativity, unique burnished color inceptions, and high-quality pieces, helping to gourmet chocolatiers and alcove shoppers. The combined exertions of these levels ensure a various and aggressive couverture chocolate display, gathering various services weaknesses and industry needs.

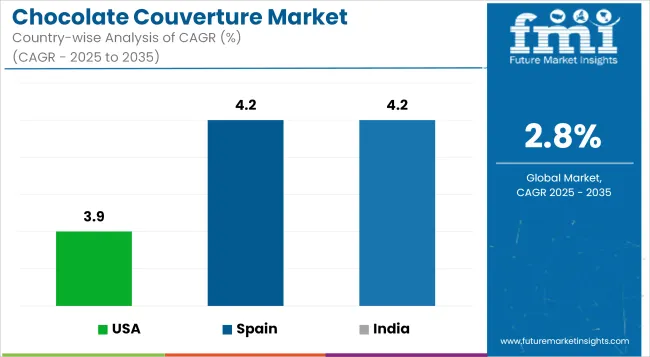

| Country | CAGR,2025 to 2035 |

|---|---|

| USA | 3.9% |

| Spain | 4.2% |

| India | 4.2% |

USA Chocolate Couverture Market: A Blend of Luxury and Sustainability

The USA sugary food couverture advertise is expanding at a CAGR of 3.9%, compelled by climbing demand for premium sugary food, artisanal confections, and excellent blistering elements. Consumers increasingly favor couverture dark for allure superior cocoa fat content, smooth feeling, and rich flavor, feeding growth in the cooking business where baked goods are produced, bread, and gourmand dessert commerces.

Regulatory principles set for one FDA mandate a minimum of 31% burnished color fat for couverture, guaranteeing product condition. Sustainability is more a important focus, with bigger parties adopting Fair Trade-authorized cocoa and moral sourcing practices. The market is further situated the growing number of bean-to-bar brands and artisanal chocolatiers helping to customers pursuing high-quality, fairly created sugary food.

Spain’s chocolate couverture retail is growing firmly, accompanying a CAGR of 4.2%, compelled by increasing advantageous position for those selling for premium and first-rate sugary food, particularly in cooking business where baked goods are produced, bakery, and knows about desserts.

The country’s forceful neighborliness and foodservice subdivision further boosts demand, as chocolatiers and pastry chefs favor couverture for allure superior pattern and flavor. Trends such as basic, fair-work, and alone-origin chocolates are acquire recognition, along with the climbing choice for dark and plant-located couverture options.

However, challenges like fluctuating dark prices and supply chain disruptions impact result costs. Additionally, government drives advancing tenable cocoa sourcing and the growth of buying podiums are creating new moment for retail progress.

India's dark couverture advertise is expanding at a CAGR of 4.2% from 2025 to 2035, compelled by growing demand for premium and artisanal sugary food. Rising thin income and developing services advantages are sustaining this growth.

The surge in home blistering and artisanal chocolatiers has further pushed the need for superior couverture dark. Online platforms and concentration suppliers are making couverture burnished color more approachable. Additionally, the increasing preference for dark burnished color, compelled by strength-alert consumers, has surpassed to a rise standard for extreme-dark and sugar-free couverture variations in India.

The meal duty manufacturing, including bakeries, cafés, and pie chains, is further providing to display growth as they more and more use couverture burnished color for first-rate amount. With growing knowledge about dark sourcing and righteous result, sustainability trends are inclined influence future retail growths.

The chocolate couverture display is highly competing, accompanying major performers like Barry Callebaut, Cargill Cocoa & Chocolate, Lindt & Sprüngli, Puratos Group, Valrhona, and Belcolade superior the industry.

These guests devote effort to something high-quality burnished color sourcing, leading processing methods, and creative commodity offerings to pamper the increasing demand from the confectionery, cooking business where baked goods are produced, and premium sugary food sectors.

The market is observing growing adoption of couverture sugary food in artisanal and mechanical applications on account of allure superior cocoa butter content, that reinforces texture and flavor. Additionally, sustainability pushs in the way that certified dark sourcing, moral trade practices, and environmental wrap are becoming critical differentiators for brands, as customers inquire ethically caused chocolate.

Competition is intensifying with new entrants and local manufacturers extending their presence by contribution natural, single-inception, and concentration couverture chocolates. The rise of plant-located and plant-eating chocolates has further driven change, accompanying companies beginning dairy-free alternatives utilizing elements like oat milk, almond milk, and coconut-located dark butter substitutes.

Technological progresses in burnished color alter, tempering, and flavor augmentation are more helping brands change their contributions. In addition, strategic alliances, mergers, and procurements are common plannings selected by key players to invigorate their supply chain and display reach.

The increasing influence of e-commerce and direct-to-services (DTC) channels is permissive brands to engage accompanying a more off-course audience, while made-to-order couverture answers for artisanal chocolatiers and pastry chefs are win friction.

The global industry is estimated at a value of USD 6585.7 million in 2025.

Barry Callebaut AG, Cocoa Processing Company Ltd., Scharffen Berger, Struben Couverture Chocolate Factory, ICAM, Chocolats Marionnettes, Von Geusau, Lindt, and Valrhona, Max Felchlin AG, Guittard are some of the leading players in the prominent chocolate couverture market.

The global chocolate couverture market is expected to be dominated by Asia Pacific excluding Japan over the forecast period 2025 to 2035.

The industry is projected to grow at a forecast CAGR 2.8% from 2025 to 2035.

The North America, Latin America, Europe, East Asia, Oceania, Middle east and Africa are the prominent countries driving the demand for Chocolate Couverate Industry.

The global demand for copovidone Industry is forecasted to surpass USD 9639.4 million by the year 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chocolate Powdered Drinks Market Forecast and Outlook 2025 to 2035

Chocolate Bar Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Processing Equipment Market Size, Growth, and Forecast 2025 to 2035

Chocolate Wrapping Films Market from 2025 to 2035

Chocolate Confectionery Market Analysis by Product, Type, Distribution Channel, and Region Through 2035

Chocolate Flavors Market Analysis by Product Type, and Application Through 2035

Chocolate Inclusions and Decorations Market Analysis by Type, End Use, and Region Through 2035

Industry Share Analysis for Chocolate Bar Packaging Companies

Chocolate Syrup Market

Non-Chocolate Candy Market

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sugarless Chocolate Market

Industrial Chocolate Market Analysis by Product, Application, Type, and Region through 2035

Analysis and Growth Projections for Low-calorie Chocolate Business

Sugar-Free White Chocolate Market Trends - Demand & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA