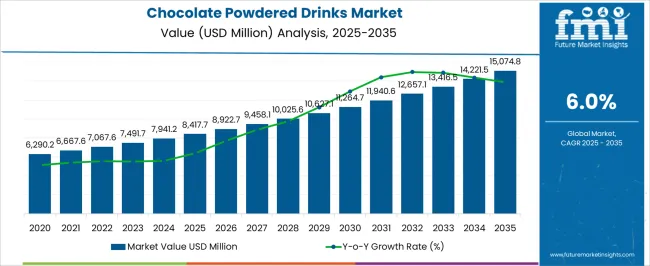

The chocolate powdered drinks market is valued at USD 8,417.7 million in 2025 and is projected to reach USD 15,074.8 million by 2035, recording a CAGR of 6.0%. This growth trajectory highlights the category’s ability to balance indulgence with convenience, catering to diverse consumer segments worldwide. Demand is driven by the increasing appeal of ready-to-mix formats, which allow for quick preparation while maintaining rich chocolate flavor profiles. The convenience factor resonates strongly with busy lifestyles, particularly in urban markets, where consumers seek both energy-boosting and comfort-oriented beverages. In addition, the category benefits from strong brand loyalty, with global players and regional brands consistently innovating to retain consumer attention and differentiate in a crowded marketplace.

Formulation innovation is central to the industry’s expansion, as manufacturers experiment with organic, fortified, and low-sugar variants to meet the evolving demands of health-conscious consumers. The integration of functional benefits such as added vitamins, minerals, and protein content has broadened the consumer base, extending appeal beyond indulgence into the health and wellness segment. This trend is particularly evident in developed economies, where shoppers are willing to pay premium prices for fortified and natural product claims. Packaging advancements, including single-serve sachets and resealable containers, have further expanded reach by enhancing portability and shelf stability, which is especially important for retailers operating in high-volume distribution networks.

Emerging markets are playing a pivotal role in driving category growth, supported by rising disposable incomes and increasingly westernized dietary preferences. Countries in Asia-Pacific, Latin America, and parts of Africa have witnessed the rapid adoption of chocolate powdered drinks as aspirational products, with multinational brands investing heavily in regional production facilities and distribution networks to capture demand. Meanwhile, established markets in North America and Europe remain steady contributors, with growth centered on premiumization, organic sourcing, and product differentiation strategies.

The retail landscape also strengthens market expansion, with supermarkets, hypermarkets, and e-commerce platforms ensuring wide accessibility. Online retail channels, in particular, have enhanced consumer awareness and availability, enabling brands to introduce niche formulations such as keto-friendly or allergen-free chocolate powders. The rising influence of digital marketing, influencer endorsements, and targeted campaigns has amplified consumer engagement, building stronger connections between brands and buyers.

| Metric | Value |

|---|---|

| Chocolate Powdered Drinks Market Estimated Value in (2025 E) | USD 8417.7 million |

| Chocolate Powdered Drinks Market Forecast Value in (2035 F) | USD 15074.8 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

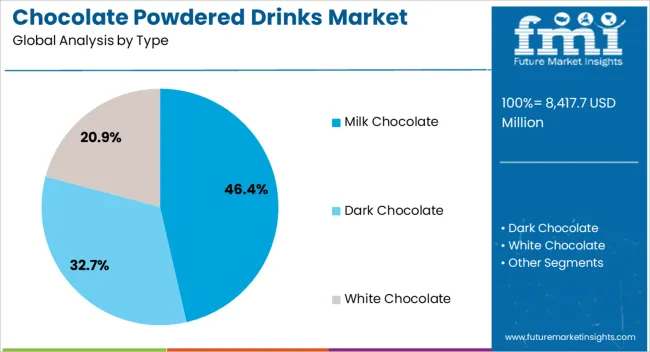

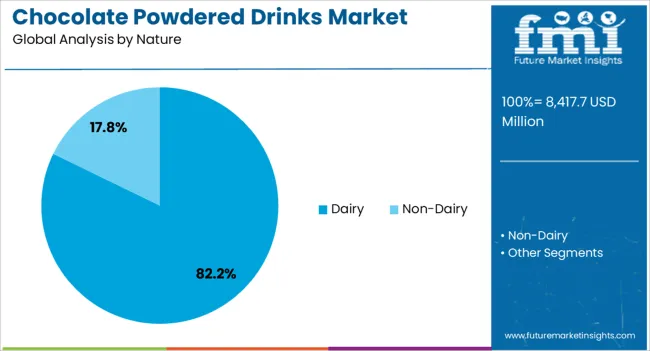

The market is segmented by Type and Nature and region. By Type, the market is divided into Milk Chocolate, Dark Chocolate, and White Chocolate. In terms of Nature, the market is classified into Dairy and Non-Dairy. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The milk chocolate segment dominates the type category, accounting for approximately 46.40% share. This segment’s leadership is attributed to its widespread consumer preference for mild sweetness, creamy flavor, and high palatability.

The versatility of milk chocolate in both cold and hot beverage applications has reinforced its strong position in the market. Manufacturers benefit from consumer familiarity and emotional attachment to classic chocolate flavors, driving brand loyalty.

Innovation in flavor combinations and the inclusion of functional ingredients such as vitamins and minerals have further expanded its consumer base. With stable demand across all age groups and regions, the milk chocolate segment is expected to maintain its leading share in the coming years.

The dairy segment leads the nature category, representing approximately 82.20% share of the chocolate powdered drinks market. Its dominance is supported by the inherent nutritional value and creamy texture that dairy-based formulations provide.

The segment benefits from strong consumer acceptance in traditional and premium product categories, particularly in regions with high milk consumption. Dairy-based powders also enable better solubility and flavor retention, enhancing the overall sensory experience.

Although plant-based alternatives are gaining traction, dairy remains the preferred base for chocolate drink formulations due to its established supply chain and cost-effectiveness. Continued innovation in enriched dairy powders and long shelf-life variants is expected to support the segment’s leading position over the forecast period.

The section presents a detailed analysis of the chocolate powdered drinks industry over the past 5 years, highlighting its projected growth trends. With a historical CAGR standing at 5.7%, the market is witnessing a consistent upward momentum. The industry is expected to witness a remarkable CAGR of 6% through 2035.

| Historical CAGR | 5.7% |

|---|---|

| Forecast CAGR | 6% |

The higher forecasted CAGR suggests optimism regarding the future performance of the market, potentially driven by factors such as evolving consumer preferences, product innovations, and market expansion strategies by industry players.

Important factors that are anticipated to impact the demand for chocolate powdered drinks through 2035.

| Attributes | Details |

|---|---|

| Trends |

|

| Opportunities |

|

The section analyzes the market across key countries, including the United States, Germany, the United Kingdom, France, and China. The section delves into the specific factors driving the demand, adoption, and sales of chocolate powdered drinks in these countries.

| Countries | Forecast CAGR from 2025 to 2035 |

|---|---|

| United States | 5.1% |

| United Kingdom | 4.4% |

| Germany | 4.9% |

| China | 6.5% |

| France | 5.9% |

With a forecasted CAGR of 5.1%, the United States market anticipates steady growth.

The market in the United Kingdom is expected to grow at a rate of 4.4%.

The market in Germany foresees a CAGR of 4.9%, indicating moderate growth.

With a forecasted CAGR of 6.5%, the market in China demonstrates significant growth potential.

The market in France is projected to grow at a rate of 5.9%.

This section focuses on providing detailed insights into specific categories in the chocolate powdered drinks industry. The analysis delves into two key attributes, the dark chocolate product type segment and the dairy nature type.

| Attributes | Details |

|---|---|

| Top Type | Dark Chocolate |

| Market Share in 2025 | 32% |

The dark chocolate segment is expected to hold a substantial market share, accounting for 32% in 2025. The preference for this segment is attributed due to several factors

| Attributes | Details |

|---|---|

| Top Nature Type | Dairy |

| Market Share in 2025 | 82.3% |

The dairy segment is poised to hold a commanding market share, reaching 82.3% in 2025. The reasons that led to the dominance of this sector

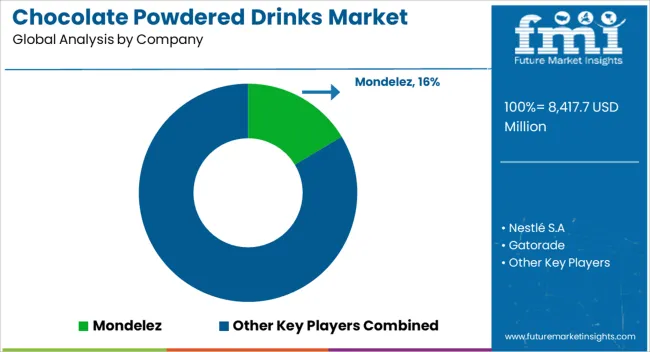

In the competitive landscape of the chocolate powdered drinks market, numerous players vie for market share and consumer attention. Established industry giants and emerging contenders contribute to a dynamic innovation environment and strategic initiatives.

Marketing strategies are pivotal, encompassing branding, promotions, and advertising efforts to enhance product visibility and consumer engagement. The integration of technology in distribution channels and e-commerce platforms has become increasingly significant, offering consumers convenient access to a diverse range of chocolate powdered drinks.

Some of the recent developments are

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 8417.7 million |

| Projected Market Valuation in 2035 | USD 15074.8 million |

| Value-based CAGR 2025 to 2035 | 6.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in US$ billion |

| Key Regions Covered |

|

| Key Market Segments Covered |

|

| Key Countries Profiled |

|

| Key Companies Profiled |

|

The global chocolate powdered drinks market is estimated to be valued at USD 8,417.7 million in 2025.

The market size for the chocolate powdered drinks market is projected to reach USD 15,074.8 million by 2035.

The chocolate powdered drinks market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in chocolate powdered drinks market are milk chocolate, dark chocolate and white chocolate.

In terms of nature, dairy segment to command 82.2% share in the chocolate powdered drinks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Bar Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Market Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Couverture Market Size, Growth, and Forecast for 2025 to 2035

Chocolate Processing Equipment Market Size, Growth, and Forecast 2025 to 2035

Chocolate Wrapping Films Market from 2025 to 2035

Chocolate Confectionery Market Analysis by Product, Type, Distribution Channel, and Region Through 2035

Chocolate Flavors Market Analysis by Product Type, and Application Through 2035

Chocolate Inclusions and Decorations Market Analysis by Type, End Use, and Region Through 2035

Industry Share Analysis for Chocolate Bar Packaging Companies

Powdered Fats Market – Growth, Demand & Industrial Applications

Chocolate Syrup Market

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powdered Hand Soap Market

Non-Chocolate Candy Market

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA