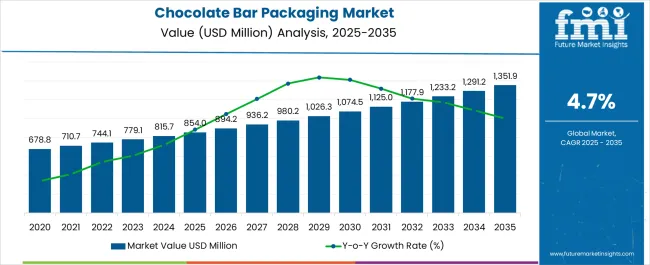

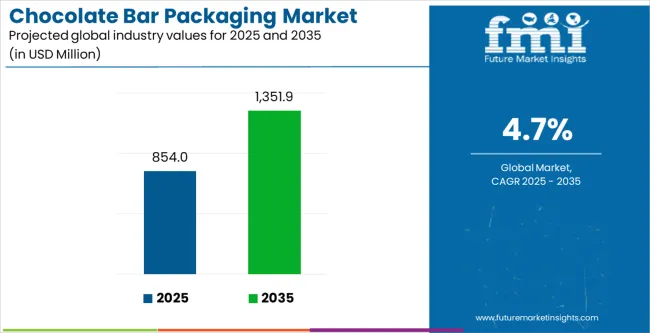

The Chocolate Bar Packaging Market is estimated to be valued at USD 854.0 million in 2025 and is projected to reach USD 1351.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Chocolate Bar Packaging Market Estimated Value in (2025 E) | USD 854.0 million |

| Chocolate Bar Packaging Market Forecast Value in (2035 F) | USD 1351.9 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

The chocolate bar packaging market is advancing steadily, driven by rising global chocolate consumption and increasing demand for innovative, sustainable packaging solutions. Growing emphasis on visual appeal, brand differentiation, and product protection has fueled continuous packaging innovation. The market benefits from heightened consumer preference for eco-friendly materials, as sustainability becomes a critical purchasing factor.

Flexible packaging formats with superior barrier properties have been widely adopted to preserve flavor, aroma, and product freshness. The premiumization trend in chocolates has also stimulated demand for customized and high-quality packaging formats.

With technological advancements enabling lightweight and recyclable materials, manufacturers are increasingly aligning packaging strategies with circular economy principles. Future growth is expected to be reinforced by expanding chocolate sales in emerging markets and evolving consumer expectations around sustainable packaging solutions.

The paper segment dominates the material category in the chocolate bar packaging market, holding approximately 36.80% share. This leadership is supported by rising demand for recyclable and biodegradable packaging solutions, as sustainability concerns influence consumer and brand choices. Paper provides effective printing flexibility, enabling attractive branding and product differentiation on store shelves.

Cost efficiency, lightweight properties, and wide availability further enhance its adoption. With increasing regulatory pressure to reduce single-use plastics, paper has gained prominence as a compliant and consumer-friendly alternative.

Brands are investing in coated and laminated paper solutions that improve barrier properties, ensuring product integrity without compromising recyclability. With global momentum toward sustainable packaging, the paper segment is expected to maintain its dominant position in the forecast period.

The wrappers segment leads the type category with approximately 42.50% share, driven by its convenience, cost-effectiveness, and strong brand visibility. Wrappers provide flexibility in design, enabling manufacturers to incorporate vibrant colors, textures, and promotional content that appeal to consumers.

Their lightweight structure reduces packaging costs and facilitates large-scale distribution, making them the preferred choice for high-volume chocolate bars. Advances in material engineering have improved barrier performance, ensuring resistance against moisture and oxygen to preserve product quality.

The segment’s adoption is further reinforced by its compatibility with automated high-speed production lines, enhancing operational efficiency for manufacturers. With strong consumer preference for portable and visually appealing packaging, the wrappers segment is expected to retain its leadership in the chocolate bar packaging market.

The market relies heavily on the overall demand for chocolate bars and confectionery products in the international marketplace. Changes in consumer preferences, such as a shift toward premium, healthier, or sustainable options have also significantly influenced the performance of the market. The market has seen a series of ups and downs in the last few years.

During the pandemic, as the world faced sudden shutdowns, the demand for chocolate and chocolate products exponentially declined. There were supply chain problems everywhere in the world. This severely affected the market. Due to the deteriorating financial conditions all over the world, people spent less on non-essential commodities, further slowing down the revenue growth.

However, as the world became accustomed to the new normal, things slowly began to pick up. As people spent more time in their homes, the overall consumption of chocolate products increased. The eCommerce boom in emerging parts of the world also stimulated the need for efficient packaging solutions. All these factors collectively contributed to the surging demand for chocolate bar packaging solutions, worldwide.

| Attributes | Key Statistics |

|---|---|

| Chocolate Bar Packaging Market Value (2020) | USD 731.4 million |

| Projected Market Value (2025) | USD 788.1 million |

| HCAGR (2020 to 2025) | 1.90% |

The market is anticipated to surpass a global valuation of USD 1,291.2 million by the year 2035, with a growth rate of 4.70% CAGR. While the market is expected to experience substantial growth, several restraining factors are adversely affecting its development:

Plastic packaging solutions have a widespread dominance in the food and beverage industry all over the world. In the chocolate bar packaging market, too, manufacturers prefer plastic packaging solutions for their affordability, availability, and durability. Plastics are comparatively lower in weight than other sustainable materials in the industry.

| Attributes | Details |

|---|---|

| Top Material | Plastic |

| Market share in 2025 | 51.30% |

Based on material, plastic chocolate bar packaging solutions dominate the market, holding a share of 51.3%. Their demand has also skyrocketed recently as manufacturers find printing on plastic material easy. These companies use the packaging to make their products stand out in retail shops, malls, and specialty confectionery stores.

Due to rapid urbanization and busier lifestyles, consumers all over the world are seeking products that offer maximum convenience and portability. Stick packs allow consumers to hold individual servings of chocolate bars, offering a practical solution for on-the-go consumption. Their surging demand, especially in the younger demographic, is due to the portion control it offers for snack-sized, easily shareable chocolate treats.

| Attributes | Details |

|---|---|

| Top Packaging Format | Stick Pack |

| Market share in 2025 | 23.40% |

Based on packaging format, stick packs dominate the market, accounting for a share of 23.40%. Besides this, stick packs also offer manufacturers and brands the opportunity for creative marketing and branding strategies. The elongated shape provides ample surface area for vibrant and attractive graphics, allowing for effective storytelling and brand communication.

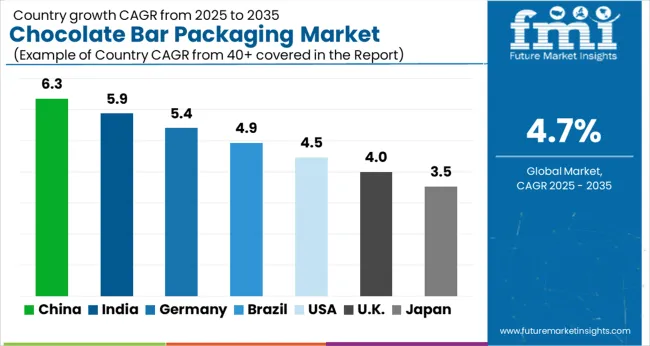

The section provides an analysis of the chocolate bar packaging market by countries, including China, India, the United Kingdom, South Korea, and Thailand. The table presents the CAGR for each country, indicating the expected growth of the market in that country through 2035.

India is one of the leading countries in this market. The Indian chocolate bar packaging market is anticipated to retain its dominance by progressing at a CAGR of 7.20% till 2035.

The rapid urbanization in India is driving the demand for convenient and on-the-go snacks, including chocolate bars. This has led to an increasing demand for packaging solutions in the confectionery industry, especially chocolates. There is also an ongoing trend toward healthier and more functional chocolates in the Indian population. This is further augmenting the need for efficient packaging solutions in India.

China is another country in the Asian region that dominates the market. The Chinese market is anticipated to retain its dominance by progressing at an annual growth rate of 6.40% through 2035.

In China, the rising trend of eCommerce is significantly impacting the chocolate bar packaging market. The increasing popularity of online shopping platforms has led to a growing demand for packaging solutions that ensure the safe and attractive delivery of chocolate bars to consumers' doorsteps.

The demand for chocolate bar packaging solutions in Thailand is projected to rise at a 6.10% CAGR over the next ten years.

Thailand is known for its world-famous tourism industry. Millions of tourists flock to the country every year. The market benefits from the gifts and souvenir chocolates. They also visit the country to try exotic and unique chocolate flavors. Brands curate packaging that reflects cultural elements to make these chocolates more appealing to foreigners.

The South Korean chocolate bar packaging market is anticipated to register a CAGR of 5.30% through 2035.

The fast-paced lifestyle and culture of snacking contribute to the growth of the chocolate bar packaging market in South Korea. Packaging that emphasizes convenience and portability is preferred by chocolate manufacturers in the region. Besides this, there is an ongoing trend of augmented reality features, interactive packaging, and smart packaging solutions in the South Korean market.

In the European region, the United Kingdom leads the market for chocolate bar packaging solutions. The market in the United Kingdom is poised to showcase a 5.20% CAGR from 2025 to 2035.

The United Kingdom market is witnessing a massive surge in demand for luxury and artisanal chocolate products. Consumers are willing to pay a little extra to get an authentic chocolate-eating experience in the United Kingdom. Brands are responding to this by providing sophisticated packaging that conveys a sense of luxury and exclusivity.

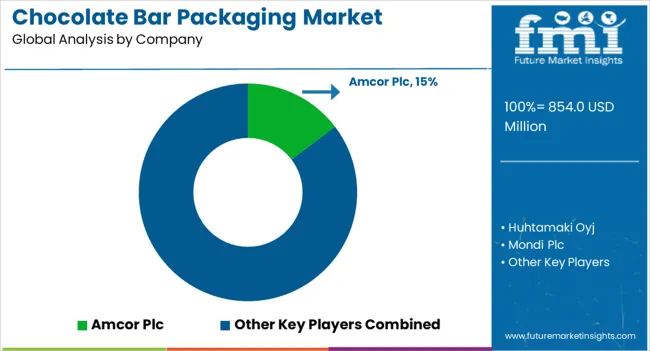

The chocolate bar packaging market is diverse, comprising established global players, emerging regional contenders, and niche players with a specialized focus. There are very few companies that operate globally. These companies have tied up with local and international chocolate-producing brands.

Small brands in the market also have a lot of opportunities. These companies can cater to the demands of regional confectionery stores and manufacturing units. The market is currently going through a transitional phase with the introduction of sustainable materials for packaging.

Recent Developments

The global chocolate bar packaging market is estimated to be valued at USD 854.0 million in 2025.

The market size for the chocolate bar packaging market is projected to reach USD 1,351.9 million by 2035.

The chocolate bar packaging market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in chocolate bar packaging market are paper, _plastic, _ldpe, _pvc, _pet, _pe, _foil and _aluminum.

In terms of type, wrappers segment to command 42.5% share in the chocolate bar packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Chocolate Bar Packaging Companies

Chocolate Powdered Drinks Market Forecast and Outlook 2025 to 2035

Chocolate Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Couverture Market Size, Growth, and Forecast for 2025 to 2035

Chocolate Processing Equipment Market Size, Growth, and Forecast 2025 to 2035

Chocolate Wrapping Films Market from 2025 to 2035

Chocolate Flavors Market Analysis by Product Type, and Application Through 2035

Chocolate Confectionery Market Analysis by Product, Type, Distribution Channel, and Region Through 2035

Chocolate Inclusions and Decorations Market Analysis by Type, End Use, and Region Through 2035

Chocolate Syrup Market

Non-Chocolate Candy Market

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sugarless Chocolate Market

Industrial Chocolate Market Analysis by Product, Application, Type, and Region through 2035

Analysis and Growth Projections for Low-calorie Chocolate Business

Sugar-Free White Chocolate Market Trends - Demand & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA