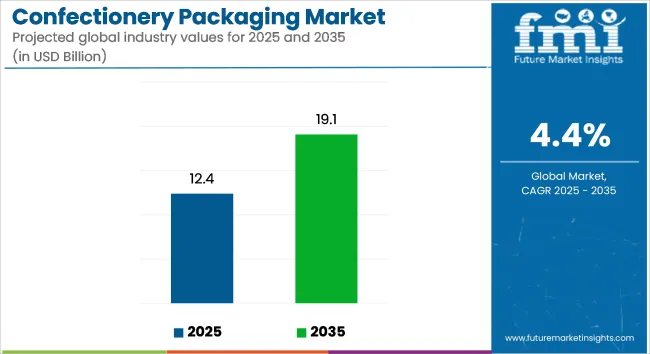

The confectionery packaging market is projected to grow from USD 12.4 billion in 2025 to USD 19.1 billion by 2035, registering a CAGR of 4.4% during the forecast period. Sales in 2024 reached USD 11.8 billion. Market expansion has been driven by rising product differentiation, branding efforts, and flexible packaging solutions tailored to sweets, gums, and chocolates.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 12.4 Billion |

| Projected Market Size in 2035 | USD 19.1 Billion |

| CAGR (2025 to 2035) | 4.4% |

Growth has also been supported by strong seasonal demand patterns, evolving shelf-ready packaging formats, and increased investments in barrier material technologies. Retail-ready and resalable pouches have increasingly been adopted for convenience and extended shelf life. Packaging companies have been continuously innovating to offer visual appeal while complying with recyclability mandates.

In January 2024, One Rock Capital Partners, LLC announced that one of its affiliates has successfully completed the acquisition of Constantia Flexibles, a leading global packaging manufacturer. “We are thrilled that Constantia is officially a part of the One Rock portfolio,” said Telmo Valido, Partner at One Rock. “This is a business already distinguished by a dedicated focus on its customers, and we look forward to contributing One Rock’s industry and operational expertise to further support the Company’s ongoing growth initiatives.”

Biodegradable films and paper-based pouches are increasingly being favored by confectionery manufacturers due to environmental regulations and consumer sentiment. Compostable wrapping options with moisture-resistant properties are being developed for chocolates, caramels, and gummies.

Meanwhile, recyclable mono-material laminates are being introduced to replace traditional multi-layered foils, reducing environmental impact. Across the market, brands are aligning packaging design with their broader sustainability pledges, integrating clean-label principles into structural design. Partnerships between material providers and packaging converters are also boosting R&D of recyclable and compostable confectionery wrappers.

Packaging strategies in the confectionery industry are undergoing significant transformation, with a clear shift toward more adaptable and consumer-friendly formats such as stand-up pouches and flow wraps that feature resalable options. These flexible packaging solutions not only enhance convenience for consumers but also help to preserve product freshness and extend shelf life.

The adoption of digital printing and smart labeling technologies is becoming increasingly prevalent, particularly among premium and artisanal confectionery brands. Packaging strategies in the confectionery industry are undergoing significant transformation, with a clear shift toward more adaptable and consumer-friendly formats such as stand-up pouches and flow wraps that feature resalable options.

These flexible packaging solutions not only enhance convenience for consumers but also help to preserve product freshness and extend shelf life. In addition, the adoption of digital printing and smart labeling technologies is becoming increasingly prevalent, among premium and artisanal confectionery brands.

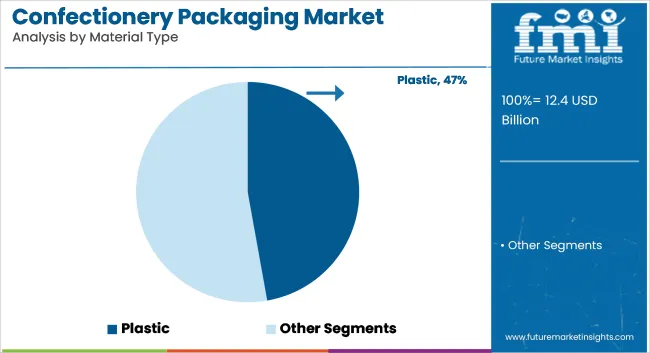

The market is segmented based on material type, packaging type, confectionery type, distribution channel, and region. Materials used include plastic, paper & paperboard, metal, aluminum foil, and glass each selected to ensure product freshness, shelf appeal, and protection against moisture or contamination.

These materials support both mass production and premium confectionery lines. Packaging types are divided into flexible packaging formats like wrappers, stick packs, sachets, liners, and pouches, and rigid formats including folding cartons, corrugated boxes, and trays. Confectionery categories encompass chocolate confectionery, sugar confectionery, and gums.

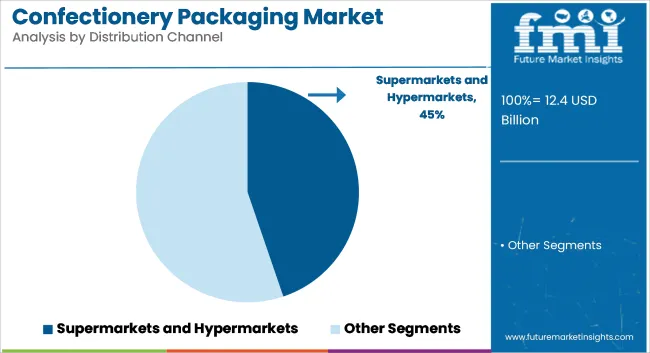

Distribution channels include supermarkets & hypermarkets, convenience stores, online retail, confectionery boutiques, and vending machines. The regional scope covers North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Plastic is estimated to hold a 47.2% share in the confectionery packaging market by 2025. It has been widely used due to its moisture resistance, flexibility, and ability to preserve freshness and product integrity. Plastic films and laminates have enabled vibrant branding, reseal ability, and extended shelf life. Innovations in biodegradable and recyclable plastic formats have supported sustainability goals while retaining functional value.

Flexible pouches, flow wraps, and thermoformed plastic trays have been used for various chocolate and candy assortments. Barrier properties against oxygen, light, and humidity have made plastic suitable for temperature-sensitive confectionery. Lightweight packaging has lowered transportation costs and reduced environmental footprint. Manufacturers have also used PET and PE blends to optimize printability and packaging aesthetics.

Food safety regulations and tamper-evident requirements have favored multilayer plastic structures. Modified atmosphere packaging (MAP) with plastic films has extended the freshness of high-end chocolates. Plastic formats have supported both primary and secondary packaging needs, especially in bulk and single-serve formats.

The rise of gifting and premium confectionery ranges has further accelerated demand for attractive and durable plastic options. Leading global brands have invested in recyclable mono-material plastic wraps and bio-based resins. Increased focus on circular economy models has influenced procurement strategies. Plastic’s compatibility with high-speed packaging machinery has enhanced production throughput. As demand for innovative, cost-effective, and sustainable solutions continues, plastic is expected to remain a preferred material for confectionery applications.

Supermarkets and hypermarkets are projected to cumulatively account for 44.8% of the confectionery packaging market by 2025. These retail formats have offered large shelf spaces, impulse-buy visibility, and wide consumer access. Eye-catching, durable packaging has been used to attract buyers and withstand high-frequency handling.

Multipacks, seasonal boxes, and point-of-sale displays have driven high-volume packaging consumption. Packaging for supermarket channels has emphasized branding, convenience, and tamper-proofing. Resalable pouches and transparent windows have enabled easy product examination and improved consumer trust. Bulk formats and family packs have required robust structural strength and stack ability. Material choices have been guided by shelf-life requirements, space optimization, and aesthetics.

Sustainability mandates from major retailers have driven shifts toward recyclable and compostable packaging formats. Brands have customized packaging sizes and graphics based on retail planogram specifications. Barcoding, freshness indicators, and eco-labeling have played crucial roles in consumer selection and regulatory compliance.

Visibility-enhancing designs have boosted sales for premium and novelty confectionery. As footfall in physical retail continues to rebound, investments in shelf-ready, attention-grabbing packaging are expected to grow. Seasonal promotions and festive collections have reinforced demand for distinctive, protective formats. Collaborations between packaging converters and retail chains have yielded tailored solutions. Supermarkets are likely to maintain dominance, supported

Plastic reduction and cost implications Regulatory pressures to reduce plastic use are pushing manufacturers to adopt alternative materials, which can be more expensive and require technological adjustments. Achieving durability and shelf stability while ensuring recyclability remains a challenge.

Smart packaging, customization, and sustainable innovationThe integration of digital labels, AR-enabled storytelling, and personalized packaging is offering new ways to engage consumers. Additionally, advancements in biodegradable films and edible packaging solutions present significant growth opportunities. The rise of e-commerce and subscription-based confectionery services is also fueling demand for protective and lightweight packaging.

The confectionery packaging market in the USA is in the lead as increasing demand from consumers for packaging that is convenient, resealable, and attractive drives the growth. The rise of premium chocolates, sugar-free candies, and functional confectionery products has been the cause for innovation in flexible materials, sustainable materials, and smart packaging technologies.

Investments in biodegradable films, tamper-evident seals, and digital printing technology are being made by USA manufacturers, as part of increasing their brands. Furthermore, the growth of e-commerce has led to greater demand for protective and lightweight confectionery packaging designed especially for direct-to-consumer shipments.

Additionally, the application of AI automation in packaging lines is undertaken to bring about efficiency and reduced material waste. Smart packaging with interactive elements like an augmented reality experience is gathering momentum with the tech-savvy crowd. It has also been found that possibilities for customizable packaging options have increased, enabling brands to design limited editions and methods for personalized branding strategies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The candy-making industry is rising at par with the fast pace of development in the UK confectionery packaging-sustainability, recyclability, and better visibility on the shelf. Manufacturers have started shifting their focus toward compostable wrappers, pouches made of paper, and alternatives to plastics as increasing concerns emerge with regard to the environment.

Digital printing and interactive are tapping their fingers towards the increase in popularity and direct engagement with consumers through QR codes and augmented reality experiences. Emerging trends such as vegan and organic candies also boost the need for clean-label packaging which resonates with health-conscious consumers.

AI-driven packaging automation would encourage production efficiency while using limited resources. Customizable packaging formats will be fitted with resealable capabilities and fit into consumer preferences regarding the convenience facets. High-barrier coatings and moisture-control layers have also furthered their advances in aspects such as product shelf life and freshness.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.6% |

Incorporated with precision, aesthetics, and functionality, the Japanese confectionery packaging market takes on a character of its own. Minimalistic wastage and premium presentation fostered the innovations of individually wrapped chocolates, compartmentalized packaging, and resealable pouches. High-barrier films and moisture-resistant packaging are widespread to assure freshness in Japan's humid climate.

Smart packaging solutions, with the help of NFC tags and temperature-sensitive indicators, are entering the market gradually to secure quality control and authenticity verification. Moreover, AI-based quality inspection systems are being integrated to facilitate defect identification and ensure consistency in packaging.

Customizable gift packaging is gaining popularity in meeting the needs of Japan's strong gifting culture. Biodegradable coatings and wrappers that are edible are being developed as sustainable alternatives for decreasing environmental impact. With augmented reality, the packaging is now aimed at engaging consumers, creating an interactive brand story.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Growing demand for premium chocolates, gift packagings, and environmentally friendly wrapping materials are factors that have positively influenced South Korea's confectionery packaging market. The strong café culture and increased popularity of K-snacks contribute to the investments of manufacturers in stylish yet resealable and environmentally friendly packaging.

Packaging for confectioneries is being enhanced to draw consumer attention and distinguish brands through integration of attributes like high gloss finishes, holographic designs, and smart labeling technologies. Shifting focus from plastics to biodegradable and paper-based alternatives has been improved by government policies introducing such changes.

AI-driven automation is optimizing the efficiency of packaging lines while at the same time reducing the waste of materials. There are indeed researches on temperature-sensitive packaging that would keep the product fresh under different temperature and storage conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

The packaging market for confectioneries is going through rapid growth as a result of rising demand for innovative, sustainable, and high-barrier solutions. Top manufacturers are launching lightweight, tamper-proof, and aesthetically appealing packaging formats to support brand differentiation.

Plant-based coatings, smart packaging integration, and individualized wrapping technologies are the main trends. Confectionery brands are collaborating with sustainable packaging providers to achieve innovation. Brands are also using biodegradable ink and water-based coatings to improve recyclability. The demand for interactive packaging, like scannable QR codes in promotion campaigns, is increasing.

Also, innovations in edible packaging solutions are catching up as companies scout for zero-waste options. Better print processes, like high-definition flexographic and digital printing, are allowing more sophisticated and personalized designs. Also, confectionery companies are looking at reusable and refillable packaging to address the needs of eco-friendly consumers.

The overall market size for the Confectionery Packaging Market was USD 12.4 Billion in 2025.

The Confectionery Packaging Market is expected to reach USD 19.1 Billion in 2035.

The Confectionery Packaging Market will be driven by premiumization, sustainability initiatives, digital branding strategies, and innovative flexible packaging solutions.

The top 5 countries driving the development of the Confectionery Packaging Market are the USA, Germany, China, France, and Japan.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Confectionery Packaging Manufacturers

Confectionery Flexible Packaging Market Trends – 2024-2034

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Confectionery Coating Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Confectionery Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA